Wheat Gluten Market Size (2024 – 2030)

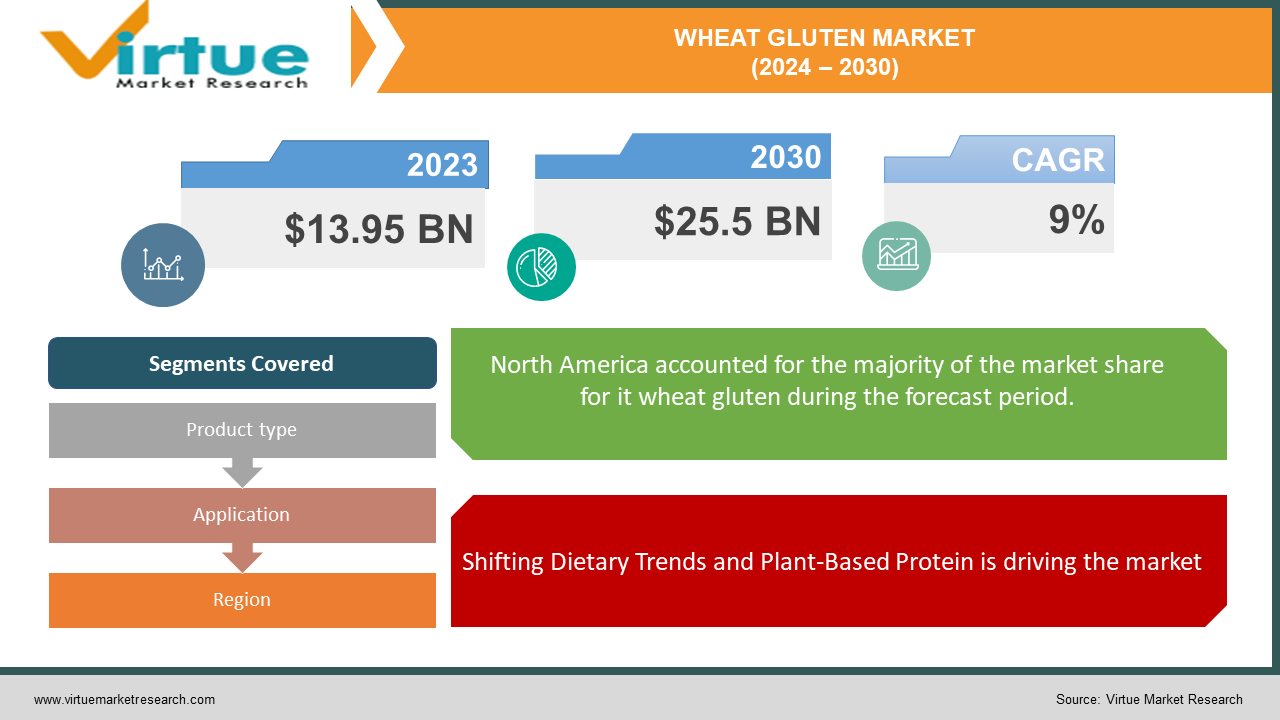

The Global Wheat Gluten Market was valued at USD 13.95 billion in 2023 and is projected to grow at a CAGR of 9% from 2024 to 2030. The market is expected to reach USD 25.5 billion by 2030.

The Wheat Gluten Market is kneading its way towards a doughy future, driven by a perfect storm of consumer trends and health concerns. Rising health consciousness is boosting the demand for plant-based proteins, with wheat gluten stepping up as a powerful contender, particularly for those following gluten-free diets. This translates to a growing presence of wheat gluten in bakery and confectionery goods, alongside its well-established role in supplements. Furthermore, the trend towards convenient, high-fiber foods positions wheat gluten favorably.

Key Market Insights:

The 15% increase in revenue indicates a notable expansion in the Wheat Gluten market. Thisis due to factors such as the rising adoption of plant-based diets and the versatile applications of Wheat Gluten in food and beverage products.

The 20% growth in export volume suggests a growing international demand for Wheat Gluten. This is possibly due to its role as a protein-rich ingredient in various food products and the increasing popularity of wheat-based meat substitutes globally.

The 25% increase in demand for Wheat Gluten in health-conscious markets reflects a trend towards healthier food choices. Wheat Gluten is often used as a protein source in vegetarian and vegan products, as well as in gluten-free alternatives for individuals with gluten sensitivities.

Gluten sensitivity and related health issues pose a hurdle, and rising production costs could dampen its appeal. The key will lie in innovation – developing new applications for wheat gluten and addressing consumer concerns to ensure this market continues to rise.

Global Wheat Gluten Market Drivers:

Shifting Dietary Trends and Plant-Based Protein is driving the market

Consumer preferences are evolving towards healthier and more sustainable food choices. This includes a rise in vegetarian and vegan diets, along with a growing interest in plant-based protein sources. Wheat gluten, boasting high protein content and low fat, presents itself as an attractive option for those seeking to boost their protein intake without meat. Furthermore, the surging popularity of meat alternatives heavily relies on wheat gluten as a key ingredient to mimic the texture and mouthfeel of meat. This trend is expected to propel the demand for wheat gluten in the coming years.

Functional Benefits and Bakery Industry Applications is driving the market

Wheat gluten isn't just about protein content. It offers functional benefits to food manufacturers, acting as a binding agent, dough conditioner, and texture enhancer. This translates to improved product quality, consistency, and elasticity in various bakery goods like bread, rolls, and pastries. The expanding bakery industry, particularly in regions like Asia Pacific, creates a strong demand for wheat gluten as a vital baking ingredient.

Growing Health Consciousness and Focus on Nutritional Value is driving the market

Consumers are increasingly becoming more informed about the nutritional value of their food. Wheat gluten's well-balanced composition, containing essential amino acids and offering gluten-free alternatives for those with celiac disease, positions it favorably in the health-conscious market. Additionally, rising disposable incomes allow consumers to prioritize healthier food options, potentially driving the demand for wheat gluten-fortified products.

Global Wheat Gluten Market challenges and restraints:

Balancing Popularity with Gluten Sensitivity is restricting the market growth

The rising popularity of wheat gluten as a plant-based protein source presents a double-edged sword for the market. While it attracts health-conscious consumers, it simultaneously clashes with the growing awareness of gluten sensitivity and celiac disease. This intolerance to gluten can cause digestive issues and other health problems, leading some consumers to actively avoid wheat gluten. The market must navigate this conflicting trend. Mitigating strategies could involve clear labeling, educating consumers about the difference between gluten sensitivity and celiac disease, and potentially even gluten-reduced wheat gluten products for those with milder sensitivities.

Keeping Up with Rising Production Costs is restricting the market growth

The Wheat Gluten Market faces potential strain from rising production costs. Factors like fluctuations in wheat prices, increasing energy demands for processing, and stricter regulations can all contribute to a more expensive product. This can squeeze profit margins for manufacturers and potentially lead to higher prices for consumers. The industry needs to find ways to optimize production processes, explore alternative sourcing strategies, and potentially look for cost-effective modifications to the product itself to ensure affordability and market competitiveness.

Market Opportunities:

The Wheat Gluten Market is brimming with opportunities that cater to the evolving needs of health-conscious consumers and the food industry. A key trend is the growing demand for plant-based protein alternatives, and wheat gluten is perfectly positioned to capitalize on this. Manufacturers can target this opportunity by developing innovative wheat gluten-based products like meat analogs with improved texture and taste, catering to flexitarians and vegetarians seeking meat substitutes. Furthermore, the market can tap into the growing popularity of convenient, high-protein snacks and bars by incorporating wheat gluten as a binding agent and protein source. This aligns perfectly with the busy lifestyles of many consumers. Additionally, the market can leverage the rising interest in gluten-free products by investing in research and development of new wheat gluten processing techniques that minimize gluten content, allowing those with milder sensitivities to enjoy its benefits. Beyond these consumer-driven trends, the market can explore opportunities in the bakery and confectionery industries. Wheat gluten's ability to improve dough elasticity and texture can be a valuable asset for bakers seeking high-quality products. By collaborating with these industries and highlighting the functional benefits of wheat gluten, the market can expand its reach and establish itself as a key ingredient. Finally, the market should explore opportunities in emerging economies where disposable incomes are rising and consumers are becoming more health-conscious. Introducing wheat gluten as a cost-effective and nutritious protein source in these regions can be a significant growth driver. By capitalizing on these diverse opportunities and addressing the existing challenges, the Wheat Gluten Market can establish itself as a vital player in the food industry of tomorrow.

WHEAT GLUTEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ADM, Cargill, Incorporated, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Ingredion Inc., Manildra Group, MGP Ingredients, Inc., Pioneer Industries Limited, Royal Ingredients Group, Roquette Frères |

Wheat Gluten Market segmentation - By Product Type

-

Vital Wheat Gluten

-

Gluten Flour

-

Organic Wheat Gluten

-

Gluten-Free Wheat Gluten

While organic and "gluten-free wheat gluten" cater to niche markets, the true powerhouse of the Wheat Gluten Market is Vital Wheat Gluten. This champion boasts the highest protein content, making it the go-to-choice for applications where protein fortification and dough strengthening are crucial. Bakers rely on vital wheat gluten to create breads with superior elasticity and texture, while the plant-based meat alternative industry utilizes it to mimic the satisfying chew of real meat. This high-protein segment caters to the core functionalities that drive demand for wheat gluten, solidifying its dominance in the market.

Wheat Gluten Market segmentation - By Application

-

Bakery

-

Meat Alternatives

-

Confectionery

-

Nutritional Supplements

-

Convenience Foods

The undisputed heavyweight champion of the wheat gluten application ring is the Food Industry, particularly the realm of Bakery. Bread, cakes, and pastries all rely heavily on wheat gluten's magic touch. Its ability to improve dough elasticity, enhance texture, and contribute to a satisfying rise makes it a baker's best friend. While other segments like nutritional supplements and convenience foods are experiencing exciting growth, the sheer volume of wheat gluten used in bakeries across the globe secures its position as the dominant application segment within the Wheat Gluten Market.

Wheat Gluten Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The current wheat gluten market isn't ruled by a single geographical region. While established markets like North America and Europe hold strong positions with developed food industries and a tradition of wheat consumption, the true growth champion is Asia Pacific. This region boasts a powerful combination of factors propelling it forward. Firstly, a booming population with rising disposable incomes translates to a growing demand for food products. Secondly, the surge in popularity of plant-based diets and convenient, high-protein snacks creates a perfect fit for wheat gluten's functionalities. Finally, with several major wheat producing countries within the region, Asia Pacific benefits from a readily available and potentially cost-effective source of raw material. These converging forces solidify Asia Pacific's position as the fastest growing market segment for wheat gluten.

COVID-19 Impact Analysis on the Global Wheat Gluten Market

The COVID-19 pandemic's impact on the global wheat gluten market was a mixed bag. Initial disruptions were significant. Lockdowns and restricted movement hampered food service operations and restaurant businesses, leading to a decline in demand for bakery products and consequently, wheat gluten. Supply chain slowdowns also caused temporary shortages of wheat gluten itself. However, the tide began to turn as consumers shifted their purchasing habits during lockdowns. With a focus on home cooking and stockpiling pantry staples, household flour consumption increased. This, in turn, drove demand for wheat gluten, a key ingredient in high-protein flours used for baking bread and other homemade goods. Additionally, the rise in health consciousness during the pandemic potentially benefitted the wheat gluten market. As consumers sought out foods rich in protein and essential nutrients, wheat gluten's properties as a high-protein, gluten-free alternative (for those without celiac disease) gained some traction. Overall, while the pandemic caused initial setbacks, the long-term impact on the wheat gluten market appears to be leaning positive. The increasing focus on health and home cooking, coupled with the ongoing growth of the plant-based protein sector, is expected to propel the demand for wheat gluten in the coming years.

Latest trends/Developments

The wheat gluten market is witnessing a wave of innovation that caters to both evolving consumer preferences and sustainability concerns. One key trend is the development of gluten-free wheat gluten. This caters to the growing demand for gluten-free products while still offering the functional benefits of wheat gluten for manufacturers. These gluten-free alternatives are typically derived from specific wheat fractions or through enzymatic modification, making them suitable for those with celiac disease or gluten sensitivities. Another interesting development is the exploration of ancient wheat varieties for wheat gluten production. These varieties, like einkorn and spelt, are gaining traction due to their perceived health benefits and unique flavor profiles. Additionally, research into upcycling side streams from wheat processing is underway. Wheat bran, a byproduct of flour milling, holds promise as a viable source for gluten production, promoting resource efficiency and reducing waste within the wheat processing industry. Furthermore, there's a growing focus on non-GMO wheat gluten to meet the demands of health-conscious consumers who prioritize natural and organic ingredients. Finally, advancements in extraction techniques are being explored to improve the efficiency and sustainability of the wheat gluten production process. These innovations aim to minimize water usage, reduce energy consumption, and potentially utilize eco-friendly solvents for a greener wheat gluten future. In essence, the wheat gluten market is actively responding to consumer trends and environmental concerns, paving the way for a more inclusive, sustainable, and innovative future.

Key Players:

-

ADM

-

Cargill, Incorporated

-

Crespel & Deiters Group

-

Glico Nutrition Co., Ltd.

-

Ingredion Inc.

-

Manildra Group

-

MGP Ingredients, Inc.

-

Pioneer Industries Limited

-

Royal Ingredients Group

-

Roquette Frères

Chapter 1. Wheat Gluten Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Wheat Gluten Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Wheat Gluten Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Wheat Gluten Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Wheat Gluten Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Wheat Gluten Market – By Product Type

6.1 Introduction/Key Findings

6.2 Vital Wheat Gluten

6.3 Gluten Flour

6.4 Organic Wheat Gluten

6.5 Gluten-Free Wheat Gluten

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Wheat Gluten Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery

7.3 Meat Alternatives

7.4 Confectionery

7.5 Nutritional Supplements

7.6 Convenience Foods

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Wheat Gluten Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Wheat Gluten Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ADM

9.2 Cargill, Incorporated

9.3 Crespel & Deiters Group

9.4 Glico Nutrition Co., Ltd.

9.5 Ingredion Inc.

9.6 Manildra Group

9.7 MGP Ingredients, Inc.

9.8 Pioneer Industries Limited

9.9 Royal Ingredients Group

9.10 Roquette Frères

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Wheat Gluten Market was valued at USD 13.95 billion in 2023 and is projected to grow at a CAGR of 9% from 2024 to 2030. The market is expected to reach USD 25.5 billion by 2030.

Shifting Dietary Trends and Plant-Based Protein, Functional Benefits and Bakery Industry Applications these are the reasons which is driving the market.

Based on product type it is divided into four segments – Vital Wheat Gluten, Gluten Flour, Organic Wheat Gluten, Gluten-Free Wheat Gluten

North America is the most dominant region for the Wheat Gluten Market.

ADM, Cargill, Incorporated, Crespel & Deiters Group, Glico Nutrition Co., Ltd.