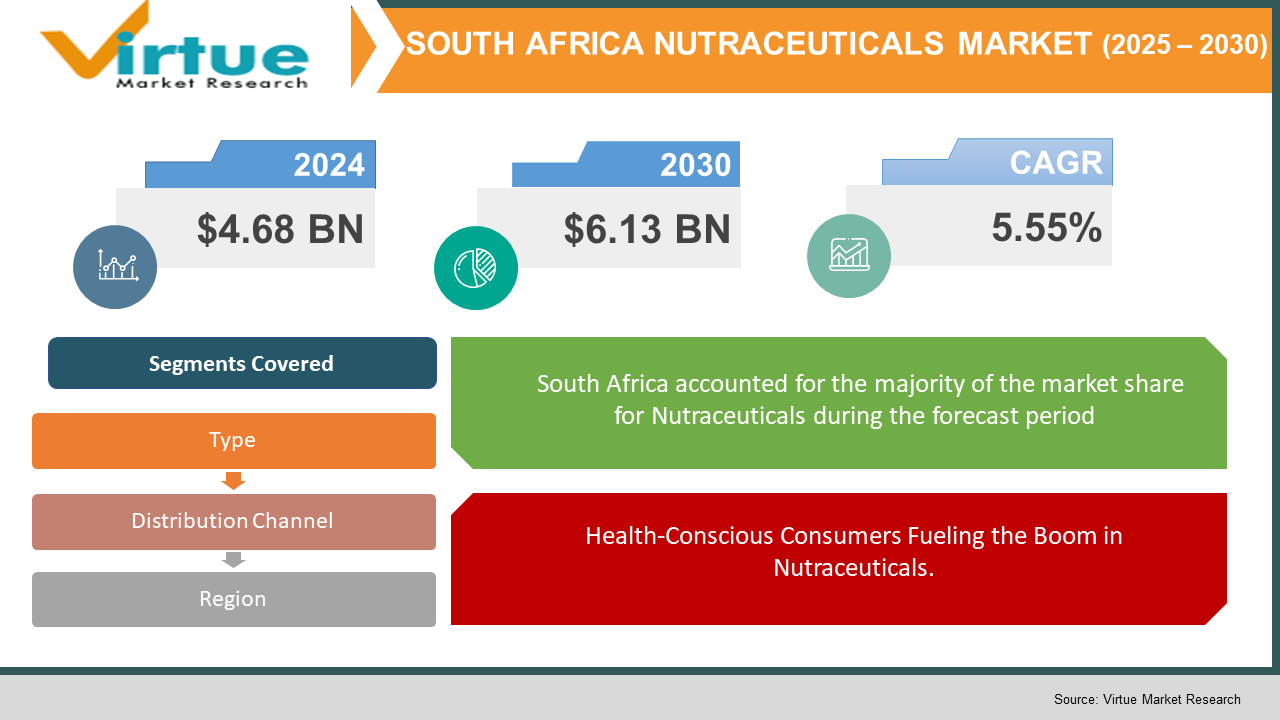

South Africa Nutraceuticals Market Size (2025 – 2030)

The South Africa Nutraceuticals Market was valued at USD 4.68 billion and is projected to reach a market size of USD 6.13 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.55%.

Nutraceuticals are products derived from food sources that provide health benefits beyond basic nutrition. They can help prevent diseases, improve overall health, and support bodily functions. Nutraceuticals combine elements of nutrition and pharmaceuticals, often containing bioactive compounds that offer therapeutic effects. As consumers in South Africa are becoming more and more health conscious and adapting their lifestyle to reflect the same the nutraceutical market is experiencing significant growth in that period. There is much more awareness about diseases and other health-harming factors, this has prompted manufacturers to supply diseases and other specific drugs in the market.

Key Market Insights:

- Technological advancements and product innovation are also transforming the sector. Companies are leveraging nanotechnology, bioavailability-enhancing formulations, and AI-driven personalized nutrition to provide targeted solutions for individual health needs.

- The e-commerce boom has made nutraceuticals more accessible, with online retail platforms offering a wider variety of products, competitive pricing, and doorstep delivery.

- In the nutraceuticals industry, strategic alliances and collaborations are growing more common as businesses look to improve their market standing and broaden their customer base. The 2023 expansion of the collaboration between Royal DSM, UNICEF, and Sight and Life, which aims to provide better nutrition to mothers and children in South Africa who are at risk, is a noteworthy example.

- Customers are becoming more interested in products that contain plant-based proteins and botanical extracts, and the market is seeing a significant trend toward natural and organic components. In response, producers are adding natural components to their product formulas, including botanicals, herbs, and superfoods.

South Africa Nutraceuticals Market Drivers:

Health-Conscious Consumers Fueling the Boom in Nutraceuticals.

The market for nutraceutical products has increased dramatically as consumers' awareness of health and well-being has grown. People are actively looking for dietary supplements, functional foods, and beverages that offer additional health benefits beyond basic nutrition as they place a higher priority on preventative healthcare and holistic well-being. The benefits of vitamins, minerals, probiotics, herbal extracts, and protein supplements for the immune system, heart, digestion, and general vigour are now more widely known to consumers. Nutraceuticals have gone from being a niche business to a mainstream sector because of this expanding understanding, as well as the availability of online resources, social media, and professional recommendations. One of the key drivers of this trend is the shift toward self-care and proactive health management. Instead of relying solely on pharmaceuticals for treating illnesses, consumers are adopting nutraceuticals as part of their daily routine to prevent health issues before they arise. This has fuelled demand for products that support weight management, anti-ageing, sports nutrition, mental well-being, and stress reduction.

E-commerce and the rise of delivery apps along with internet penetration have made consumers much more aware of nutraceuticals and thus have driven up demand.

A major factor in raising consumer knowledge and demand for nutraceuticals has been the quick growth of e-commerce, mobile delivery apps, and growing internet penetration. Consumers are choosing dietary supplements, functional foods, and wellness items with greater knowledge since more individuals have immediate access to online health information, product evaluations, and professional advice. It is now easier than ever for people to include health-promoting goods into their daily routines because to the simplicity of buying nutraceuticals through subscription services, online platforms, and same-day delivery apps. The rise of e-commerce giants like Amazon, local online pharmacies, and health-focused platforms has created a competitive marketplace where brands can showcase their products with detailed descriptions, benefits, and customer testimonials. At the same time, delivery apps and quick-commerce services have capitalized on the growing demand for instant access to vitamins, protein supplements, probiotics, and functional drinks, enabling consumers to order health products on demand with same-day or even 10-minute deliveries.

South Africa Nutraceuticals Market Restraints and Challenges:

The regulatory environment in South Africa is complicated for getting nutraceuticals approved, also there is a need for greater awareness about the possible side effects of these nutraceuticals.

The regulatory environment for nutraceuticals in South Africa is complex, posing challenges for companies seeking approval for their products. Unlike pharmaceuticals, which undergo strict testing and clinical trials, nutraceuticals often fall into a grey area between food and medicine, making regulation less standardized and more difficult to navigate. The South African Health Products Regulatory Authority (SAHPRA) oversees dietary supplements and functional foods, but unclear classifications, lengthy approval processes, and evolving legal frameworks create hurdles for businesses. Beyond regulatory challenges, there is also a need for greater consumer awareness about the possible side effects of nutraceuticals. While these products offer numerous health benefits, excessive consumption, incorrect dosages, and interactions with medications can lead to adverse effects. Many consumers self-prescribe supplements without consulting healthcare professionals, increasing the risk of overuse or misuse.

South Africa Nutraceuticals Market Opportunities:

With a rich history of traditional medicine and herbal remedies, South Africa presents an opportunity for herbal and plant-based nutraceuticals. Products containing Rooibos, Buchu, Aloe Ferox, and African Baobab are gaining attention both locally and internationally for their antioxidant, anti-inflammatory, and digestive health benefits. Developing locally sourced, organic herbal supplements can appeal to eco-conscious and health-focused consumers.

SOUTH AFRICA NUTRACEUTICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.55% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Latin America, BRAZIL, argentina, chille |

|

Key Companies Profiled |

GlaxoSmithKline (GSK), Nestlé SA, Herbalife Nutrition, Amway Corp, The Kellogg Company, , Red Bull GmbH, Ascendis Health, Danone SA, Vital Health Foods, Nautilus Pharma |

South Africa Nutraceuticals Market Segmentation:

South Africa Nutraceuticals Market Segmentation: By Type:

- Functional Food

- Functional Beverages

- Dietary Supplements

Functional foods include fortified cereals, probiotic yoghurts, omega-3-enriched bread, and plant-based protein products, which offer additional health benefits beyond basic nutrition. These products are particularly popular among health-conscious consumers looking for convenient ways to enhance their diet without making drastic lifestyle changes. The increasing preference for organic, clean-label, and non-GMO food products is further driving the demand for functional foods in the country.

Functional beverages and dietary supplements also play a crucial role in the market’s growth. Functional beverages, such as energy drinks, herbal teas, vitamin-infused water, and electrolyte sports drinks, are gaining traction due to the rising demand for on-the-go nutrition and hydration solutions. Meanwhile, dietary supplements, including vitamins, minerals, herbal extracts, and probiotics, are widely used for immune support, digestive health, cognitive function, and athletic performance. The growing awareness of preventive healthcare and personalized nutrition is fuelling the expansion of these segments, making nutraceuticals a key part of modern consumer lifestyles in South Africa.

South Africa Nutraceuticals Market Segmentation: By Distribution Channel

- Supermarkets

- Online

- Drug Stores/ Pharmacies

Because they provide convenience, a wide range of products, and instant availability, supermarkets continue to be an important distribution channel. This enables customers to evaluate brands and formulas before making a purchase. Because supermarkets carry reliable brands and provide special discounts, many customers prefer to purchase nutraceuticals there, making them an affordable choice for functional foods and drinks. Larger retail chains have also expanded their health and wellness sections, dedicating more shelf space to vitamins, minerals, and protein supplements to meet growing demand.

Online platforms have become an increasingly popular distribution channel, especially with the rise of e-commerce and mobile shopping apps. Consumers appreciate the convenience of home delivery, wider product selection, and access to customer reviews, which help them make informed decisions. Many online platforms also offer subscription-based services, allowing users to receive nutraceutical products at regular intervals. Meanwhile, drug stores and pharmacies continue to be a trusted channel for dietary supplements and medical-grade nutraceuticals, as consumers rely on expert recommendations from pharmacists and healthcare professionals. Pharmacies are particularly important for consumers seeking targeted health solutions, such as probiotics for digestion, multivitamins for immunity, or herbal supplements for stress relief.

Regional Analysis:

- South Africa

In South Africa, consumers are becoming more aware of the benefits of dietary supplements, functional foods, and beverages, leading to higher demand for products that support immune health, cognitive function, and overall wellness. Functional foods and beverages fortified with probiotics, vitamins, and minerals are gaining popularity all over South Africa due to their convenience and health benefits. However, challenges such as regulatory hurdles and the need for consumer education persist.

COVID-19 Impact on the South Africa Nutraceuticals Market:

The market for nutraceuticals in South Africa was greatly impacted by the COVID-19 pandemic, which increased demand for functional foods, immune-boosting goods, and nutritional supplements. Increased purchases of probiotics, zinc, vitamin C, and herbal supplements meant to boost immunity and stave off infections resulted from consumers' growing health consciousness. As more people began integrating nutraceuticals into their daily routines to promote general well-being, the pandemic also hastened the transition toward preventive healthcare. As anxiety and health worries increased during lockdown periods, shops and manufacturers saw a sharp spike in sales, especially in immune-supporting and stress-relieving supplements. The crisis also reshaped consumer behaviour, driving more people towards e-commerce and online purchases of nutraceuticals. With lockdown restrictions limiting physical store visits, online platforms, pharmacy apps, and direct-to-consumer brands saw a spike in orders. Companies responded by expanding their digital presence, offering home delivery services, and increasing online promotions to capture the growing demand.

Trends/Developments:

Since the COVID-19 pandemic, there has been a growing emphasis on preventive healthcare, with consumers increasingly purchasing immune-supporting supplements such as vitamin C, zinc, echinacea, and probiotics. People are more proactive about maintaining long-term health, leading to a sustained demand for functional foods and dietary supplements aimed at preventing diseases.

With the rising adoption of fitness and active lifestyles, the demand for sports nutrition products such as protein powders, amino acids, and endurance-boosting supplements has increased. Consumers are particularly interested in clean-label, organic, and plant-based sports nutrition products, prompting companies to reformulate traditional supplements with natural ingredients.

Ascendis Health is a company listed on the Johannesburg Stock Exchange has expanded its portfolio to include natural remedies and wellness brands. Recognizing the global growth in sports nutrition, Ascendis acquired Europe's Scitec International for approximately $203 million. This acquisition positions Ascendis to tap into the burgeoning sports nutrition market, with plans to export to developing regions like the Middle East and Africa.

Key Players:

- GlaxoSmithKline (GSK)

- Nestlé SA

- Herbalife Nutrition

- Amway Corp

- The Kellogg Company

- Red Bull GmbH

- Ascendis Health

- Danone SA

- Vital Health Foods

- Nautilus Pharma

Chapter 1. SOUTH AFRICA NUTRACEUTICALS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. SOUTH AFRICA NUTRACEUTICALS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. SOUTH AFRICA NUTRACEUTICALS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. SOUTH AFRICA NUTRACEUTICALS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. SOUTH AFRICA NUTRACEUTICALS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. SOUTH AFRICA NUTRACEUTICALS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Functional Food

6.3 Functional Beverages

6.4 Dietary Supplements

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. SOUTH AFRICA NUTRACEUTICALS MARKET – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets

7.3 Online

7.4 Drug Stores/ Pharmacies

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8. SOUTH AFRICA NUTRACEUTICALS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. South America

8.1.1 By Country

8.1.1.1. Brazil

8.1.1.2. Argentina

8.1.1.3. Colombia

8.1.1.4. Chile

8.1.1.5. Rest of South America

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. SOUTH AFRICA NUTRACEUTICALS MARKET– Company Profiles – (Overview, Packaging Type Portfolio, Financials, Strategies & Developments)

9.1 GlaxoSmithKline (GSK)

9.2 Nestlé SA

9.3 Herbalife Nutrition

9.4 Amway Corp

9.5 The Kellogg Company

9.6 Red Bull GmbH

9.7 Ascendis Health

9.8 Danone SA

9.9 Vital Health Foods

9.10 Nautilus Pharma

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The market is growing due to increasing health awareness, preventive healthcare trends, and consumer demand for functional foods, dietary supplements, and immunity-boosting products. The rise of e-commerce, personalized nutrition, and plant-based supplements is also contributing to market expansion

Key challenges include complex regulatory approval processes, lack of standardized classifications, and consumer awareness regarding potential side effects. Supply chain disruptions and counterfeit products also pose concerns for manufacturers and retailers

: The pandemic accelerated demand for immune-boosting supplements like vitamin C, zinc, and probiotics. Consumers became more focused on preventive healthcare, leading to increased sales of functional foods, stress relief supplements, and herbal remedies. The crisis also fuelled a shift to online shopping for nutraceutical products.

Nutraceuticals are widely sold through supermarkets, online platforms, and pharmacies. While supermarkets remain a key channel due to immediate availability, e-commerce and pharmacy apps are gaining traction due to convenience, wider product selection, and home delivery options

: Key trends include increased demand for organic and plant-based supplements, AI-driven personalized nutrition, functional beverages, and sports nutrition products. Companies are also focusing on sustainability, herbal nutraceuticals, and regulatory compliance to meet evolving consumer expectations