Superfood Market Size (2024 – 2030)

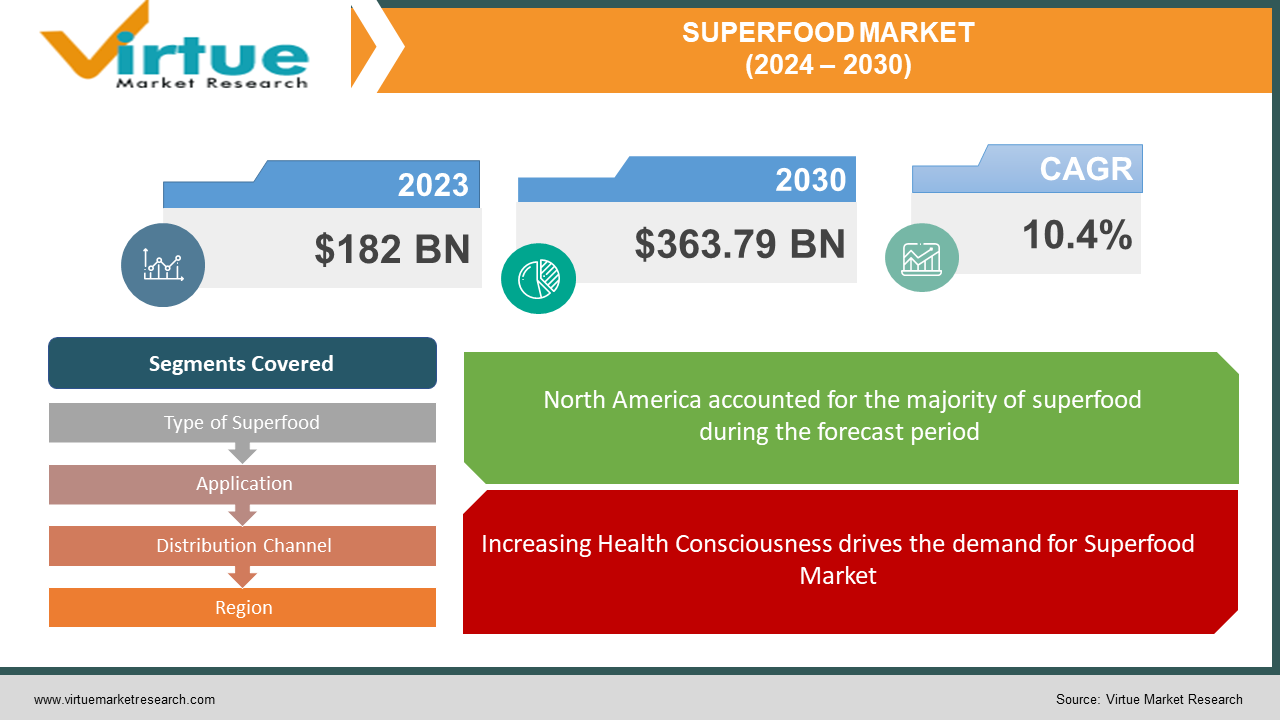

The Global Superfood Market was valued at USD 182 billion and is projected to reach a market size of USD 363.79 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.4%.

Superfoods are nutrient-dense foods that are believed to provide health benefits. It has been utilized by indigenous communities for centuries, offering holistic benefits to the mind and body. It has a high content of vitamins, minerals, antioxidants, and other beneficial compounds. Some superfoods include berries, leafy greens, chia seeds, quinoa, and turmeric. The Superfood Market is expected to grow significantly in the coming years due to the growing trend toward healthier lifestyles and wellness. The major well-established key players in the Superfood Market are Navitas Organics, Sunfood Superfoods, Organic Traditions, Nutiva, and Amazing Grass.

Key Market Insights:

People are becoming more health-conscious. There is a growing interest in foods that offer potential health benefits. Superfoods are functional foods that can contribute to overall well-being. Blueberries lead in antioxidant content among fruits, providing 3.6 grams of fiber per cup. This makes them a superfood choice for weight management. Potatoes contribute significantly to a balanced diet by offering potassium, vitamin C, and dietary fiber for digestion support. The increasing health consciousness, a rise in chronic health conditions, a preference for natural products, influential marketing, and innovation in product development, e-commerce growth, and global culinary influence are propelling the Superfood Market. The restraints on the Superfood Market include high prices, sustainability concerns, supply chain issues (seasonal variability and global sourcing challenges), educational barriers, and regulatory challenges. North America occupies the highest share of the Superfood Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Superfood Market Drivers:

Increasing Health Consciousness drives the demand for Superfood Market

Growing awareness about the importance of a healthy lifestyle and balanced nutrition is driving the demand for superfoods known for their rich nutrient profiles. The shift towards preventive healthcare and holistic well-being is leading consumers to seek foods that offer specific health benefits, such as improved immunity, increased energy, and overall vitality. Superfoods are nutrient-dense, containing high levels of vitamins, minerals, antioxidants, and other bioactive compounds. This provides the maximum nutritional value per calorie. Superfoods are often considered functional foods. This contributes not only to basic nutrition but also offers potential health-promoting properties. This attracts consumers who view food as a means of promoting well-being.

Preference for Natural and Organic Products is propelling the Superfood Market

Consumers are increasingly seeking transparency in food products. Superfoods are often associated with clean, minimally processed, and natural ingredients. Many superfood brands focus on offering organic options. This appeals to consumers who prioritize products free from synthetic pesticides and genetically modified organisms (GMOs). The preference for natural and organic products extends to environmental consciousness. Consumers are supporting sustainable and eco-friendly practices in food production. Superfoods are often positioned as authentic and traditional. It resonates with consumers who value the historical use of these foods for health and well-being. Brands that emphasize authenticity and ethical sourcing often gain consumer trust and interest.

Superfood Market Restraints and Challenges

The major challenge faced by the Superfood Market is the high price. Some superfoods, due to their exotic nature or cultivation requirements, are expensive. Another challenge is the Seasonal Variability. The availability of certain superfoods can be seasonal. This leads to fluctuations in supply and potential shortages during off-seasons. The other restraints to the Superfood Market include sustainability concerns, supply chain issues, global sourcing challenges, educational barriers, and regulatory challenges.

Superfood Market Opportunities:

The Superfood Market has various opportunities in the market. Opportunities exist for creating new superfood-based products, such as snacks, beverages, and supplements. This caters to diverse consumer preferences and needs. The growing interest in functional foods presents an opportunity to position superfoods as ingredients that offer specific health benefits. This contributes to overall well-being. Capitalizing on the continued growth of health and wellness trends provides opportunities for superfood brands. This aligns with consumer preferences for healthier food choices. Other Opportunities in the Superfood Market include innovating product development, capitalizing on the functional food trend, expanding online retailing, fostering collaborations, educational initiatives, customization, global and cultural integration, and emphasizing clean label and sustainability practices.

SUPERFOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.4% |

|

Segments Covered |

By Type of Superfood, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Navitas Organics, Sunfood Superfoods, Organic Traditions, Nutiva, Amazing Grass, Terrasoul Superfoods, Alovitox, Nature's Path Organic, Kuli Kuli, Green Foods Corporation |

Superfood Market Segmentation: By Type of Superfood

-

Fruits (e.g., blueberries, acai berries)

-

Vegetables (e.g., kale, spinach)

-

Seeds and nuts (e.g., chia seeds, flaxseeds)

-

Grains (e.g., quinoa)

-

Herbs and spices (e.g., turmeric, ginger)

-

Algae and seaweeds (e.g., spirulina, chlorella)

In 2023, based on market segmentation by Type of Superfood, Fruits (e.g., blueberries, acai berries) occupy the highest share of the Superfood Market. Blueberries and acai berries have been among the popular fruits in the superfood category. They are known for their high antioxidant content and health benefits.

The vegetables (e.g., kale, spinach) sector also has a significant market share. Kale, among leafy greens, has gained immense popularity for its nutritional richness, being a source of vitamins, minerals, and fiber.

However, Seeds and nuts (e.g., chia seeds, flaxseeds) are the fastest-growing segment during the forecast period. Chia seeds have gained popularity due to their nutritional density, high omega-3 fatty acid content, and versatility in various dishes.

The herbs and spices (e.g., turmeric, ginger) sector is also growing significantly. Turmeric, particularly in its powdered form or as a supplement, has seen significant growth attributed to its anti-inflammatory properties and potential health benefits.

Superfood Market Segmentation: By Application

-

Ingredients for the food and beverage industry

-

Dietary supplements and nutraceuticals

-

Cosmetics and personal care products

In 2023, based on market segmentation by Application, the Ingredients for Food and Beverage Industry segment occupies the highest share of the Superfood Market. This is mainly due to the increasing usage of Superfoods as ingredients in various food and beverage products such as smoothies, energy bars, cereals, and baked goods.

However, Cosmetics and Personal Care Products are the fastest-growing segment during the forecast period. This is mainly due to the growing trend of using certain superfoods in skincare, haircare, and personal care products due to their potential antioxidant and nutrient-rich properties. Superfoods like aloe vera, coconut oil, and various plant extracts are integrated into beauty and personal care items.

Superfood Market Segmentation: By Distribution Channel

-

Online retail

-

Supermarkets and hypermarkets

-

Health food stores

-

Specialty stores

-

Convenience stores

-

Direct-to-consumer channels

In 2023, based on market segmentation by Distribution Channel, the Supermarkets and Hypermarkets segment occupies the highest share of the Superfood Market. They offer a wide range of products, attracting a broad consumer base.

However, online retail is the fastest-growing segment during the forecast period. This growth is driven by convenience, a wide product selection, and the ability to reach a global audience. Many consumers prefer the ease of ordering superfoods online.

Superfood Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Superfood Market. This growth is due to the combination of health-conscious consumer trends, and a robust market infrastructure. North America is a developed region with a well-established health and wellness culture. Nations like the United States and Canada have significant markets for superfoods. The online retail segment within the region, driven by e-commerce platforms and direct-to-consumer channels, is witnessing rapid growth. The convenience of online shopping and a shift towards digital platforms contribute to this trend.

European countries, with a strong emphasis on healthy living and sustainable practices, have a substantial share of superfoods. Consumer awareness of the nutritional benefits of superfoods has contributed to their popularity in European markets.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to increasing health awareness, a rising middle class, and a cultural emphasis on natural remedies. Countries like China, India, and Japan, have significant market share for superfoods.

COVID-19 Impact Analysis on the Global Superfood Market:

The COVID-19 pandemic had a significant impact on the Superfood Market. There were lockdowns, social distancing, and other safety restrictions. The pandemic caused disruptions in global supply chains and affected the sourcing and availability of superfood ingredients. Factors such as transportation restrictions, labor shortages, and fluctuations in demand also impacted the supply chain. There were changes in consumer behavior during the pandemic, such as increased focus on health and wellness, home cooking, and online shopping. This influenced the demand for superfoods. Some superfoods that align with immune health and overall well-being may have seen increased demand. Thus, the pandemic accelerated certain trends in the Superfood Market.

Latest Trends/ Developments:

One of the trends, in the Superfood Market is increasing interest in superfoods with functional ingredients and adaptogens known for their potential stress-reducing and immune-supporting properties. There is a growing popularity of plant-based superfoods, aligning with the broader trend towards plant-based diets and sustainable food choices. There is integration of technology in the superfood industry, including apps and platforms providing personalized nutrition recommendations, recipe ideas, and information on the benefits of different superfoods. There is increasing emphasis on sustainable and ethical sourcing practices, with consumers showing a preference for brands that prioritize environmental responsibility and fair trade.

Key Players:

-

Navitas Organics

-

Sunfood Superfoods

-

Organic Traditions

-

Nutiva

-

Amazing Grass

-

Terrasoul Superfoods

-

Alovitox

-

Nature's Path Organic

-

Kuli Kuli

-

Green Foods Corporation

Market News:

-

In January 2024, Meaningful Partners invested in M2 Ingredients and Om Mushroom Superfood, a leading nutraceuticals platform, aiming to accelerate distribution and scale manufacturing for functional mushrooms, enhancing whole-body health benefits.

-

In April 2023, MannaBrew in Prieska, South Africa, uncovered the superfood potential of Mesquite tree seed pods, turning them into a unique 'coffee' with a rich, smooth flavor. The caffeine-free product supports the local economy, providing endurance energy from essential sugars.

Chapter 1. Superfood Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Superfood Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Superfood Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Superfood Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Superfood Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Superfood Market – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Online retail

6.3 Supermarkets and hypermarkets

6.4 Health food stores

6.5 Specialty stores

6.6 Convenience stores

6.7 Direct-to-consumer channels

6.8 Y-O-Y Growth trend Analysis By Distribution Channel

6.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 7. Superfood Market – By Type of Superfood

7.1 Introduction/Key Findings

7.2 Fruits (e.g., blueberries, acai berries)

7.3 Vegetables (e.g., kale, spinach)

7.4 Seeds and nuts (e.g., chia seeds, flaxseeds)

7.5 Grains (e.g., quinoa)

7.6 Herbs and spices (e.g., turmeric, ginger)

7.7 Algae and seaweeds (e.g., spirulina, chlorella)

7.8 Y-O-Y Growth trend Analysis By Type of Superfood

7.9 Absolute $ Opportunity Analysis By Type of Superfood, 2024-2030

Chapter 8. Superfood Market – By Application

8.1 Introduction/Key Findings

8.2 Ingredients for the food and beverage industry

8.3 Dietary supplements and nutraceuticals

8.4 Cosmetics and personal care products

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Superfood Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Distribution Channel

9.1.3 By Type of Superfood

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Distribution Channel

9.2.3 By Type of Superfood

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Distribution Channel

9.3.3 By Type of Superfood

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Distribution Channel

9.4.3 By Type of Superfood

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Distribution Channel

9.5.3 By Type of Superfood

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Superfood Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1 Navitas Organics

10.2 Sunfood Superfoods

10.3 Organic Traditions

10.4 Nutiva

10.5 Amazing Grass

10.6 Terrasoul Superfoods

10.7 Alovitox

10.8 Nature's Path Organic

10.9 Kuli Kuli

10.10 Green Foods Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Superfood Market was valued at USD 182 billion and is projected to reach a market size of USD 363.79 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.4%.

The increasing health consciousness and preference for natural products and organic products are the main market drivers of the Global Superfood Market.

Ingredients for the food and beverage industry, Dietary supplements and nutraceuticals, and Cosmetics and personal care products are the segments under the Global Superfood Market by Application.

North America is the most dominant region for the Global Superfood Market.

Navitas Organics, Sunfood Superfoods, Organic Traditions, Nutiva, and Amazing Grass are the key players in the Global Superfood Market.