North America Superfood Market Size (2024-2030)

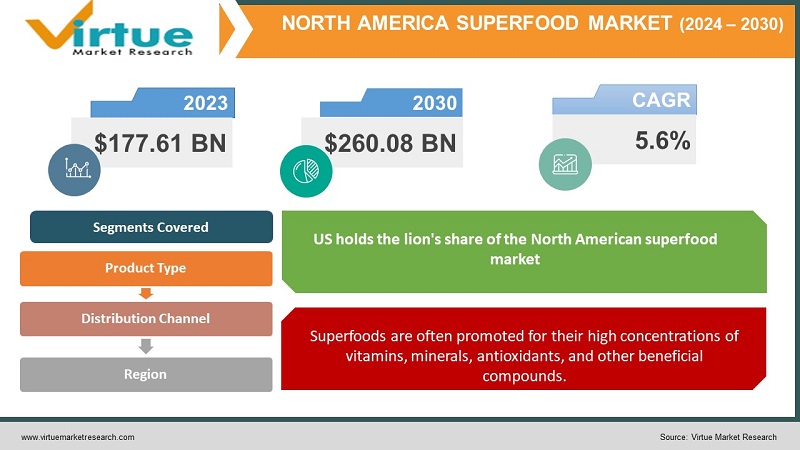

The North America Superfood Market was valued at USD 177.61 Billion in 2024 and is projected to reach a market size of USD 260.08 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.6%.

Superfoods are understood as nutrient-dense foods considered exceptionally beneficial for health and well-being. They often boast high concentrations of vitamins, minerals, antioxidants, or other health-promoting compounds. Consumers are increasingly prioritizing preventative health and seeking natural, whole-food ways to support overall wellness. Social media, blogs, and online resources have democratized information about superfoods, their potential benefits, and ways to incorporate them into diets. Once found primarily in health food stores, superfoods are now readily available in mainstream supermarkets and online retailers. Superfoods are incorporated into a wide variety of convenient formats – powders, smoothies, snack bars, and supplements – catering to busy lifestyles. The rise of vegetarian, vegan, and flexitarian diets increases demand for nutrient-packed plant-based options, which superfoods naturally fit. Growing culinary curiosity and globalization of flavors expose North Americans to exotic superfoods from different parts of the world. Health-conscious seniors, a significant demographic, may seek superfoods for their potential anti-aging properties and disease-prevention benefits.

Key Market Insights:

The superfood market in North America is a vibrant subset of the broader health and wellness sector. Superfoods are frequently marketed as being rich in antioxidants, vitamins, minerals, and other health-promoting substances. Their high nutrient density makes them an appealing option for people who are concerned about their health. Superfoods typically provide special or uncommon nutrients, such as unusual forms of fiber, certain phytochemicals, or polyphenols. This appeals to a desire for a more varied and effective diet. Superfoods are seen by consumers as a component of a larger wellness toolset. This comprises immune system stimulation, proactive health management, and support for certain health objectives (digestion, energy, etc.). Whole-food sources of nourishment are strongly preferred by consumers over highly processed supplementation. Superfoods satisfy this demand for unprocessed, natural ingredients. Superfoods go in well with the trend towards eating foods that provide advantages over simple nourishment. The desire to enhance well-being through every day dietary decisions propels the intake of superfoods. Superfoods with unusual provenance or historical usage have enthralling backstories that appeal to customers looking for genuineness and alternatives to conventional fare. Superfoods are becoming more and more like supplements, incorporating things like collagen peptides, probiotic-rich meals, and bee pollen. Superfoods are no longer only found in niche retailers. Their addition to smoothies, granola bars, snacks, and other foods makes them more easily accessible and convenient.

North America Superfood Market Drivers:

Superfoods are often promoted for their high concentrations of vitamins, minerals, antioxidants, and other beneficial compounds.

Wellness now encompasses not just physical health, but also encompasses mental well-being, emotional resilience, spiritual fulfillment, and a sense of vitality. Superfoods, with their diverse nutrients and potential adaptogenic properties, align with this multi-dimensional view of health. Rather than a reactive approach to health issues, consumers are motivated to invest in preventative solutions. Superfoods, laden with antioxidants and protective compounds, are seen as proactive tools to bolster the body's defenses and potentially reduce long-term disease risk. Individuals seek autonomy in their health journeys, desiring to play an active role. Superfoods represent a tangible step they can take daily, offering a sense of control and proactive contribution to their overall well-being. Growing skepticism towards extensively refined foods, artificial ingredients, and the potential side effects of some pharmaceutical solutions fuels a back-to-basics approach. Superfoods, often minimally processed and derived from whole-food sources, resonate with the desire for natural nourishment.

Consumers see superfoods as part of a broader wellness toolkit. This includes proactive health management, boosting immunity, and supporting specific health goals driving market growth.

Cooking shows, celebrity chefs, and a flood of food content on social media elevate food beyond necessity and into the realm of entertainment and a medium for creativity. A generation raised on globalized food options and tantalizing online food imagery hungry for new tastes, textures, and ingredients. Superfoods become the culinary 'treasures' to be discovered. Home cooking is experiencing a renaissance but with a focus on both mastery and adventure. Superfoods allow people to expand their repertoire, try complex recipes, and impress friends and family with their culinary prowess. Diet choices increasingly reflect personal values– ethical eating, sustainability, and prioritizing a plant-centric approach. Superfoods symbolize a conscious choice and advertise one's commitment to a specific lifestyle. Food-centered niches form strong bonds. Sharing superfood recipes, farmer’s market finds, or 'secret' sources creates a sense of belonging and insider knowledge that fuels the market. Online platforms for recipe sharing, food blogs, and influential wellness personalities foster a global community focused on superfoods. This bypasses geographic limitations and fuels a constant exchange of ideas. Wellness no longer means deprivation. Superfoods allow for healthy eating that is also delicious, colorful, and Instagram-worthy. This combats the notion of diet as a restriction.

North America Superfood Market Restraints and Challenges:

Because of their manufacturing, sourcing, or uniqueness, several superfoods fetch higher costs. As a result, there is an economic barrier that can prevent access to a larger market.

Many superfoods, due to their sourcing, production, or novelty, command higher prices. This creates an economic barrier, potentially limiting access to a wider market. Consumers might become skeptical if they perceive superfoods as primarily driven by marketing hype rather than providing tangible value at their price point. The superfood narrative often centers on trendy, expensive ingredients. Ensuring access and inclusivity in the wellness movement requires broadening the definition of nutrient-dense, beneficial foods. While many superfoods have traditional usage or promising initial research, some claims outpace the available scientific evidence. This can erode consumer trust long-term. It's crucial to walk the line between enthusiasm for the potential of superfoods and avoiding unsubstantiated or exaggerated claims that could fuel skepticism or regulatory action. The wellness industry can be vulnerable to short-lived fads. Superfoods need to demonstrate lasting value based on sound science and tangible benefits to avoid this cyclical trend. Superfoods sourced from various regions need to meet North American food safety standards, with potential delays and additional costs for testing and compliance. Changes in the classification of supplements, import restrictions on specific ingredients, or stricter labeling requirements could disrupt the market and impact availability. Growing demand puts pressure on ensuring superfoods are grown and harvested sustainably without exploiting local resources or communities in their regions of origin. Consumers are increasingly demanding to know where their food comes from. Building a transparent supply chain enhances trust and aligns with ethical consumption values.

North America Superfood Market Opportunities:

While early adopters were likely affluent and deeply health-focused, there's massive potential in making superfoods appealing and accessible to a broader demographic. Focusing on a few core benefits of superfoods (energy, immunity, etc.) that resonate with everyday needs can widen their appeal and combat the "too complex" perception. Developing product ranges with both premium superfoods and more affordable options helps expand access without diluting the core appeal for discerning consumers. Incorporating superfoods into everyday items like granola bars, snacks, yogurt mixes, etc., lowers the barrier to trial and makes them part of regular dietary patterns. Highlighting lesser-known but nutrient-dense foods indigenous to North America (berries, certain ancient grains, specific leafy greens) taps into both sustainability and a sense of discovery. Locally sourced superfoods can offer lower environmental impact, support regional farmers, and create a unique selling point driven by freshness and provenance. Reviving awareness of foods consumed by indigenous communities, with respect for their cultural context, adds a layer of heritage and potential health benefits that resonate with consumers. Consumers are demanding personalized solutions in many areas of life, and superfoods can be part of this. Powdered blends tailored for specific needs (gut health, athletic performance) offer an avenue for growth. Wearable technology and at-home health tracking could integrate insights with personalized superfood recommendations, creating a more targeted and data-supported approach.

NORTH AMERICA SUPERFOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.6% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, mexico, canada |

|

Key Companies Profiled |

Navitas Organics, Nutiva, Sunfood, Terrasoul Superfoods, Amazing Grass, Organifi, Superfoods Company |

North America Superfood Market Segmentation:

North America Superfood Market Segmentation: By Product Type -

- Fruits

- Vegetables

- Seeds and Nuts

- Ancient Grains

Fruits hold the largest share of the superfood market, estimated at roughly 40-45%. Wide popularity, ease of consumption in both fresh and processed forms, familiarity, and strong scientific backing for the benefits of many berry varieties. Vegetables comprise a significant segment, accounting for approximately 25-30% of the market. Rising emphasis on plant-based nutrition, increased use of green powders for convenience, and recognition of the diverse phytonutrients in vegetables all boost this segment. Seeds and Nuts hold a substantial 15-20% share of the superfood market. Versatility in product formats (whole, nut butter, meal additions), compatibility with numerous dietary trends, and their role as functional snacking options contribute to growth. Ancient Grains is a smaller but steadily growing segment, accounting for around 5-8% of the market. This segment appeals to those seeking gluten-free or low-gluten options, interest in diversifying grain intake, and their culinary versatility fuels interest in this niche. Fruits, particularly berries, hold the most substantial market share due to their familiarity, accessibility, and established research base.

North America Superfood Market Segmentation: By Distribution Channel -

- Supermarkets and Hypermarkets

- Specialty Health Food Stores

- Online Retailers

- Farmers Markets

Supermarkets and Hypermarkets- These hold the largest market share due to their widespread presence, vast product selection, and the integration of superfoods across various categories (produce, snack aisles, frozen sections). They cater to a broad consumer base, from the highly health-conscious to everyday shoppers seeking convenient options. Specialty Health Food Stores- Known for natural, organic, and less-processed products, they attract consumers specifically prioritizing health and wellness. Online Retailers- E-commerce is surging within the superfood market, fuelled by convenience, unparalleled choice, price comparison, and access to niche products. Consumer reviews, detailed product information, and subscription services enhance the online buying journey. Farmers Markets- Offer fresh, locally sourced superfoods, appealing to those prioritizing origin and seasonality. Direct interaction with farmers strengthens the connection to food sources. Supermarkets and Hypermarkets are still the dominant sections, while the Online Retailers section is rapidly becoming the fastest-growing section in the industry.

North America Superfood Market Segmentation: Regional Analysis:

- US

- Canada

- Mexico

The US holds the lion's share of the North American superfood market, with an estimated 70-75% dominance. The US is a major hub for health and wellness trends, with a large consumer base receptive to superfoods. Greater spending power fuels interest in premium superfoods and innovative products. Well-developed supermarket chains, natural food stores, and online channels offer diverse distribution avenues. The US is home to influential voices in the wellness space, driving superfood awareness and adoption. Canada boasts the second-largest share, accounting for approximately 20-25% of the market. Canadians exhibit an increasing focus on preventative health and proactive nutrition, aligning with superfood benefits. A multicultural population drives demand for exotic superfoods and flavors. Canada's regulatory framework generally facilitates the introduction of new superfood products. Trends from the US often permeate into the Canadian market, influencing superfood preferences. Mexico represents a smaller but rapidly expanding segment, holding an estimated 5-10% share. A growing middle class in Mexico is driving a shift towards proactive health management and interest in superfood concepts. Mexico possesses a rich tradition of nutritious foods (chia, amaranth, etc.), and renewed interest fuels the market. Increased availability of superfoods in supermarkets and online platforms widens market access for Mexican consumers. Currently, Mexico exhibits the highest potential for rapid growth within the North American superfood market. While starting from a smaller base, the combination of a burgeoning middle class, evolving health focus, and the potential to leverage its own 'local' superfoods position it for significant expansion in the coming years.

COVID-19 Impact Analysis on the North America Superfood Market:

The worldwide food business was rocked by the introduction of COVID-19, and the North American superfood market was no exception. Tight border restrictions and lockdowns interfered with long-established trade lines, making it more difficult to import and export superfoods on time from different parts of the globe. Price swings and product shortages resulted from this, especially for superfoods that were uncommon or in great demand. Superfoods may not be as high on the short-term buying list as they were before many consumers redirected their immediate spending priorities towards necessities as the pandemic spread. Superfood sales may have been momentarily damaged by the first panic buying, but soon there was a greater emphasis on individual wellness. Foods thought to support the immune system became more popular, which may have helped several superfood categories. Lockdowns and social distancing policies drove the expansion of online shopping sites. This change made it possible for customers to conveniently acquire a greater selection of superfoods from home, providing superfood sellers with a much-needed lifeline. People cooked more meals at home while restaurants were closed or were partially open. This could have increased demand for convenient formats like snack bars, ingredients to add to home-cooked meals and superfood powders.

Latest Trends/ Developments:

Consumers are moving away from a 'one-size-fits-all' superfood approach towards seeking ingredients with targeted benefits. Emphasis on superfoods with research supporting benefits for gut health, brain function, athletic performance, or specific health concerns. The idea of using targeted superfoods to potentially lower risk factors for chronic diseases is gaining traction. Renewed interest in superfoods used traditionally in various cultures (e.g., Ayurvedic herbs, African baobab, traditional Chinese medicinal mushrooms). Ancient superfoods offer novel antioxidants, and phytochemicals, and offer a way to diversify nutrient intake. The rich histories and traditional usage narratives behind these superfoods add a layer of authenticity and intrigue for consumers. Superfoods align perfectly with the plant-forward eating trend. Fruits, leafy greens, algae, seeds, and nuts remain cornerstones of the market. High-protein plant-based superfoods (hemp seeds, certain algae) appeal to both vegetarians/vegans and those seeking to reduce meat intake. Superfoods like kimchi, sauerkraut tap into the booming interest in probiotics and gut health optimization. Historically, some superfoods suffered from unpalatable flavors. Innovations address this with better extraction techniques and combining superfoods in balanced blends.

Key Players:

- Navitas Organics

- Nutiva

- Sunfood

- Terrasoul Superfoods

- Amazing Grass

- Organifi

- Superfoods Company

Chapter 1. North America Superfood Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Superfood Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Superfood Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Superfood Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Superfood Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Superfood Market– By Product Type

6.1. Introduction/Key Findings

6.2. Fruits

6.3. Vegetables

6.4. Seeds and Nuts

6.5. Ancient Grains

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Superfood Market– By Distribution channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Specialty Health Food Stores

7.4. Online Retailers

7.5. Farmers Markets

7.6. Y-O-Y Growth trend Analysis By Distribution channel

7.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. North America Superfood Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Superfood Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Navitas Organics

9.2. Nutiva

9.3. Sunfood

9.4. Terrasoul Superfoods

9.5. Amazing Grass

9.6. Organifi

9.7. Superfoods Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Consumers view health as a multifaceted, proactive pursuit encompassing physical and mental well-being. Superfoods align perfectly with this desire for deeply rooted, preventative solutions

Many high-quality superfoods, especially those ethically sourced or with rarer ingredients, command higher prices. This creates an economic barrier, potentially limiting access to a wider demographic.

Navitas Organics, Nutiva, Sunfood, Terrasoul Superfoods, Amazing Grass.

The US currently holds the largest market share, estimated at around 75%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy