Testing and Simulation Systems Market Size (2024-2030)

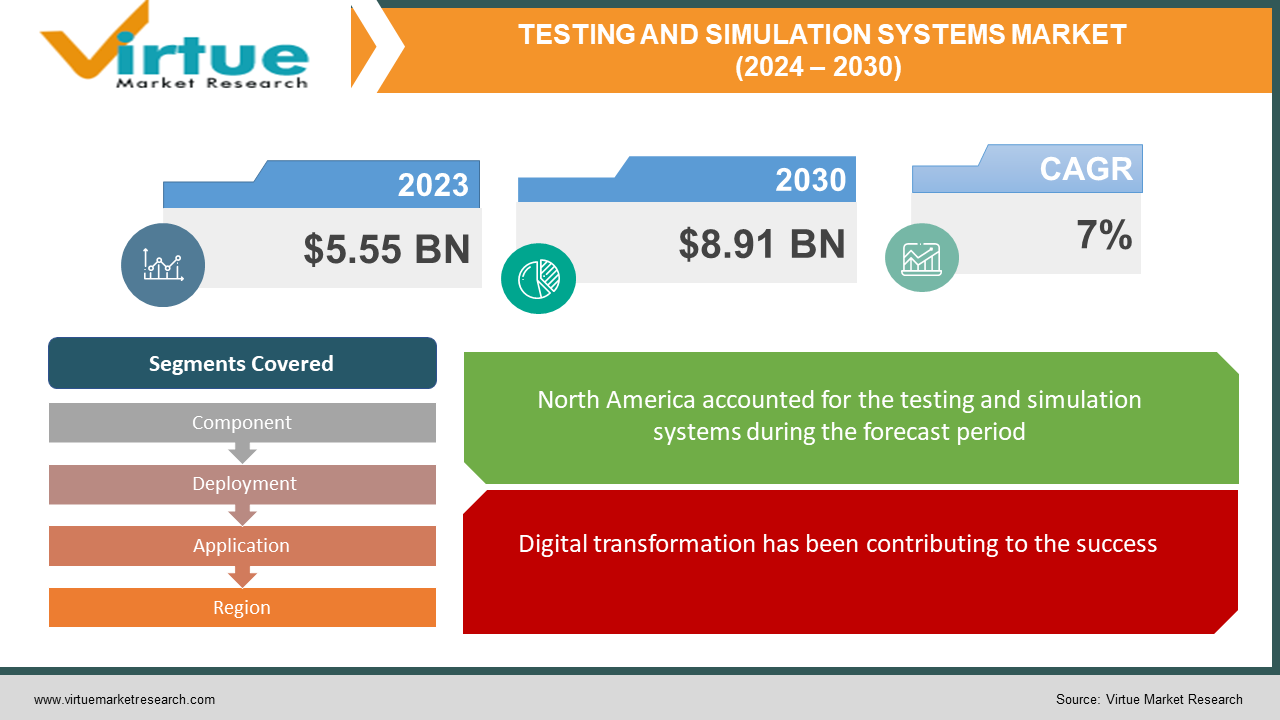

The testing and simulation systems market was valued at USD 5.55 billion in 2023 and is projected to reach a market size of USD 8.91 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7%.

The testing and simulation systems are adopted in diverse industries, from aerospace testing to manufacturing optimization, ensuring efficiency, safety, and sustainability. Digital transformation, AI integration, and a focus on green solutions drive this growth, while systems like HIL, SIL, and MIL cater to specific needs. From designing sleek cars to simulating surgeries, these simulations are everywhere. Asia leads this market, but regions like South America and Africa are showing significant growth.

Key Market Insights:

The testing and simulation systems market has a lot of innovations powering industries from medicine to manufacturing. This is fueled by a mix of trends, including AI-powered testing, and a growing focus on sustainability. Physicians rehearsing intricate surgeries on simulated patients or sleek automobiles optimized in virtual wind tunnels are possible through these innovations.

Under the hood, different systems like HIL, SIL, and MIL have specific purposes. HIL throws real hardware into the virtual mix for near-world testing, while SIL focuses on software glitches in a simulated environment. MIL uses mathematical models to test designs before anything gets built. This tailored approach ensures efficiency, safety, and a greener future for everything from airplanes to assembly lines.

Asia-Pacific, with its rapid industrialization and technological advancements, is propelling this market. With continuous advancements in technology, virtual reality, and cloud computing, the future of testing and simulation promises to be even more immersive and impactful. This market is anticipated to have a smoother, cleaner, and more innovative tomorrow across diverse industries.

The Testing and Simulation Systems Market Drivers:

Digital transformation has been contributing to the success.

Businesses are embracing virtual twins and digital testing methodologies across diverse industries. This shift allows for faster design iterations, optimized performance, and reduced risk compared to traditional physical testing methods. AI is transforming the testing and simulation landscape by enabling autonomous testing, predictive maintenance, and real-time data analysis. This leads to more efficient testing processes, improved accuracy, and deeper insights into system behavior.

A growing focus on sustainability is accelerating the growth rate.

The growing emphasis on environmental responsibility is driving the use of simulations to develop eco-friendly products and processes. This includes optimizing resource utilization, minimizing waste, and designing products with a lower environmental impact.

Advancements in hardware and software are driving the market.

Continuous improvements in computing power, software capabilities, and virtual reality technology are pushing the boundaries of what's possible in simulations. This creates ever-more realistic and immersive virtual environments, leading to more accurate testing and analysis.

Rising demand for efficiency and cost reduction has been fueling the development.

Companies across various sectors are constantly seeking ways to improve efficiency and reduce costs. Testing and simulation systems offer significant advantages in this regard by identifying potential issues early in the development process, reducing the need for expensive physical prototypes, and minimizing operational downtime. The market is seeing the development of specialized testing and simulation solutions tailored to the unique requirements of different industries. This ensures that systems address specific challenges and optimize performance within each sector.

Testing and Simulation Systems Market Restraints and Challenges:

The high initial investment is a barrier to market growth.

Implementing these systems can be costly, encompassing not just the software and hardware itself but also training personnel, building infrastructure, and ongoing maintenance. This can create barriers for the smaller firms, causing losses for the growth.

The skill gap has been creating obstacles.

Operating and interpreting complex simulations requires specialized expertise in areas like modeling, data analysis, and engineering. The current industry faces a shortage of qualified personnel, hindering wider adoption and optimal utilization of these systems.

Standardization issues are hindering the expansion.

Lack of consistent standards across different software platforms and hardware components can create compatibility problems, making data sharing and collaboration between teams or organizations challenging.

Model validation and uncertainty are creating difficulties.

The accuracy and reliability of simulations depend heavily on the quality of the underlying models and data. Inadequate validation processes or uncertainties in model parameters can lead to inaccurate results, affecting decision-making based on simulations. Integrating testing and simulation systems with existing workflows and data management systems can be complex and time-consuming. This can impede smooth adoption and limit the potential benefits of these technologies.

Security and privacy concerns are a major issue that needs to be tackled.

Simulations often involve sensitive data, raising concerns about cybersecurity threats and data privacy breaches. Robust security measures and clear data governance policies are crucial to addressing these concerns and building trust in the technology.

Testing and Simulation Systems Market Opportunities:

With the growing adoption of electric vehicles, this market has an ample number of possibilities in the automotive industry. There is an increasing need for systems to test the safety, reliability, and performance of these vehicles. This application is also extensively used in the aerospace industry for testing new models of airplanes. Secondly, it can be used in the healthcare industry to test various medical devices. The medical staff can be trained to use this equipment and perform virtual surgeries. Moreover, to optimize energy production and improve energy efficiency, these systems can be used in renewable energy sectors like solar, wind, and hydroelectric power. Furthermore, in the electronics industry, they can be used to check the performance and durability of devices like tablets, smartphones, laptops, etc. Apart from this, they are even used in the educational sector to create an artificial environment for learning in various fields.

TESTING AND SIMULATION SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Component, Deployment, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ANSYS, Siemens PLM Software, Dassault Systèmesm, MathWorks, Autodesk, Bentley Systems, AVL, Cybernet, National Instruments Corporation, Keysight Technologies, Inc., Dassault Systèmes |

Testing and Simulation Systems Market Segmentation: By Component

-

Hardware-in-the-Loop (HIL)

-

Software-in-the-Loop (SIL)

-

Model-in-the-Loop (MIL)

In terms of components, the Hardware-in-the-Loop (HIL) segment is the largest segment. This is favored for its ability to test complex systems in near-real-world environments. This is commonly used in the automotive and aerospace industries. However, the Software-in-the-Loop (SIL) segment is the fastest-growing segment, driven by the increasing complexity of software and the focus on early bug detection. This shift reflects the growing emphasis on software testing and optimization within the market.

Testing and Simulation Systems Market Segmentation: By Deployment

-

On-premises

-

Cloud-based

When it comes to deployment, the on-premises segment is the largest category in 2023. The main reason for this is the early adoption, which has resulted in a greater market share. This is provided by well-established companies. This helps in gaining the trust of the clients easily. This model is also known for its advanced control and security, which fuel the demand. However, the cloud-based segment is rapidly gaining traction as the fastest-growing segment, fueled by its cost-effectiveness, scalability, accessibility for smaller players, and diverse applications. This shift reflects the growing preference for flexible and readily available simulation solutions. Furthermore, most of the updates are automatic, which tends to attract a broader consumer base since charges are reduced for installation.

Testing and Simulation Systems Market Segmentation: By Application

-

Aerospace and Defense

-

Automotive

-

Manufacturing

-

Healthcare

-

Other Industries

Within application sectors, the automotive industry is the largest application. Leveraging simulations for design optimization, safety testing, and fuel efficiency is extremely crucial in this industry. Besides, with an increased demand for automatic and electric vehicles, the need for creating a simulation and testing the same has become vital. However, the healthcare sector is the fastest-growing category, fueled by advancements in medical devices, surgical simulations, and personalized treatment plans. This dynamic landscape highlights the diverse potential of testing and simulation across various industries.

Testing and Simulation Systems Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest growing market based on area, holding a rough share of around 35% in 2023. This region has established players like Siemens, ANSYS, National Instruments Corporation, MathWorks, Inc., Autodesk, Inc., and Keysight Technologies, Inc. They have a global presence that generates greater revenue. The automotive and aerospace industries drive the demand, while advancements in AI and cloud computing fuel innovation. Countries like the United States and Canada are at the forefront.

Asia-Pacific is the fastest-growing region, experiencing explosive growth fueled by China's ambitious industrial plans and diverse applications across sectors like healthcare and manufacturing. Government support and cost-effective manufacturing further propel the market. This area holds an approximate share of 25%.

Europe is a strong contender, known for its focus on high-tech solutions and niche applications in sectors like defense and energy. Continued investments in R&D and supportive policies ensure a steady rise.

South America is showing promising growth, with rapid infrastructure development and rising awareness of simulation benefits. Government initiatives and collaborations with established players unlock the market's potential.

The Middle East and Africa are emerging frontiers, with early signs of growth driven by resource exploration, smart city initiatives, and increasing investments in technology. Collaboration and knowledge sharing are keys to unlocking full potential.

COVID-19 Impact Analysis on the Testing and Simulation Systems Market:

COVID-19 threw the testing and simulation systems market a curveball, initially grounding test flights and silencing carmakers. Supply chains were hindered, disrupting the flow of hardware and casting a shadow on deliveries. But amidst the chaos, opportunities emerged. The healthcare sector gained tremendous prominence, with simulations across medical device development, surgical training, and drug discovery. Manufacturers have embraced simulations to optimize production lines, test remote work models, and predict supply chain disruptions. Cloud-based solutions were emphasized as the companies highlighted the process of flexibility and accessibility. Governments and industries joined hands, sharing knowledge and fostering collaboration to tackle pandemic challenges. COVID-19, though disruptive, was a digital transformation catalyst. The market helped in adapting, innovating, and emerging stronger. As industries rebuild and reshape, simulations are poised to take the lead in a future waltz of efficiency, resilience, and sustainability.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

AI has been a boon for the market. This field involves autonomously optimizing designs and predicting failures. Digital twins are ditching static snapshots and morphing into real-time mirrors, constantly fed by sensor data for live monitoring and predictive maintenance. Cloud-based platforms are democratizing simulations, putting powerful tools in the hands of startups and farmers alike. Ethical considerations around data privacy, bias, and transparency are being advanced to avoid any breaches and misuse.

Key Players:

-

ANSYS

-

Siemens PLM Software

-

Dassault Systèmes

-

MathWorks

-

Autodesk

-

Bentley Systems

-

AVL

-

Cybernet

-

National Instruments Corporation

-

Keysight Technologies, Inc.

-

Dassault Systèmes

In November 2023, large-scale vibration analysis and model-based harmonics will be two new capabilities that SimScale GmbH has revealed for engineers who specialize in structural and mechanical simulation. SimScale is a cloud-native engineering simulation tool used worldwide in the construction, electronics, industrial, automotive, and medical sectors. Engineers may now do vibration analysis on intricate CAD models with a single analysis type that automatically provides complete response spectrums thanks to the availability of modal-based harmonics in SimScale.

Chapter 1. Testing and Simulation Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Testing and Simulation Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Testing and Simulation Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Testing and Simulation Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Testing and Simulation Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Testing and Simulation Systems Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware-in-the-Loop (HIL)

6.3 Software-in-the-Loop (SIL)

6.4 Model-in-the-Loop (MIL)

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Testing and Simulation Systems Market – By Deployment

7.1 Introduction/Key Findings

7.2 On-premises

7.3 Cloud-based

7.4 Y-O-Y Growth trend Analysis By Deployment

7.5 Absolute $ Opportunity Analysis By Deployment, 2024-2030

Chapter 8. Testing and Simulation Systems Market – By Application

8.1 Introduction/Key Findings

8.2 Aerospace and Defense

8.3 Automotive

8.4 Manufacturing

8.5 Healthcare

8.6 Other Industries

8.7 Y-O-Y Growth trend Analysis By Application

8.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Testing and Simulation Systems Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Component

9.1.3 By Deployment

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Component

9.2.3 By Deployment

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Component

9.3.3 By Deployment

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Component

9.4.3 By Deployment

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Component

9.5.3 By Deployment

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Testing and Simulation Systems Market – Company Profiles – (Overview, By Component Portfolio, Financials, Strategies & Developments)

10.1 ANSYS

10.2 Siemens PLM Software

10.3 Dassault Systèmes

10.4 MathWorks

10.5 Autodesk

10.6 Bentley Systems

10.7 AVL

10.8 Cybernet

10.9 National Instruments Corporation

10.10 Keysight Technologies, Inc.

10.11 Dassault Systèmes

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The testing and simulation systems market was valued at USD 5.55 billion in 2023 and is projected to reach a market size of USD 8.91 billion by the end of 2030. Over the forecast period of 2024–2030, the request is projected to grow at a CAGR of 7%.

Digital transformation, artificial intelligence integration, a focus on sustainability, advancements in hardware and software, rising demand for efficiency and cost reduction, and a focus on specific industry needs are the main drivers.

Aerospace & defense, automotive, manufacturing, healthcare, and other industries are the categories based on application.

North America currently holds the crown for market share dominance in the testing and simulation systems market, claiming approximately 35% of the market.

ANSYS, Siemens PLM Software, and Dassault Systèmes are the prominent players in this market.