Unsaturated Polyester Resins Market Size (2024 – 2030)

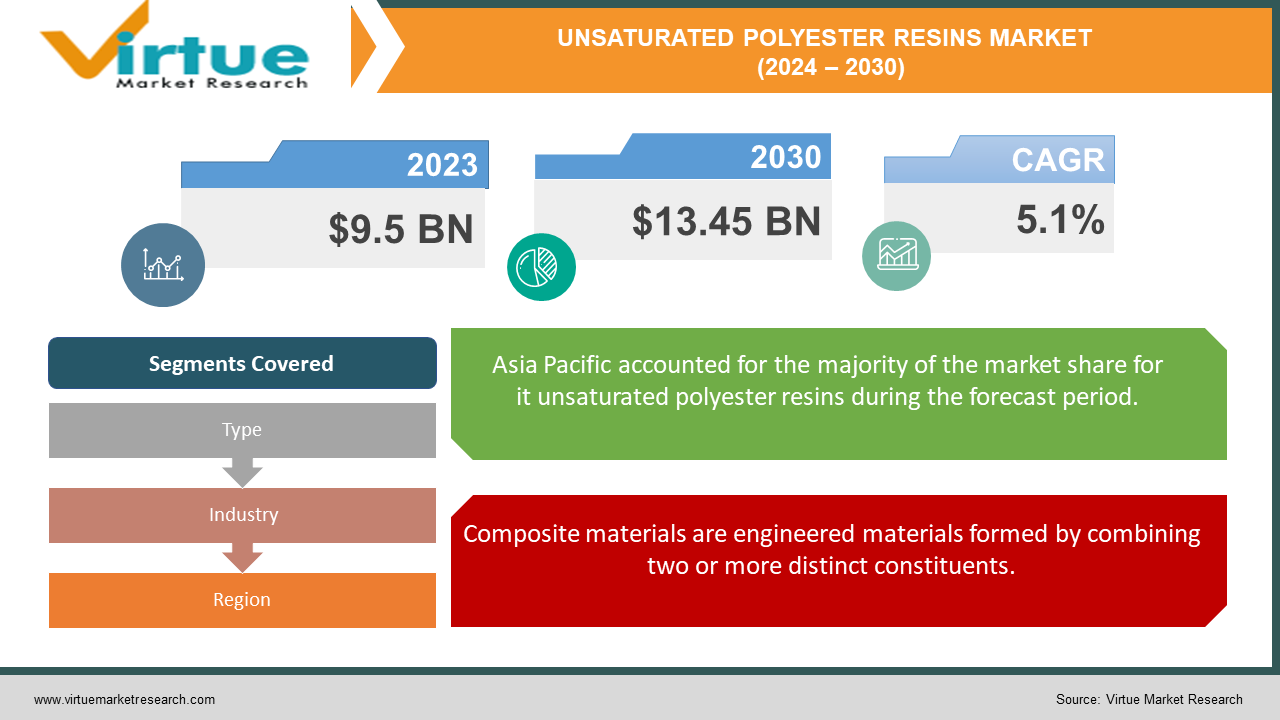

The Global Unsaturated Polyester Resins Market was valued at USD 9.5 Billion in 2023 and is projected to reach a market size of USD 13.45 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.1%.

Unsaturated polyester resins (UPRs) are a versatile class of thermosetting resins widely used across various industries. They offer a unique combination of properties – affordability, ease of processing, and good mechanical strength – making them a go-to material for a vast array of applications. UPRs are formed by the reaction of unsaturated polyester monomers with various additives and initiators. The most common type is styrene-based UPR, but due to environmental and health concerns, non-styrene UPRs are gaining traction. UPRs find application in a wide range of sectors. UPRs are a crucial component in composite materials, which are increasingly replacing traditional materials like metals and wood due to their lightweight nature and superior strength-to-weight ratio. Developments in non-styrene UPRs and bio-based UPR formulations are addressing environmental and health concerns, opening doors to new market opportunities.

Key Market Insights:

Global spending on construction projects is expected to reach $15. 2 trillion by 2027, propelling demand for UPRs in building and construction applications.

The composite materials market is projected to reach $140. 7 billion by 2027, with UPRs playing a significant role due to their cost-effectiveness and versatility.

The global transportation sector is anticipated to reach $8. 3 trillion by 2025, driving demand for UPRs in boat building, automotive parts, and other transportation applications.

UPRs offer a cost-competitive alternative to other resins, making them an attractive choice for manufacturers, particularly in price-sensitive sectors.

A 2024 survey by a leading industry association revealed that 68% of manufacturers consider UPRs a cost-effective solution compared to other resin options.

Global investments in R&D for high-performance UPRs are expected to reach $350 million by 2026.

Research into biodegradable UPR formulations is gaining traction, with a projected 10% increase in funding by 2025.

The demand for non-styrene UPRs is expected to grow at a CAGR of 8-10% over the next five years, driven by environmental concerns and regulatory pressures.

Unsaturated Polyester Resins Market Drivers:

The global construction industry is experiencing a period of significant growth. This surge in construction activity translates to a heightened demand for building materials, and UPRs are poised to benefit immensely from this trend.

UPRs are a cost-effective alternative to other resin choices, which attracts builders and contractors looking to minimize project expenses. To generate robust composite materials, UPRs can be readily molded into a variety of shapes and reinforced with fibers. Because of its strong resistance to weather, UPRs are appropriate for use in outdoor settings. They can endure inclement weather, such as wind, rain, and UV rays, extending the life of building materials. Some UPR formulations have the ability to resist fire, which makes them an excellent material for construction elements that must adhere to strict fire safety standards. The construction industry is increasingly acknowledging the importance of sustainability. Green building practices and the adoption of eco-friendly materials are gaining traction. While traditional styrene-based UPRs raise environmental concerns due to styrene emissions, advancements in UPR technology are paving the way for more sustainable solutions.

Composite materials are engineered materials formed by combining two or more distinct constituents. They offer unique properties that surpass those of their individual components, making them highly sought-after in various industries.

When it comes to composites, UPRs provide a more affordable matrix material than epoxy resins or other resin alternatives. Because of their affordability, UPR composites are a desirable option for a range of applications. UPR composites have outstanding weight-to-strength ratios. They are perfect for situations where weight reduction is important because they are lightweight and have high mechanical qualities. UPRs can be reinforced using a variety of fibers, such as carbon fiber, fiberglass, or natural fibers, based on the final composite material's desired qualities. Because of its adaptability, UPR composites can be made with a variety of physical properties that are suited to certain uses.

Unsaturated Polyester Resins Market Restraints and Challenges:

Because of worries about the environment and human health, styrene-based UPRs, the industry's mainstay, are coming under more scrutiny. One volatile organic compound (VOC) that may be released during the manufacture and usage of UPR is styrene. VOCs add to air pollution, and exposure to styrene has been connected to a number of health problems. As a result, there is an increasing emphasis on tighter environmental laws pertaining to VOC emissions. Stricter global regulatory agencies are enforcing limits on allowed VOC levels, which is forcing the UPR sector to adjust and develop. The UPR market is susceptible to fluctuations in the prices of raw materials. Key raw materials for UPR production include unsaturated polyester monomers and additives. Global events such as political unrest or trade wars can disrupt supply chains for raw materials, leading to price fluctuations and potential shortages. For UPR manufacturers, rising raw material costs can squeeze profit margins if they are unable to pass on the increased costs to their customers entirely. This can lead to reduced profitability and potentially hinder investments in R&D and market expansion.

Unsaturated Polyester Resins Market Opportunities:

The growing focus on environmental responsibility within various industries creates a strong market pull for bio-based UPRs. Consumers and manufacturers alike are increasingly seeking eco-friendly materials to reduce their environmental footprint. Stringent environmental regulations on VOC emissions are pushing the UPR industry towards more sustainable options. Bio-based UPRs align well with these regulations, offering a path for compliance and market competitiveness. Research and development efforts are continuously improving the performance characteristics of bio-based UPRs. With ongoing advancements, bio-based UPRs have the potential to achieve performance levels comparable to traditional UPRs, further accelerating market adoption. While advancements are being made some bio-based UPR formulations might not yet fully match the performance characteristics of traditional UPRs in terms of strength, durability, or chemical resistance. Further research is needed to bridge this gap. Government support and incentives for the development and adoption of bio-based UPRs can significantly accelerate market growth. UPR composites offer a cost-efficient solution for wind turbine blade manufacturing. Their lightweight nature, good mechanical strength, and ease of fabrication make them ideal for this application. UPR composites can potentially find applications in other renewable energy technologies, such as geothermal power plants or biofuel production facilities, due to their versatility and adaptability.

UNSATURATED POLYESTER RESINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Type, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Polynt-Reichhold Group, INEOS Group , Royal DSM , AOC , BASF SE , U-PICA Company Ltd , Ashland Inc. , Scott Bader Company Ltd. , Xinyang Technology Group , Nuplex Industries Ltd |

Unsaturated Polyester Resins Market Segmentation: By Type

-

Styrene-Based UPR

-

Non-Styrene UPR

-

Others

For many years, the mainstay of the UPR industry has been UPRs made of styrene. Because styrene monomers are reasonably priced as raw materials, styrene-based UPRs offer an affordable option for a range of applications. UPRs made of styrene provide a strong combination of strength, stiffness, and dimensional stability, which makes them appropriate for a variety of structural uses. With commonly available catalysts, these UPRs are easily cured at room temperature and are highly feasible. Because of their ease of processing, they are versatile and easy to integrate into different production procedures. Styrene-based UPRs are extensively used in roofing sheets, wall cladding panels, prefabricated building components, and sanitary ware due to their affordability and ability to be molded into various shapes.

Non-styrene UPRs represent a rapidly growing segment of the UPR market, driven by environmental and health concerns surrounding styrene emissions. These UPRs utilize alternative monomers besides styrene, offering a more sustainable and worker-friendly solution. These UPRs utilize vinyl esters as the primary monomer, offering performance characteristics comparable to styrene-based UPRs. Vinyl ester UPRs exhibit good adhesion, chemical resistance, and flame retardancy, making them a suitable alternative for various applications. Derived from renewable resources like vegetable oils, bio-based UPRs offer the most environmentally friendly option. However, they are still under development, and their performance characteristics may not yet fully match traditional UPRs in all aspects.

Unsaturated Polyester Resins Market Segmentation: By Industry

-

Building & Construction

-

Transportation

-

Pipes & Tanks

-

Consumer Goods

-

Electrical Applications

-

Other Applications

The building and construction industry is the undisputed champion in UPR consumption, accounting for an estimated 30-35% of the global UPR market share. UPRs offer a competitive price point compared to alternative materials like epoxy resins. This affordability makes them an attractive choice for builders and contractors seeking to optimize project costs. UPR formulations are imbued with fire-retardant properties, making them a valuable materials for building components that need to meet stringent fire safety regulations. Derived from renewable resources like vegetable oils, these UPRs offer a more environmentally friendly alternative to traditional options. Bio-based UPRs are still under development, but research is ongoing to improve their performance characteristics to match those of traditional UPRs.

The wind energy sector is experiencing explosive growth driven by global commitments to renewable energy. UPR composites are playing a crucial role in this expansion, with the wind energy segment projected to be the fastest-growing end-user for UPRs, boasting a growth rate of 8-10%. UPR composites offer a cost-efficient solution for wind turbine blade manufacturing. Their lightweight nature, good mechanical strength, and ease of fabrication make them ideal for this application. Traditional steel blades are heavier and more expensive to produce, making UPR composites a compelling alternative. Wind turbine blades are subjected to harsh weather conditions, including high winds, rain, and extreme temperatures. UPR composites exhibit good durability and weather resistance, ensuring the blades can withstand these demanding environments.

Unsaturated Polyester Resins Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With an estimated 35–40% market share, the Asia-Pacific region leads the global market for unsaturated polyester resins. The region's fast industrialization, the rising need for infrastructure development, and the expansion of numerous manufacturing sectors, especially in China and India, are all responsible for this domination. The Asia-Pacific market's expansion has also been aided by the existence of significant UPR suppliers and the availability of cost-effective production capabilities.

The unsaturated polyester resins market is considered to be expanding at the quickest rate in the Asia-Pacific area. A favorable environment for the growth of the UPR market has been generated by the region's economic development, the growing adoption of innovative manufacturing technology, and the emphasis on sustainable practices. Furthermore, the growing need for consumer products and the development of sectors like transportation and construction have increased the demand for strong, lightweight materials, which has accelerated the use of UPR.

COVID-19 Impact Analysis on the Unsaturated Polyester Resins Market:

Lockdowns and travel restrictions disrupted the global supply chain for UPR raw materials. Shortages of key components like unsaturated monomers and additives created production bottlenecks and price fluctuations. The pandemic led to widespread lockdowns and a slowdown in construction projects around the world. This significantly reduced demand for UPRs, a critical material in the building and construction sector, the dominant end-user of UPRs. Movement restrictions and logistical hurdles hampered the transportation of UPRs from manufacturers to end-users. This caused delays in project timelines and added logistical costs. Social distancing measures and worker illness led to labor shortages in UPR manufacturing facilities and construction sites. This further hampered production and project completion. The pandemic's impact on the transportation sector was multifaceted. Travel restrictions and reduced economic activity led to a decrease in demand for UPRs used in boat building and automotive parts. However, the rise of e-commerce during lockdowns might have partially offset this decline through increased demand for UPRs in packaging materials.

Latest Trends/ Developments:

Bio-based UPRs cater to the growing demand for eco-friendly materials across various industries. They address concerns about volatile organic compound (VOC) emissions associated with traditional UPRs. Governments worldwide are increasingly implementing policies and regulations that promote the use of sustainable materials. This creates a favorable environment for the development and adoption of bio-based UPRs. Research and development efforts are continuously improving the performance characteristics of bio-based UPRs. As these UPRs approach the performance levels of traditional formulations, their market acceptance is expected to rise significantly. Currently, bio-based UPRs may be more expensive than traditional options due to factors like limited production scale and ongoing research. However, the cost gap is expected to narrow as production volumes increase and bio-based UPR technology matures.

Key Players:

-

Polynt-Reichhold Group

-

INEOS Group

-

Royal DSM

-

AOC

-

BASF SE

-

U-PICA Company Ltd

-

Ashland Inc.

-

Scott Bader Company Ltd.

-

Xinyang Technology Group

-

Nuplex Industries Ltd

Chapter 1. Unsaturated Polyester Resins Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Unsaturated Polyester Resins Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Unsaturated Polyester Resins Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Unsaturated Polyester Resins Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Unsaturated Polyester Resins Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Unsaturated Polyester Resins Market – By Type

6.1 Introduction/Key Findings

6.2 Styrene-Based UPR

6.3 Non-Styrene UPR

6.4 Others

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Unsaturated Polyester Resins Market – By Industry

7.1 Introduction/Key Findings

7.2 Building & Construction

7.3 Transportation

7.4 Pipes & Tanks

7.5 Consumer Goods

7.6 Electrical Applications

7.7 Other Applications

7.8 Y-O-Y Growth trend Analysis By Industry

7.9 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 8. Unsaturated Polyester Resins Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Unsaturated Polyester Resins Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Polynt-Reichhold Group

9.2 INEOS Group

9.3 Royal DSM

9.4 AOC

9.5 BASF SE

9.6 U-PICA Company Ltd

9.7 Ashland Inc.

9.8 Scott Bader Company Ltd.

9.9 Xinyang Technology Group

9.10 Nuplex Industries Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The building and construction industry is the dominant end-user of UPRs. As global infrastructure development and construction activity increase, the demand for UPRs for applications like roofing, wall panels, and prefabricated building components is expected to rise.

Styrene emissions from traditional UPRs are a major concern. Styrene is a volatile organic compound (VOC) that can contribute to air pollution and potential health risks.

Polynt-Reichhold Group, INEOS Group, Royal DSM, AOC, BASF SE, U-PICA Company Ltd, Ashland Inc., Scott Bader Company Ltd., Xinyang Technology Group, Nuplex Industries Ltd.

Asia-Pacific emerged as the most dominant player in the market, commanding an impressive 35% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.