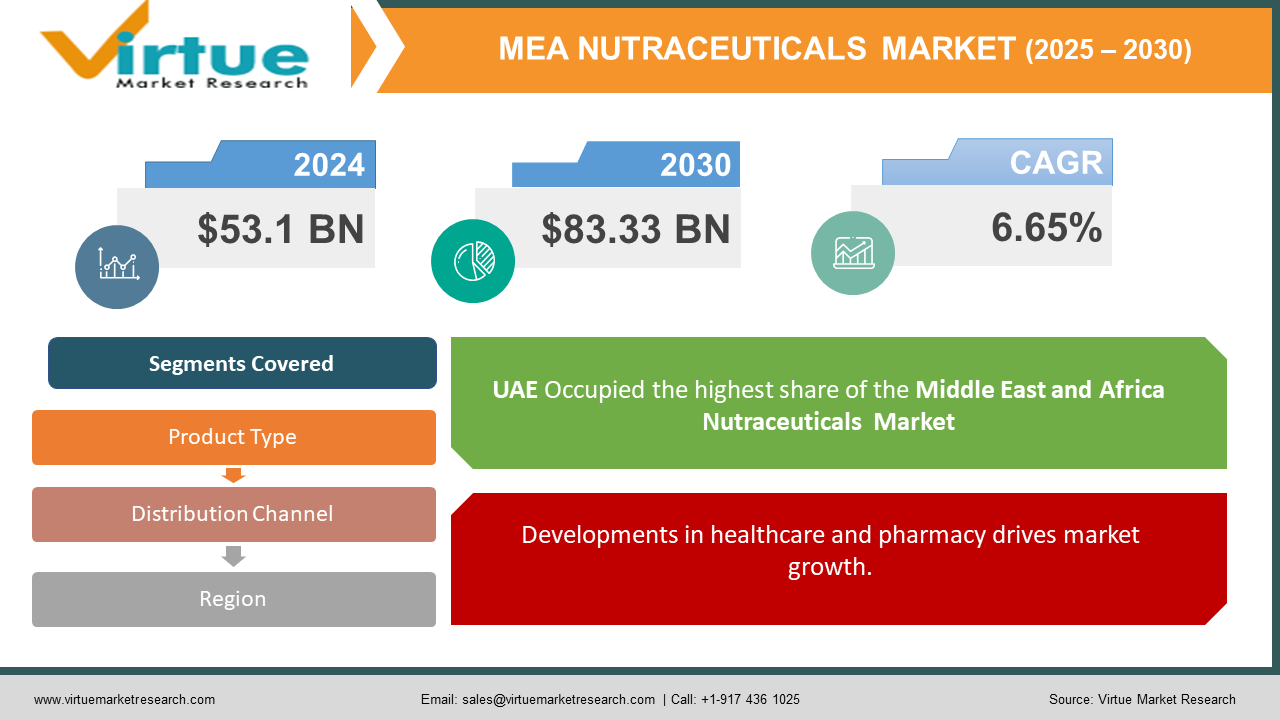

Middle East and Africa Nutraceuticals Market Size (2024-2030)

The Middle East and Africa Nutraceuticals Market was valued at USD 53.1 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 83.33 billion by 2030, growing at a CAGR of 6.65%.

Nutraceutical is a comprehensive term used to denote products sourced from food with additional health advantages. Nutraceuticals are categorized as components of food that offer health benefits and contribute to overall bodily energy while helping to prevent diseases such as cancer, hypertension, and obesity. Within the realm of nutraceuticals, there are dietary supplements and food additives. Dietary supplements, often in the form of tablets, provide bodily energy, whereas food additives are substances incorporated into food to maintain flavor or enhance taste. A nutraceutical can either be a naturally nutrient-dense or medicinally potent food, such as soybeans or garlic, or it can be a specific ingredient from a food item, like omega-3 fish oil extracted from salmon and other cold-water fish.

Key Market Insights:

- The nutraceuticals market in the Middle East and Africa (MEA) is experiencing significant expansion driven by evolving consumer preferences and heightened awareness of health and wellness.

- An increasing interest in preventive healthcare is evident, with consumers in the MEA region becoming more aware of the connection between nutrition and overall well-being. Nutraceuticals, which include functional foods, dietary supplements, and herbal products, are perceived as a practical and proactive approach to filling nutritional gaps, supporting immune function, and enhancing overall health. This growing recognition of nutrition's impact on health is fueling the rising demand for nutraceutical products in the MEA market.

Middle East and Africa Nutraceuticals Market Drivers:

Developments in healthcare and pharmacy drives market growth.

The Middle East and Africa are actively investing in their healthcare systems by implementing reforms designed to improve healthcare delivery across the region. Advanced technologies such as robotics, artificial intelligence (AI), and other automation tools are being integrated into the healthcare sector to streamline processes and enhance patient care. As technology becomes more prevalent, the emphasis on human interaction in the pharmacist-patient relationship is growing. This shift focuses on transitioning from merely dispensing medications to engaging with patients and providing a comprehensive range of services based on pharmacists' specialized training.

These reforms include the development and expansion of public health initiatives, the adoption of new medical technologies, and advancements in socioeconomic and educational sectors. Consequently, access to basic healthcare services has notably improved, leading to significant enhancements in morbidity and mortality rates and other health indicators, such as life expectancy.

Governments in middle-income countries within the Middle East and Africa are enacting health reforms that address the financial and organizational aspects of healthcare systems, including the introduction of social health insurance programs. Increased demand from various healthcare providers, including voluntary and private sectors, has led to fragmented delivery and financing systems aimed at bridging gaps in population and service coverage.

In parallel, there has been a notable rise in research and development activities within the Middle East and Africa's nutraceuticals market. Nutraceutical companies, academic institutions, and research organizations are investing in studies to assess the potential health benefits of various nutraceutical ingredients and develop innovative products. This research encompasses clinical trials, evaluations of safety and efficacy, and the exploration of new formulations and delivery systems. The goal is to create evidence-based nutraceutical products that address the specific health needs of the Middle Eastern and African populations.

Omega-3 Health Benefits increase the demand.

The growing demand for Omega-3 fatty acids is a prominent trend influencing the nutraceuticals market. Omega-3s have become increasingly popular due to their well-established health benefits. Notably, the flexibility in dosage forms provided by nutraceuticals has drawn considerable interest from pharmaceutical companies. Nutraceuticals, particularly in appealing formats such as gummies and soft gels, present a user-friendly method for integrating Omega-3s into daily health regimens. This trend is anticipated to continue driving the dynamics of the nutraceuticals market throughout the forecast period.

Middle East and Africa Nutraceuticals Market Restraints and Challenges: Regulatory Stringent Laws hinder Market Growth

Despite the increasing demand for nutraceutical products, several factors are hindering market growth. A major challenge is the complex and stringent regulatory framework that governs the commercialization of these products. There is a notable absence of standardized regulations regarding the composition of nutraceuticals, with inconsistent upper limits and usage conditions for botanicals, botanical preparations, and bioactive substances still pending harmonization. Furthermore, divergent views among various regulatory bodies on permissible ingredients and their quantities further exacerbate the difficulty of achieving regulatory uniformity.

Middle East and Africa Nutraceuticals Market Opportunities:

The Rise in Demand from people of all age groups creates opportunities.

The market for functional foods and nutraceuticals is expanding due to heightened public interest, consumer demand, and ongoing research into the properties and potential applications of nutraceutical compounds. Key drivers of this growth include demographic and health changes such as the increasing proportion of elderly individuals and rising life expectancy. As the average age of the population increases, there is a growing focus on health and wellness. While the introduction of generic versions may lower the cost of some nutraceuticals, the rising consumer reliance on these products and their increasing availability suggest that market growth will persist.

In the Middle East and Africa, nutraceuticals such as vitamins, minerals, herbal extracts, and probiotics are gaining popularity. These supplements are increasingly utilized to address specific health issues, including immune function, digestive health, and cardiovascular health. The rising incidence of lifestyle-related diseases, such as obesity, diabetes, and cardiovascular conditions, has further driven demand for nutraceuticals in the region. According to the Social Sciences Research Ethics Committee of the United Arab Emirates University, the primary reasons for using nutraceuticals include health improvement (66.1%), bodybuilding (9.9%), disease prevention (6.8%), and weight management (5.3%).

MIDDLE EAST AND AFRICA NUTRACEUTICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.65% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Arab Emirates (UAE), Saudi Arabia, South Africa, Kenya, Rest of MEA |

|

Key Companies Profiled |

Amway, Pfizer Inc., Nestle, The Kraft Heinz Company, The Hain Celestial Group, Inc., Nature's Bounty, Danone, General Mills Inc., Tyson Foods, and GlaxoSmithKline plc. |

Middle East and Africa Nutraceuticals Market Segmentation:

Middle East and Africa Nutraceuticals Market Segmentation: By Product Type:

- Dietary Supplements

- Functional Foods

- Functional Beverages

The functional beverages segment has secured a prominent share of the market, largely due to the increasing number of health-conscious consumers transitioning from sugary drinks to lower-calorie, lower-sugar options that provide functional benefits.

This shift towards greater health awareness is prompting consumers to replace traditional soft drinks, colas, and sodas with functional beverages. Moreover, the focus of leading brands on creating low and no-sugar functional foods is anticipated to strengthen their market presence.

Middle East and Africa Nutraceuticals Market Segmentation: By Distribution Channel:

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail

- Others

Online retail marketplaces function as digital platforms that link consumers with merchants, eliminating the need for physical product warehousing. These platforms offer a range of services, including shipping, delivery, and various payment options. Key factors driving sustained growth in the online retail segment include competitive pricing, discounts, shopping convenience, free shipping, and an extensive product selection.

The supermarkets and hypermarkets segment is expected to see substantial growth during the forecast period. This growth is due to the pivotal role these stores play as major distributors, leveraging their high consumer trust and reliance for acquiring a diverse range of food products, including healthy foods and beverages.

Middle East and Africa Nutraceuticals Market Segmentation- by region

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Egypt

- Nigeria

- Kenya

- Rest of Middle East and Africa

The UAE nutraceuticals market is being propelled by heightened health awareness, an increase in lifestyle-related diseases, and a rising elderly population. The market's expansion is further supported by heightened awareness of preventive healthcare, growing demand for functional foods, and a preference for natural supplements. Government initiatives that promote a healthy lifestyle, along with strong economic development, are broadening the consumer base.

Additionally, advancements in research and development, product innovations, and a thriving wellness industry are contributing to the market's growth.

In Saudi Arabia, the nutraceuticals market is experiencing significant growth, fueled by rising consumer interest in health and wellness. Nutraceuticals, including dietary supplements and functional foods, provide benefits beyond basic nutrition. As consumers increasingly seek nutraceutical products to address specific health issues and enhance overall well-being, the market continues to expand.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has significantly and positively influenced the nutraceutical market. There has been a notable increase in demand for products believed to boost health and immunity. Widespread recommendations from healthcare professionals to incorporate functional foods and dietary supplements into daily routines to support immune function have greatly driven the adoption of these products.

Latest Trends/ Developments:

- In May 2023, Roquette, a leading supplier of excipients for pharmaceutical and nutraceutical applications, launched a new excipient innovation named PEARLITOL® ProTec. This advanced product is a co-processed blend of mannitol and maize starch, both sourced from plants.

- In January 2023, Evonik introduced a groundbreaking line of nutraceuticals branded IN VIVO BIOTICS™. These innovative synbiotics combine probiotics with a variety of other health-enhancing components, drawing on extensive scientific research into human health.

- In December 2022, Nutrilitius, a growing brand under Pune-based Shover Foods International, expanded its offerings into the nutraceutical sector. The new product line, which goes beyond its traditional range of nuts and dry fruits, is designed to enhance overall health and strengthen immunity.

Key Players:

These are top 10 players in the Middle East and Africa Nutraceuticals Market :-

- Amway

- Pfizer Inc.

- Nestle

- The Kraft Heinz Company

- The Hain Celestial Group, Inc. Nature's Bounty

- Danone

- General Mills Inc.

- Tyson Foods

- GlaxoSmithKline plc.

Chapter 1. Middle East and Africa Nutraceuticals Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Nutraceuticals Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Nutraceuticals Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Nutraceuticals Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Nutraceuticals Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Nutraceuticals Market– By Product Type

6.1. Introduction/Key Findings

6.2. Dietary Supplements

6.3. Functional Foods

6.4. Functional Beverages

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Middle East and Africa Nutraceuticals Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Hypermarkets/Supermarkets

7.3. Convenience Stores

7.4. Online Retail

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East and Africa Nutraceuticals Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Product Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Nutraceuticals Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amway

9.2. Pfizer Inc.

9.3. Nestle

9.4. The Kraft Heinz Company

9.5. The Hain Celestial Group, Inc.

9.6. Nature's Bounty

9.7. Danone

9.8. General Mills Inc.

9.9. Tyson Foods

9.10. GlaxoSmithKline plc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East and Africa Nutraceuticals Market was valued at USD 53.1 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 83.33 billion by 2030, growing at a CAGR of 6.65%.

The top players operating in the Middle East and Africa Nutraceuticals Market are - Amway, Pfizer Inc., Nestle, The Kraft Heinz Company, The Hain Celestial Group, Inc., Nature's Bounty, Danone, General Mills Inc., Tyson Foods, and GlaxoSmithKline plc

The COVID-19 pandemic has significantly and positively influenced the nutraceutical market.

The opportunities in the market for functional foods and nutraceuticals are expanding due to heightened public interest, consumer demand, and ongoing research into the properties and potential applications of nutraceutical compounds.

Saudi Arabia, the nutraceuticals market is experiencing significant growth, fueled by rising consumer interest in health and wellness.