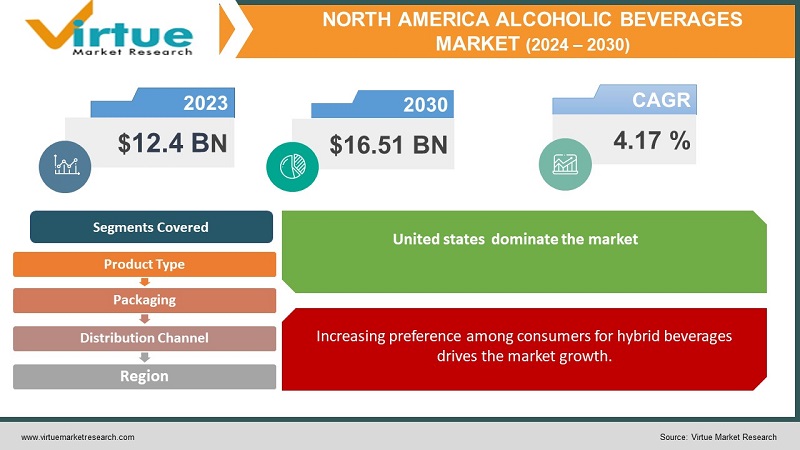

North America Alcoholic Beverages Market Size (2024-2030)

The North America Alcoholic Beverages Market was valued at USD 12.4 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 16.51 billion by 2030, growing at a CAGR of 4.17%.

Alcoholic beverages encompass liquids containing ethanol, a psychoactive substance. These libations undergo a sequence of fermentation and distillation processes to augment the ethanol concentration. The presence of a substantial quantity of ethanol in alcoholic drinks elicits an intoxicating effect. These beverages exhibit varying ethanol contents, such as beer with 4%-5% volume, wine with 12% volume, and similar distinctions. Regulatory frameworks governing the manufacture, distribution, and consumption of alcohol exhibit disparities across different geographical regions.

Key Market Insights:

The rapid expansion of the alcoholic beverages market can be attributed to the burgeoning youth demographic, rising middle-class incomes, and a robust economy. The escalating consumer preference for novel variants within the alcoholic beverages sector has sparked a revolution in the formulation of craft beer. Consequently, in response to the heightened market demand, there has been a substantial increase in the production of craft beer by various regional and global breweries. Moreover, the growing awareness regarding the adverse effects of moderate alcohol consumption among consumers has fueled an increased demand for premium and high-alcohol-content beverages. Producers specializing in the creation of high-performance, top-quality alcoholic beverages are witnessing significant commercial growth.

North America Alcoholic Beverages Market Drivers:

Buying beverages online increases the market growth.

The anticipated growth of the alcoholic beverages market during the forecast period is attributed to the burgeoning online platforms for purchasing such products. A multitude of online websites is dedicated to providing distribution services for alcoholic beverages, catering to both corporate events and individual preferences for beer and wine. Notably, various manufacturers facilitate substantial distribution services, reaching diverse countries, local breweries, and liquor stores. It is imperative to highlight that all transactions made through online platforms for alcohol orders necessitate processing by and delivery to an adult aged 21 or older. Consequently, the proliferation of online platforms for acquiring alcoholic beverages significantly contributes to market expansion.

Increasing preference among consumers for hybrid beverages drives the market growth.

In response to evolving consumer preferences and tastes, alcoholic beverage manufacturers are currently introducing ready-to-mix hybrid beverages. These hybrid concoctions are crafted by employing distinctive flavor combinations and production techniques derived from various drink categories. Notable examples of such popular beverages include Malibu Red (a blend of rum and tequila), Absolut Tune (combining vodka and sparkling wine), and Kahlua Midnight (a fusion of rum and Kahlua). Consequently, the increasing consumer inclination towards hybrid beverages is expected to be a key driver for market growth.

North America Alcoholic Beverages Market Restraints and Challenges:

Campaigns against alcohol consumption represent a significant challenge impeding the growth of the alcoholic beverages market. Factors like the increasing prevalence of alcohol abuse and alcohol-related incidents, particularly among the younger demographic, have led to the initiation of various campaigns by regulatory and social organizations discouraging alcohol consumption. Moreover, governments and health organizations actively endorse such campaigns to disseminate information about the detrimental effects associated with consuming alcoholic beverages.

Consequently, this heightened awareness has the potential to adversely impact the expansion of the alcoholic beverages market in the region. For instance, in November 2021, the Pan-American Health Organization (PAHO) launched the "Live Better, Drink Less" campaign to raise awareness about the harmful effects of alcohol consumption, including its links to liver diseases, cancer, cardiovascular problems, and tuberculosis. The cumulative effect of such efforts is anticipated to pose a hindrance to the growth of the alcoholic beverages market throughout the forecast period.

North America Alcoholic Beverages Market Opportunities:

The expanding population is anticipated to generate substantial demand for alcoholic beverages, thereby creating favorable opportunities for market growth. To meet the heightened demand resulting from the increased population, there will be a requisite for amplified crop production, augmented trade volumes, and intensified farming activities. Consequently, companies operating in the alcoholic beverages market are poised to capitalize on the rising demand for alcoholic beverage products, driven by the growing population during the forecast period.

Consumers are willing to pay for premium products creating opportunities in the market.

The alcoholic beverages market is poised for substantial growth due to an increasing demand for premium products. Within the U.S. alcohol industry, the ready-to-drink cocktail segment stands out as the fastest-growing category, holding significant potential for expansion into new markets and providing access to premium cocktails comparable to those found in bars. An exemplar of this trend is the notable growth of bar-quality cocktails, such as the brand Cutwater, which currently leads the U.S. full-flavor cocktail market for ready-to-drink cocktails with a notable surge in growth during 2021. Hence, the escalating demand for premium products serves as a catalyst for the growth of the market.

NORTH AMERICA ALCOHOLIC BEVERAGES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.17% |

|

Segments Covered |

By Product Type, Packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bacardi Ltd., Anheuser Busch InBev SA NV, Constellation Brands Inc., Asahi Group Holdings Ltd., Brown Forman Corp., Bronco Wine Co., The Mark Anthony Group of Companies, Diageo Plc, Heaven Hill Sales Co., Fifth Generation Inc. |

North America Alcoholic Beverages Market Segmentation:

North America Alcoholic Beverages Market Segmentation By Product Type:

- Beer

- Wine

- Spirits

Beer holds a prominent position as the primary alcoholic beverage consumed globally, with a notable prevalence in the United States. The beer market in the region has experienced a surge in popularity, driven by the growing appeal of craft beer, particularly flavored varieties, among consumers, notably the millennial demographic. Given that millennials constitute the largest segment of the U.S. population, accounting for approximately 22%, breweries are strategically introducing innovative flavors to cater to this demographic and gain a competitive advantage. An illustrative example is Constellation Brands' introduction of passionfruit lime, guava lime, and coconut lime under the Corona Refresca brand, specifically targeting millennials in the United States.

Simultaneously, the premium liquor segment in the region is witnessing growth, especially in darker spirits such as whiskey. Notwithstanding, Mexico emerges as the fastest-growing alcoholic beverage market in North America. Despite this, there is a discernible shift in preferences among the younger generations in the region towards craft beer and a diverse range of wines. The sales of low-alcohol beers and wines are on the rise, buoyed by a growing interest from health-conscious consumers, contributing to the overall growth of the market.

North America Alcoholic Beverages Market Segmentation By Packaging:

- Glass Bottles

- Tin

- Plastic Bottles

The glass bottle packaging segment has historically commanded a significant share of the North America alcoholic beverages market. However, forecasts suggest that the tin packaging category is poised to witness substantial market growth in the near future and is expected to progress at a rapid pace throughout the forecast period.

North America Alcoholic Beverages Market Segmentation By Distribution Channel:

- Specialty Stores

- Online Retailers

- Hotels/Bars/Restaurants

- Convenience Stores

The off-trade segment is anticipated to undergo significant growth throughout the forecast period. This segment predominantly includes supermarkets, hypermarkets, specialty stores, and various retail formats, including online sales. Supermarkets and hypermarkets, in particular, dedicate special sections for the storage and display of alcoholic beverages, featuring extensive inventories of diverse brands.

The off-trade channel segments are gaining popularity due to their convenience, offering consumers a broad array of options to choose from. The continuous expansion of new supermarkets and hypermarkets is expected to further amplify the sales of alcohol through these off-trade channels. As an illustration, Aldi has outlined plans to inaugurate nearly 2,500 stores in the US by 2022. Major hypermarkets and supermarkets such as Tesco Plc, Carrefour SA, and Target Brands Inc. contribute to this trend by providing a diverse selection of alcoholic beverage brands in the US market.

North America Alcoholic Beverages Market Segmentation- by Region

- United States

- Canada

- Mexico

The alcoholic market in the United States is characterized by maturity in demand, particularly for spirits and beers. Notably, according to data from the Brewery Association, there was a notable opening of 202 new brewpubs in the country in the year 2022. The market is experiencing growth, driven by the increasing per capita consumption of beer, a trend linked to the rising disposable income in the nation.

COVID-19 Pandemic: Impact Analysis

The outbreak of COVID-19 and the subsequent government-imposed restrictions on travel have significantly influenced alcohol consumption patterns and settings. Although the path to recovery remains challenging, the crisis has heightened the likelihood of individuals resorting to risky drinking as a coping mechanism for stress. The period of the COVID-19 pandemic has witnessed an increase in domestic violence, which serves as a risk factor for problematic alcohol consumption.

The abuse of alcohol carries adverse effects on the consumer's health, elevates the risk of diseases and injuries, weakens the body's defenses against COVID-19, and entails significant economic and social repercussions. Consequently, the development of the COVID-19 pandemic has led to a surge in the production and demand for alcoholic beverages across industries. Furthermore, since the onset of the COVID-19 epidemic, there has been a notable shift in consumer drinking habits, transitioning from bars and restaurants to home settings. This shift has had a commonplace impact on social lives, signifying a significant influence of COVID-19 on alcohol consumption behaviors.

Latest Trends/ Developments:

- In the year 2022, Diageo made a notable announcement regarding the acquisition of Balcones Distilling, commonly known as "Balcones." As a prominent producer of American Single Malt Whisky in the United States, Balcones leverages Texas' intense heat and temperature fluctuations to create whiskies with distinctive flavors.

- Also in 2022, Bacardi introduced a new Indian-made whiskey named Legacy. This strategic move is aimed at establishing a discounted pricing category for consumers, thereby reinforcing Bacardi's position and expansion plans in the Indian market.

Key Players:

These are top 10 players in the North America Alcoholic Beverages Market:-

- Bacardi Ltd.

- Anheuser Busch InBev SA NV

- Constellation Brands Inc.

- Asahi Group Holdings Ltd.

- Brown Forman Corp.

- Bronco Wine Co.

- The Mark Anthony Group of Companies

- Diageo Plc

- Heaven Hill Sales Co.

- Fifth Generation Inc.

Chapter 1. North America Alcoholic Beverages Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Alcoholic Beverages Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Alcoholic Beverages Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Alcoholic Beverages Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Alcoholic Beverages Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Alcoholic Beverages Market– By Product Type

6.1. Introduction/Key Findings

6.2. Beer

6.3. Wine

6.4. Spirits

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Alcoholic Beverages Market– By Packaging

7.1. Introduction/Key Findings

7.2. Glass Bottles

7.3. Tin

7.4. Plastic Bottles

7.5. Y-O-Y Growth trend Analysis By Packaging

7.6. Absolute $ Opportunity Analysis By Packaging , 2024-2030

Chapter 8. North America Alcoholic Beverages Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Specialty Stores

8.3. Online Retailers

8.4. Hotels/Bars/Restaurants

8.5. Convenience Stores

8.6. Y-O-Y Growth trend Analysis By Distribution Channel

8.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 9. North America Alcoholic Beverages Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Packaging

9.1.3. By Distribution Channel

9.1.4. product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Alcoholic Beverages Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Bacardi Ltd.

10.2. Anheuser Busch InBev SA NV

10.3. Constellation Brands Inc.

10.4. Asahi Group Holdings Ltd.

10.5. Brown Forman Corp.

10.6. Bronco Wine Co.

10.7. The Mark Anthony Group of Companies

10.8. Diageo Plc

10.9. Heaven Hill Sales Co.

10.10. Fifth Generation Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The rapid expansion of the alcoholic beverages market can be attributed to the burgeoning youth demographic, rising middle-class incomes, and a robust economy

The top players operating in the North America Alcoholic Beverages Market are - Bacardi Ltd., Anheuser Busch InBev SA NV, Constellation Brands Inc., Asahi Group Holdings Ltd., Brown Forman Corp., Bronco Wine Co., and The Mark Anthony Group of Companies, Diageo Plc, Heaven Hill Sales Co., and Fifth Generation Inc.

The outbreak of COVID-19 and the subsequent government-imposed restrictions on travel have significantly influenced alcohol consumption patterns and settings.

Companies operating in the alcoholic beverages market are poised to capitalize on the rising demand for alcoholic beverage products, driven by the growing population during the forecast period

The alcoholic market in the United States is characterized by maturity in demand, particularly for spirits and beers