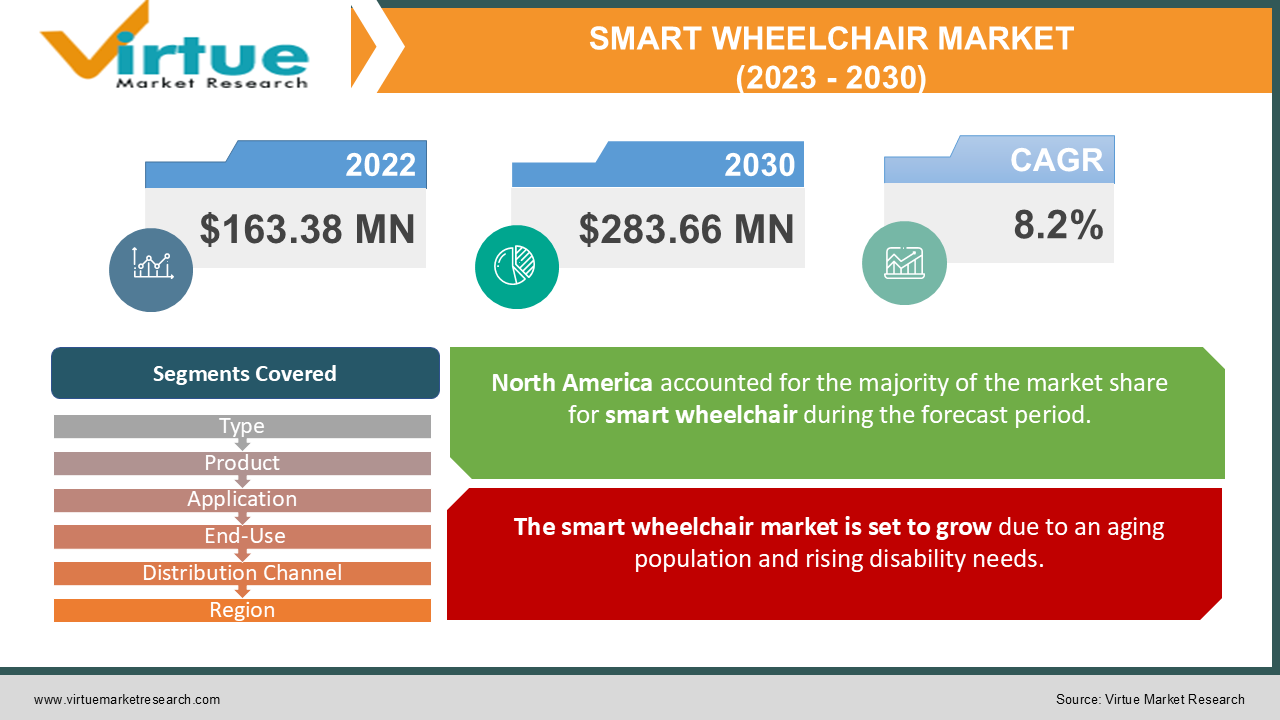

Smart Wheelchair Market Size (2023 –2030)

In 2022, the Global Smart Wheelchair Market was valued at USD 163.38 Million and is projected to reach a market size of USD 283.66 Million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.2%.

An electric wheelchair that gathers information about the user's movements and interactions with their environment is called a smart wheelchair. Because they are joystick-operated, these wheelchairs are simple to use and don't require a lot of upper body strength. For those who have restricted hand or arm movement, they are extremely beneficial. Recent years have seen significant advancements in mobility technology for smart wheelchairs. Particularly in airports, hospitals, tourist destinations, schools, and healthcare settings, their use is expanding. In the upcoming years, it is anticipated that this growing adoption will increase demand for smart wheelchairs.

Key Market Insights:

- A smart wheelchair can cost anywhere between $5,000 and $20,000 on average, depending on the features and degree of automation.

- It is estimated that there are approximately 5 million potential users in the global market for smart wheelchairs.

- Depending on how they are used, smart wheelchairs can last anywhere from 8 to 16 hours on a single charge.

- Roughly 80% of the market for smart wheelchairs is comprised of the elderly and disabled; the remaining 20% is supplied by medical facilities and rehabilitation centers.

Global Smart Wheelchair Market Drivers:

The smart wheelchair market is set to grow due to an aging population and rising disability needs.

The growing number of elderly people worldwide and the rising rates of disability are predicted to fuel growth in the smart wheelchair market. Smart wheelchairs with cutting-edge mobility features are in higher demand as the population ages and becomes more disabled. A World Health Organization report from November 2021 states that over 1 billion people worldwide experience a disability every year, which supports the market's expansion.

It is anticipated that new product releases and a rise in technological developments in the wheelchair and mobility sector will propel market expansion worldwide.

The market for smart wheelchairs is anticipated to expand as a result of developments in wheelchair technology and the application of artificial intelligence by significant players in the market. Businesses are making significant R&D investments to lower costs while improving wheelchair features and integrating new technologies. The market's potential is growing internationally thanks to this innovation.

Smart Wheelchair Market Challenges and Restraints:

The primary obstacle impacting the worldwide wheelchair industry is the exorbitant price of these devices. The cost of a smart wheelchair as of December 2020 can vary from $1,000 to $15,000, based on several factors including brand, quality, size, features, and particular needs. For numerous people who require these cutting-edge mobility devices, these expenses may pose a challenge.

Smart Wheelchair Market Opportunities:

The market for smart wheelchairs offers numerous chances for expansion and innovation. One significant opportunity is the growing demand for smart wheelchairs, which increase mobility and independence among the world's aging population. The need for smart wheelchairs is also increasing in healthcare environments, including hospitals and rehabilitation centers, as a result of better workflows and more effective patient transportation. Furthermore, new developments in AI, IoT, and sensor technologies provide opportunities for the development of increasingly sophisticated features like remote monitoring, autonomous navigation, and customized user interfaces. The proliferation of e-commerce platforms enables enhanced accessibility and distribution of intelligent wheelchairs, thereby catering to a wider range of consumers. Moreover, by addressing particular user needs and enhancing overall product offerings, alliances and collaborations between wheelchair manufacturers, healthcare providers, and technology firms can promote innovation and accelerate market growth.

SMART WHEELCHAIR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.2% |

|

Segments Covered |

By Type, Product, Application, End-Use, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

INVACARE CORPORATION (U.S.), MEYRA GROUP GMBH (Germany),. SUNRISE MEDICAL (Germany), OTTOBOCK (Germany), MATIA ROBOTICS (U.S.), KARMAN HEALTHCARE INC (U.S.), PITSCO EDUCATION LLC (U.S.), WHEEL INC (U.S.), MEDICAL DEPOT INC (U.S.), Permobil AB |

Smart Wheelchair Market Segmentation – By Type

-

Standard Powered Wheelchairs

-

Standard Plus Powered Wheelchairs

-

Custom-Built Powered Wheelchairs

Due to its affordability and widespread use, the Standard Powered Wheelchair is the most common type, accounting for the largest share of the market. These wheelchairs offer a straightforward solution for mobility needs, making them the first choice for people venturing into the smart wheelchair market. The category with the fastest rate of growth is Standard Plus Powered Wheelchairs. This is because more people are requesting slightly more sophisticated features without having to pay the high price and complexity of custom-built options. These wheelchairs are more popular because they are more comfortable and easier to maneuver.

Smart Wheelchair Market Segmentation – By Product

-

Joystick-based Smart Wheelchairs

-

Bluetooth Connected Smart Wheelchairs

The most widely used kind of smart wheelchair is the joystick-based model, which has gained the most market share thanks to its user-friendly interface and potent mobility-enhancing capabilities. These wheelchairs are popular because they are simple to operate. The fastest-growing category in the market is the Bluetooth-connected smart wheelchair, which is also becoming more and more popular. This is because it uses Bluetooth technology, which improves user experiences and draws in tech-savvy people searching for cutting-edge methods to communicate with their mobile devices.

Smart Wheelchair Market Segmentation – By Application

-

Mobility Impairment

-

Ocular Disability

-

Geriatric Group

-

Multiple-Disability

-

Others

With the biggest revenue share in the smart wheelchair market, the Geriatric Group is the most well-known segment. This is a result of the aging population in many nations, and the fact that older people frequently require advanced mobility solutions because they have a variety of disabilities. This category of smart wheelchairs provides a range of control options, customized adjustments, and integrated support systems to accommodate individuals with complex mobility requirements. Within this group, the category with the fastest growth is Ocular Disability. Due to advancements in sensing technologies and auditory feedback systems that meet the needs of people with visual impairments, it has been growing steadily.

Smart Wheelchair Market Segmentation – By End-Use

-

Rehab Centers

-

Hospitals

-

Homecare Settings

-

Others

Because they employ these wheelchairs extensively for patient care to facilitate efficient workflow and transportation, hospitals dominate the market for smart wheelchairs and generate the highest revenue share. The market segment with the fastest rate of growth is home care. The aging population and the desire for independent mobility at home are the main drivers of this growth, which is driving up demand for smart wheelchairs in comfortable settings.

Smart Wheelchair Market Segmentation – By Distribution Channel

-

Retail

-

E-commerce

With the largest market revenue share and the highest sales of smart wheelchairs, the retail segment is primarily driven by its extensive network of physical stores where customers can view and test out products before making a purchase. This promotes confidence and trust in their purchasing choices. With its rapid growth, the E-Commerce segment is predicted to hold a significant revenue share in the future. Online shopping is becoming more and more popular due to its ease of use, large selection of products, and convenient doorstep delivery, which appeals to tech-savvy customers who are accustomed to making purchases online.

Smart Wheelchair Market Segmentation – By Region

-

North America

-

Europe

-

South America

-

Asia-Pacific

-

Middle East and Africa

North America leads the market and has the largest revenue share in the global smart wheelchair market. This is because investing in healthcare and cutting-edge technology is becoming more popular in North America, and people there are more aware of the benefits of smart wheelchair technology. Asia Pacific is the fastest-growing region in the global smart wheelchair market. This is mainly due to the growing adoption of technological advancements.

COVID-19 Impact on the Global Smart Wheelchair Market:

Following its onset in December 2019, the COVID-19 pandemic has spread to more than 100 countries globally, prompting the World Health Organization to declare a public health emergency on January 30, 2020. The pandemic had a major impact on economic growth in several sectors. It had a financial impact on businesses and financial markets, disrupted the demand and production for goods, and created issues in the distribution networks. Transportation of goods and services was made more difficult by worldwide shutdowns in nations such as China, India, Saudi Arabia, the United Arab Emirates, Egypt, and others. People with physical disabilities were also severely impacted by the pandemic, which increased their susceptibility to diseases like COVID-19 and restricted their access to healthcare. It was discovered in the UK that people with disabilities had a higher chance of dying from COVID-19. Due to disruptions in the supply chains and raw material supply, the global economy experienced never-before-seen effects that affected every industry, including the market for smart wheelchairs. But when economies started to partially recover in 2021, it gave major players in the sector new chances for expansion.

Latest Trend/Development:

Several noteworthy trends and advancements are driving the evolution of the smart wheelchair market. The incorporation of cutting-edge technologies like the Internet of Things (IoT), machine learning, and artificial intelligence (AI) into smart wheelchair designs is one of the main trends. Features like obstacle detection and autonomous navigation are made possible by these technologies. By including programmable seating options and user-friendly control interfaces, manufacturers are also concentrating on enhancing accessibility features. Increasingly, models are being designed to be lightweight and portable to improve user convenience in various settings. Improved connectivity with Bluetooth and Wi-Fi enables mobile apps for remote monitoring and navigation support. Ergonomic designs and anti-tip mechanisms are among the features that prioritize safety and comfort. Modular and hybrid designs are becoming more popular to offer customization and flexibility. The market is getting more competitive, which is encouraging product diversification and innovation to meet the changing needs of consumers looking for increased freedom and mobility.

Merya Group acquired TA Services A/S to strengthen its position in the Danish market for smart wheelchairs. Numotion purchased Monroe Wheelchair, expanding its offering of sophisticated rehab technology services worldwide.

Key Players:

-

INVACARE CORPORATION (U.S.)

-

MEYRA GROUP GMBH (Germany)

-

SUNRISE MEDICAL (Germany)

-

OTTOBOCK (Germany)

-

MATIA ROBOTICS (U.S.)

-

KARMAN HEALTHCARE INC (U.S.)

-

PITSCO EDUCATION LLC (U.S.)

-

WHEEL INC (U.S.)

-

MEDICAL DEPOT INC (U.S.)

-

Permobil AB

Market News:

-

To increase its footprint in Western Europe, Ottobock purchased Livit B.V. in February 2022.

-

Invacare Corporation introduced the 'One Solution' initiative in January 2022, combining premium features with its well-liked wheelchairs.

Chapter 1. Smart Wheelchair Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Wheelchair Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Wheelchair Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Wheelchair Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Wheelchair Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Wheelchair Market – By Type

6.1 Introduction/Key Findings

6.2 Standard Powered Wheelchairs

6.3 Standard Plus Powered Wheelchairs

6.4 Custom-Built Powered Wheelchairs

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Smart Wheelchair Market – By Application

7.1 Introduction/Key Findings

7.2 Mobility Impairment

7.3 Ocular Disability

7.4 Geriatric Group

7.5 Multiple-Disability

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Smart Wheelchair Market – By End-User

8.1 Introduction/Key Findings

8.2 Rehab Centers

8.3 Hospitals

8.4 Homecare Settings

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Smart Wheelchair Market – By Product

9.1 Introduction/Key Findings

9.2 Joystick-based Smart Wheelchairs

9.3 Bluetooth Connected Smart Wheelchairs

9.4 Y-O-Y Growth trend Analysis By Product

9.5 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 10. Smart Wheelchair Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Retail

10.3 E-commerce

10.4 Y-O-Y Growth trend Analysis By Distribution Channel

10.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. Smart Wheelchair Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Type

11.1.2.1 By Application

11.1.3 By End-User

11.1.4 By Distribution Channel

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Type

11.2.3 By Application

11.2.4 By End-User

11.2.5 By Product

11.2.6 By Distribution Channel

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Type

11.3.3 By Application

11.3.4 By End-User

11.3.5 By Product

11.3.6 By Distribution Channel

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Type

11.4.3 By Application

11.4.4 By End-User

11.4.5 By Product

11.4.6 By Distribution Channel

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Type

11.5.3 By Application

11.5.4 By End-User

11.5.5 By Product

11.5.6 By Distribution Channel

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Smart Wheelchair Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 INVACARE CORPORATION (U.S.)

12.2 MEYRA GROUP GMBH (Germany)

12.3 SUNRISE MEDICAL (Germany)

12.4 OTTOBOCK (Germany)

12.5 MATIA ROBOTICS (U.S.)

12.6 KARMAN HEALTHCARE INC (U.S.)

12.7 PITSCO EDUCATION LLC (U.S.)

12.8 WHEEL INC (U.S.)

12.9 MEDICAL DEPOT INC (U.S.)

12.10 Permobil AB

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2023, the Global Smart Wheelchair Market was valued at $163.38 Million and is projected to reach a market size of $283.66 Million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.2 %.

Technological enhancements in the field of wheelchairs, increasing sedentary lifestyles among people, and increasing affordability of ultra-lightweight smart wheelchairs are some of the trends driving the smart wheelchair industry.

The sales of the smart wheelchair in Europe are anticipated to grow at a CAGR of 8.2% over the forecast timeline, 2023-2030.

The U.S., U.K., China, Germany, and Japan are the most dominating countries leading the global smart wheelchair market.

Medical Depot, Inc., Pride Mobility Products Ltd., MEYRA GmbH, Tmsuk Company Limited, Ottobock, WHILL Inc., and Karman Healthcare, Inc., are some of the key players in the smart wheelchair market globally.