Wrapping Machine Market Size (2024 – 2030)

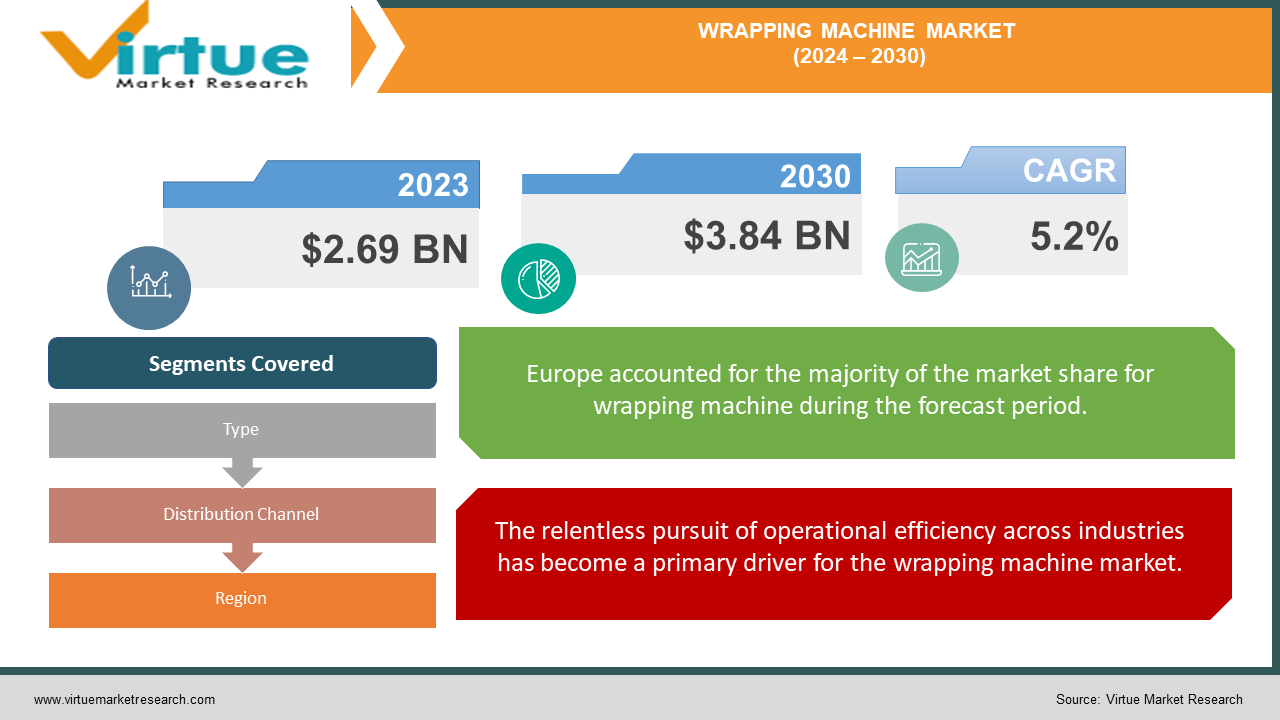

The Global Wrapping Machine Market was valued at USD 2.69 billion in 2024 and is projected to reach a market size of USD 3.84 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

Wrapping machines are the unsung heroes of the modern world, ensuring that goods reach customers in perfect shape. These devices are essential for maintaining the integrity of products, prolonging their shelf lives, and improving their visual appeal in a variety of industries, including food and beverage, pharmaceutical, and cosmetics. They operate nonstop in the background to wrap, seal, and protect; they are the foundation of packaging operations. The wrapping machine industry is a dynamic, innovative tapestry. Manufacturers are incorporating cutting-edge technologies like automation, IoT, and AI, always pushing the envelope of what is feasible. These developments go beyond efficiency and speed to include the development of intelligent, adaptable systems that can easily manage demanding packaging specifications. Environmental sustainability is another thread woven into the fabric of the wrapping machine market. As global consciousness shifts towards greener practices, manufacturers are responding with eco-friendly solutions. Machines are being designed to use less energy, reduce waste, and accommodate biodegradable and recyclable materials. This shift is not just a trend but a fundamental transformation in how packaging is approached, ensuring that the process is as gentle on the planet as it is on the products.

Key Market Insights:

Small tabletop wrapping machines for retail use averaged $750 per unit.

The market saw a 7% year-over-year growth from 2022 to 2023.

Europe led consumption with 380,000 units sold. North America followed with 310,000 units.

The Asia-Pacific region showed the fastest growth at 9.5% year-over-year.

Wrapping machines with speeds over 100 packages per minute saw 14% growth.

Machines capable of handling multiple package sizes grew by 19%.

Eco-friendly wrapping solutions experienced a 25% surge in demand.

The e-commerce sector drove 11% of total market growth.

Wrapping machines with AI-powered optimization features commanded a 30% price premium.

The food industry utilized 52% of all wrapping machines sold.

The pharmaceutical sector consumed 18% of units.

Consumer goods manufacturers purchased 15% of wrapping machines.

The average lifespan of an industrial wrapping machine was 8.5 years.

Energy-efficient models saw a 22% increase in demand.

Wrapping Machine Market Drivers:

The relentless pursuit of operational efficiency across industries has become a primary driver for the wrapping machine market.

In the food and beverage business, automated wrapping machines offer precise and hygienic packaging, which is essential for maintaining product freshness and appearance. These robots can handle a variety of goods, such as baked goods and fresh fruit, with little help from humans. This not only speeds up the packaging process but also reduces the risk of infection. As e-commerce grows, effective packaging solutions become more and more crucial. Online retailers may find it challenging to quickly process and ship out a wide variety of products. Product packaging, ranging from large home goods to small gadgets, may be completed efficiently and precisely using wrapping machines that come equipped with barcode scanners and integrated inventory management systems.

The growing global focus on sustainability and environmental responsibility has emerged as a significant driver in the wrapping machine market.

One key area of development is in machines designed to work with sustainable packaging materials. Traditional plastic wraps are being replaced by biodegradable alternatives, recycled content films, and even plant-based materials. Wrapping machines capable of handling these new substrates without sacrificing speed or reliability are in high demand. This shift not only addresses environmental concerns but also helps companies comply with increasingly strict packaging regulations in various markets. Waste reduction is another area where wrapping machines are making significant strides. Precision control systems ensure that only the necessary amount of wrapping material is used for each package, minimizing excess. Some machines now incorporate scrap recovery systems, allowing for the collection and recycling of trim waste generated during the wrapping process.

Wrapping Machine Market Restraints and Challenges:

Complexity in operation and maintenance is a significant issue for many end-users. Advanced wrapping machines often require specialized skills to operate efficiently and troubleshoot problems. This necessitates ongoing training for staff, which can be time-consuming and costly. The shortage of skilled technicians in many regions exacerbates this problem, leading to potential downtime and reduced productivity. Customization requirements pose another challenge. Different products and industries often need specific wrapping solutions, but developing and manufacturing highly customized machines can be expensive and time-consuming for equipment makers. This can lead to longer lead times and higher costs for end-users seeking tailored solutions. The ongoing shift towards sustainable packaging creates both opportunities and challenges. While there's a growing demand for machines that can handle eco-friendly materials, these new substrates often require different processing parameters. Adapting existing machines or developing new ones to work effectively with a wide range of sustainable materials is a complex engineering challenge.

Wrapping Machine Market Opportunities:

One of the most promising areas lies in the development of smart, connected wrapping machines. The integration of Internet of Things (IoT) technology allows for real-time monitoring, predictive maintenance, and remote diagnostics. This not only improves machine uptime and efficiency but also opens up new service models for manufacturers, such as subscription-based maintenance plans or performance-based pricing. The growing demand for personalized and custom packaging presents another significant opportunity. Wrapping machines equipped with digital printing capabilities or able to handle small, variable batch sizes can cater to this trend. This is particularly relevant in industries like cosmetics, specialty foods, and gift packaging, where unique, eye-catching wraps can significantly influence consumer purchasing decisions. Emerging markets offer substantial growth potential. As manufacturing and retail sectors in countries like India, Brazil, and Southeast Asian nations continue to expand, the demand for efficient packaging solutions is set to surge. Developing cost-effective, robust machines tailored to the specific needs and constraints of these markets could yield significant returns.

WRAPPING MACHINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Robopac S.p.A., Lantech, Maillis Group, ARPAC LLC, Beumer Group, Signode Industrial Group, Pro Mach, Inc., Aetna Group, Wulftec International Inc., Phoenix Wrappers |

Wrapping Machine Market Segmentation: By Types

-

Stretch Wrapping Machines

-

Shrink Wrapping Machines

-

Banding Machines

-

Bundling Machines

-

Bagging Machines

-

Skin Wrapping Machines

-

Overwrapping Machines

-

Tray Wrapping Machines

Shrink wrapping machines continue to dominate the market due to their wide-ranging applications across industries. These machines excel in creating tight, tamper-evident seals around products, making them ideal for packaging everything from food items to consumer electronics. The dominance of shrink wrappers is reinforced by their ability to provide excellent product visibility while offering protection against moisture and dust. Recent developments in energy-efficient heating systems and precision control have made shrink wrappers more cost-effective to operate.

Stretch wrapping machines have emerged as the fastest-growing segment in the wrapping machine market. This growth is primarily driven by their versatility and efficiency in securing pallet loads across various industries. The rise of e-commerce and the need for secure transportation of goods have significantly boosted demand. These machines offer adjustable wrap tension and patterns, allowing for customized protection of diverse product shapes and sizes.

Wrapping Machine Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributor Sales

-

Online Retail

-

Equipment Leasing Companies

-

System Integrators

-

Aftermarket Service Providers

Direct sales remain the dominant distribution channel for wrapping machines, particularly for high-end, customized solutions. This channel's strength lies in the complex nature of many wrapping machine installations, which often require tailored solutions and ongoing support. Direct sales allow manufacturers to build strong relationships with clients, offering personalized service, technical expertise, and after-sales support.

The online retail channel has experienced the most rapid growth in the wrapping machine market. This surge is attributed to the increasing comfort of businesses, especially SMEs, in making significant capital investments through digital platforms. Online marketplaces offer a wide range of options, easy comparison tools, and often more competitive pricing. The COVID-19 pandemic accelerated this trend, as traditional in-person sales and demonstrations became challenging.

Wrapping Machine Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Europe maintains its position as the dominant region in the global wrapping machine market, accounting for nearly a third of the total market share. This leadership is underpinned by several factors that have created a robust ecosystem for wrapping machine manufacturing and consumption. The region's strong industrial base, particularly in countries like Germany, Italy, and France, has fostered a culture of innovation in packaging technology. European manufacturers are renowned for producing high-quality, technologically advanced wrapping machines that set global standards.

The Asia-Pacific region is experiencing the most rapid growth in the wrapping machine market, driven by a confluence of economic, demographic, and technological factors. China and India, the world's two most populous countries, are at the forefront of this growth. Their expanding middle classes and increasing urbanization are fueling demand for packaged consumer goods, necessitating more sophisticated packaging solutions. The region's booming e-commerce sector is another major driver, with companies investing heavily in efficient packaging systems to handle high-volume, diverse product ranges.

COVID-19 Impact Analysis on the Wrapping Machine Market:

The food, pharmaceutical, and medical supply industries experienced a sharp increase in demand for wrapping equipment during the early phases of the epidemic. Touchless, completely automated wrapping methods are used due to the necessity for improved hygiene and contamination avoidance. Orders for these machines increased significantly for the manufacturers, especially for the ones that could apply antimicrobial coatings or create tamper-evident seals. On the other hand, demand for luxury goods, automobiles, and non-essential consumer items fell sharply, which resulted in orders for wrapping equipment being delayed or canceled. As a result, the market became divided, with some industries flourishing while others had difficulty. The disruption of international supply networks brought attention to the importance of local and regional packaging skills. This sparked interest in more flexible, modular wrapping systems that could be quickly deployed or reconfigured to handle different products as needs changed. Manufacturers who could offer rapid deployment and remote installation support gained a competitive edge.

Latest Trends/ Developments:

The food, pharmaceutical, and medical supply industries experienced a sharp increase in demand for wrapping equipment during the early phases of the epidemic. Touchless, completely automated wrapping methods are used due to the necessity for improved hygiene and contamination avoidance. Orders for these machines increased significantly for the manufacturers, especially for the ones that could apply antimicrobial coatings or create tamper-evident seals. On the other hand, demand for luxury goods, automobiles, and non-essential consumer items fell sharply, which resulted in orders for wrapping equipment being delayed or canceled. As a result, the market became divided, with some industries flourishing while others had difficulty. The disruption of international supply networks brought attention to the importance of local and regional packaging skills. There's a growing emphasis on wrapping machines designed to work with eco-friendly materials such as biodegradable films, paper-based wraps, and recycled content packaging. Manufacturers are developing machines that can handle these materials without sacrificing speed or reliability. Additionally, there's an increased focus on machines that minimize material usage through precise control and innovative wrapping techniques.

Key Players:

-

Robopac S.p.A.

-

Lantech

-

Maillis Group

-

ARPAC LLC

-

Beumer Group

-

Signode Industrial Group

-

Pro Mach, Inc.

-

Aetna Group

-

Wulftec International Inc.

-

Phoenix Wrappers

Chapter 1. Wrapping Machine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wrapping Machine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wrapping Machine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wrapping Machine Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wrapping Machine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wrapping Machine Market – By Types

6.1 Introduction/Key Findings

6.2 Stretch Wrapping Machines

6.3 Shrink Wrapping Machines

6.4 Banding Machines

6.5 Bundling Machines

6.6 Bagging Machines

6.7 Skin Wrapping Machines

6.8 Overwrapping Machines

6.9 Tray Wrapping Machines

6.10 Y-O-Y Growth trend Analysis By Types

6.11 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Wrapping Machine Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributor Sales

7.4 Online Retail

7.5 Equipment Leasing Companies

7.6 System Integrators

7.7 Aftermarket Service Providers

7.8 Y-O-Y Growth trend Analysis By Distribution Channel

7.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Wrapping Machine Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wrapping Machine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Robopac S.p.A.

9.2 Lantech

9.3 Maillis Group

9.4 ARPAC LLC

9.5 Beumer Group

9.6 Signode Industrial Group

9.7 Pro Mach, Inc.

9.8 Aetna Group

9.9 Wulftec International Inc.

9.10 Phoenix Wrappers

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The increasing preference for convenience and ready-to-consume products is driving the demand for efficient packaging solutions.

The purchase and installation of advanced wrapping machines can be a significant investment for businesses, especially small and medium-sized enterprises.

Robopac S.p.A., Lantech, Maillis Group, ARPAC LLC, Beumer Group, Signode Industrial Group, Pro Mach, Inc., Aetna Group, Wulftec International Inc., Phoenix Wrappers.

Europe is the most dominant region in the market, accounting for approximately 35% of the total market share.

Asia Pacific is the fastest-growing region in the market.