Europe Yogurts Market Size (2024-2030)

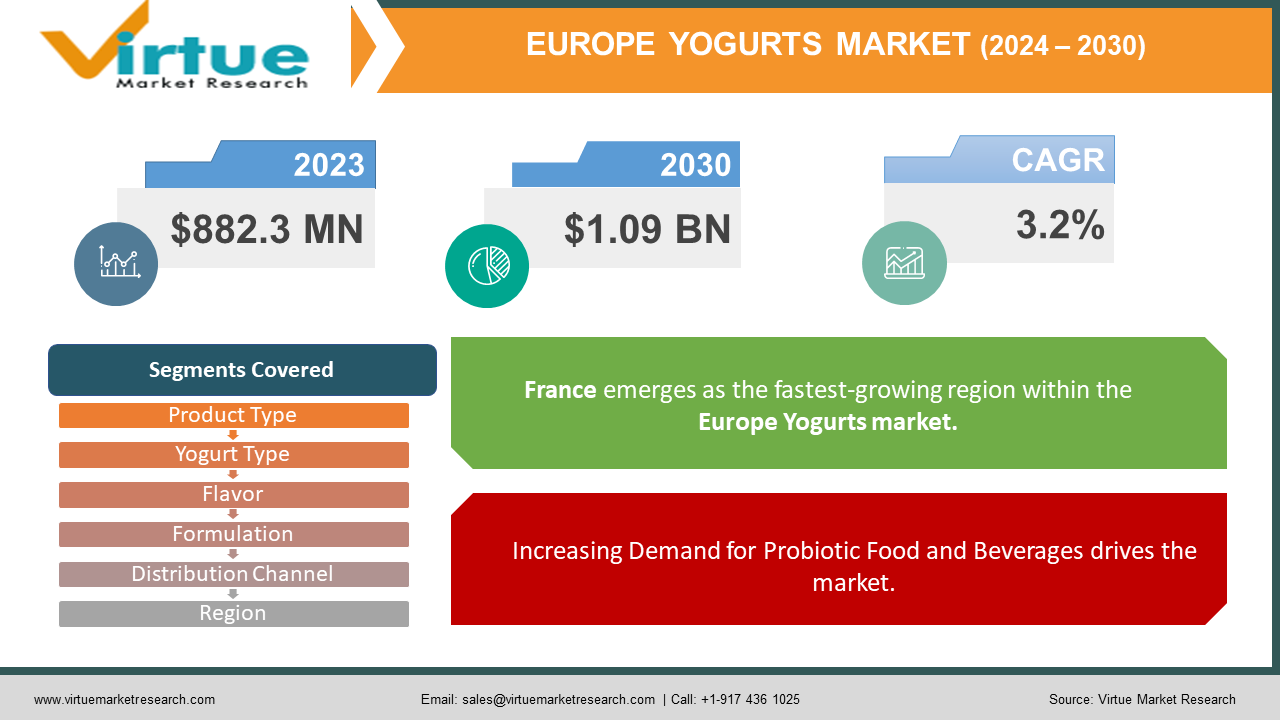

The Europe yogurt market was valued at USD 882.3 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.09 billion by 2030, growing at a CAGR of 3.2%.

Key Market Insights:

Yogurt undergoes bacterial fermentation of milk, a process vital in its production. A noteworthy aspect of yogurt is its incorporation of probiotics, essential for bolstering immune systems and aiding digestion, along with containing crucial vitamins such as B1, B2, B12, A, and D. Live probiotic cultures found in yogurt, such as Streptococcus thermophilus and Lactobacillus delbrueckii subsp. Bulgaricus, are beneficial bacteria that contribute to nurturing a healthy gut, reducing blood pressure, and enhancing the immune system.

Certain varieties of yogurt serve as significant sources of calcium, crucial for bone health. Vegan yogurt, on the other hand, is crafted from nondairy plant sources like almonds, soy, coconuts, peas, or cashews instead of traditional cow’s milk. The production process involves fermenting almond milk, soy milk, or oat milk and blending it with an appropriate amount of cane sugar, fruits, and various other ingredients. This alternative yogurt is notably rich in fiber, calcium, and protein, while also containing probiotics beneficial for digestive health.

Europe Yogurts Market Drivers:

Increasing Demand for Probiotic Food and Beverages drives the market.

The prevalent occurrence of digestive disorders is propelling the demand for probiotic foods among diverse consumer segments. Yogurt emerges as the favored probiotic option, available in various flavors and forms, including spoonable and drinkable varieties. Within the European populace, the growing inclination towards healthy dietary choices and snacking alternatives is further fueling the consumption of probiotics, encompassing products like kombucha, yogurts, and probiotic beverages.

Moreover, fermented foods such as sauerkraut, pickles, and a range of beverages like kefir, buttermilk, tempeh, kimchi, and miso are integral components of the European diet, contributing to the widespread adoption of probiotics. Non-dairy probiotic alternatives have garnered significance amidst the rising popularity of veganism and the substantial prevalence of lactose intolerance across European communities.

Furthermore, fermented fruit juices, desserts, and cereal-based products have proven to be effective carriers for delivering probiotics, enhancing their market potential. This increased incorporation of dairy and non-dairy yogurt has prompted key players in the yogurt industry to continually invest in research and development endeavors to innovate products, aligning with evolving consumer preferences such as low or no-sugar formulations.

Additionally, yogurt stands out as a protein-rich dietary option that aids in metabolism improvement, leading individuals to integrate it into their daily consumption habits to potentially enhance calorie burning. The growing recognition of yogurt's health benefits, including its contribution to weight management and gut health enhancement, further drives its increasing demand.

The rising health benefits of yogurt increase the market growth

Yogurt is produced through the bacterial fermentation process of milk. A key component of yogurt lies in its inclusion of probiotics, which play a vital role in enhancing immune function, aiding digestion, and delivering essential vitamins such as B1, B2, B12, A, and D. These constituents contribute significantly to the health benefits associated with yogurt, thereby driving its consumption. Within yogurt, live probiotic cultures including Streptococcus thermophilus and Lactobacillus delbrueckii subsp. Bulgaricus thrive, promoting gut health, regulating blood pressure, and fortifying the immune system. Furthermore, certain yogurt variants serve as noteworthy sources of bone-strengthening calcium, further amplifying the demand for yogurt in the market

Vegan yogurt, crafted from non-dairy plant sources like almonds, soy, coconuts, peas, or cashews, offers an alternative to traditional dairy-based options. Utilizing almond milk, soy milk, or oat milk as its base, and combining it with cane sugar, fruits, and other ingredients, vegan yogurt emerges as a fiber-rich, calcium-laden, and protein-packed product. Its probiotic content contributes positively to digestive health. Particularly, coconut yogurt presents various health advantages, including fortifying bones, enhancing vision, reducing waist circumference, and supporting cardiovascular health.

As a nutrient-dense food choice, yogurt enhances diet quality and promotes healthy habits. It appeals to individuals mindful of their health and those managing obesity concerns, thereby bolstering yogurt consumption and augmenting its market presence.

Europe Yogurts Market Restraints and Challenges:

The consumption of dairy products has experienced notable growth among consumers, with yogurt emerging as a significant contributor to the dairy industry's expansion. However, this upward trend may face challenges due to the escalating prevalence of lactose intolerance, a condition characterized by the body's inability to digest lactose, a sugar found in dairy products. The incidence of lactose intolerance has been on the rise within the population, posing a potential hindrance to yogurt intake.

Furthermore, milk allergies present another concern for a segment of the population, primarily triggered by two milk proteins: casein and whey. When individuals with milk allergies consume dairy, their immune systems perceive these proteins as harmful, prompting the production of antibodies. Subsequent interactions between these antibodies and milk proteins lead to allergic reactions, manifesting in symptoms ranging from mild to severe, such as nausea, vomiting, and digestive issues.

Of particular concern is cow’s milk allergy, identified as one of the leading causes of childhood food allergies in European countries and beyond. The World Allergy Organization, a global coalition of allergy and immunology societies, has highlighted cow’s milk allergy as a significant public health challenge, underscoring the need for heightened awareness and management strategies to address this widespread issue.

Europe Yogurts Market Opportunities:

In recent years, there has been a notable surge in consumer demand for flavored yogurt, driving manufacturers to diversify their offerings to meet this growing preference. A wide array of flavors, including strawberry, blueberry, banana, and cherry, have been introduced to cater to varying consumer tastes. This trend extends beyond yogurt to encompass other dairy products, such as flavored milk, cheese variants like smoked flavored cheese, drinkable yogurt, and various other flavored dairy items. The availability of diverse flavor options stands out as a key driver behind the expanding yogurt market.

Furthermore, manufacturers often incorporate additive flavors into dairy products to elevate their taste profiles. Commonly found flavors include strawberry, blueberry, raspberry, vanilla, chocolate, banana, coconut, mixed berries, and tropical fruit, among others. This strategic inclusion of flavors not only enhances taste but also serves to attract consumers across all age groups, thereby fueling market growth.

Moreover, flavored yogurt's appeal lies not only in its taste but also in its nutritional value. Blueberries, for instance, are rich in essential minerals such as iron, calcium, and phosphorus, providing consumers with added nutritional benefits. This nutritional enrichment, coupled with the appealing taste of flavored yogurts, contributes significantly to the market's expansion.

As a result, the introduction of enticing new yogurt flavors continues to drive growth within the yogurt market, appealing to a broad spectrum of consumers and solidifying its position in the region's food market landscape.

EUROPE YOGURTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.2% |

|

Segments Covered |

By Product Type, Yogurt Type,Flavor, Formulation, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Danone SA, Lactalis Group, Royal FrieslandCampina NV, Nestle SA, Emmi Group , General Mills Inc, Fage International SA, Müller, J Sainsbury plc, KOLIOS SA, Honsha |

Europe Yogurts Market Segmentation

Europe Yogurts Market Segmentation BY YOGURT TYPE

- Regular yogurt

- Skyr/ icelandic-style yogurt

- Concentrated yogurt

- Probiotic yogurt

- Set yogurt

- Bio live yogurt

- Stirred yogurt

- Others

Set yogurt has emerged as the predominant player in the European yogurt market, distinguished by its unique setting process that results in a firmer texture compared to other yogurt varieties. Meanwhile, Greek yogurt is anticipated to experience the most significant growth trajectory during the forecast period. This growth is attributed to the increasing consumer preference for thick-textured yogurt, consequently driving the demand for Greek yogurt across Europe.

Europe Yogurts Market Segmentation BY Product Type

- Drinkable yogurt

- Spoonable yogurt

- Frozen yogurt

- Others

In the market, frozen yogurt stands out as a dominant segment, while drinkable yogurt emerges as the fastest-growing segment. The frozen products market is at an all-time high augmenting the demand for frozen products. They are easy to store and have longer shelf life which is also contributing to its dominance over other segments.

Europe Yogurts Market Segmentation BY Flavor

- Plain

- Flavored

The Europe yogurt market is primarily led by the Plain segment, holding the largest market share. This dominance is attributed to the high nutritional value associated with plain yogurts, which fuels the segment's growth. Conversely, the flavored yogurt segment is expected to witness the highest compound annual growth rate (CAGR) during the forecast period. This growth trajectory is driven by the increasing consumer preference for a diverse range of flavored yogurt options, thereby boosting demand within this segment.

Europe Yogurts Market Segmentation BY Formulation

- Sweetened

- Unsweetened

Unsweetened yogurt holds the largest market share for its wide application for various recipes, while the sweetened yogurt market is experiencing the most rapid growth during the forecast period, 2024-2030.

Europe Yogurts Market Segmentation BY Distribution Channel

- Store-based retailing

- Non-store retailing

Supermarkets and hypermarkets currently hold the largest market share in the yogurt retail landscape, as consumers typically favor purchasing yogurt from these outlets due to their perceived freshness. However, the Online Stores segment is poised for the highest compound annual growth rate (CAGR) over the forecast period. This growth is fueled by several factors including high discounts, convenient doorstep delivery, and competitive pricing, making online purchasing an increasingly attractive option for consumers.

Europe Yogurts Market Segmentation- by Region

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

Western Europe serves as a crucial region for yogurt manufacturers, with the top five countries - France, Germany, Italy, Spain, and the UK - collectively commanding over 60% of the yogurt market. Among these nations, Germany emerges as the leader, holding the largest market share in the European yogurt market. The region's growth is propelled by the increasing consumer preference for healthy and organic food options.

France, renowned for its culinary culture, also ranks as one of the foremost consumer countries of yogurt. As of 2022, the annual yogurt consumption volume in France is estimated to stabilize at approximately 21.3 kg per capita, highlighting the enduring popularity of yogurt within the country.

COVID-19 Pandemic: Impact Analysis

Latest Trends/ Developments:

- In January 2022, DANONE finalized its leadership team by appointing three key executives to the Executive Committee: a Chief Operations Officer, a Chief Research, Innovation, Quality, and Food Safety Officer, This strategic initiative was designed to fortify its innovation strategy and drive sustainable long-term revenue growth.

Key Players:

These are the top 10 players in the European Yogurts Market: -

- Danone SA

- Lactalis Group

- Royal FrieslandCampina NV

- Nestle SA

- Emmi Group

- General Mills Inc

- Fage International SA

- Müller, J Sainsbury plc

- KOLIOS SA

- Yakult Honsha

Chapter 1. Europe Yogurts Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Yogurts Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Yogurts Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Yogurts Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Yogurts Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Yogurts Market – By Yogurt Type

6.1. Introduction/Key Findings

6.2. Regular yogurt

6.3. Skyr/ icelandic-style yogurt

6.4. Concentrated yogurt

6.5. Probiotic yogurt

6.6. Set yogurt

6.7. Bio live yogurt

6.8. Stirred yogurt

6.9. Others

6.10. Y-O-Y Growth trend Analysis By Yogurt Type

6.11. Absolute $ Opportunity Analysis By Yogurt Type , 2024-2030

Chapter 7. Europe Yogurts Market – By Product Type

7.1. Introduction/Key Findings

7.2 Drinkable yogurt

7.3. Spoonable yogurt

7.4. Frozen yogurt

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Product Type

7.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 8. Europe Yogurts Market – By Flavor

8.1. Introduction/Key Findings

8.2 Plain

8.3. Flavored

8.4. Y-O-Y Growth trend Analysis Flavor

8.5. Absolute $ Opportunity Analysis Flavor , 2024-2030

Chapter 9. Europe Yogurts Market – By Formulation

9.1. Introduction/Key Findings

9.2 Sweetened

9.3. Unsweetened

9.4. Y-O-Y Growth trend Analysis Formulation

9.5. Absolute $ Opportunity Analysis Formulation , 2024-2030

Chapter 10. Europe Yogurts Market – By Distribution Channel

10.1. Introduction/Key Findings

10.2 Store-based retailing

10.3. Non-store retailing

10.4. Y-O-Y Growth trend Analysis Distribution Channel

10.5. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 11. Europe Yogurts Market , By Geography – Market Size, Forecast, Trends & Insights

11.1. Europe

11.1.1. By Country

11.1.1.1. U.K.

11.1.1.2. Germany

11.1.1.3. France

11.1.1.4. Italy

11.1.1.5. Spain

11.1.1.6. Rest of Europe

11.1.2. By Yogurt Type

11.1.3. By Product Type

11.1.4. By Flavor

11.1.5. Formulation

11.1.6. Distribution Channel

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Europe Yogurts Market – Company Profiles – (Overview, Yogurt Type Portfolio, Financials, Strategies & Developments)

12.1. Danone SA

12.2. Lactalis Group

12.3. Royal FrieslandCampina NV

12.4. Nestle SA

12.5. Emmi Group

12.6. General Mills Inc

12.7. Fage International SA

12.8. Müller, J Sainsbury plc

12.9. KOLIOS SA

12.10. Yakult Honsha

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The prevalent occurrence of digestive disorders is propelling the demand for probiotic foods among diverse consumer segments. Yogurt emerges as the favored probiotic option, available in various flavors and forms, including spoonable and drinkable varieties

The top players operating in the Europe Yogurts Market are - Danone SA, Lactalis Group, Royal FrieslandCampina NV, and Nestle SA

In January 2022, DANONE finalized its leadership team by appointing three key executives to the Executive Committee: a Chief Operations Officer, and a Chief Research, Innovation, Quality, and Food Safety Officer. This strategic initiative was designed to fortify its innovation strategy and drive sustainable long-term revenue growth

France, renowned for its culinary culture, also ranks as one of the foremost consumer countries of yogurt