Packaging Machinery Market Size (2024-2030)

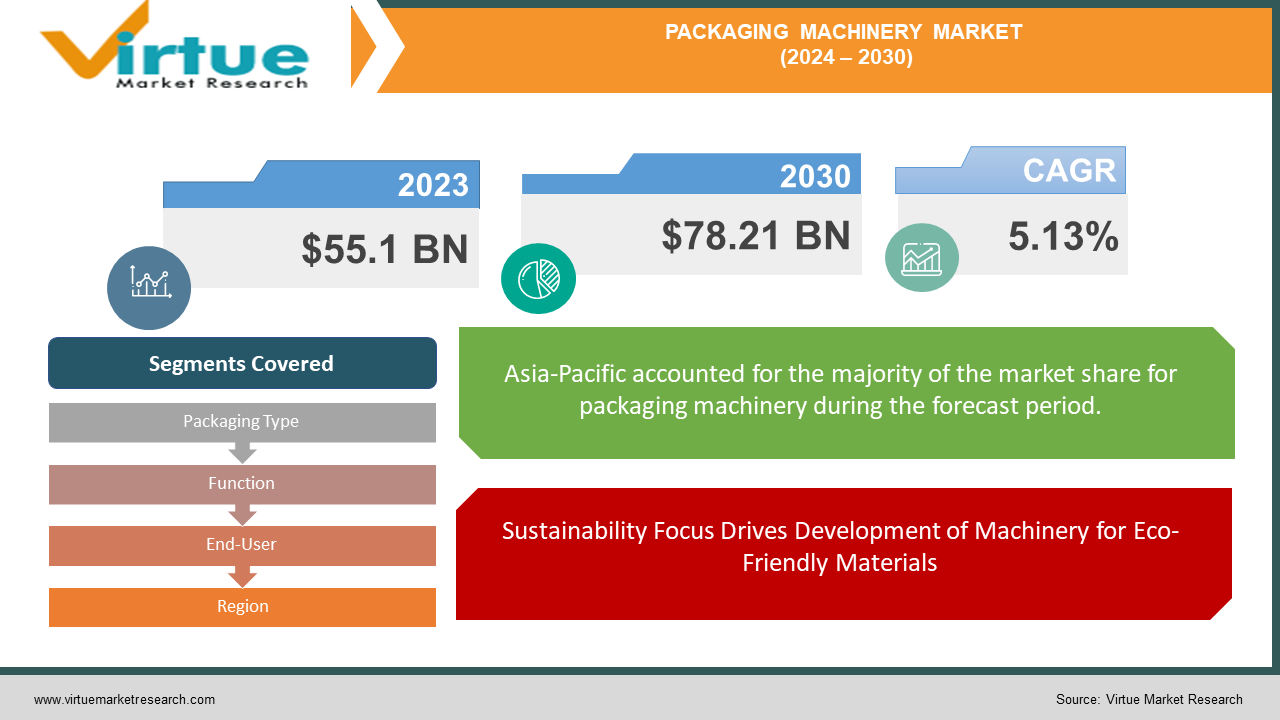

The Packaging Machinery Market was valued at USD 55.1 billion in 2023 and is projected to reach a market size of USD 78.21 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.13%.

The packaging machinery market plays a critical role in ensuring products reach consumers safely and securely. Fueled by the rising demand for packaged goods across various sectors like food & beverage, pharmaceuticals, and personal care, this market is experiencing steady growth. The e-commerce boom has further propelled its importance, as efficient and secure packaging solutions become essential. Additionally, growing concerns about product safety and tamper-evident packaging are driving innovation.

Key Market Insights:

The packaging machinery industry is experiencing a period of exciting transformation driven by several key trends. One significant factor is the e-commerce boom. With online sales skyrocketing, the demand for machinery that can handle the high volume and rapid pace of e-commerce fulfilment is surging. This translates to a need for solutions that ensure tamper-proof packaging and efficient handling of individual items.

Automation is rapidly transforming the landscape. Manufacturers are increasingly seeking automated packaging solutions to achieve multiple goals. These include boosting efficiency (by increasing production output), reducing labor costs, and ensuring consistent quality control throughout the packaging line. This trend is fueled by the integration of robotics and artificial intelligence into packaging machinery, creating smarter and more streamlined operations.

Packaging Machinery Market Drivers:

Sustainability Focus Drives Development of Machinery for Eco-Friendly Materials

Growing environmental concerns are pushing the packaging machinery industry towards embracing more eco-friendly practices. This translates to a two-pronged approach. Firstly, there's a strong emphasis on developing machinery that can handle recyclable and biodegradable materials on a larger scale. Secondly, there's a focus on designing machinery that minimizes waste generation during the packaging process itself. This holistic approach aims to create a more sustainable supply chain with a reduced environmental footprint.

Rising Consumption of Packaged Goods Creates a Multifaceted Market Driver

The ever-increasing consumption of packaged goods across various sectors is a significant driver for the packaging machinery market. This includes a wide range of products like food & beverages, pharmaceuticals, and personal care items. As consumer demand for convenience and extended shelf life grows, the need for innovative and efficient packaging solutions intensifies, creating a dynamic and multifaceted market for packaging machinery.

Packaging Machinery Market Restraints and Challenges:

The packaging machinery market, despite its growth trajectory, faces hurdles that can impede wider adoption and innovation. A significant challenge lies in the high upfront costs associated with acquiring and installing cutting-edge machinery. This can be a roadblock for smaller businesses, who might lack the budgetary resources to invest in such advanced technology. Furthermore, the operational complexity of these machines presents another hurdle. Advanced machinery often requires specialized skills to operate and maintain effectively. Businesses with limited technical expertise or manpower might struggle to manage these intricate systems, hindering their ability to leverage the machinery's full potential. Additionally, the ever-fluctuating prices of raw materials used in packaging, such as plastics and metals, can disrupt cost-effectiveness calculations. This volatility can create uncertainty for businesses when selecting machinery, making it difficult to determine the long-term economic viability of different packaging solutions. Finally, integrating new machinery with existing production lines can be a complex undertaking. Such integration often necessitates significant modifications to current workflows, which can be a daunting prospect for companies hesitant to disrupt their established operational processes. These challenges highlight the need for the packaging machinery industry to address affordability concerns, develop user-friendly solutions, and prioritize seamless integration capabilities to ensure broader market adoption and continued innovation.

Packaging Machinery Market Opportunities:

The packaging machinery market brims with opportunities beyond just catering to the e-commerce boom. A significant avenue for growth lies in the development of machinery that utilizes innovative and sustainable packaging materials. As consumers and businesses become more environmentally conscious, there's a growing demand for machinery that can handle recyclable and biodegradable materials efficiently. Additionally, there's an opportunity to develop machinery that minimizes waste generation during the packaging process itself, contributing to a more circular economy. Furthermore, the rise of smart packaging, which integrates Internet of Things (IoT) technology, presents exciting possibilities. This allows for real-time data collection and analysis, enabling remote control capabilities and optimizing machinery performance throughout the supply chain. This focus on intelligent packaging solutions can lead to predictive maintenance and improved overall efficiency. Finally, the burgeoning economies of developing regions offer a vast and untapped market potential. As these regions experience growth, the demand for efficient and cost-effective packaging solutions will surge, creating significant opportunities for packaging machinery manufacturers to expand their reach.

PACKAGING MACHINERY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.13% |

|

Segments Covered |

By Packaging Type, Function, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

KHS Group, SIG Combibloc Group, Tetra Laval International, Krones AG, Bosch Packaging Technology, GEA Group, Sacmi, Langley Holdings, ProMach, Barry-Wehmiller, Douglas Machine, Coesia S.p.A., Maillis Group |

Packaging Machinery Market Segmentation: By Packaging Type

-

Rigid

-

Flexible

-

Aseptic

In the packaging machinery market segmented by packaging type, the most dominant segment is rigid packaging machinery. This includes equipment for cartooning, bottling, and capping, which caters to a vast range of products. The fastest-growing segment is expected to be flexible packaging machinery. This segment deals with machines for pouches, bags, and wrapping, which are increasingly favoured for their convenience, lightweight design, and recyclability potential.

Packaging Machinery Market Segmentation: By Function

-

Filling Machinery

-

Capping Machinery

-

Labelling Machinery

-

Sealing Machinery

-

Palletizing Machinery

In the 'By Function' segment, Filling Machinery is the most dominant segment, encompassing machines that fill containers with various products. This is driven by the ever-increasing demand for packaged food, beverages, and pharmaceuticals. However, Palletizing Machinery is experiencing the fastest growth. The rise of e-commerce and automation in warehouses necessitates efficient palletizing solutions for faster product movement and storage.

Packaging Machinery Market Segmentation: By End-User

-

Food & Beverage

-

Pharmaceuticals & Medical

-

Personal Care & Cosmetics

-

Chemicals & Industrial

-

Others

The end-user sector with the largest market share for packaging machinery is Food & Beverage, driven by the high demand for packaged food and beverages across the globe. This segment requires machinery for a vast array of products, from bottling lines to pouching machines. On the other hand, the Asia Pacific region is experiencing the fastest growth due to its booming population, expanding economies, and a rapidly growing middle class with rising disposable income, leading to a surge in demand for packaged goods.

Packaging Machinery Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has a well-established market with a strong focus on technological advancements and automation. Here, manufacturers are constantly innovating to create high-speed, high-efficiency machinery that caters to the demands of large production lines. Sustainability is also a growing concern, with a rise in demand for machinery that utilizes recyclable materials. However, market saturation in some segments can be a challenge for manufacturers in North America.

Asia-Pacific has the fastest-growing market due to its booming population, expanding economies, and a rapidly growing middle class. This surge in consumer demand for packaged goods is driving the need for a wide variety of packaging machinery solutions. The market in this region is also receptive to cost-effective solutions, creating opportunities for manufacturers who can offer efficient machinery at competitive prices. However, a lack of stringent regulations in some developing countries within this region can pose challenges for enforcing quality and safety standards.

COVID-19 Impact Analysis on the Packaging Machinery Market:

The COVID-19 pandemic undeniably impacted the packaging machinery market. Initial lockdowns and supply chain disruptions caused a temporary decline in demand as production slowed across various sectors. However, the landscape quickly shifted. The e-commerce boom necessitated machinery capable of handling the high volume and rapid pace of online fulfillment, creating a new area of opportunity. In the long term, the pandemic is expected to have a more nuanced effect. Heightened hygiene concerns are driving demand for tamper-proof and single-use packaging solutions, while the focus on pharmaceuticals and vaccine distribution has boosted the need for specialized pharmaceutical packaging machinery. Perhaps most significantly, the pandemic has accelerated the adoption of automation in packaging lines. This shift towards automation is driven by the need to minimize human contact and ensure worker safety. While there may have been a temporary rise in single-use plastics, sustainability concerns remain a major long-term trend. Manufacturers are continuing to develop machinery that can handle eco-friendly packaging materials, ensuring the industry remains adaptable and environmentally conscious. The impact of COVID-19 will likely vary by region, with developed markets recovering faster due to their established infrastructure and ability to adapt to changing consumer behavior. Developing markets, on the other hand, may face a slower recovery due to economic instability and lingering supply chain disruptions. In conclusion, the COVID-19 pandemic has presented the packaging machinery market with both challenges and opportunities. While there was an initial setback, the long-term trends point towards growth, particularly in areas like e-commerce packaging, automation, and the development of sustainable solutions.

Latest Trends/ Developments:

The packaging machinery market is witnessing a surge in advancements driven by technology and evolving consumer preferences. A key trend is the rise of "smart packaging" that integrates Internet of Things (IoT) technology. Imagine sensors embedded in packaging that track product freshness or location during transport! This real-time data can optimize logistics, predict maintenance needs, and improve overall supply chain efficiency. Sustainability remains a major focus, with machinery development geared towards handling innovative, recyclable, and biodegradable materials. Additionally, there's a push to minimize waste generation during the packaging process itself. E-commerce is another area driving innovation. Packaging machinery solutions are being tailored to address specific e-commerce needs, such as personalized packaging, tamper-evident closures for enhanced security, and efficient handling of a wider variety of item sizes and shapes. Artificial Intelligence (AI) is also making its mark. AI systems can analyze data to optimize packaging line performance, identify potential problems, and even predict maintenance requirements. This allows for more proactive and efficient management. Finally, the market is demanding greater flexibility and adaptability from machinery. Manufacturers are developing modular and adaptable systems that can be easily reconfigured for different packaging needs. This agility ensures companies can respond quickly to changing market demands and production requirements, keeping the packaging machinery market at the forefront of innovation.

Key Players:

-

KHS Group

-

SIG Combibloc Group

-

Tetra Laval International

-

Krones AG

-

Bosch Packaging Technology

-

GEA Group

-

Sacmi

-

Langley Holdings

-

ProMach

-

Barry-Wehmiller

-

Douglas Machine

-

Coesia S.p.A.

-

Maillis Group

Chapter 1. Packaging Machinery Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Packaging Machinery Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Packaging Machinery Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Packaging Machinery Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Packaging Machinery Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Packaging Machinery Market – By Packaging Type

6.1 Introduction/Key Findings

6.2 Rigid

6.3 Flexible

6.4 Aseptic

6.5 Y-O-Y Growth trend Analysis By Packaging Type

6.6 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 7. Packaging Machinery Market – By Function

7.1 Introduction/Key Findings

7.2 Filling Machinery

7.3 Capping Machinery

7.4 Labelling Machinery

7.5 Sealing Machinery

7.6 Palletizing Machinery

7.7 Y-O-Y Growth trend Analysis By Function

7.8 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 8. Packaging Machinery Market – By End User

8.1 Introduction/Key Findings

8.2 Food & Beverage

8.3 Pharmaceuticals & Medical

8.4 Personal Care & Cosmetics

8.5 Chemicals & Industrial

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End User

8.8 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 9. Packaging Machinery Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Packaging Type

9.1.3 By Function

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Packaging Type

9.2.3 By Function

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Packaging Type

9.3.3 By Function

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Packaging Type

9.4.3 By Function

9.4.4 By Function

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Packaging Type

9.5.3 By Function

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Packaging Machinery Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 KHS Group

10.2 SIG Combibloc Group

10.3 Tetra Laval International

10.4 Krones AG

10.5 Bosch Packaging Technology

10.6 GEA Group

10.7 Sacmi

10.8 Langley Holdings

10.9 ProMach

10.10 Barry-Wehmiller

10.11 Douglas Machine

10.12 Coesia S.p.A.

10.13 Maillis Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Packaging Machinery Market was valued at USD 55.1 billion in 2023 and is projected to reach a market size of USD 78.21 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 5.13%.

E-commerce Boom: A Packaging Frenzy, Sustainability Focus, Automation on the Rise, Rising Demand for Packaged Goods.

Food & Beverage, Pharmaceuticals & Medical, Personal Care & Cosmetics, Chemicals & Industrial, Others.

The Asia Pacific region reigns supreme in the Packaging Machinery Market, driven by its booming population, expanding economies, and surging demand for packaged goods.

KHS Group, SIG Combibloc Group, Tetra Laval International, Krones AG, Bosch Packaging Technology, GEA Group, Sacmi, Langley Holdings, ProMach, Barry-Wehmiller, Douglas Machine, Coesia S.p.A., Maillis Group.