Simulation Software Market Size (2024 – 2030)

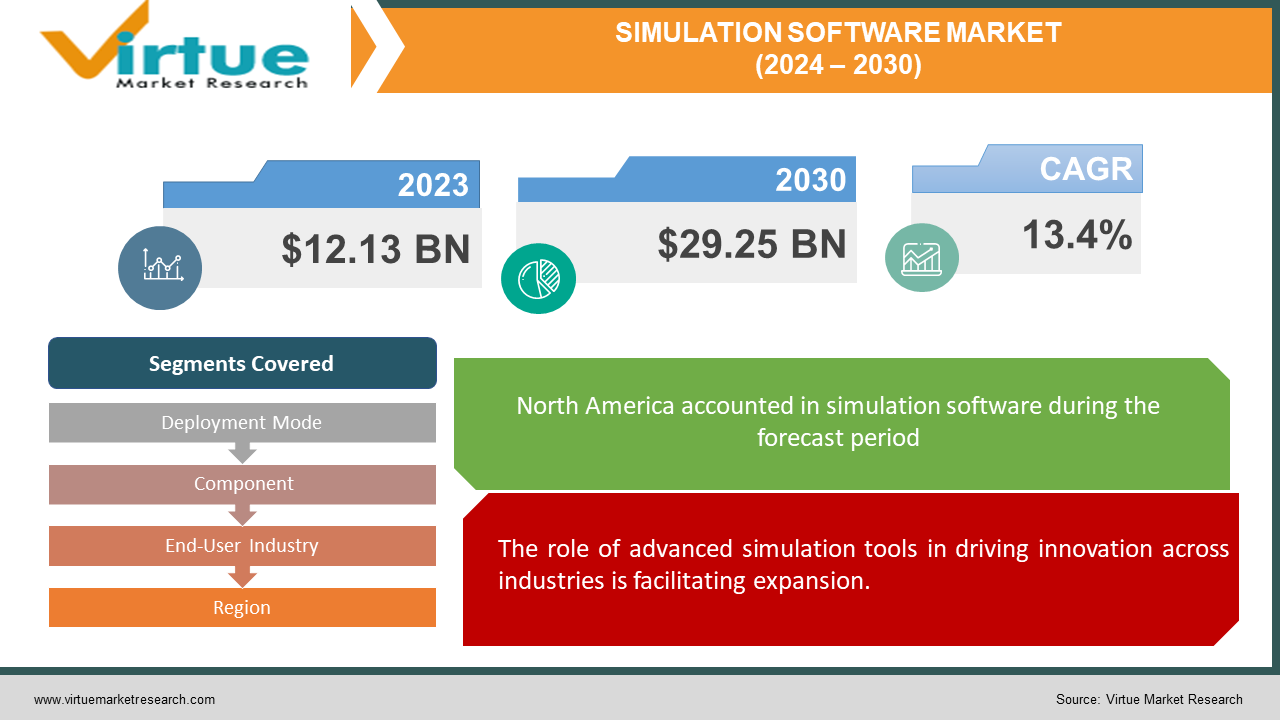

The market for simulation software was estimated to be worth 12.13 USD billion in 2023 and is expected to increase to 29.25 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 13.4% from 2024 to 2030.

Software that simulates system behavior lets people watch how a system works without really having to do it. Its foundation is the method of using a set of mathematical formulas to model an actual phenomenon. To develop equipment that will come as close to the design specifications as possible without requiring costly in-process modifications, simulation software is commonly employed. Software for simulation can be used to assess a novel design, identify issues with an existing design, and test a system in difficult-to-replicate environments, such as space for a satellite.

Key Market Insights:

The simulation software market has been experiencing robust growth, with a steady annual increase of 12% over the past two years. This growth is driven by the rising adoption of simulation technology across various industries, including automotive, aerospace, healthcare, and manufacturing. Companies are investing in virtual prototyping software to accelerate product development cycles and reduce time-to-market. This has led to a 15% increase in the adoption of simulation software for product design and testing purposes. There is a rising demand for cloud-based simulation platforms due to their scalability, accessibility, and cost-effectiveness. As a result, the market for cloud-based simulation software is projected to grow by 20% annually, driven by factors such as remote collaboration, real-time data analysis, and resource optimization. Simulation software is being utilized for a wide range of applications beyond traditional engineering and manufacturing, including virtual training, predictive maintenance, and digital twin simulations. This diversification of application areas has contributed to a 10% expansion of the overall simulation software market. There is a 5% decrease in customer satisfaction ratings. To address this, software vendors should prioritize quality assurance measures, offer comprehensive technical support, and actively gather feedback from users to improve their products and services.

Global Simulation Software Market Drivers:

The role of advanced simulation tools in driving innovation across industries is facilitating expansion.

The recreation program showcase is encountering a surge in requests driven by the requirement for imaginative item advancement over businesses. Progressed reenactment devices empower organizations to form virtual models, conduct comprehensive testing, and optimize plans sometimes for physical generation, in this manner quickening time-to-market and decreasing advancement costs. With the integration of cutting-edge advances such as virtual reality (VR) and expanded reality (AR), recreation computer programs are revolutionizing the item plan handle, cultivating imagination, and empowering the creation of next-generation items with prevalent execution and usefulness.

The transformative impact of simulation software on manufacturing and industrial sectors is accelerating the growth rate.

The rise of Industry 4.0 and the developing emphasis on advanced change are driving the selection of recreation computer programs over fabricating and mechanical segments. Recreation tools play a pivotal role in the usage of savvy fabricating activities by encouraging advanced twins, prescient support, and handle optimization. By mimicking fabricating forms and generation situations, organizations can recognize wasteful aspects, optimize asset utilization, and upgrade their general operational proficiency. Furthermore, by enabling continuous interaction with other Industry 4.0 advancements like the Web of Things (IoT), artificial intelligence (AI), and mechanical autonomy, the recreation computer program advances display development.

The rising demand for virtual preparation and instruction arrangements is enabling the development.

The expanding center on virtual preparation and instruction arrangements is driving the selection of reenactment computer programs within the instruction and preparation segment. With the expansion of online learning stages and further preparation activities, the reenactment computer program offers an immersive and intuitive learning experience for understudies and experts alike. From virtual research facilities and preparing recreations to intelligently 3D modeling situations, the recreation program empowers hands-on learning and expertise advancement in assorted spaces such as healthcare, building, and flying. Since organizations and educational instructors place a high value on continued education and online learning environments, it is expected that requests for recreation programs will see significant growth in the upcoming years.

Global Simulation Software Market Restraints and Challenges:

Information security concerns are a major barrier.

Despite the various benefits advertised by a recreation computer program, information security concerns pose a critical challenge to its development. The capacity and preparation of touchy data inside recreation situations raise misgivings concerning information protection, mental property assurance, and cybersecurity dangers. Organizations are reluctant to receive reenactment programs without vigorous security measures in place, dreading potential information breaches, unauthorized access, or mental property burglary. Tending to these concerns requires exacting information encryption conventions, getting to controls, and compliance with industry controls to instill certainty among clients and cultivate belief in reenactment program arrangements.

Interoperability issues restrain integration.

Interoperability challenges prevent the consistent integration of reenactment computer programs with existing frameworks and workflows, hindering their appropriation by businesses. Incongruence between distinctive computer program stages, record groups, and information measures complicates information trade and collaboration among partners. As organizations endeavor to use recreational computer programs for all-encompassing decision-making and prepare optimization, interoperability becomes fundamental for streamlining workflows, upgrading efficiency, and maximizing return on speculation. Overcoming interoperability boundaries requires the advancement of standardized interfacing, information trade conventions, and integration systems to encourage consistent interoperability and compatibility with different program biological systems.

Expertise deficiencies and preparation prerequisites are significant hurdles.

A deficiency of talented experts capable of recreation computer programs poses a critical challenge to advertising development and appropriation. The complex nature of recreation instruments requires specialized skills in information analytics, scientific modeling, and computer program programming, which are regularly in short supply. Besides, the nonstop advancement of recreation innovation requires continuous preparation and upskilling activities to keep pace with industry patterns and trends. Organizations confront challenges in selecting and holding qualified faculty with vital specialized proficiencies, restricting their capacity to completely tackle the potential of recreation computer programs. Tending to ability deficiencies and contributing to preparing programs are fundamental to constructing an ability pipeline and enabling clients with the imperative aptitudes to successfully use reenactment computer programs for decision-making and advancement.

Global Simulation Software Market Opportunities:

Virtual reality (VR) and augmented reality (AR) integration are providing the market with many possibilities.

The joining of recreation computer programs with virtual reality (VR) and increased reality (AR) innovations presents energizing openings for immersive and intuitive reenactments. By integrating VR and AR capabilities into reenactment program stages, organizations can make exceedingly reasonable and lock in virtual situations for preparing, planning visualization, and situation arranging. From intelligently item recreations to virtual preparing works out, the integration of VR and AR improves client engagement, moves forward learning results, and opens up modern roads for application over businesses such as instruction, healthcare, and fabricating.

The development of advanced twins for prescient support is beneficial.

The development of computerized twins, virtual copies of physical resources or frameworks, speaks to a transformative opportunity for prescient upkeep and resource administration. The recreation program empowers the creation and reenactment of computerized twins to screen, analyze, and optimize the execution of hardware, apparatus, and foundations in real-time. By leveraging simulation-based advanced twins, organizations can foresee and anticipate hardware disappointments, optimize support plans, and maximize operational proficiency. The integration of recreation computer programs with counterfeit insights (AI) and machine learning (ML) innovations offers monstrous potential for prescient analytics, optimization, and choice bolster. By combining AI and ML calculations, recreation programs can analyze tremendous datasets, recognize designs, and anticipate results with more noteworthy exactness and productivity. From prescient modeling and optimization to independent decision-making, AI-powered reenactment computer programs empower organizations to pick up more profound experiences, optimize forms, and drive development in assorted spaces. The merging of recreation, AI, and ML is anticipated to open unused openings for shrewd mechanization, data-driven decision-making, and transformative development within the worldwide commercial center.

SIMULATION SOFTWARE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.4% |

|

Segments Covered |

By Deployment Mode, Component, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ANSYS Inc., Siemens Digital Industries Software, Dassault Systèmes, Altair Engineering, Inc., MSC Software Corporation, MathWorks, Inc., Autodesk, Inc., COMSOL AB, Bentley Systems, Incorporated, The Math Company |

Simulation Software Market Segmentation: By Deployment Mode

-

On-Premises

-

Cloud-Based

Cloud-based deployment is the largest and fastest-growing segment. This arrangement offers a few focal points over conventional on-premises arrangements, making it exceedingly viable for meeting the energetic needs of advanced businesses. One of the essential benefits of cloud-based arrangements is adaptability. This adaptability empowers businesses to proficiently handle fluctuating workloads, suit development, and adjust to changing showcase conditions. Moreover, cloud-based recreation programs offer upgraded openness and collaboration. With cloud arrangements, clients can access recreation apparatuses and information from any area with a web association, empowering inaccessible collaboration and real-time decision-making. This availability cultivates more noteworthy collaboration among topographically scattered groups, quickens extended timelines, and makes strides in general efficiency. Besides, cloud-based sending disposes of the requirement for organizations to oversee and keep up complex IT foundations. Cloud benefit suppliers handle errands such as computer program overhauls, security patches, and information reinforcements, calming the burden of IT administration and permitting them to center on their competencies. By leveraging the adaptability, accessibility, and hassle-free support advertised by cloud-based arrangements, organizations can successfully streamline their recreation workflows, optimize asset utilization, and drive development within the computerized age.

Simulation Software Market Segmentation: By Component

-

Software

-

Services

Software is the largest growing component in this market. The effective design, modeling, and optimization of hybrid capacitor systems are made possible in large part by software. Utilizing design software, engineers may generate virtual models, run simulations, and examine performance metrics to guarantee the best capacitor arrangements for certain uses. Through the use of simulation software, hybrid capacitor systems may be tested in a variety of operating environments, assisting manufacturers in identifying possible problems and improving performance before actual manufacturing. Services are the fastest-growing category. Services are essential to the lifetime of hybrid capacitor systems, providing manufacturers, integrators, and end users with support. A variety of tasks are included in service offerings, such as technical assistance, installation, commissioning, maintenance, and consultation. Consulting services help customers maximize system performance and choose the best hybrid capacitor solutions for their unique needs. To save downtime and maximize efficiency, installation and commissioning services guarantee the correct integration and operation of hybrid capacitor systems. To avoid any problems and guarantee continuous functioning, maintenance services include routine testing, inspections, and troubleshooting.

Simulation Software Market Segmentation: By End-User Industry

-

Automotive

-

Aerospace & Defense

-

Electronics and Semiconductor

-

Healthcare

-

Energy & Utilities

-

Others

The automobile industry is the largest growing end-user. The early usage of virtual tools for product development is attributed to the increase. In addition, the use of electric and driverless cars is becoming increasingly prevalent in the automobile sector. The primary factor propelling this segment's growth is the industry's use of simulation to improve manufacturing processes. The healthcare segment is the fastest-growing category. The healthcare industry is a key domain in the simulation software market that is seeing increasing adoption and transformation. Simulation technologies are transforming patient care, education, and training in the medical field by providing authentic virtual settings where practitioners may hone their skills, practice procedures, and improve decision-making. Healthcare personnel may obtain practical experience in a safe and controlled environment with simulation software, which can range from surgical simulations to patient monitoring systems. This can eventually improve patient outcomes and lower medical mistakes. Furthermore, simulation software in the healthcare industry is constantly developing due to the integration of artificial intelligence (AI) and virtual reality (VR) technology, offering cutting-edge solutions for medical research, diagnosis, treatment planning, and training.

Simulation Software Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

North America is the largest growing market. North America leads the industry in software simulation solutions, serving a wide range of sectors, including automotive, aerospace, healthcare, and manufacturing. The region is known for its strong technical infrastructure and vibrant innovation environment. The software simulation market is growing as a result of the region's concentration on research and development and large expenditures on cutting-edge technologies like virtual reality and artificial intelligence. Asia-Pacific is the fastest-growing market, fueled by expanding ventures in advanced change, technological advancements, and a rising selection of reenactment computer programs for different businesses. Offering tremendous development potential for software simulation companies, the Asia-Pacific area is focused on smart manufacturing, industrial automation, and digital transformation projects.

COVID-19 Impact Analysis on the Global Software Simulation Market:

The widespread COVID-19 has had a critical effect on worldwide reenactment program advertising, reshaping industry elements and quickening computerized change activities across different segments. The episode of the widespread disturbances incited far-reaching disturbances to conventional commerce operations, supply chains, and workforce elements, driving organizations to look for inventive arrangements to moderate dangers and adjust to the modern ordinary. In reaction to the challenges posed by the widespread, there has been a developing dependence on reenactment programs to empower inaccessible collaboration, virtual prototyping, and situation arranging. Businesses such as fabricating, cars, healthcare, and instruction have progressively turned to reenactment devices to optimize forms, improve decision-making, and guarantee trade progression in the face of phenomenal challenges. Furthermore, the move towards inaccessible work and virtual situations has impelled requests for cloud-based reenactment arrangements, advertising versatility, openness, and adaptability for conveyed groups. Whereas the widespread phenomenon has displayed various challenges, it has also quickened the appropriation of recreation programs as a basic enabler of digital transformation and versatility within the post-pandemic world. As organizations explore the advancing scene, a reenactment program is anticipated to play an imperative role in driving development, progressing proficiency, and encouraging recuperation in businesses.

Latest Trends/ Developments:

The recreation program advertised is seeing fast advancement and development, driven by a few of the most recent patterns and improvements forming the industry scene. One unmistakable slant is the integration of manufactured insights (AI) and machine learning (ML) capabilities into recreation programs, empowering progress in prescient analytics, optimization, and independent decision-making. AI-powered recreation instruments offer improved prescient capabilities, empowering organizations to expect results, recognize designs, and optimize forms with more prominent precision and effectiveness. Another key drift is the developing selection of cloud-based recreation arrangements, driven by the requirement for versatility, availability, and cost-effectiveness. Cloud-sending models offer adaptability for inaccessible collaboration, consistent versatility, and decreased IT framework costs, making recreation computer programs more available to organizations of all sizes. Furthermore, the development of advanced twins as a transformative innovation is reshaping the reenactment scene. Computerized twins make virtual copies of physical resources or frameworks, empowering real-time checking, investigation, and optimization of execution.

By leveraging computerized twins fueled by recreation computer programs, organizations can make strides in resource administration, optimize operations, and drive development across different businesses. Additionally, the joining of reenactment with other rising innovations such as virtual reality (VR), expanded reality (AR), and the Internet of Things (IoT) is opening modern conceivable outcomes for immersive and intuitive recreations. VR and AR empower reasonable visualization and interaction with virtual situations, whereas IoT sensors give real-time information for reenactment models, upgrading precision and authenticity. In general, these most recent patterns and advancements are driving advancement, upgrading capabilities, and extending the application of recreation programs over assorted businesses, clearing the way for transformative alter and development within the showcase.

Key Players:

-

ANSYS Inc.

-

Siemens Digital Industries Software

-

Dassault Systèmes

-

Altair Engineering, Inc.

-

MSC Software Corporation

-

MathWorks, Inc.

-

Autodesk, Inc.

-

COMSOL AB

-

Bentley Systems, Incorporated

-

The Math Company

Chapter 1. SIMULATION SOFTWARE MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SIMULATION SOFTWARE MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SIMULATION SOFTWARE MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SIMULATION SOFTWARE MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SIMULATION SOFTWARE MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SIMULATION SOFTWARE MARKET – By Deployment Mode

6.1 Introduction/Key Findings

6.2 On-Premises

6.3 Cloud-Based

6.4 Y-O-Y Growth trend Analysis By Deployment Mode

6.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 7. SIMULATION SOFTWARE MARKET – By Component

7.1 Introduction/Key Findings

7.2 Software

7.3 Services

7.4 Y-O-Y Growth trend Analysis By Component

7.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 8. SIMULATION SOFTWARE MARKET – By End-User Industry

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Aerospace & Defense

8.4 Electronics and Semiconductor

8.5 Healthcare

8.6 Energy & Utilities

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-User Industry

8.9 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 9. SIMULATION SOFTWARE MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Deployment Mode

9.1.3 By Component

9.1.4 By End-User Industry

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Deployment Mode

9.2.3 By Component

9.2.4 By End-User Industry

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Deployment Mode

9.3.3 By Component

9.3.4 By End-User Industry

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Deployment Mode

9.4.3 By Component

9.4.4 By End-User Industry

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Deployment Mode

9.5.3 By Component

9.5.4 By End-User Industry

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. SIMULATION SOFTWARE MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ANSYS Inc.

10.2 Siemens Digital Industries Software

10.3 Dassault Systèmes

10.4 Altair Engineering, Inc.

10.5 MSC Software Corporation

10.6 MathWorks, Inc.

10.7 Autodesk, Inc.

10.8 COMSOL AB

10.9 Bentley Systems, Incorporated

10.10 The Math Company

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The market for simulation software was estimated to be worth 12.13 USD billion in 2023 and is expected to increase to 29.25 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 13.4% from 2024 to 2030.

The essential drivers of the global simulation software market include progressions in innovation, expanding requests for virtual modeling and investigation devices, and the developing emphasis on computerized change in businesses.

Key challenges confronting the global simulation software market include information security concerns, interoperability issues, and the requirement for gifted experts.

In 2023, North America held the largest share of the global simulation software market.

ANSYS Inc., Siemens Advanced Businesses Software, Dassault Systèmes, Altair Building, Inc., MSC Computer Program Corporation, MathWorks, Inc., Autodesk, Inc., COMSOL AB, Bentley Frameworks, Incorporated, and The Math Company are the key players in the global simulation software market.