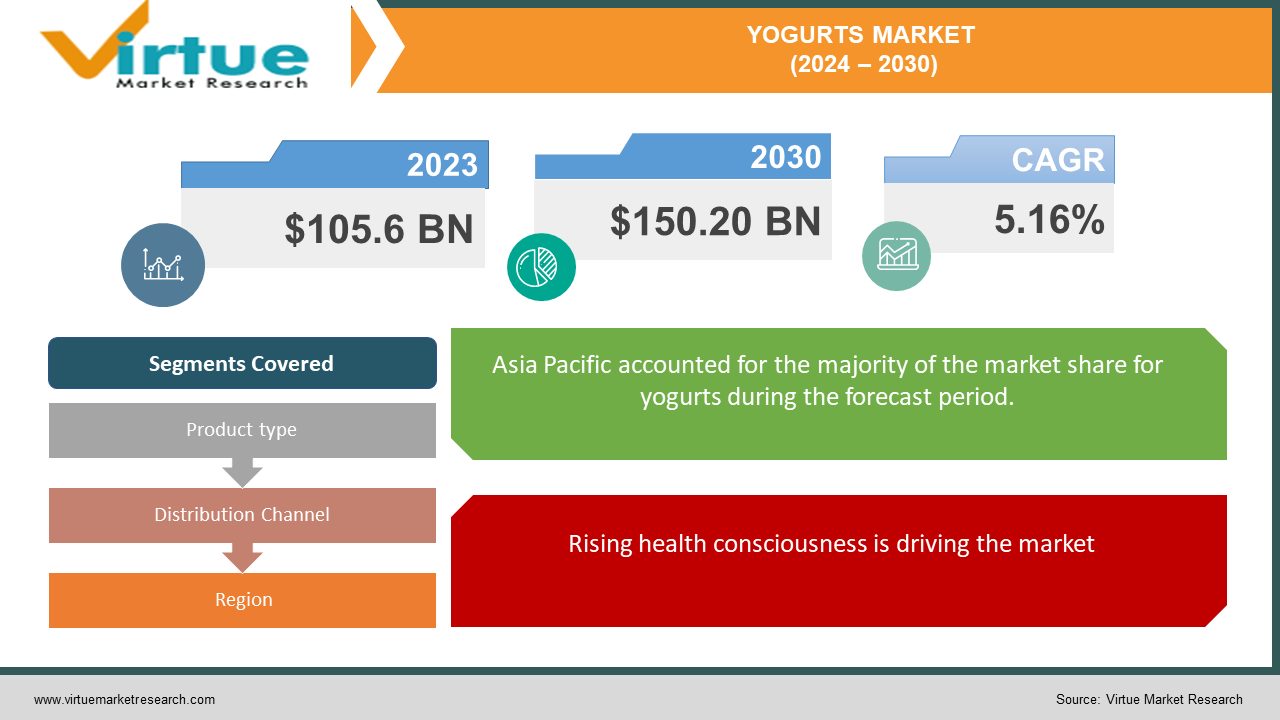

Yogurts Market Size (2024 – 2030)

The Global Yogurts Market was valued at USD 105.6 billion in 2023 and will grow at a CAGR of 5.16% from 2024 to 2030. The market is expected to reach USD 150.20 billion by 2030.

Yogurt is a creamy, slightly tart food made by fermenting milk with live bacteria, typically Lactobacillus and Streptococcus thermophilus. This process thickens and sours the milk, breaking down lactose sugars and creating a characteristic tanginess. Available in various textures, from smooth and drinkable to thick and spoonable, yogurt is enjoyed plain or flavored with fruits, honey, granola, or other toppings. It often boasts a range of potential health benefits, including improved gut health, protein, and calcium intake, and potentially even boosted immunity. Plant-based alternatives are gaining significant traction, catering to the growing vegan and dairy-free population and aligning with ethical and sustainability concerns.

Key Market Insights:

Asia-Pacific currently reigns supreme as the largest yogurt market, boasting a value share of 44.55%.

Consumers are increasingly seeking functional yogurts that offer health benefits beyond just calcium. This includes options with high protein content, probiotics, and gut health-supporting ingredients.

Supermarkets account for a dominant 61.43% value share within the off-trade segment.

The yogurt market is witnessing a surge in innovative product formats like yogurt drinks, frozen yogurts, and snackable yogurts.

Easy availability across retail and food service channels is another key factor propelling market growth, with Asia-Pacific leading the consumption charge at a projected growth rate of 10.68%.

Global Yogurts Market Drivers:

Rising health consciousness is driving the market

The health and wellness trend is a major driver for yogurt consumption. As people become more health-conscious, they seek out nutritious foods. Yogurt perfectly fits the bill, offering a rich source of protein, essential for building and maintaining muscle, and calcium, crucial for strong bones and teeth. Additionally, yogurt often contains probiotics, live bacteria believed to improve gut health and potentially boost the immune system. These perceived health benefits contribute to yogurt's image as a delicious and wholesome food choice.

The shift towards low-fat and low-sugar options is driving the market

Consumers are ditching sugary treats in favor of yogurt's guilt-free indulgence. The rise of low-fat and low-sugar options caters to those watching their weight or managing dietary needs. These yogurts offer a satisfying sweetness without packing on the calories or sugar crash. They can even be a better alternative to sugary desserts, providing protein and a creamy texture that curbs cravings while still fulfilling a sweet tooth.

Demand for functional benefits is driving the market

Yogurt is transcending its status as a simple snack, evolving into a targeted health product. Consumers are increasingly seeking yogurts with specific functionalities like gut health improvement, immune system support, and weight management. This has led to the rise of fortified and functional yogurts, addressing these precise needs. These yogurts often boast added prebiotics, probiotics, or other ingredients tailored to deliver specific health benefits. This functional twist not only positions yogurt as a valuable dietary addition but also positions it as a healthier alternative to traditional sugary desserts.

Global Yogurts Market challenges and restraints:

Fluctuations in milk prices are restricting the market growth

As milk forms the foundation of yogurt, fluctuations in its price directly impact yogurt manufacturers' profitability. Since milk constitutes a significant portion of the production cost, any rise in its price translates into higher production costs, squeezing profit margins. Conversely, a dip in milk prices offers a window for manufacturers to potentially lower their costs, though fierce competition in the market might lead them to maintain prices instead, sacrificing some profit gains to remain competitive. This dependence on a volatile commodity like milk necessitates strategic planning by manufacturers, including exploring alternative sourcing options, negotiating long-term contracts with suppliers, and adjusting product pricing models to mitigate the risk associated with milk price fluctuations.

Stringent regulations are restricting the market growth

The yogurt industry grapples with stringent regulations, impacting manufacturers in two ways: increased production costs and compliance burdens. Firstly, adhering to these regulations often necessitates additional investments in equipment, facilities, and quality control measures, driving up production costs. This can be particularly challenging for smaller manufacturers who may have limited resources. Secondly, complying with complex regulations requires dedicating manpower and resources to navigate the legal framework and ensure adherence. This can be time-consuming and divert resources from other areas of the business.

Rising use of artificial additives and ingredients is restricting the market growth

The tide is turning towards natural and organic yogurts, driven by a growing consumer focus on health and wellness. This shift is putting pressure on conventional yogurts laden with artificial additives and ingredients. Health-conscious individuals are increasingly wary of potential health risks associated with artificial sweeteners, preservatives, and artificial flavors. This concern translates into declining sales of conventional yogurts and a surge in demand for natural options. Manufacturers are responding by reformulating products with cleaner labels, featuring organic milk, minimal processing, and limited artificial ingredients. This trend is expected to continue as consumers prioritize natural ingredients and transparency in their food choices, posing a significant challenge to conventional yogurt producers who must adapt or risk losing market share.

Market Opportunities:

The yogurt market presents exciting opportunities for innovative companies to cater to evolving consumer preferences. The growing demand for natural and organic products opens doors for yogurts made with organic milk, minimal processing, and limited artificial additives. Sugar-conscious consumers create a space for yogurts with reduced sugar content, incorporating natural sweeteners like stevia or monk fruit. The fitness and protein enthusiasts represent an opportunity for high-protein yogurts with added whey or plant-based proteins. Emerging markets like Asia and Africa, with growing disposable incomes and rising health awareness, offer significant untapped potential. Additionally, the convenience trend paves the way for innovative formats like single-serve portion packs and yogurt drinks for on-the-go consumption. By capitalizing on these trends and focusing on product innovation, sustainability, and catering to diverse dietary needs, companies can unlock significant growth opportunities in the dynamic Yogurts Market.

YOGURTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.16% |

|

Segments Covered |

By Product type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Danone S.A., Nestlé S.A., FrieslandCampina N.V., Yili Group, Mengniu Dairy, General Mills, Inc., Chobani, LLC, Lactalis Group, Savencia SA, Gujarat Cooperative Milk Marketing Federation Ltd. |

Yogurts Market Segmentation - by Product Type

-

Set Yogurt

-

Greek Yogurt

-

Drinking Yogurt

-

Frozen Yogurt

While each yogurt type caters to different preferences, pinpointing the absolute best seller is difficult due to varying regional popularity and diverse consumer choices. However, Set Yogurt's classic appeal and versatility, coupled with its historical dominance, make it a strong contender for the top-selling position globally.

Yogurts Market Segmentation - By Distribution Channel

-

Supermarkets

-

Convenience Stores

-

Independent Retailers

-

Specialist Retailers

-

Online Stores

While online options are gaining ground, Supermarkets/Hypermarkets currently hold the largest share of yogurt sales. These larger stores offer the widest variety of brands and products, catering to diverse consumer needs and preferences. They also benefit from established customer traffic and bulk buying habits, solidifying their dominant position in the yogurt distribution landscape

Yogurts Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The global yogurt market exhibits diverse growth patterns across different regions. Asia Pacific currently holds the dominant position in terms of market share, driven by factors like increasing disposable incomes, a growing middle class, and rising health consciousness. This region, particularly China, India, and Japan, presents a significant market opportunity for yogurt manufacturers. However, the fastest-growing region is Latin America, fueled by burgeoning urbanization, a young population, and a growing taste for convenient and healthy food options. Brazil and Mexico are the frontrunners in this region, showcasing a strong demand for yogurt. While North America and Europe remain established markets with a high yogurt consumption base, their growth is expected to be slower compared to the dynamic and rapidly evolving markets in Asia Pacific and Latin America.

COVID-19 Impact Analysis on the Global Yogurts Market

COVID-19's impact on the yogurt market was a mixed bag. Initial lockdowns led to a dip in sales as impulse purchases at convenience stores declined. However, the focus on health during the pandemic boosted the demand for yogurts perceived as immunity boosters due to their probiotic content. This surge in health-conscious buying benefitted the sales of specific yogurt segments like Greek yogurt. Moreover, with disrupted supply chains and limited restaurant options, consumers turned to stockpiling shelf-stable yogurts, further impacting short-term sales. In the long run, however, the pandemic accelerated the trend toward e-commerce, prompting yogurt manufacturers to strengthen their online presence. Overall, COVID-19's impact appears to be short-term, with the market likely returning to its pre-pandemic growth trajectory, potentially fueled by a lasting emphasis on health and immunity.

Latest trends/Developments

The global yogurt market is experiencing a wave of exciting developments driven by evolving consumer preferences and a focus on health and wellness. The demand for functional benefits is at an all-time high, with consumers seeking yogurts that boast specific health claims like improved gut health, immunity support, and weight management. This trend is fueling the rise of fortified and functional yogurts, often enriched with prebiotics, probiotics, and other targeted ingredients. Plant-based alternatives are gaining significant traction, catering to the growing vegan and dairy-free population and aligning with ethical and sustainability concerns. Manufacturers are experimenting with various plant-based milks like coconut, soy, and oat, offering a wider range of options for consumers with dietary restrictions or ethical choices. Convenience remains paramount, with single-serve and on-the-go yogurts witnessing rising popularity. Additionally, unique flavor profiles are enticing consumers, with manufacturers incorporating exotic fruits, functional ingredients, and innovative combinations to stand out in a competitive market. Sustainability is also becoming a crucial factor, with consumers increasingly opting for yogurts made with organic and locally sourced ingredients. Manufacturers are responding by implementing sustainable practices throughout the supply chain, using eco-friendly packaging, and minimizing their environmental footprint.

Key Players:

-

Danone S.A.

-

Nestlé S.A.

-

FrieslandCampina N.V.

-

Yili Group

-

Mengniu Dairy

-

General Mills, Inc.

-

Chobani, LLC

-

Lactalis Group

-

Savencia SA

-

Gujarat Cooperative Milk Marketing Federation Ltd.

Chapter 1. Yogurts Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Yogurts Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Yogurts Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Yogurts Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Yogurts Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Yogurts Market – By Product Type

6.1 Introduction/Key Findings

6.2 Set Yogurt

6.3 Greek Yogurt

6.4 Drinking Yogurt

6.5 Frozen Yogurt

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Yogurts Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets

7.3 Convenience Stores

7.4 Independent Retailers

7.5 Specialist Retailers

7.6 Online Stores

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Yogurts Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Yogurts Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Danone S.A.

9.2 Nestlé S.A.

9.3 FrieslandCampina N.V.

9.4 Yili Group

9.5 Mengniu Dairy

9.6 General Mills, Inc.

9.7 Chobani, LLC

9.8 Lactalis Group

9.9 Savencia SA

9.10 Gujarat Cooperative Milk Marketing Federation Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global yogurt market was valued at USD 105.6 billion in 2023 and will grow at a CAGR of 5.16% from 2024 to 2030. The market is expected to reach USD 150.20 billion by 2030.

Rising health consciousness is driving the market, Product diversification, these are the reason which is driving the market.

Based on product type it is divided into four segments – Set Yogurt, Greek Yogurt, Drinking Yogurt, Frozen Yogurt

Asia-Pacific is the most dominant region for the yogurt market.

Danone S.A., Nestlé S.A., FrieslandCampina N.V., Yili Group