Europe Wheat Gluten Market Size (2024-2030)

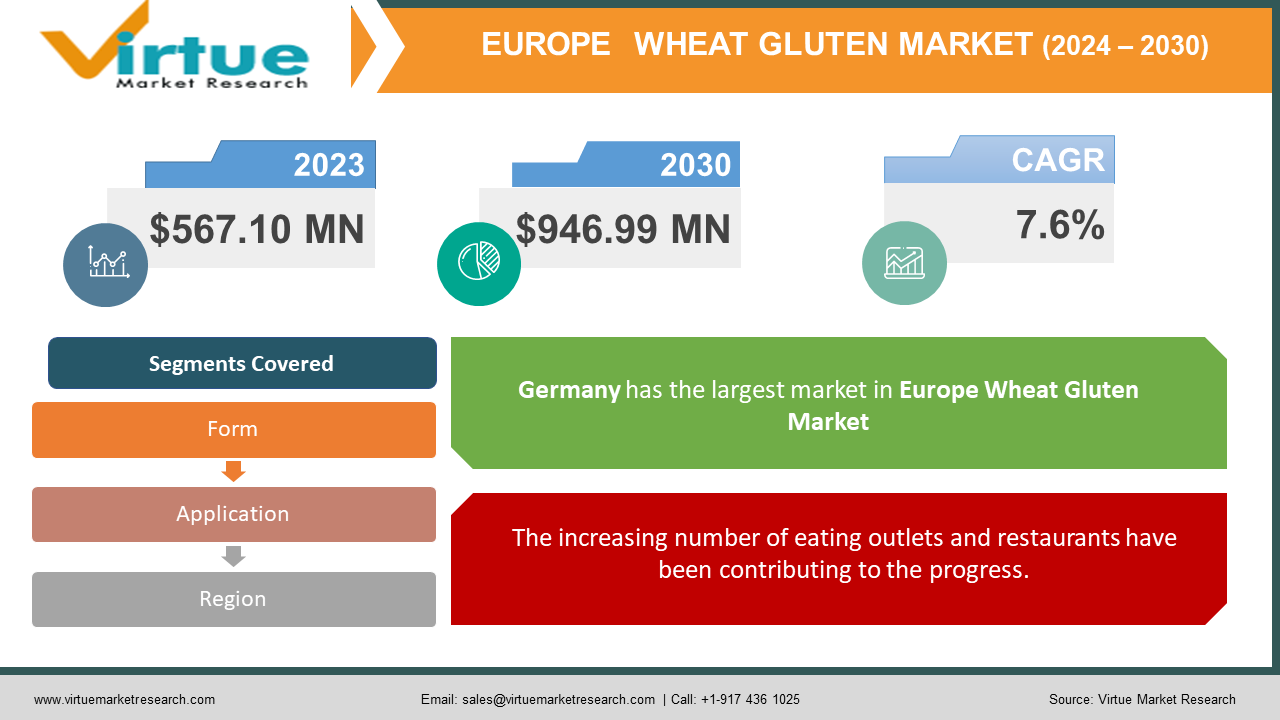

The European wheat gluten market was valued at USD 567.10 million and is projected to reach a market size of USD 946.99 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.6%.

Two water-insoluble proteins called glutenins and gliadins make up the majority of wheat gluten (WG), a by-product of the wheat starch industry. These proteins are important in establishing the functional characteristics of flour. Low-molecular-weight proteins make up glutenins, whereas high-molecular-weight proteins make up glutenins. This market has had a significant presence in the past in Europe due to the strong agricultural system and traditional use of wheat in various food products. Presently, the market has seen a notable expansion owing to the increasing population and demand. In the future, with a focus on innovations and biotechnological methods, this market is anticipated to witness good growth.

Key Market Insights:

The value of wheat and gluten exports climbed to over 208 million euros in 2022 in France.

The value of Poland's wheat-gluten exports rose by 43.66% in 2022.

The value of Belgium's wheat-gluten exports rose by 10.91% in 2022.

The value of wheat gluten exported from the United Kingdom rose by 18.5 million British pounds in 2022. Thus, at 49.5 million British pounds, the value reached its maximum throughout the time under observation.

The estimated frequency in European countries like Finland for gluten allergies ranges from 2–3%. This number is predicted to increase during the forecast period. To tackle this, companies have been coming up with gluten-free alternatives and are prioritizing clean labeling.

Wheat Gluten Market Drivers:

The nutritional benefits of wheat gluten have been facilitating market development.

There has been an increasing health consciousness amongst people due to a higher incidence of chronic illnesses from a young age. Wheat gluten is known for its high protein content and is incorporated by many people in their diets due to this factor. 370 calories, 75 grams of protein, 14 grams of carbs, 1.9 grams of fat, 0.3 grams of saturated fat, and 0 milligrams of cholesterol are found in a 100-gram meal of wheat gluten. It is an important iron and selenium source. About 2.6 milligrams of iron, or 12–14% of the daily required requirement for adult women and 32% for adult men and women over 50, may be found in two ounces of essential wheat gluten. Besides, it contains phosphorus, which aids in digestion. Moreover, wheat protein has all nine of the necessary amino acids, making it a complete protein. Furthermore, the high fiber content of wheat protein might help in cholesterol reduction. All these advantages make it an ideal choice, creating an elevation in its use in various food products.

The increasing number of eating outlets and restaurants have been contributing to the progress.

Over the years, there has been an increase in the number of restaurants, hotels, and other eateries. These places offer many cuisines that include wheat gluten as an essential ingredient. People are constantly looking for more choices and are keen on experimentation. Wheat gluten is used in the food industry in cereals, soups, desserts, snacks, fried items, meat, etc. When wheat gluten is added to food items, it acts as a binding agent, binding food together and giving it shape. Secondly, it creates a very elastic and extensible structure when combined and moistened, which is what gives bread dough its capacity to contain gas. The dough keeps its form and rises because of the flexibility that gluten imparts to it. This frequently results in a chewy texture for the finished product. Thirdly, in processed foods, gluten is frequently used as an addition to enhance flavor, texture, and moisture retention. Furthermore, bakery goods that include gluten can have a longer shelf life and can be kept at room temperature before losing quality. All these unique properties are creating an upsurge.

Wheat Gluten Market Restraints and Challenges:

Gluten-related disorders and intense competition are the main concerns of the market.

A certain percent of the population cannot digest gluten. This is because of an autoimmune response to gluten that is called celiac disease. If such patients consume gluten, their small intestines can be affected. Few research studies have indicated cognitive impairment in people who are gluten-sensitive and have celiac disease. A person with a cognitive disability struggles with learning, remembering, concentrating, making decisions, and using judgment. In a few others, gluten is responsible for allergies in the form of body rash and itching. The rest of the people have experienced inflammation in the gut and other issues like mood swings, sudden weight gain, fatigue, joint pain, and digestive challenges. Apart from this, this market can experience losses due to alternative proteins like soy, pea, and rice protein. Consumers can opt for these choices due to health benefits and increasing allergies. As a result, manufacturers can opt for the manufacturing and processing of these alternatives.

Wheat Gluten Market Opportunities:

Veganism is the practice of incorporating plant-based diets. A lot of people are inclined towards this dietary preference. Wheat gluten is derived from plant-based sources. By encouraging and educating the public about this factor, the market can explore an ample number of possibilities. Secondly, innovations and product diversity are beneficial. By capitalizing on this, the market can increase its revenue. This includes manufacturing gluten-free products to reach a wider consumer base and people who have a gluten intolerance. R&D activities are being carried out to expand the application of wheat gluten in the pharmaceutical industry for various drugs and other formulations. Additionally, the animal industry is exploring the potential use of this ingredient for animal feed. Online retail is a boon. By creating a virtual presence, companies and sellers can increase their sales globally. Apart from this, there has been a rise in meat substitutes. These food products use wheat gluten for various meat substitutes like sausages, burgers, and meatballs. Wheat gluten's property provides texture and elasticity, helping to acquire a similar taste as that of the actual meat in these products.

EUROPE WHEAT GLUTEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2023 - 2030 |

|

|

Base Year |

2023 |

|

|

Forecast Period |

2024 - 2030 |

|

|

CAGR |

7.6% |

|

|

Segments Covered |

By Form, Application, and Region |

|

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

|

Regional Scope |

|

|

|

Key Companies Profiled |

Cargill, Incorporated, Archer Daniels Midland Company, Roquette Frères, Tereos, CropEnergies AG, MGP Ingredients, Inc., Manildra Group, Crespel & Deiters GmbH & Co. KG, Kröner-Stärke GmbH, Glico Nutrition Co., Ltd. |

Europe Wheat Gluten Market Segmentation:

Europe Wheat Gluten Market Segmentation: By Form:

- Liquid

- Powder

The powder segment is the largest category in 2023 with the dominant market share. Wheat gluten is a powder that resembles flour and is almost all gluten and very little starch. After soaking wheat flour to activate the gluten protein, everything except the gluten is removed by processing. Protein content in wheat gluten powder normally ranges from 70% to 80% on a dry weight basis. Because of this, it's a great source of plant-based protein for diets that include vegetarianism and veganism. In the culinary sector, wheat gluten powder is frequently used as an ingredient, especially for making baked goods like bread, pizza dough, bagels, and pastries. Liquid form is the fastest-growing segment. Liquid wheat gluten concentrates and extracts have become popular because they are easy to handle, are included in formulations, and may offer functional benefits in some applications. Furthermore, liquid forms could provide certain practical benefits in particular uses, such as better dough hydration in breadmaking.

Europe Wheat Gluten Market Segmentation: By Application:

- Dietary Supplements

- Bakery & Confectionery

- Animal Feed

- Others

Based on application, bakery & confectionery has the largest market share in 2023. A frequent component of bread, buns, cakes, pastries, cookies, and other baked foods is wheat gluten. Due to its special functional qualities, which include giving dough structure, elasticity, and strength, it is an essential ingredient in baking recipes. Besides, the rising demand for bakery items due to their taste and diversity has been fueling the growth. Dietary supplements are the fastest-growing category. Demand for plant-based protein sources, including wheat gluten in dietary supplements, has increased as a result of rising vegetarian and vegan lifestyles and growing consumer knowledge of the health advantages of protein supplementation.

Wheat gluten is a popular component in protein powders, shakes, bars, and other dietary supplements marketed to athletes, fitness enthusiasts, and health-conscious consumers due to its high protein content and nutritional profile.

Europe Wheat Gluten Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany has the largest market in the year 2023. Because of the considerable consumer demand for an alternate source of meat and soy protein, Germany makes up a sizeable portion of the industry. The bakery, confectionery, and processed food industries are all part of Germany’s well-established and mature food industry. Because of this infrastructure, it is easier to produce, distribute, and consume goods containing wheat gluten, which attracts suppliers and manufacturers. The United Kingdom is the fastest-growing market. In the culinary traditions of the United Kingdom, baked foods, including bread, cakes, and pastries, have cultural importance. Because of these items' widespread appeal, there is a constant need for wheat gluten, an essential component of many bakery recipes. Supermarkets, convenience stores, specialist food stores, and internet merchants are all part of the UK's varied retail scene. With the help of this varied distribution network, producers of wheat gluten goods may contact customers through a variety of channels, meeting a range of tastes and purchasing habits.

COVID-19 Impact Analysis on the European Wheat Gluten Market:

The viral epidemic hurt the market. Lockdowns, movement limitations, and social isolation became the new standards. Transportation, other logistics, and the supply chain were all affected by this. As a result, import-export operations deteriorated. To stop the virus from spreading, all restaurants were forced to close. Production and other operations were stopped as a result. Because of the unpredictability of the economy, layoffs were prevalent in several industries. Numerous people experienced job losses. The majority of the funds were used for necessities and basic utilities. All funds were directed toward medical applications, such as PPE kits, hospital beds, oxygen tanks, masks, and vaccinations. Launches and partnerships were delayed as a result. Apart from this, there was a lot of awareness about the importance of having a healthy mind and body. People started consuming food that was healthy and helped provide immunity. Home-cooked food gained prominence. A research paper published by the National Institute of Health showed that a gluten-free diet may lessen inflammatory responses generally, which may enhance immune system function generally and lessen the risk of contracting COVID-19 infection. This caused significant losses for the market. Following the epidemic, the market has started to improve. The market is now adjusting to sustainable methods. Online channels have seen good growth due to convenience. People can place their order and have it delivered to their doorstep. The easing of regulations and the raising of standards have returned to normal.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Sustainability is becoming a crucial factor for both organizations and consumers. Manufacturers of wheat gluten are incorporating sustainable practices into their production processes, such as using wheat that has been cultivated sustainably, using less energy and water, and producing less waste.

Key Players:

- Cargill, Incorporated

- Archer Daniels Midland Company

- Roquette Frères

- Tereos

- CropEnergies AG

- MGP Ingredients, Inc.

- Manildra Group

- Crespel & Deiters GmbH & Co. KG

- Kröner-Stärke GmbH

- Glico Nutrition Co., Ltd.

- In May 2023, IFF introduced ENOVERATM 2000. This product line may substitute up to 50% of the essential gluten in whole wheat bread. The ENOVERATM 2000 series, a next-generation enzyme dough strengthener, is intended for bakery makers who are interested in replacing critical gluten, especially in difficult applications like whole wheat bread. Due to this ground-breaking enzymatic discovery, operating costs may be lowered without sacrificing volume or quality.

- In May 2023, in Norrköping, Sweden, Lantmännen Biorefineries opened a new manufacturing plant for extracting wheat protein, or gluten. The resilience of Swedish food production is enhanced, and an expanding industrial demand is matched by its greatly enlarged production capacity. A total of SEK 800 million was invested in the new production plant.

- In March 2022, Lantmännen Biorefineries announced its initiative to produce gluten-free wheat starch from carefully chosen autumn wheat cultivated in western Sweden. This product is a fine white powder that tastes neutral and has great baking qualities that work well for all kinds of gluten-free baking. It will be introduced first in the Nordics and northern Europe, where there is now a great deal of demand, and is gluten-free according to European guidelines.

Chapter 1. Europe Wheat Gluten Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Form of Material s

1.5. Secondary Product Form of Material s

Chapter 2. Europe Wheat Gluten Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Wheat Gluten Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Wheat Gluten Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Wheat Gluten Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Wheat Gluten Market– By Form

6.1. Introduction/Key Findings

6.2. Liquid

6.3. Powder

6.4. Y-O-Y Growth trend Analysis By Form

6.5. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. Europe Wheat Gluten Market– By Application

7.1. Introduction/Key Findings

7.2 Dietary Supplements

7.3. Bakery & Confectionery

7.4. Animal Feed

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Wheat Gluten Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Application

8.1.3. By Form

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Wheat Gluten Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Archer Daniels Midland Company

9.2. Roquette Frères

9.3. Tereos

9.4. CropEnergies AG

9.5. MGP Ingredients, Inc.

9.6. Manildra Group

9.7. Crespel & Deiters GmbH & Co. KG

9.8. Kröner-Stärke GmbH

9.9. Glico Nutrition Co., Ltd.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The European wheat gluten market was valued at USD 567.10 million and is projected to reach a market size of USD 946.99 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.6%.

The nutritional benefits of wheat gluten and demand from the food industry are the main factors propelling the European wheat gluten market

Based on form, the European wheat gluten market is segmented into liquid and powder.

Germany is the most dominant region for the European wheat-gluten market.

Cargill, Incorporated, Archer Daniels Midland Company, and Roquette Frères are the key players operating in the European wheat-gluten market