AI in Manufacturing Execution System Market Size (2023 – 2030)

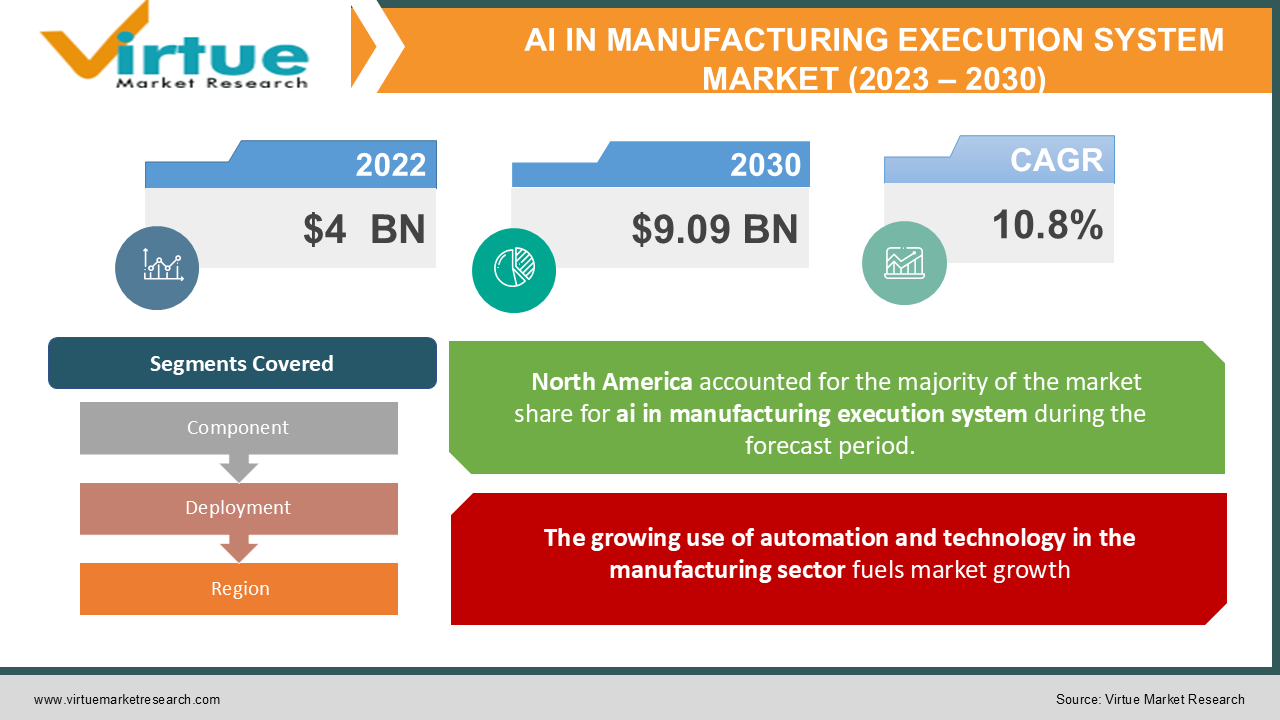

In 2022, the Global AI in Manufacturing Execution System Market was valued at USD 4 billion and is projected to reach a market size of USD 9.09 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.8%.

Industry Overview:

Manufacturers are concentrating on enhancing MES capabilities with the integration of cutting-edge technology, such as artificial intelligence (AI), to quickly evaluate massive amounts of data in response to contemporary security risks. Quick mathematical computations are supported by the AI to improve the critical capacities of human intelligence and quickly identify dangers like anomalies, outliers, and patterns in a workforce with lower skill levels. To improve their analytic and incident response capabilities, many MES service providers have integrated AI into their current solutions. The manufacturing execution system market is expanding as a result of the rise in the end customers' expectations regarding user behavior and threat detection abilities and the integration of existing MES with cutting-edge analytical technologies. The enterprises recognize manufacturing competency as a critical factor to stay competitive in the market, resulting in the high adoption of manufacturing execution system (MES) solutions as a greater priority.

Manufacturers are increasingly using real-time manufacturing execution systems (MES) in conjunction with real-time manufacturing operations management (MOM) systems to track and control their operations to deal with this complexity. They are discovering that their outdated enterprise resource planning (ERP), materials requirements planning (MRP), and manufacturing execution system (MES) systems, when combined with planning boards and spreadsheets, are unable to meet the tracking, planning, and scheduling requirements in today's real-time, demand-driven environment. The AI-based rules and algorithms continuously scan the data gathered by the operations tracking system and data imported from other systems to identify potential problems. The technology may then notify management of alarms via email or text message so they can act right away. Industry 4.0's arrival, which allows for low-cost, higher-quality, and quicker processing during manufacturing is fuelling the market growth. Manufacturers are becoming more and more interested in a variety of technologies, including the internet of things (IoT), cloud storage, mobile computing, advanced analytics, robotics, and machine learning.

MARKET DRIVERS:

The growing use of automation and technology in the manufacturing sector fuels market growth

In today's commercial environments, the full industrial and manufacturing environment is becoming intelligent, smart, and linked. The ecosystem of how exchanges and collaborations between people, machines, data, and technology take place has altered as a result of the emergence of new types of process manufacturing of sensors, smart machines, and linked items. The collection, organization, analysis, and extraction of business values from data and information is a major component of the modern digitalized factories that support smart manufacturing. The requirement for an advanced MES has been further highlighted by Industry 4.0's rising acceptance. Industry 4.0 establishes an interoperability platform between operations and information technology, allowing various pieces of machinery, goods, and materials to connect via embedded electronics. The MES oversees and maintains work progress in a manufacturing facility and provides a solid foundation upon which to create an industry 4.0 application.

AI simplifies and lowers the cost of Manufacturing Execution System Adoption

AI integration into an MES/MOM system entails adding user-defined rules and algorithms with user-defined parameters to the system to significantly increase its intelligence. By doing this, manufacturers may use computers to their full potential, quickly analyzing massive amounts of data in real-time and taking routine choices without the need for human involvement. Numerous operational advantages can be achieved by automating the tracking, planning, and scheduling of manufacturing operations using an MES in conjunction with a real-time MOM system, such as: providing real-time manufacturing visibility of the status of production, inventory, and customer orders; preventing operational errors; eliminating needless overhead labor costs; automatically collecting material traceability data, and increasing sales by providing dependable delivery of semi-custom products.

The market is being driven by the need for mass production and a connected supply chain to accommodate the expanding population

The need for a linked supply chain in industrial businesses is one of the major reasons influencing the MES market. An essential component for enabling effective production activities is efficient information flow throughout the factory. IoT systems can be used by factories for supply chain reporting, inventory tracking, and location tracking of manufactured goods. Another advantage of connected manufacturing solutions is that it is simple for information to flow throughout the whole supply chain, which makes it easy for firms to adjust to the changing market conditions. Real-time data helps producers cut inventory costs, identify potential hazards, and change the output to satisfy market demands. Growth in industrial operations for mass production on a global scale as well as quality improvement is driving the demand for cutting-edge machinery and software systems. Modern production methods and technologies can fill this need with manufacturing execution systems.

MARKET RESTRAINTS:

Costs associated with upgrades, upkeep, and other large capital expenditures may limit market expansion

The investment cost of AI in MES consists of consulting, acquisition, adjustment, implementation, and running charges, all of which raise a company's costs. Since MES adoption varies by industry, MES capital investments are also substantial because they cover several services associated with this system. A company's expenses will rise as a result of the costs associated with MES, which are mostly deployment and operating expenses. The cost of MES may be high due to the software's complexity and other costs like custom integration. Consequently, these businesses must do a thorough analysis of their return on investments before implementing MES. Additionally, due to the high prices of modern MES, many small businesses are unable to upgrade or replace their current MES. As a result, one major aspect that can hinder the MES market's expansion is the expense.

The market growth may be hampered by the complexity of MES deployment in different sectors

The deployment of MES is complicated since each such system is unique depending on the requirements of the specific industries. Additionally, the procedures used in manufacturing and production operations vary from sector to sector. The manufacturing process has several stages, including implementation, staging, and moving to the factory floor. Due to the complexity of the hardware architecture of the production or shop floor, implementation at these distinct phases becomes challenging. Because the manufacturing execution system requires numerous alterations during installation, it is difficult for it to adapt to various situations at various phases and execute well. The main obstacles facing the MES market are the intricate processes required to integrate manufacturing execution systems with every system on a production floor and the lengthy deployment process.

AI IN MANUFACTURING EXECUTION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.8% |

|

Segments Covered |

By Component, Deployment and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AVEVA Group plc, Emerson Electric Co., Dassault Systèmes SE, EAZYWORKS INC.,Siemens, Honeywell International Inc., General Electric Company, SAP SE, Oracle Corporation, Rockwell Automation, Inc. |

Segmentation Analysis

AI in Manufacturing Execution System Market – By Component:

-

Software

-

Services

In 2021, the manufacturing execution system market was dominated by the software category, which held a bigger market share. Manufacturing activities are the focus of the manufacturing execution system's development and construction. The majority of manufacturing businesses employ a planning procedure, such as manufacturing resource planning or enterprise resource planning, to decide which items will be produced. The production execution system decreases work-in-process inventory, shortens manufacturing cycles, enhances product quality, eliminates data input time, and accomplishes many other things. Such elements are what fuel the global market for AI in manufacturing execution systems.

AI in Manufacturing Execution System Market – By Deployment:

-

On-Premises

-

Cloud

-

Hybrid

Based on deployment type, the AI in the manufacturing execution system market is categorized into on-premises, cloud, and hybrid. In 2021, the on-premises market category held a greater market share. The advantages of on-premises deployment for manufacturers installing manufacturing execution systems include the preservation of all existing internal systems, including authentication and access privileges. The hybrid deployment category is anticipated to grow at the greatest CAGR during the anticipated period. Due to the increasing significance of tracking real-time information about the activities in oil and gas fields, the use of hybrid deployment of manufacturing execution systems has grown in the oil and gas sector. Additionally, a hybrid manufacturing execution system offers additional storage space, protecting data security.

AI in Manufacturing Execution System Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

North America is anticipated to hold the largest market share for AI in MES throughout the projection period. The region is home to numerous important MES providers that foster innovation, including Honeywell, Oracle Corporation, Emerson, and Rockwell Automation. Additionally, North America's solid financial standing allows it to make significant investments in cutting-edge products and technology that have given it a competitive edge in the market. Additionally, the region is witnessing several partnerships amongst market participants, which is enabling them to combine their goods and solutions to strengthen their market position. One of the potential market opportunities in the region's ongoing expenditures and expansions in digitization across all industries. The number of SMEs is expanding, and major companies like IBM and General Electric are digitizing more industrial processes, which is helping the IoT market in the local manufacturing sector flourish. SMEs are becoming more open to integrating new technology into their current systems, whereas major firms have significant expenditures for digitalization.

Asia Pacific is anticipated to experience the greatest CAGR growth for AI in the manufacturing execution systems market during the forecast period. The Asia Pacific has a very high need for manufacturing execution systems because of nations like China, Japan, South Korea, and India. Due to their rapid industrialization and emphasis on manufacturing operations in sectors like the automotive, consumer electronics, and other industries, China and India have the fastest-growing economies in the world. As a result of the country's rising demand for manufacturing facilities, China is predicted to grow at the fastest rate. Along with the establishment of several production facilities in sectors like textiles, power, and pharmaceuticals where manufacturing execution systems are in high demand, there has also been an increased focus on these sectors in addition to automotive and consumer electronics. The expansion of the market is being fueled by the spread of IIoT (Industrial Internet of Things) and Big Data in sectors like healthcare, automotive, and pulp & paper.

Major Key Players in the Market

The major players in the global AI in Manufacturing Execution System Market are

-

Honeywell International Inc.

-

General Electric Company

-

SAP SE

-

Oracle Corporation

-

Rockwell Automation, Inc.

Notable happenings in the AI in Manufacturing Execution System Market in the recent past:

-

Product Launch- In May 2021, Siemens unveiled Opcenter Execution Discrete 4.1, a robust MES solution that also fully integrates regulatory and quality requirements, synchronizes production processes for the best supply-chain management, and offers consistent maintenance and operating cost savings.

-

Product Launch- In November 2021, Rockwell Automation introduced a new remote access solution that includes strong security features including multi-factor authentication and encrypted protocols. The remote access solution can put OEMs in a position to meet present and future demands for remote support.

-

Product Launch- In November 2021, AVEVA released a tool for image classification-based analytics called the Vision AI Assistant 2021. The AI solution is now incorporated into AVEVA Insight and System Platform and Operations Management Interface.

COVID-19 pandemic impact on AI in Manufacturing Execution System Market

The COVID-19 pandemic negatively impacted the world economies in 2020 and presented numerous difficulties. Lockdowns caused the temporary closure of several production sectors, which decreased demand for manufacturing execution system (MES) solutions internationally. The second quarter (April to June) of 2020 saw a decline in manufacturing output of 11.2% when compared to the same period in 2019, according to the World Manufacturing Production Statistics by the UNIDO. The COVID-19 epidemic thus negatively impacted the manufacturing execution system market because MES solutions are directly proportionate to production operations. Ease in lockdown restrictions allowed manufacturing businesses to resume operations with upgraded and improved supply chains, further advancing the use of MES. The demand for MES is likely to increase as a result of their expanding applications in the manufacturing industries and the expanding use of high-tech goods based on artificial intelligence (AI) in these industries.

Chapter 1. AI in Manufacturing Execution System Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. AI in Manufacturing Execution System Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. AI in Manufacturing Execution System Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. AI in Manufacturing Execution System Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. AI in Manufacturing Execution System Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. AI in Manufacturing Execution System Market – By Component

6.1. Software

6.2. Services

Chapter 7. AI in Manufacturing Execution System Market – By Deployment

7.1. On-Premises

7.2. Cloud

7.3. Hybrid

Chapter 8. AI in Manufacturing Execution System Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. AI in Manufacturing Execution System Market – key players

9.1 AVEVA Group plc

9.2 Emerson Electric Co.

9.3 Dassault Systèmes SE

9.4 EAZYWORKS INC.

9.5 Siemens

9.6 Honeywell International Inc.

9.7 General Electric Company

9.8 SAP SE

9.9 Oracle Corporation

9.10 Rockwell Automation, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900