Europe Tea Market Size (2024-2030)

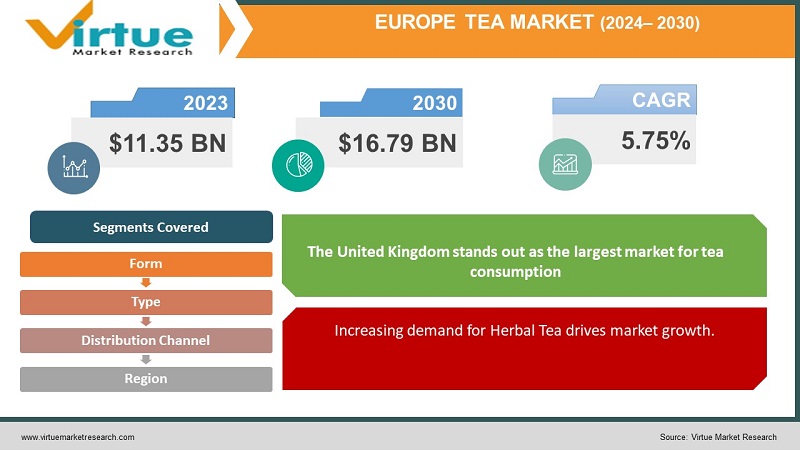

The Europe Tea Market was valued at USD 11.35 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 16.79 billion by 2030, growing at a CAGR of 5.75%.

The aromatic beverage known as tea originates from the Camellia Sinensis plant. It ranks among the most widely consumed beverages globally, second only to water. Predominantly, black tea and green tea enjoy popularity, though herbal tea is rapidly garnering interest in various regions. Regarded as a healthful drink, tea boasts a rich content of potent antioxidants and essential minerals, including potassium, manganese, magnesium, and calcium.

Key Market Insights:

A surge in premiumization characterizes the European tea market, driven by consumer preferences for high-quality, distinctive tea experiences. This trend presents significant opportunities for specialty tea suppliers. Although the market for specialty teas in Europe remains relatively small, it is steadily expanding.

Organic tea retail sales are predominantly led by Western European countries. Projections indicate that these nations will continue to spearhead growth in the foreseeable future.

The rising awareness of the health benefits associated with tea consumption, coupled with increasing concerns regarding carbonated beverages, are pivotal factors propelling the demand for tea in the region. Furthermore, the prevalent work culture and hectic schedules among consumers are redirecting per capita spending toward the tea market.

Europe Tea Market Drivers:

Increasing demand for Herbal Tea drives market growth.

Aggressive marketing strategies and campaigns emphasizing the health advantages of tea have fueled a rapid increase in demand for green tea and herbal tea within the nation. Consumption of tea is linked to enhanced blood circulation by dilating crucial arteries and mitigating clotting risks, consequently reducing the likelihood of heart attacks. Moreover, tea exhibits a remarkable capacity to scavenge oxygen radicals within the human body, thereby neutralizing harmful free radicals. These inherent health benefits associated with tea consumption are significant drivers of its demand in the country.

Furthermore, the burgeoning popularity of tea within the food services sector adds to its allure. Herbal tea, in particular, is recognized for its potential to bolster the immune system. The preference for herbal tea is on the rise as many consumers view it as a medicinal aid capable of enhancing digestive health.

Europe Tea Market Restraints and Challenges:

Differences in tea prices restrict market growth.

Foreseen obstacles to the expansion of the tea market during the forecast period include the higher price point of the product and apprehensions regarding labor exploitation within plantations. Additionally, the availability of substitute products and a lack of awareness, especially in developing economies, are expected to pose substantial and formidable challenges to market growth.

Europe Tea Market Opportunities:

Increasing health benefits creates opportunities for the market.

The demand for tea is experiencing a surge, propelled by the recognized health advantages of tea consumption and a growing awareness regarding the detrimental effects of carbonated beverages. Tea contains flavonoids, antioxidants, and phytochemicals, which contribute to enhancing various bodily functions. The expanding understanding of tea's benefits for individuals coping with conditions such as arthritis, cardiovascular diseases, and high blood pressure is anticipated to catalyze market growth in the forthcoming years.

Furthermore, factors such as increasing disposable income, shifting consumer preferences, and the introduction of additional health-promoting ingredients in tea formulations by various market players are also driving market expansion.

EUROPE TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.75% |

|

Segments Covered |

By Type, Form, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

UK, Germany, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Unilever, Dilmah Ceylon Tea Company PLC, Associated Britsh Foods PLC, Group Orientis, Kusmi tea, Nestle, Cafedirect PLC, Ekaterra, Typhoo Tea Limited, Clipper Teas |

Europe Tea Market Segmentation

Europe Tea Market Segmentation By Form:

- Leaf Tea

- CTC Tea

The market is divided into two primary forms: leaf tea and cut, tear, and curl (CTC) tea. The leaf tea segment is projected to hold a significant market share, primarily driven by the rising adoption of traditional tea production methods. These methods involve a meticulous process of plucking, withering, rolling, oxidation, and drying. Additionally, antioxidants present in leaf tea play a pivotal role in selectively targeting and eliminating cancer-causing cells while preserving the integrity of surrounding healthy cells.

Moreover, CTC Tea is associated with potential weight loss benefits, as it aids in inhibiting fat absorption within cells, thus contributing to weight management efforts.

Europe Tea Market Segmentation By Type:

- Black Tea

- Green Tea

- Herbal Tea

- Other Types

Categorizing the European tea market by types reveals divisions into black tea, green tea, herbal tea, and other varieties. Notably, the green tea segment is anticipated to undergo substantial growth in the forecast period. This growth trajectory is partly attributed to shifts in consumer lifestyles, which are gradually elevating the significance of herbal tea. The substantial nutritional content and fat-burning properties inherent in green tea, combined with a significant portion of the population favoring green tea over traditional options, are key factors propelling market expansion. Additionally, vendors are capitalizing on this trend by introducing natural and infused flavors of tea tailored to meet the preferences of health-conscious consumers.

Conversely, the surge in the green tea segment is driven by a mounting emphasis on health and wellness among consumers, who actively seek out natural and antioxidant-rich beverage options. Renowned for its potential health benefits, including its role in weight management and metabolism improvement, green tea emerges as a preferred choice for health-conscious individuals. Moreover, the integration of green tea into various culinary applications, ranging from desserts to savory dishes, further drives growth within this segment.

Europe Tea Market Segmentation By Distribution Channel:

- Hypermarket/Supermarket

- Specialist Retailers

- Convenience Stores

- Online Retailers

- Other Distribution Channels

The Europe tea market, when analyzed in terms of distribution channels, is segmented into hypermarkets/supermarkets, specialist retailers, convenience stores, online retailers, and others. Notably, the online retailers segment is expected to demonstrate a remarkable Compound Annual Growth Rate (CAGR) during the forecast period. This impressive growth can be attributed to several factors, including the proliferation of online applications and the availability of discounts, as well as the convenience of product delivery, all of which have had a positive impact on market expansion.

Online retailers capitalize on their digital platforms to offer a wide array of products, ranging from groceries to household items and electronics, leveraging their expansive store spaces. Additionally, they often employ bulk-purchasing strategies, enabling cost-effective pricing for consumers. Furthermore, online retailers invest significantly in extensive marketing campaigns to attract and engage customers, thereby further enhancing their market presence and driving growth within the segment.

Europe Tea Market Segmentation- by Region

- Spain

- United Kingdom

- France

- Germany

- Italy

- Rest of Europe

The United Kingdom stands out as the largest market for tea consumption. Evolving lifestyles are progressively accentuating the significance of herbal tea, with a considerable portion of the population now favoring herbal variants over-caffeinated options. The substantial nutritional value and fat-burning properties inherent in green tea contribute significantly to the growth of the tea market. This growing demand for tea allows manufacturers to introduce a variety of natural and infused flavors targeted specifically at health-conscious consumers. For example, Lipton Herbal Tea is widely recognized for its potential to aid the treatment of liver problems by facilitating the release of toxins from the body. Additionally, given the multitude of tasks individuals engage in, stress levels often escalate. Consequently, consumers in this region prefer tea as a stress-relieving beverage, as it helps reduce cortisol levels, the hormone associated with stress. Consequently, consumer demand for tea is on the rise in the region, thereby propelling market growth.

Furthermore, according to the CBI Ministry of Foreign Affairs, West European countries and Poland are key European tea markets with a rich tea tradition. Notably, the United Kingdom holds the distinction of being the largest tea market globally. Moreover, there has been a noticeable surge in the popularity of specialty teas boasting unique flavors and superior quality across Europe. Green tea and herbal/fruit teas, in particular, are gaining momentum in European markets due to their perceived health benefits.

COVID-19 Pandemic: Impact Analysis

The European tea market has faced significant disruptions as a result of the COVID-19 pandemic, leading to interruptions in the supply chain that have resulted in shortages in some regions and surpluses in others. Changes in consumption habits have sparked a heightened demand for loose-leaf and specialty teas, while the closure of tea shops and cafes has contributed to an overall decline in sales. Furthermore, export markets for tea have been affected, with certain countries experiencing a decrease in demand.

The pandemic has underscored the importance of health and wellness, leading to an increased demand for teas perceived to offer health benefits. This evolving consumer focus on well-being has influenced purchasing preferences, thereby further shaping the dynamics of the tea market during these challenging times.

Latest Trends/ Developments:

- In September 2022, JDE Peet's, a Netherlands-based company, disclosed its intention to acquire the French tea company Les 2 Marmottes for an undisclosed amount. This acquisition is aimed at expanding the company's portfolio of tea brands, as stated by JAB Holding. Furthermore, JDE Peet has assured that the Haute-Savoie-based business will retain its autonomy and maintain its workforce of 90 employees.

Key Players:

These are the top 10 players in the Europe Tea Market: -

- Unilever

- Dilmah Ceylon Tea Company PLC

- Associated Britsh Foods PLC

- Group Orientis

- Kusmi tea

- Nestle

- Cafedirect PLC

- Ekaterra

- Typhoo Tea Limited

- Clipper Teas

Chapter 1. Europe Tea Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Tea Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Tea Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Tea Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Tea Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Tea Market– By Form

6.1. Introduction/Key Findings

6.2. Leaf Tea

6.3. CTC Tea

6.5. Y-O-Y Growth trend Analysis By Form

6.6. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. Europe Tea Market– By Type

7.1. Introduction/Key Findings

7.2 Black Tea

7.3. Green Tea

7.4. Herbal Tea

7.5. Other Types

7.6. Y-O-Y Growth trend Analysis By Type

7.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 8. Europe Tea Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets and hypermarkets

8.3. Specialty stores

8.4. Online retailers

8.5. Convenience Stores

8.6. Y-O-Y Growth trend Analysis Distribution Channel

8.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 9. Europe Tea Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Form

9.1.3. By Type

9.1.4. By Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Tea Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Unilever

10.2. Dilmah Ceylon Tea Company PLC

10.3. Associated Britsh Foods PLC

10.4. Group Orientis

10.5. Kusmi tea

10.6. Nestle

10.7. Cafedirect PLC

10.8. Ekaterra

10.9. Typhoo Tea Limited

10.10. Clipper Teas

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A surge in premiumization characterizes the European tea market, driven by consumer preferences for high-quality, distinctive tea experiences. This trend presents significant opportunities for specialty tea suppliers. Although the market for specialty teas in Europe remains relatively small, it is steadily expanding

The top players operating in the Europe Tea Market are - Unilever, Dilmah Ceylon Tea Company PLC, Associated Britsh Foods PLC, Group Orientis, Kusmi Tea, Nestle, Cafedirect PLC, Cafedirect PLC, Ekaterra, Typhoo Tea Limited.

The European tea market has faced significant disruptions as a result of the COVID-19 pandemic, leading to interruptions in the supply chain that have resulted in shortages in some regions and surpluses in others

Factors such as increasing disposable income, shifting consumer preferences, and the introduction of additional health-promoting ingredients in tea formulations by various market players are also driving market expansion

The United Kingdom holds the distinction of being the largest tea market globally