Tea Market Size (2024 – 2030)

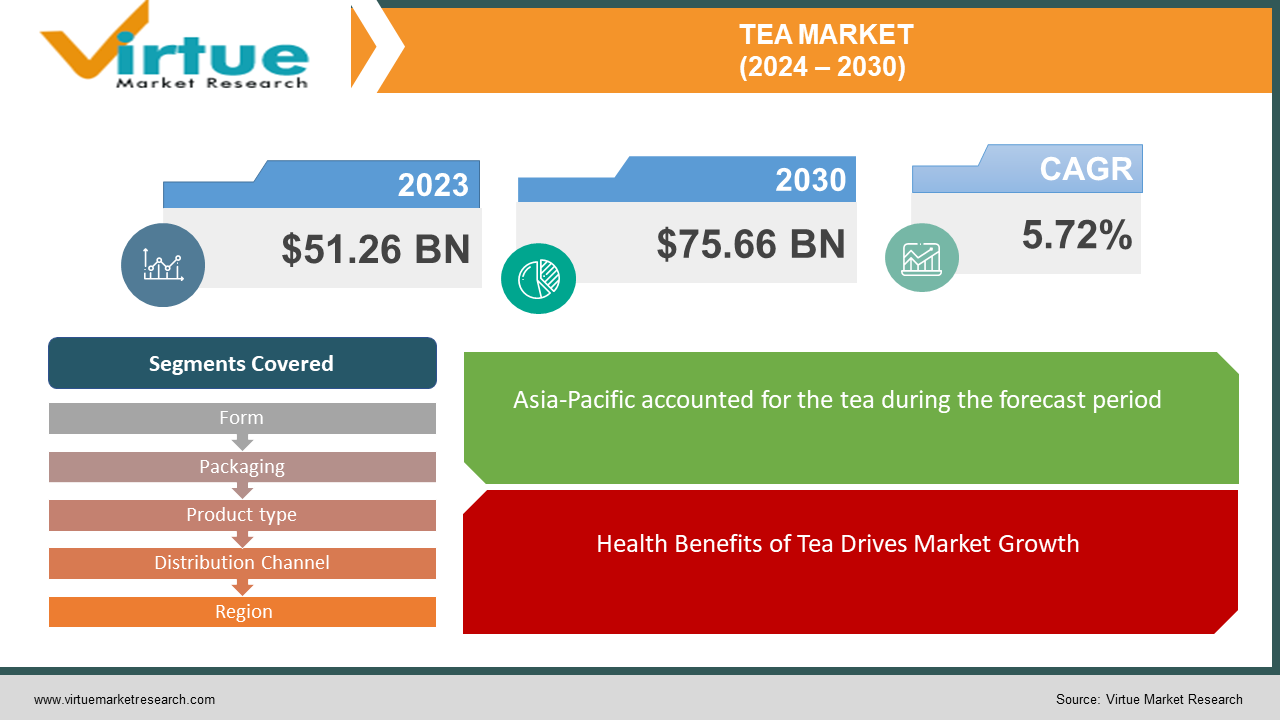

The Tea Market was valued at USD 51.26 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 75.66 billion by 2030, growing at a CAGR of 5.72%.

Tea stands as the second most widely consumed beverage globally, following water, and boasts various health advantages. This fragrant infusion is crafted through the processing and fermentation of leaves from the Camellia Sinensis plant. Rich in flavonoids, robust antioxidants that counteract detrimental free radicals in the system, tea also contains essential vitamins C, K, B12, B6, and E, along with trace amounts of potassium, manganese, magnesium, and calcium minerals, accompanied by various amino acids like L-theanine. Numerous studies and investigations into tea propose its efficacy in cancer prevention, cholesterol reduction, promotion of weight loss, and reinforcement of the immune system. Broadly speaking, tea can be classified into black and green varieties, determined by the extent of fermentation or oxidation.

Key Market Insights:

The expansion of the tea market is anticipated to be propelled by prevailing health and wellness trends. The heightened focus on health and well-being in recent years has substantially contributed to the notable growth observed in the tea market. Tea is increasingly regarded as a health-conscious beverage choice, prompting a surge in consumer adoption as a means to enhance overall health and wellness. Consumers are exhibiting a growing preference for teas that specifically address health-related objectives, such as stress reduction, digestive improvement, immune system enhancement, and support for weight management.

Consequently, there has been an upsurge in the availability of functional teas designed with particular ingredients to address these health concerns. Herbal teas, in particular, have witnessed increased popularity owing to their perceived health advantages. Many herbal teas are acknowledged for their anti-inflammatory and antioxidant properties, and some have been associated with promoting improved sleep and digestion. As individuals increasingly seek natural remedies for their health considerations, herbal teas have emerged as a preferred choice.

Tea Market Drivers:

Health Benefits of Tea Drives Market Growth

The surge in tea consumption is primarily steered by the increasing consumer preference for novel non-alcoholic beverages over traditional choices such as fruit juices and carbonated drinks. The popularity of tea is particularly attributable to its convenient bag format, offering heightened ease of use and serving as a fitting, practical, and health-conscious substitute for juices and carbonated beverages. Market participants are introducing a range of new and health-oriented tea products, garnering attention from consumers worldwide.

Tea, recognized for its hydrating properties, immediate refreshment, and invigorating effects, is acknowledged as a beneficial option for consumer health. The market is witnessing the availability of various herbal variants, featuring fortified nutrients, offered in diverse sizes and flavors, contributing to its expanding market share. In response to consumer preferences, industry players are introducing ayurvedic and herbal tea products to cater to a broader audience.

Tea Market Restraints and Challenges:

Fluctuating tea prices restraint, market growth.

Anticipated impediments to the growth of the tea market in the forecast period include the elevated cost of the product and concerns related to labor exploitation on plantations. The accessibility of alternative products and a deficiency in awareness, particularly in developing economies, are poised to represent significant and formidable challenges to market expansion.

Tea Market Opportunities:

The increasing favorability towards organic tea is expected to have a beneficial influence on the expansion of the tea market. Manufacturers are actively involved in research and development endeavors to enhance the quality and flavor profiles of their products, aiming to attract a broader consumer base. A case in point is the introduction by Green Hills of Rum and Honey Flavored Herbal Tea, catering to consumers seeking low-sugar beverage options. This product, devoid of alcohol, features a blend of licorice, apple, cinnamon, and star anise, providing a taste reminiscent of alcoholic beverages.

TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.72% |

|

Segments Covered |

By Form, Packaging, Product type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Unilever, Barry’s Tea, Associated British Foods Plc, Taetea Group, McLeod Russel, Tata Consumer Products Limited (Tata Group), Mighty Leaf Tea Company, Apeejay Surrendra Group Numi Organic Tea, Bettys & Taylors Group Ltd |

Tea Market Segmentation: By Form

-

Leaf Tea

-

CTC Tea

The tea market is predominantly led by CTC Tea, renowned for its abundance of antioxidants that contribute to cancer prevention. The antioxidants play a crucial role in selectively eliminating cancer-causing cells without causing harm to surrounding healthy cells. Furthermore, CTC Tea is associated with weight loss benefits, as it assists in impeding fat absorption in cells, thereby contributing to weight management.

Tea Market Segmentation: By Packaging

-

Plastic Containers

-

Loose Tea

-

Paper Boards

-

Aluminum Tin

-

Tea Bags

-

Others

The leading market segment is represented by paper boards, primarily influenced by the growing environmental concerns and the increasing preference for eco-friendly packaging solutions. Paperboard materials, being biodegradable and recyclable, align with the rising sustainability consciousness among consumers.

On the other hand, the plastic containers segment is propelled by the surging demand for convenience and durability in tea packaging. Plastic containers offer airtight sealing and convenient storage, ensuring prolonged freshness of the tea.

Conversely, the loose tea segment is driven by consumers' preferences for customization and sustainability. Loose tea allows enthusiasts to choose and measure their desired quantity, reducing packaging waste and providing a more authentic tea experience.

The aluminum tin segment gains popularity due to its capacity to shield tea leaves from light, moisture, and air, thereby preserving the freshness and flavor of the tea. Meanwhile, tea bags continue to thrive, emphasizing their convenience, particularly in terms of portion control and ease of brewing.

Tea Market Segmentation: By Product type

-

Black Tea

-

Green Tea

-

Herbal Tea

-

Other Product Types

The market is predominantly led by the black tea segment, owing to the rising consumer preference for bold and robust flavors, making it a favored choice among those who appreciate a stronger tea taste. The increased awareness of potential health benefits associated with black tea, such as antioxidants and improved heart health, further contributes to its sustained demand. Additionally, the versatility of black tea, serving as a base for various flavored and specialty teas, enhances its appeal, catering to a diverse consumer base with varying taste preferences.

Conversely, the green tea segment is propelled by the growing focus on health and wellness, with consumers seeking natural and antioxidant-rich beverages. Green tea is renowned for its potential health advantages, including weight management and improved metabolism, making it a preferred option for health-conscious individuals. Furthermore, the incorporation of green tea into various culinary applications, including desserts and savory dishes, serves as an additional driver for the growth of this segment.

Tea Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Specialist Retailers

-

Convenience Stores

-

Other Distribution Channels

The industry is predominantly dominated by supermarkets and hypermarkets, holding the largest share. The surge in the supermarkets and hypermarkets segment is propelled by the growing consumer inclination towards one-stop shopping destinations that provide a comprehensive array of products under a single roof. Leveraging their expansive store spaces, these establishments offer a diverse range of goods, encompassing groceries, household items, and electronics, all in a convenient and easily accessible manner. Additionally, they frequently employ bulk-purchasing strategies, facilitating cost-effective pricing for consumers, and invest significantly in extensive marketing campaigns to attract and engage customers.

Tea Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region holds the largest segment in the tea market, driven by the increasing awareness of the health benefits associated with tea consumption and a growing understanding of the detrimental effects of carbonated drinks. The demand for tea is significantly rising in this region. The expanding knowledge about the advantages of tea consumption for individuals dealing with arthritis, cardiovascular diseases, and high blood pressure is expected to contribute to future market growth. Black tea remains the most popular variant, although green tea is gaining popularity, primarily driven by the preferences of health-conscious consumers.

In North America, rapid growth at a CAGR of 6.0% is anticipated during the forecast period. This growth is attributed to the easy availability of products from prominent companies such as Twining’s, Numi Organic Tea, and Tata Global Beverages, among others, which is expected to boost the regional market.

COVID-19 Pandemic: Impact Analysis

The global tea market has experienced significant disruptions due to the COVID-19 pandemic, resulting in supply chain interruptions that have caused shortages in certain regions and surpluses in others. Shifts in consumption patterns have triggered a heightened demand for loose-leaf and specialty teas, while the closure of tea shops and cafes has led to a decline in overall sales. Export markets for tea have also been impacted, with certain countries witnessing a demand reduction.

The pandemic has amplified the emphasis on health and wellness, contributing to an increased demand for teas with perceived health benefits. This evolving consumer focus on well-being has influenced purchasing preferences, further shaping the dynamics of the tea market during these unprecedented times.

Latest Trends/ Developments:

-

In November 2022, Netsurf Network introduced a range of herbal teas in India, featuring various herbal flavors such as Bramhi & cinnamon, ginger & cumin, and ashwagandha & lemon, among others.

-

In July 2022, CVC Capital Partners Fund VIII successfully concluded the acquisition of Ekaterra, Unilever's tea business. The cash-free, debt-free transaction, valued at EUR 4.5 billion (USD 4.83 billion), was agreed upon in November 2021.

-

In June 2022, the United Kingdom-based Clipper Tea Company extended its product range in the United States, introducing new packaging and flavors. The newly added varieties include organic Earl Grey black tea, organic orange & turmeric herbal tea, organic green tea & lemon, organic winter apple and cinnamon herbal tea, and organic winter berries herbal tea.

Key Players:

These are the top 10 players in the Tea Market: -

-

Unilever

-

Barry’s Tea

-

Associated British Foods Plc

-

Taetea Group

-

McLeod Russel

-

Tata Consumer Products Limited (Tata Group)

-

Mighty Leaf Tea Company

-

Apeejay Surrendra Group

-

Numi Organic Tea

-

Bettys & Taylors Group Ltd

Chapter 1. TEA MARKET– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. TEA MARKET– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. TEA MARKET– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. TEA MARKETEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. TEA MARKET– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. TEA MARKET– By Form

6.1 Introduction/Key Findings

6.2 Leaf Tea

6.3 CTC Tea

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. TEA MARKET– By Packaging

7.1 Introduction/Key Findings

7.2 Plastic Containers

7.3 Loose Tea

7.4 Paper Boards

7.5 Aluminum Tin

7.6 Tea Bags

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Packaging

7.9 Absolute $ Opportunity Analysis By Packaging, 2024-2030

Chapter 8. TEA MARKET– By Product type

8.1 Introduction/Key Findings

8.2 Black Tea

8.3 Green Tea

8.4 Herbal Tea

8.5 Other Product Types

8.6 Y-O-Y Growth trend Analysis By Product type

8.7 Absolute $ Opportunity Analysis By Product type, 2024-2030

Chapter 9. TEA MARKET– By Distribution Channel

9.1 Introduction/Key Findings

9.2 Supermarkets/Hypermarkets

9.3 Specialist Retailers

9.4 Convenience Stores

9.5 Other Distribution Channels

9.6 Y-O-Y Growth trend Analysis By Distribution Channel

9.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10. TEA MARKET, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Form

10.1.2.1 By Packaging

10.1.3 By Product type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Form

10.2.3 By Packaging

10.2.4 By Product type

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Form

10.3.3 By Packaging

10.3.4 By Product type

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Form

10.4.3 By Packaging

10.4.4 By Product type

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Form

10.5.3 By Packaging

10.5.4 By Product type

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. TEA MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Unilever

11.2 Barry’s Tea

11.3 Associated British Foods Plc

11.4 Taetea Group

11.5 McLeod Russel

11.6 Tata Consumer Products Limited (Tata Group)

11.7 Mighty Leaf Tea Company

11.8 Apeejay Surrendra Group

11.9 Numi Organic Tea

11.10 Bettys & Taylors Group Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The expansion of the tea market is anticipated to be propelled by prevailing health and wellness trends. The heightened focus on health and well-being in recent years has substantially contributed to the notable growth observed in the tea market.

The top players operating in the Tea Market are - Unilever, Barry’s Tea, Associated British Foods Plc, Taetea Group, McLeod Russel, Tata Consumer Products Limited (Tata Group), Mighty Leaf Tea Company, Apeejay Surrendra Group, Numi Organic Tea, Bettys & Taylors Group Ltd.

The global tea market has experienced significant disruptions due to the COVID-19 pandemic, resulting in supply chain interruptions that have caused shortages in certain regions and surpluses in others.

Manufacturers are actively involved in research and development endeavors to enhance the quality and flavor profiles of their products, aiming to attract a broader consumer base.

In North America, rapid growth at a CAGR of 6.0% is anticipated during the forecast period.