Alcoholic Beverages Market Size (2024 – 2030)

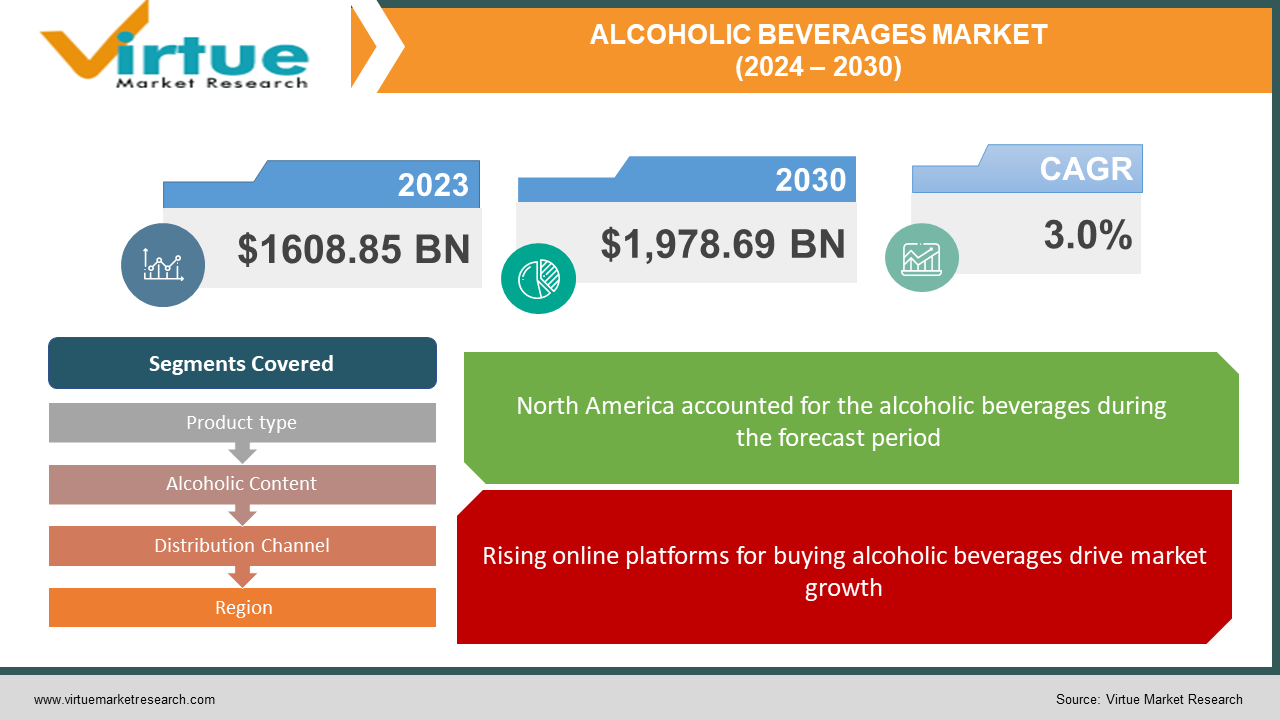

The Alcoholic Beverages Market was valued at USD 1608.85 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1,978.69 Billion by 2030, growing at a CAGR of 3.0%.

An alcoholic beverage constitutes a liquid concoction crafted by blending ethanol with various ingredients such as grains, fermented fruits, and sugars. Ciders and wines are produced utilizing a fermented fruit foundation, whereas spirits and beers are concocted through the fermentation of rye and barley. The potency of the alcoholic drink is influenced by its duration of storage and the vessel in which fermentation occurs. These beverages are widely enjoyed for recreational and invigorating purposes.

Key Market Insights:

The worldwide alcoholic beverages market is experiencing a notable surge, propelled by the expanding youth demographic, rising middle-class incomes, and robust economic conditions. This escalating consumer preference for novel variants within the realm of alcoholic beverages has spurred a renaissance in craft beer production. Consequently, to meet the burgeoning market demand, the production of craft beer across various regional and global breweries has seen a substantial increase. Moreover, as consumers become more aware of the adverse effects of moderate alcohol consumption, there is a growing demand for stronger and premium alcoholic beverages. Manufacturers of top-tier, high-quality alcoholic beverages are witnessing significant commercial expansion as a result.

Alcoholic Beverages Market Drivers:

Rising online platforms for buying alcoholic beverages drive market growth.

The burgeoning online marketplace for purchasing alcoholic beverages is anticipated to propel market growth throughout the forecast period. A plethora of online platforms now offer distribution services for alcoholic beverages, catering to both corporate events seeking beer and wine provisions. Additionally, there exists a significant distribution infrastructure from numerous manufacturers to various countries, encompassing local breweries and liquor stores. However, it is imperative to note that all transactions on online alcohol ordering platforms must adhere to strict regulations, requiring that orders be made, shipped to, and processed by an adult aged 21 or older. Consequently, the expansion of online platforms for purchasing alcoholic beverages is poised to stimulate market growth further.

Preference among consumers for hybrid beverages increasing market growth.

Alcoholic beverage manufacturers are responding to shifting consumer preferences and tastes by introducing ready-to-mix hybrid beverages. These hybrid drinks are crafted through the fusion of distinct flavor combinations and production techniques from multiple beverages. Examples of such popular concoctions include Malibu Red (a blend of rum and tequila), Absolut Tune (vodka combined with sparkling wine), and Kahlua Midnight (a mixture of rum and Kahlua). As a result, the increasing consumer inclination towards hybrid beverages is poised to fuel market growth.

Alcoholic Beverages Market Restraints and Challenges:

Side effects due to alcoholic beverages can restrain market growth.

Alcoholic beverage overdoses can lead to a range of adverse effects, including high blood pressure, heart disease, stroke, liver disease, and digestive issues. Furthermore, excessive alcohol consumption is associated with an increased risk of various cancers affecting the breast, mouth, throat, esophagus, voice box, liver, colon, and rectum. Consequently, the awareness of these detrimental health consequences is expected to diminish the demand for alcoholic beverages, thereby impeding market growth.

Inclined consumers toward non-alcoholic beverages affect the market.

The growing consumer preference for non-alcoholic beverages, including carbonated drinks, tonic water, fruit punch, and sparkling water, is anticipated to hinder market growth. Non-alcoholic beverage options are often associated with health benefits such as lowering blood pressure and maintaining heart rate, thereby reducing the demand for alcoholic beverages in the market.

Alcoholic Beverages Market Opportunities:

The escalating global population is poised to drive significant demand for alcoholic beverages, thus presenting abundant opportunities for market growth. To meet this heightened demand, there will be a requisite increase in crop production, trade volumes, and farming activities. Consequently, companies operating in the alcoholic beverages market are poised to benefit from the expanding consumer base in the forecast period.

ALCOHOLIC BEVERAGES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.0% |

|

Segments Covered |

By Product type, Alcoholic Content, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Halewood International Limited (U.K.), Mike's Hard Lemonade Co. (U.S.), Davide Campari-Milano N.V. (Netherlands), Diageo (U.K.), CASTEL FRÈRES. (France), Accolade Wines (Australia), Brown Forman (U.S.), Pernod Ricard (France), Bacardi (Bermuda), Anheuser-Busch Companies LLC (U.S.) |

Alcoholic Beverages Market Segmentation - By Product Type

-

Beer

-

Wine

-

Spirits

-

Others

Beer commands the largest market share within the alcoholic beverages industry, driven by its increasing popularity on a global scale. Companies have capitalized on understanding consumer preferences for various beer flavors and occasions, thereby fostering enduring relationships with their clientele. Additionally, the rising trend of beer taprooms is further amplifying consumer engagement and contributing to the collaborative development of new beer flavors.

Following closely behind, distilled spirits emerge as the second most dominant category within the market. Distilled spirits are produced through the distillation process, which involves distilling a fermented alcohol mixture. This process results in an elevation of alcohol concentration and a reduction in water-related dilution. Consequently, distilled spirits typically contain a higher alcohol content compared to brewed beverages.

Alcoholic Beverages Market Segmentation - By Alcoholic Content

-

High

-

Medium

-

Low

Medium alcohol content beverages currently hold a dominant position in driving market growth. However, low-alcohol-content products are experiencing the fastest growth within the market. Moreover, the rising demand for premium products within the alcoholic beverages market is set to create ample growth opportunities. In the U.S. alcohol industry, the fastest-growing segment is the ready-to-drink cocktail sector, which demonstrates considerable potential for expansion into new markets while offering access to high-quality premium cocktails akin to those found in bars. Notably, brands like Cutwater exemplify the rapid growth of bar-quality cocktails in the market.

Alcoholic Beverages Market Segmentation - By Distribution Channel

-

Modern Trade

-

Convenience Stores

-

Specialty Stores

-

Online Retailers

-

Hotels/Restaurants/Bars

-

Commercial Stores

-

On Premises

-

Liquor Stores

-

Grocery Shops

-

Internet Retailing

-

Supermarkets

During the forecasted period, liquor stores are anticipated to maintain their dominance in the market. These establishments offer convenience and accessibility, particularly in urban areas, providing consumers with a convenient option for purchasing alcoholic beverages without extensive travel or lengthy queues. Liquor stores boast a diverse array of products, ranging from well-known branded liquors to locally sourced and craft beverages, catering to the varied tastes and preferences of consumers.

Simultaneously, supermarkets are expected to experience growth in the forecasted period. This growth is facilitated by partnerships between supermarkets and major players in the global alcoholic beverages industry. In the United States, supermarkets command approximately 50% of the alcoholic beverages market. By offering a broader customer base, supermarkets afford manufacturers increased opportunities for sales growth.

Alcoholic Beverages Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is poised to dominate the alcoholic beverages market, primarily driven by the growing young adult population in the region. Additionally, the increasing consumption of high-quality alcoholic beverages is anticipated to fuel further market growth. The North American alcohol market is forecasted to witness significant expansion due to rising disposable incomes, with developing countries playing a pivotal role in driving industry growth. Craft beer and craft spirits emerge as the fastest-growing segments, driven by consumer perceptions of premium quality and the rise of mindful drinking practices.

Meanwhile, Asia-Pacific is expected to emerge as the fastest-growing region, propelled by the escalating disposable incomes in the area. Moreover, the growing demand for agave-based spirits in evolving economies like India and China is projected to further bolster market growth in this region.

COVID-19 Pandemic: Impact Analysis

During the COVID-19 outbreak, the alcoholic beverages market faced significant challenges due to the closure of specialty shops, bars, pubs, and restaurants. However, by mid-2020, the gradual easing of lockdown measures instilled confidence among retailers. Despite this, certain countries experienced a notable increase in prices, primarily due to government regulations and taxes, albeit with minimal impact on the overall market. For instance, on March 24, 2020, Pernod Ricard adjusted its fiscal year outlook, anticipating a nearly 20% decline in profit margins attributed to the spread of COVID-19. Moreover, companies observed a surge in off-premise sales compared to on-premise sales, reflecting shifting consumer behaviors amid the pandemic. For example, Constellation Brands reported a 30% increase in beer volume in the US off-premise channel in February 2020, as consumers opted to avoid on-premise establishments to mitigate the risk of COVID-19 transmission. Notably, there was a growing demand for hard drinks such as whiskey and gin during the pandemic, while beer witnessed volume growth. The trend of in-house consumption, coupled with brand stocking, emerged as a key factor driving market resilience during the pandemic.

Latest Trends/ Developments:

-

In 2022, Diageo made headlines by announcing its acquisition of Balcones Distilling, colloquially known as "Balcones." Balcones Distilling stands out as one of the foremost producers of American Single Malt Whisky in the United States. Renowned for its utilization of Texas' intense heat and temperature fluctuations, Balcones crafts whiskies with distinctive flavors.

-

Also in 2022, Bacardi unveiled Legacy, an Indian-made whiskey aimed at capturing a segment focused on affordability. Bacardi aims to bolster its position and expansion strategy in India by offering Legacy as a value-driven option for consumers.

-

Furthermore, Constellation Brands Inc., a prominent player in the beverage alcohol industry, forged a brand authorization agreement with The Coca-Cola Company in the United States during the same year. This collaboration will introduce the FRESCA brand into the alcoholic beverages category, marking a significant diversification move for both companies.

Key Players:

These are the top 10 players in the Alcoholic Beverages Market: -

-

Halewood International Limited (U.K.)

-

Mike's Hard Lemonade Co. (U.S.)

-

Davide Campari-Milano N.V. (Netherlands)

-

Diageo (U.K.)

-

CASTEL FRÈRES. (France)

-

Accolade Wines (Australia)

-

Brown Forman (U.S.)

-

Pernod Ricard (France)

-

Bacardi (Bermuda)

-

Anheuser-Busch Companies LLC (U.S.)

Chapter 1. Alcoholic Beverages Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Alcoholic Beverages Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Alcoholic Beverages Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Alcoholic Beverages Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Alcoholic Beverages Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Alcoholic Beverages Market – By Product Type

6.1 Introduction/Key Findings

6.2 Beer

6.3 Wine

6.4 Spirits

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Alcoholic Beverages Market – By Alcoholic Content

7.1 Introduction/Key Findings

7.2 High

7.3 Medium

7.4 Low

7.5 Y-O-Y Growth trend Analysis By Alcoholic Content

7.6 Absolute $ Opportunity Analysis By Alcoholic Content, 2024-2030

Chapter 8. Alcoholic Beverages Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Modern Trade

8.3 Convenience Stores

8.4 Specialty Stores

8.5 Online Retailers

8.6 Hotels/Restaurants/Bars

8.7 Commercial Stores

8.8 On Premises

8.9 Liquor Stores

8.10 Grocery Shops

8.11 Internet Retailing

8.12 Supermarkets

8.13 Y-O-Y Growth trend Analysis By Distribution Channel

8.14 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Alcoholic Beverages Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Alcoholic Content

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Alcoholic Content

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Alcoholic Content

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Alcoholic Content

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Alcoholic Content

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Alcoholic Beverages Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Halewood International Limited (U.K.)

10.2 Mike's Hard Lemonade Co. (U.S.)

10.3 Davide Campari-Milano N.V. (Netherlands)

10.4 Diageo (U.K.)

10.5 CASTEL FRÈRES. (France)

10.6 Accolade Wines (Australia)

10.7 Brown Forman (U.S.)

10.8 Pernod Ricard (France)

10.9 Bacardi (Bermuda)

10.10 Anheuser-Busch Companies LLC (U.S.)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The worldwide alcoholic beverages market is experiencing a notable surge, propelled by the expanding youth demographic, rising middle-class incomes, and robust economic conditions. This escalating consumer preference for novel variants within the realm of alcoholic beverages has spurred a renaissance in craft beer production.

The top players operating in the Alcoholic Beverages Market are - Halewood International Limited (U.K.), Davide Campari-Milano N.V. (Netherlands), Diageo (U.K.), and CASTEL FRÈRES. (France), Accolade Wines (Australia), Brown Forman (U.S.), Pernod Ricard (France), Bacardi (Bermuda), Anheuser-Busch Companies LLC (U.S.).

During the COVID-19 outbreak, the alcoholic beverages market faced significant challenges due to the closure of specialty shops, bars, pubs, and restaurants. However, by mid-2020, the gradual easing of lockdown measures instilled confidence among retailers.

In 2022, Diageo made headlines by announcing its acquisition of Balcones Distilling, colloquially known as "Balcones." Balcones Distilling stands out as one of the foremost producers of American Single Malt Whisky in the United States. Renowned for its utilization of Texas' intense heat and temperature fluctuations, Balcones crafts whiskies with distinctive flavors.

Asia-Pacific is expected to emerge as the fastest-growing region, propelled by the escalating disposable incomes in the area. Moreover, the growing demand for agave-based spirits in evolving economies like India and China is projected to further bolster market growth in this region.