Automotive Polyester Resins Market Size (2023-2030)

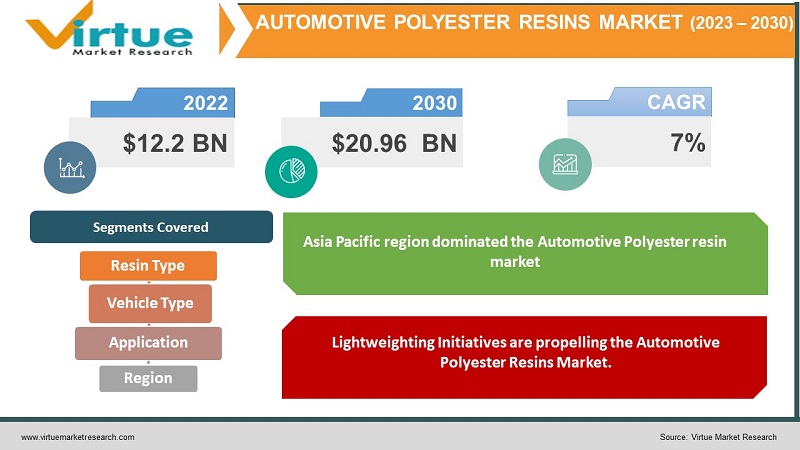

The Global Automotive Polyester Resins Market was valued at USD 12.2 billion and is projected to reach a market size of USD 20.96 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7%.

The market for polyester resins used in the automotive industry purely refers to those sectors that are fully engaged in the production as well as distribution of resins specifically manufactured for vehicles. Polyester resins are one category of strong plastics that are commonly employed across industries due to their remarkable capacity for sticking things together, their resistance to corrosion, and their mechanical properties. Over the course of the last 10 years, there has been a noticeable rise in trade for the automotive polyester resins sector due primarily to the surging need for lightweight materials that possess sturdy rust resistance characteristics too. Resin formulations have seen significant technical improvements that have translated into better endurance and strength contributing further towards heightened adoption as well.

Key Market Insights:

The automotive polyester resins market is growing fast due to factors like the need for lightweight materials, corrosion resistance, and the increasing production of vehicles globally. Unsaturated Polyester Resin (UPR) is the dominant resin type in the market because of its versatility and cost-effectiveness. Polyester resins are the preferred choice for various automotive applications. According to a study, there is a 40% reduction in carbon emissions with automotive polyester resins. Automotive Polyester Market creates 30% lighter vehicles, enhancing fuel efficiency. Automotive Polyester Resins help to provide 20% lower manufacturing costs for eco-conscious automakers.

The Asia Pacific region dominated the Automotive Polyester resin market. In 2022, China became the largest automotive production base globally, with 27 million units produced. It saw a 3.4% increase from the previous year. The first 7 months of 2022 saw a 31.5% YoY growth in car production, with battery-powered electric vehicle sales growing by 117.2%.In India, the automotive industry produced 22.03 million vehicles in FY 2021-22, compared to 22.66 million units in the previous fiscal year, and car production in July 2022 increased to 193.63 thousand units from 169.52 thousand units in June 2022, indicating a rising demand for the Automotive Polyester Resins Market.

Automotive Polyester Resins Market Drivers:

Lightweighting Initiatives are propelling the Automotive Polyester Resins Market.

The automotive polyester resins market is heavily influenced by the lightweight trend. Governments globally are imposing stricter regulations on vehicle emissions and fuel efficiency. As a result, automakers are exploring lightweight materials to reduce the weight of their vehicles. Polyester resins have become a go-to solution due to their low density and high strength-to-weight ratio. They play a crucial role in achieving significant weight reductions while maintaining structural integrity and safety standards. The transition towards electric vehicles (EVs) in the automotive industry is paving the way for polyester resins to play a crucial role as these materials are lightweight.

Corrosion Resistance and Cost-Efficiency are driving the Automotive Polyester Resins Market.

The automotive industry relies heavily on the remarkable anti-corrosion abilities of polyester resins, especially in areas that experience severe environmental conditions. It is vital to protect vehicle components from corrosion to maintain their structural integrity and longevity. Polyester resins are a hot commodity in the automotive industry due to their cost considerations. In terms of affordability, compared to other resources such as carbon fiber composites, polyester resins give a competitive edge. Even though the resins are budget-friendly, they do not trade-off performance. Car manufacturers must pay attention to cost efficiency to contend in the aggressive automotive market, and that's where polyester resins come in. The material offers a viable solution to achieve an equilibrium between performance, durability, and affordability, making it an appealing choice for different vehicle applications.

Automotive Polyester Resins Market Restraints and Challenges:

As automakers increasingly face scrutiny over their environmental impact, the polyester resin market is feeling the effects. There is a growing desire for eco-friendly materials in car manufacturing, which is causing a shift in demand for polyester resins. This material is affordable and adaptable, but its roots in petrochemicals pose a problem for biodegradability. Whether through recycling or greener resin formulations, manufacturers must tackle the challenge of reducing their environmental impact. In addition, strict regulations on emissions and waste disposal have ramped up demand for sustainable practices in the industry, which could impact the widespread acceptance of polyester resins in automotive applications.

Automotive Polyester Resins Market Opportunities:

The transition towards electric vehicles (EVs) in the automotive industry is paving the way for polyester resins to play a crucial role. These materials are both lightweight and resistant to corrosion, making them the perfect fit for a range of EV components. This helps improve the efficiency and performance of these vehicles, presenting a sizable opportunity for the use of polyester resins. Polyester resins are becoming increasingly essential in creating high-performance automotive components due to ongoing research in composite technology. Advancements in composite materials offer opportunities for tailored properties, thus opening doors for the creation of advanced composites. In emerging economies, there is an ever-growing market for automotive production due to swift industrialization and urbanization. The rising demand for vehicles in these regions can be catered to by polyester resins because of their versatility and cost-effectiveness.

AUTOMOTIVE POLYESTER RESINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Resin Type, Vehicle Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Reichhold LLC, BASF SE, Ashland Global Holdings Inc., Hexion Inc., Scott Bader Company Ltd., Allnex Belgium SA/NV, Polynt Group, Sika AG, DIC Corporation, AOC, LLC |

Automotive Polyester Resins Market Segmentation:

Automotive Polyester Resins Market Segmentation: By Resin Type

- Unsaturated Polyester Resin (UPR)

- Vinyl Ester Resin

- Other (Hybrid Resins)

In 2022, based on market segmentation by resin type, Unsaturated Polyester Resin (UPR) occupies the highest share 45 % of the market. It is due to many factors. Cost-effectiveness and adaptability are the main factors. Also, Unsaturated Polyester Resin (UPR) serves as a foundational material, offering a balance of strength and flexibility crucial in the production of components like body panels and interior parts.

Vinyl Ester Resin is the fastest-growing segment and is growing at a fast CAGR of 20% during the forecast period. The fastest-growing segment, Vinyl Ester Resin is recognized for its exceptional chemical and corrosion resistance. It has gained traction in demanding automotive environments and its ability to provide prolonged protection against harsh conditions positions made it a vital material in the production of components that require heightened durability.

Automotive Polyester Resins Market Segmentation: By Vehicle Type

- Passenger Cars

- Commercial Vehicles

In 2022, based on market segmentation by vehicle type, Passenger cars occupy the highest share 60%of the market. This category contains a wide range of vehicles designed primarily for the transportation of passengers. Passenger cars play a major significance in the automotive market, with millions being produced and sold annually worldwide. Their applications, from compact sedans to SUVs, contribute to the demand for polyester resins in various components.

However, the fastest-growing sector is commercial vehicles. This category includes a wide range of vehicles used for business and industrial purposes, such as trucks, buses, and commercial vans. The segment is experiencing rapid growth, mainly due to factors like urbanization, e-commerce expansion, and increased freight transportation needs. As the demand for commercial vehicles increases, the need for durable and efficient materials like polyester resins in their production also increases.

Automotive Polyester Resins Market Segmentation: By Application

- Body Panels

- Interior Components

- Adhesives and Sealants

- Coatings and Paints

In 2022, based on market segmentation by application, body panels occupy the highest share of the market. In the automotive polyester resins market, polyester resins play a pivotal role in the manufacturing of exterior body panels due to their lightweight and durable properties. This sector constitutes a significant portion of the market to reduce overall vehicle weight while maintaining structural and safety standards.

In 2022, based on market segmentation by application coatings and paints, is the fastest growing segment. Coatings and paints provide a protective layer against environmental elements. With an increase in demand for high-quality finishes and protective coatings, this sector is experiencing rapid growth. Consumers increasingly value longevity in their vehicles. So the demand for polyester resins in coatings and paints is anticipated to continue its upward trajectory.

Automotive Polyester Resins Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2022, the Asia Pacific region dominated the Automotive Polyester resin market with a revenue of 45%. The Asia-Pacific region is the largest market for automotive polyester resins due to the significant presence of major automotive manufacturers and the high production in countries like China, Japan, South Korea, and India. The Asia-Pacific region has the highest number of vehicles produced annually and more users, making it a dominant market for automotive materials, including polyester resins. China is the world's largest automotive market due to its increasing vehicle production,

However, the North American region is anticipated to grow at the fastest CAGR of about 20% during the forecast period due to its well-established automotive industry and strong technological advancements. Its innovation and high standards in automotive manufacturing also contributed to its growth. The region has the presence of major automotive manufacturers, creating demand for advanced materials like polyester resins. Additionally, light-weighting, driven by the growing interest in electric vehicles, further boosts the market for polyester resins in North America.

COVID-19 Impact Analysis on the Global Automotive Polyester Resins Market:

The market for automotive polyester resins witnessed a significant change due to the COVID-19 pandemic which resulted in a drop in demand for polyester resins in 2020 as global supply chains were disrupted and automotive production facilities temporarily closed functioning. As safety measures were the need of the hour, industries had no option but to adapt and this shift prompted a marked preference for personal vehicles. Through this pandemic, cars built from lightweight and corrosion-resistant materials have proven to be invaluable and led to an increased potential for the use of polyester resins in automobile sectors.

Latest Trends/ Developments:

At present, businesses operating within this sphere continue to prosper with major players channeling investment towards R&D activities aimed at producing innovative answers meeting ever-changing industrial norms including sustainability aspects and environment friendliness. Prospects of the automotive polyester resin industry seem quite optimistic driven mainly by ongoing stress on fuel efficiency coupled with electric vehicle manufacture and increasing focus on the usage of eco-friendly constituents. Furthermore, stringent regulatory frameworks about pollution control along with long-term sustainability material usage strategies are likely expected to play a pivotal guiding role in steering the industry towards greener options.

Key Players:

- Reichhold LLC

- BASF SE

- Ashland Global Holdings Inc.

- Hexion Inc.

- Scott Bader Company Ltd.

- Allnex Belgium SA/NV

- Polynt Group

- Sika AG

- DIC Corporation

- AOC, LLC

Chapter 1. Global Automotive Polyester Resins Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Automotive Polyester Resins Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Automotive Polyester Resins Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Automotive Polyester Resins Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Automotive Polyester Resins Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Automotive Polyester Resins Market– By Resin Type

6.1. Introduction/Key Findings

6.2. Unsaturated Polyester Resin (UPR)

6.3. Vinyl Ester Resin

6.4. Other (Hybrid Resins)

6.5. Y-O-Y Growth trend Analysis By Resin Type

6.6. Absolute $ Opportunity Analysis By Resin Type, 2023-2030

Chapter 7. Global Automotive Polyester Resins Market– By Vehicle Type

7.1. Introduction/Key Findings

7.2. Passenger Cars

7.3. Commercial Vehicles

7.4. Y-O-Y Growth trend Analysis By Vehicle Type

7.5. Absolute $ Opportunity Analysis By Vehicle Type, 2023-2030

Chapter 8. Global Automotive Polyester Resins Market– By Application

8.1. Introduction/Key Findings

8.2. Body Panels

8.3. Interior Components

8.4. Adhesives and Sealants

8.5. Coatings and Paints

8.6. Y-O-Y Growth trend Analysis Application

8.7. Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Global Automotive Polyester Resins Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Resin Type

9.1.3. By Vehicle Type

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Resin Type

9.2.3. By Vehicle Type

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Resin Type

9.3.3. By Vehicle Type

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By Resin Type

9.4.3. By Vehicle Type

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By Resin Type

9.5.3. By Vehicle Type

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Automotive Polyester Resins Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Reichhold LLC

10.2. BASF SE

10.3. Ashland Global Holdings Inc.

10.4. Hexion Inc.

10.5. Scott Bader Company Ltd.

10.6. Allnex Belgium SA/NV

10.7. Polynt Group

10.8. Sika AG

10.9. DIC Corporation

10.10. AOC, LLC

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Automotive Polyester Resins Market was valued at USD 12.2 billion and is projected to reach a market size of USD 20.96 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 7%.

Light weighting Initiatives, Corrosion Resistance, and Cost-Efficiency are propelling the Automotive Polyester Resins Market

Based on Vehicle Type, the Global Automotive Polyester Resins Market is segmented into Passenger Cars and Commercial Vehicles

Asia Pacific is the most dominant region for the Global Automotive Polyester Resins Market

Reichhold LLC, BASF SE, Ashland Global Holdings Inc., Hexion Inc., and Scott Bader Company Ltd. are the key players operating in the Global Automotive Polyester resin market