Wheelchairs Market Size (2025-2030)

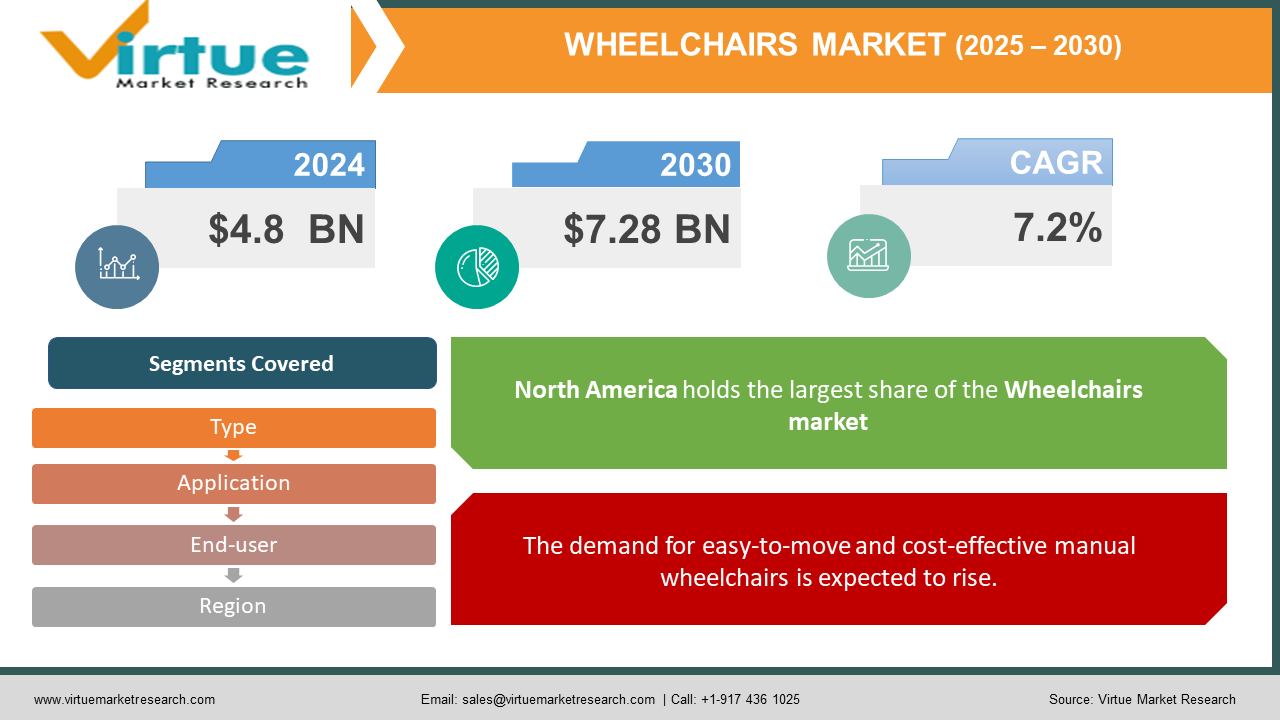

The Wheelchairs Market was valued at USD 4.8 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 7.28 billion by 2030, growing at a CAGR of 7.2%.

A wheelchair is a medical apparatus created to facilitate movement for individuals with restricted or no ability to walk independently. Wheelchairs can be operated either manually or through powered mechanisms, helping individuals gain greater independence and mobility. The prevalence of physical disabilities among both children and adults is increasing globally.

Key Market Insights:

- The growing elderly population and the rising incidence of spinal cord injuries, which require mobility aids, are significant factors contributing to the market's expansion. As reported by the National Spinal Cord Injury Statistical Center, approximately 17,730 new cases of spinal cord injuries are documented annually in the U.S., with motor vehicle accidents being the primary cause. Consequently, the United States represents a key market for wheelchairs.

- According to a 2024 United Nations report, approximately 250 million people worldwide are currently living with moderate to severe mobility impairments.

Wheelchairs Market Drivers:

The growing aging population, combined with ongoing advancements in technology, is projected to fuel the expansion of the wheelchair market.

As individuals age, they are more likely to experience mobility issues, leading to an increased demand for wheelchairs.

In addition, the rising incidence of spinal cord injuries, particularly among the elderly, is anticipated to further accelerate market demand during the forecast period. The growing prevalence of walking disabilities across all age groups, combined with an increase in lower extremity injuries, is expected to contribute to higher demand for wheelchairs.

Technological advancements in wheelchair design, including innovations such as powered wheelchairs introduced by various manufacturers, are also expected to drive sales in the coming years.

Furthermore, government initiatives aimed at improving access to advanced wheelchairs in low-resource countries are likely to provide an additional boost to market growth during the forecast period.

The demand for easy-to-move and cost-effective manual wheelchairs is expected to rise.

Manual wheelchairs provide users with the freedom and independence to navigate both indoor and outdoor spaces with ease. They are typically more affordable than motorized wheelchairs, making them an appealing option for individuals on a budget. Unlike powered wheelchairs, manual models do not require charging, eliminating concerns about battery depletion during use. In addition to being lightweight, manual wheelchairs are designed for easy maneuverability. They offer versatility and customization, with features such as adjustable components and lightweight frames. Available in various styles, including standard, transport, folding, rigid, and dynamic tilt models, they can be tailored to meet the specific needs of the user. Their straightforward design, with no complex electrical parts, reduces the likelihood of frequent servicing. Many manual wheelchairs are also foldable, making them convenient to store and transport, whether loading into a vehicle or storing when not in use.

Wheelchairs Market Restraints and Challenges:

Economic fluctuations pose a constraint on market growth.

Compliance with regulatory standards and evolving demands presents a significant challenge for vendors in the mobility device market. Changes in regulations, both domestically and internationally, often require costly adjustments to manufacturing processes and product designs, adding complexity to operations.

Additionally, the financial pressures stemming from factors such as raw material costs, labor, and overhead expenses can negatively impact profit margins for vendors.

Economic fluctuations and shifts in consumer spending, particularly in sectors related to healthcare and mobility aids, further limit consumer purchasing behavior. In response, wheelchair manufacturers are increasingly adapting their marketing strategies and pricing models to accommodate changes in demand and consumer buying power.

Wheelchairs Market Opportunities:

Adopting eco-friendly manufacturing processes is expected to create new opportunities in the mobility device market.

Advancements in materials science, automation, and artificial intelligence are poised to drive significant progress in wheelchair technology. By focusing on the specific needs of users, manufacturers can develop products that are more advanced, customizable, and responsive to individual requirements.

The growing emphasis on environmental sustainability presents a unique opportunity for manufacturers to produce eco-friendly motorized wheelchairs. Using materials and manufacturing processes that minimize carbon footprints can help reduce the overall environmental impact of the industry and align with global sustainability goals.

Additionally, the integration of 3D printing technology in wheelchair production enables highly personalized designs, with tailored features and sizes that better meet the needs of individual users. This technology also offers faster production times, increased efficiency, and the ability to create lightweight yet durable wheelchairs, enhancing both performance and user satisfaction.

GLOBAL WHEELCHAIRS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, application, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Carex Health Brands, Inc., Graham-Field Health Products Inc., Drive Medical Design & Manufacturing, Medline and Invacare. |

Market Segmentation Analysis:

Global Wheelchairs Market Segmentation By Type:

- Manual

- Powered

The powered wheelchair segment holds the largest share of the wheelchair market in 2024, driven by the increasing adoption of powered models and the benefits they offer over manual wheelchairs. Powered wheelchairs can be operated with minimal effort, enhancing convenience and independence for users. The introduction of new and innovative powered wheelchair models by key industry players is also expected to further propel the growth of this segment.

On the other hand, manual wheelchairs remain popular due to their ease of operation, affordability, and low maintenance requirements. These wheelchairs do not necessitate external assistance and are cost-effective, making them an attractive option for users in both high- and middle-income countries. The increasing use of manual wheelchairs in these regions is expected to drive further demand during the forecast period.

Global Wheelchairs Market Segmentation By Application:

- Standard Wheelchair

- Bariatric Wheelchair

- Sports Wheelchair

- Others

The powered wheelchair segment holds the largest share of the wheelchair market, driven by the increasing adoption of powered models and the benefits they offer over manual wheelchairs. Powered wheelchairs can be operated with minimal effort, enhancing convenience and independence for users. The introduction of new and innovative powered wheelchair models by key industry players is also expected to further propel the growth of this segment.

On the other hand, manual wheelchairs remain popular due to their ease of operation, affordability, and low maintenance requirements. These wheelchairs do not necessitate external assistance and are cost-effective, making them an attractive option for users in both high- and middle-income countries. The increasing use of manual wheelchairs in these regions is expected to drive further demand during the forecast period.

Global Wheelchairs Market Segmentation By End-user:

- Personal User

- Institutional User

In 2024, the powered wheelchair segment holds the largest share of the wheelchair market, driven by the increasing adoption of powered models and the benefits they offer over manual wheelchairs. Powered wheelchairs can be operated with minimal effort, enhancing convenience and independence for users. The introduction of new and innovative powered wheelchair models by key industry players is also expected to further propel the growth of this segment.

On the other hand, manual wheelchairs remain popular due to their ease of operation, affordability, and low maintenance requirements. These wheelchairs do not necessitate external assistance and are cost-effective, making them an attractive option for users in both high- and middle-income countries. The increasing use of manual wheelchairs in these regions is expected to drive further demand during the forecast period.

Global Wheelchairs Market Segmentation- By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America is expected to maintain its dominance in the global wheelchair market throughout the forecast period, driven by an increase in mobility impairment disorders and a growing geriatric population. These factors, along with the presence of major players in the mobility devices sector, particularly in the U.S., are poised to support market growth in the region.

Europe is anticipated to hold the second-largest market share, following North America, due to the rising number of elderly individuals in the region. The aging population is a key factor fueling the demand for wheelchairs and other mobility aids.

The Asia Pacific market is projected to experience the fastest growth during the forecast period, largely due to a rising incidence of developmental disabilities among children and an increase in accidental injuries resulting in mobility loss. This growth is further supported by improvements in healthcare infrastructure and government initiatives aimed at providing better mobility solutions. The region benefits from a large population base in countries like India and China, coupled with advancements in healthcare services and governmental efforts to improve access to quality mobility devices. Additionally, the high geriatric population in Japan further contributes to the market’s expansion in the region.

Meanwhile, Latin America and the Middle East & Africa are expected to witness significant market growth, driven by the growing adoption of powered wheelchairs and rising unmet mobility needs in these regions.

COVID-19 Pandemic: Impact Analysis

During the COVID-19 pandemic, wheelchair manufacturers faced operational halts as a result of global disruptions. At the same time, hospitals saw a consistent demand for wheelchairs due to the surge in elderly patients requiring care as a result of COVID-19 infections. As COVID-19 restrictions have been adjusted, companies have resumed their operations, and the demand for wheelchairs is expected to rise. This increase is driven by the growing prevalence of chronic diseases, an expanding geriatric population, and the rising incidence of lifestyle-related disorders, including obesity and sedentary behavior, which further contribute to the need for mobility aids.

Latest Trends/ Developments:

In March 2024, Sunrise Medical launched the QUICKIE Q50 R Carbon, a lightweight, foldable power wheelchair that weighs only 32 pounds. As the lightest foldable power wheelchair in the QUICKIE lineup, the Q50 R Carbon is designed to enhance user independence and mobility, allowing individuals to remain active without expending unnecessary time or energy.

In October 2023, Permobil introduced the CR1 (Carbon Rigid 1), a highly configurable, ultra-lightweight wheelchair that combines user-centric design with durability. The CR1 features an innovative production method, setting a new standard for mobility devices by offering both advanced customization options and long-lasting performance.

Key Players:

These are top 10 players in the Wheelchairs Market :-

- Carex Health Brands, Inc.

- Graham-Field Health Products Inc.

- Drive Medical Design & Manufacturing

- Medline

- Invacare

- Karman Healthcare

- Sunrise Medical LLC

- Numotion

- Quantum

- Rehab Seating Matters

- Pride Mobility Products Corp.

Chapter 1. GLOBAL WHEELCHAIRS MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL WHEELCHAIRS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL WHEELCHAIRS MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL WHEELCHAIRS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL WHEELCHAIRS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL WHEELCHAIRS MARKET– BY Type

6.1. Introduction/Key Findings

6.2. Manual

6.3. Powered

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. GLOBAL WHEELCHAIRS MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Standard Wheelchair

7.3. Bariatric Wheelchair

7.4. Sports Wheelchair

7.5. Others

7.6. Y-O-Y Growth trend Analysis By APPLICATION

7.7. Absolute $ Opportunity Analysis By APPLICATION , 2025-2030

Chapter 8. GLOBAL WHEELCHAIRS MARKET– BY End-user

8.1. Introduction/Key Findings

8.2. Personal User

8.3. Institutional User

8.4. Y-O-Y Growth trend Analysis End-user

8.5. Absolute $ Opportunity Analysis End-user , 2025-2030

Chapter 9. GLOBAL WHEELCHAIRS MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By APPLICATION

9.1.3. By End-user

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By APPLICATION

9.2.3. By End-user

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By APPLICATION

9.3.3. By End-user

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By End-user

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By End-user

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL WHEELCHAIRS MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Carex Health Brands, Inc.

10.2. Graham-Field Health Products Inc.

10.3. Drive Medical Design & Manufacturing

10.4. Medline

10.5. Invacare

10.6. Karman Healthcare

10.7. Sunrise Medical LLC

10.8. Numotion

10.9. Quantum Rehab

10.10. Seating Matters

10.11. Pride Mobility Products Corp.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growing elderly population and the rising incidence of spinal cord injuries, which require mobility aids, are significant factors contributing to the market's expansion

The top players operating in the Wheelchairs Market are - Carex Health Brands, Inc., Graham-Field Health Products Inc., Drive Medical Design & Manufacturing, Medline and Invacare.

During the COVID-19 pandemic, wheelchair manufacturers faced operational halts as a result of global disruptions.

The growing emphasis on environmental sustainability presents a unique opportunity for manufacturers to produce eco-friendly motorized wheelchairs. Using materials and manufacturing processes that minimize carbon footprints can help reduce the overall environmental impact of the industry and align with global sustainability goals.

The Asia Pacific market is projected to experience the fastest growth during the forecast period.