Smart Mobility Market Size (2024 – 2030)

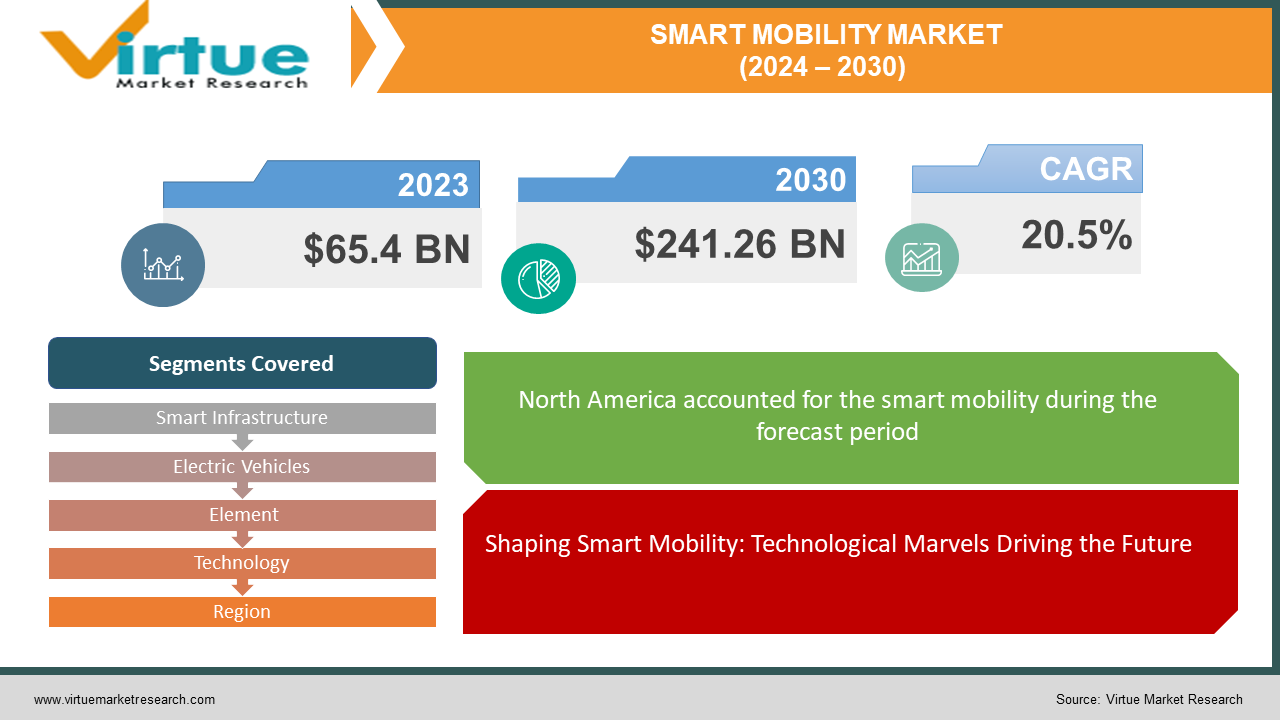

The global smart mobility market was valued at USD 65.4 billion in 2023 and is projected to reach a market size of USD 241.26 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 20.5%.

Several important factors have contributed to the market's remarkable growth and transformation in smart mobility. To handle issues like traffic congestion and pollution, smart and effective transport solutions are required. Urbanization is a global trend that is only going to pick up speed. Novel advancements in electric vehicles, autonomous driving, and intelligent transportation systems have been made possible by the emergence of technologies such as the Internet of Things (IoT), artificial intelligence (AI), and advanced connectivity. Governments everywhere have pushed the market ahead by enacting laws, regulations, and incentives that encourage smart mobility, realizing the potential benefits of sustainability and quality of life. The market is divided into different segments, all of which contribute to the ecosystem as a whole. The popularity of electric vehicles has grown significantly.

Key Market Insights:

The increasing uptake of electric vehicles (EVs), improvements in autonomous driving technologies, and the incorporation of intelligent infrastructure in urban areas are driving the robust growth of the global smart mobility market. Government incentives and policies that support environmentally friendly transportation have helped the EV market gain a lot of traction. Concurrently, there is still a lot of effort being put into testing and developing autonomous car technologies to achieve safe and effective self-driving capabilities. The Internet of Things (IoT) and connectivity have emerged as essential elements that enable real-time data exchange between infrastructure and vehicles to improve traffic management and overall transportation efficiency.

With consumers favoring on-demand and integrated mobility services more and more, ride-sharing platforms and mobility-as-a-service (MaaS) solutions are reshaping traditional transportation paradigms. Government programs, such as those that promote EV adoption through incentives and investments in smart infrastructure projects, are vital in determining the market environment. Investments in electric cars and sustainable mobility solutions have increased as environmental sustainability continues to be a major concern. There is fierce competition in the smart mobility market, with new entrants, technology companies, and established automakers all fighting for market share.

Collaborations and partnerships are common as industry participants strive to create all-encompassing smart mobility solutions. There are still issues to be resolved, such as unclear regulations, worries about the safety of self-driving cars, and the requirement for uniform frameworks to enable smooth integration between different smart mobility components. It is advisable to consult recent market reports and industry analyses for the most up-to-date insights.

Global Smart Mobility Market Drivers:

Shaping Smart Mobility: Technological Marvels Driving the Future.

Technological developments in the dynamic field of smart mobility are guiding the sector towards increased efficiency, connectedness, and sustainability. Modern battery technologies powering electric vehicles provide higher energy density and quicker charging, resolving important issues and encouraging widespread adoption. Advanced driver-assistance systems powered by artificial intelligence and machine learning are revolutionizing vehicle safety, while autonomous vehicles make use of complex sensors and perception systems. V2X communication, connectivity, and IoT technologies facilitate smooth communication between vehicles and infrastructure, enabling real-time data exchange for better traffic management.

Blockchain technology makes sure that transactions are safe and transparent. Meanwhile, virtual and augmented reality are used in driver assistance and training. High-speed connectivity is made possible by the introduction of 5G networks, and energy management systems aid in the creation of infrastructure for electric vehicle charging that is economical. Together, these advancements create a paradigm-shifting environment that portends a time when intelligent, connected, and sustainable transportation options are synonymous with smart mobility.

The policies and incentives of the government have hastened the transition to intelligent mobility solutions.

The global smart mobility landscape is largely shaped by government policies and incentives, which offer the structure and encouragement needed to promote the uptake of cutting-edge transport technologies. Many governments throughout the world have put in place a variety of policies to promote the adoption of electric vehicles (EVs) as a result of realizing how important it is to make the switch to efficient and sustainable transportation systems. Customers can purchase electric vehicles at a lower total cost of ownership thanks to incentives like tax credits, subsidies, and rebates. Furthermore, automakers are compelled to invest in cleaner technologies by regulatory measures like fuel efficiency requirements and emission standards, which hastens the development and implementation of electric and hybrid vehicles. Governments are also making significant investments in the implementation of smart infrastructure to facilitate advanced mobility solutions. Funding and support are provided for projects like the creation of smart traffic management systems, intelligent transportation networks, and infrastructure for electric vehicle charging.

A shift towards smart and sustainable mobility is fueled by public awareness.

The landscape of smart mobility is evolving due in large part to changes in behavior and public awareness. People's interest in embracing more environmentally friendly transportation options has grown as a result of growing public awareness of environmental issues, climate change, and the need for sustainable living. People's preferences are shifting in favor of forms of transportation that have a lower carbon footprint and less negative impact on the environment as they grow more aware of their environmental impact. Campaigns for education, media attention, and advocacy that emphasize the advantages of electric cars, shared mobility services, and other environmentally friendly transportation options frequently serve to raise public awareness of these issues. The growing need for convenient and on-demand mobility services is indicative of consumers' evolving behavior. Mobility-as-a-service (MaaS) solutions, bike-sharing initiatives, and ride-sharing platforms are examples of how traditional ownership models are giving way to more adaptable and effective transportation options.

Transportation is revolutionized by smart mobility in the face of sustainability imperatives and environmental concerns.

The smart mobility revolution is based on environmental concerns and sustainability, which motivate the search for transport solutions with the least possible negative ecological impact. An international movement is underway to replace conventional fossil fuel-powered vehicles with more ecologically friendly models due to increased awareness of climate change and the negative impacts of these vehicles. With the rise in popularity of electric vehicles (EVs), which provide a greener and cleaner form of transportation, the automotive industry in particular is undergoing a revolutionary transition. Governments and business entities are investing more money in environmentally friendly mobility solutions as a way to fulfill global commitments to cut carbon emissions and fight air pollution. These factors highlight the critical role that sustainability and environmental concerns will play in determining the future of transportation.

Smart Mobility Market Restraints and Challenges:

The security and privacy of data present serious challenges for the smart mobility market.

In the context of smart mobility, data security, and privacy are critical issues because of the growing risks associated with data exchange and connectivity between automobiles, infrastructure, and backend systems. With cars becoming more and more connected and gathering and sending massive volumes of data, protecting private data has emerged as a major concern. The security of private information, such as user preferences and location data, and the avoidance of unwanted access to in-car technology are among the issues at hand. Strong cybersecurity defenses are necessary to fend off threats such as identity theft, hacking, and unauthorized use of connected cars. To reduce cybersecurity risks and create a secure environment for the implementation of smart mobility technologies, industry stakeholders must work together to develop and implement standards and protocols. Furthermore, fostering trust in smart mobility solutions requires educating industry professionals and consumers about best practices in data privacy and security.

Resolving Supply Chain Disruptions and Time Concerns.

Numerous technological obstacles stand in the way of the smart mobility sector's smooth integration and broad adoption. The development of autonomous car technology is one of the main challenges. Ensuring the safety and dependability of autonomous systems in a variety of intricate real-world scenarios continues to be a major challenge, even with notable progress. Artificial intelligence algorithms and sensor technologies need to be continuously improved to address issues like erratic road conditions, identifying pedestrians and cyclists, and handling edge cases. The creation of effective and reasonably priced energy storage systems for electric cars (EVs) is another technical challenge. To overcome these technological obstacles, industry players and research institutions must work together, research and development must be ongoing, and innovation must be prioritized to propel the development of smart mobility solutions.

Infrastructure readiness is a key obstacle to the evolution of smart mobility.

In the context of smart mobility, infrastructure readiness is a prominent challenge, especially given the swift advancement of electric vehicles (EVs). The creation of a strong charging infrastructure is necessary for the mass adoption of electric vehicles. Although there has been progress, potential EV owners still face difficulties due to the uneven accessibility and availability of charging stations across different regions. Current transportation systems must be upgraded to incorporate sensors, communication networks, and data processing capabilities. Governments, towns, and private organizations must work together to ensure that roads and urban areas have the infrastructure needed to support real-time data exchange, vehicle-to-everything (V2X) communication, and other smart technologies. This is a challenging task. Thus, infrastructure readiness becomes a crucial challenge that necessitates concerted efforts to lay the groundwork for an intelligent and seamlessly connected mobility ecosystem.

Global Smart Mobility Market Opportunities:

Revolutionizing Urban Mobility: Mobility-as-a-Service (MaaS) Platforms' Smooth Experience.

Mobility-as-a-Service (MaaS) platforms offer integrated, user-centric solutions for a range of mobility needs, thereby representing a transformative approach to transportation. By providing consumers with a single location to plan, reserve, and pay for a variety of transportation options, these platforms seek to streamline and simplify the entire transportation experience. Through a single application or platform, users in a MaaS ecosystem can easily access a variety of transportation services, such as public transportation, ride-sharing, bike-sharing, and even electric scooters. The capacity of MaaS platforms to offer real-time information and help with travel planning is one of their primary characteristics.

Last-Mile Revolution: Sustainable and Efficient Logistics Are Made Possible by Innovations in Delivery Solutions.

With last-mile delivery solutions, the crucial problem of effectively delivering goods to end users is addressed, and they have emerged as a focal point in the changing logistics and e-commerce landscape. From distribution centers to the customer's door, this last part of the delivery process is frequently the most expensive and complicated. By utilizing a variety of technologies and tactics, last-mile delivery solutions maximize this critical phase and support more environmentally friendly and customer-focused logistics. To increase productivity, shorten delivery times, and lessen the delivery process's negative environmental effects, innovations include the use of autonomous drones, electric delivery vehicles, and route optimization algorithms. Last-mile delivery innovations, which provide a balance between speed, cost-effectiveness, and environmental responsibility, are critical in shaping the future of logistics as the demand for quick and environmentally responsible delivery solutions grows.

SMART MOBILITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20.5% |

|

Segments Covered |

By Smart Infrastructure, Electric Vehicles, Element, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

TOYOTA motor corporation, Excel fore, Cisco Systems, Inc., Ford Motor Company, Siemens, Robert Bosch Gmbh, Qualix Information System, Maas Global Oy, Tom Tom International N.V, Innoviz technologies |

Mobility Market Segmentation: By Smart Infrastructure

-

Traffic Management Solutions

-

Smart Parking Solutions

Advanced traffic management systems, which make use of real-time data and analytics to optimize traffic flow, lessen congestion, and improve overall transportation efficiency, could be the subject of one area of smart infrastructure. The creation and application of intelligent transportation networks, which combine different forms of transportation and provide seamless connectivity, may comprise another section. Segments might also be devoted to the implementation of smart parking solutions, which maximize parking space utilization and lessen traffic congestion by utilizing IoT sensors and data analytics. Stakeholders can customize their strategies to address particular technological needs and challenges associated with developing intelligent and interconnected transportation ecosystems by segmenting the market based on smart infrastructure.

Businesses and policymakers can better comprehend the unique requirements of various components within the larger smart mobility landscape by using market segmentation based on smart infrastructure. This strategy makes it possible to make focused investments, development projects, and business alliances that advance smart mobility solutions as a whole.

Mobility Market Segmentation: By Electric Vehicles

-

Vehicle Type (Compact Midsize, and Luxury)

-

Range (Short and Long Range)

Vehicle type, which includes classes like electric cars (compact, midsize, and luxury), electric buses, electric trucks, and electric two-wheelers, is a key segmentation factor. Every vehicle type, from personal commuting to commercial transportation, meets a variety of consumer preferences and use cases.

Another important segmentation factor that distinguishes between short- and long-range electric vehicle models is range. While long-range models appeal to buyers who need greater mileage, short-range EVs are frequently chosen for urban commuting.

Mobility Market Segmentation: By Element

-

Ride Sharing

-

Car Sharing

-

Others

Market segmentation in the context of smart mobility includes several areas, such as ride- and car-sharing services. Within the ride-sharing industry, companies adapt their strategies to meet the specific needs and preferences of different clientele groups. For example, although some consumers value privacy and are willing to pay extra for a more personalized experience, others place a higher value on the economy and are content to travel with strangers at a lower cost. Ride-sharing firms can offer a variety of service tiers to cater to the preferences of various customer groups due to this segmentation. In addition, these companies need to understand how consumer behavior varies by location to appropriately tailor their products, considering factors like population density, cultural preferences, and local regulations.

Car-sharing services provide a significant additional market niche for smart mobility. Thanks to this segmentation, businesses may handle a wide range of use cases, from longer-term car-sharing agreements to short-term leases for specific outings. Companies that provide vehicle-sharing services can adapt their offerings to meet the needs of city dwellers who want occasional access to a car but don't want to handle the responsibilities of ownership. They can, however, also satisfy the needs of those seeking more flexible and ecologically beneficial forms of transportation. By adopting market segmentation, car-sharing companies can better adjust their fleet composition, pricing tactics, and user experiences to meet the unique needs of their clients across different regions and geographical areas.

Mobility Market Segmentation: By Technology

-

3G & 4G

-

Wi-Fi

-

GPS

-

RFID

-

Embedded System

Wi-Fi is widely used to enhance connectivity for people with compatible devices by enabling short-range communication within certain locations, such as public areas, smart cities, or transit hubs. This is due to its local area network features.

GPS technology is the cornerstone of smart mobility since it provides the exact position data required for navigation, route optimization, and location-based services. Access control to vehicles, parking lots, and transportation networks can be effectively and safely managed with the use of RFID technology, which is commonly used for tracking and identification. Embedded systems, which integrate hardware and software, are essential to the integration and functioning of smart devices in infrastructure and automobiles.

Market segmentation based on these technologies allows industry participants to understand the unique requirements and challenges associated with each, enabling targeted development and deployment strategies that are in line with the evolving demands of the smart mobility market.

Mobility Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America's 40% market share is significant and reflects the region's active involvement in the creation and uptake of smart mobility solutions. North America is a leading player in the global mobility market because of the existence of important industry players, a strong technological infrastructure, and regulatory frameworks that are supportive of the sector. The adoption of electric vehicles, the development of smart cities, and the progress made in autonomous driving technologies all serve to reinforce the region's standing as a premier center for mobility innovations.

Europe is a major influence on the global mobility landscape, accounting for 21% of the market. The adoption of electric vehicles and other sustainable transportation solutions is fueled by the European market's strong emphasis on sustainability and environmental consciousness. The continent's well-established public transit systems and proactive approach to smart city projects support the expansion of cutting-edge mobility services. Europe's market share demonstrates how dedicated it is to creating linked, intelligent transport systems that put efficiency and environmental impact first.

With a substantial 25% market share, Asia Pacific is a reflection of the dynamic and quickly changing mobility ecosystem in the region. Asia Pacific is leading the way in the development of smart infrastructure, the adoption of electric vehicles, and the integration of mobility-as-a-service (MaaS) platforms. Asia-Pacific is a hub for technological innovation. Due to the presence of significant automakers, rising urbanization, and the need for effective transportation in developing nations, Asia Pacific will play a significant role in determining the direction of global mobility in the future. The Asia-Pacific mobility market is growing and becoming more competitive, in large part due to the variety of mobility solutions coming from nations like South Korea, Japan, and China.

COVID-19 Impact Analysis on the Global Smart Mobility Market:

Disruption to Conventional Transportation Modes: The COVID-19 pandemic caused hitherto unseen disruptions to conventional transportation modes, which had a significant effect on public transportation and ride-sharing services. Public transportation experienced operational challenges and reduced passenger capacity to comply with health guidelines, while ride-sharing platforms saw a significant decline in ridership due to lockdowns, social distancing measures, and safety concerns. Because of this, commuters started using other forms of transportation, such as bicycles, e-scooters, and personal cars, which changed demand and forced an assessment of the conventional commuting model.

Change in Commuting Patterns and Impact of Remote Work: The pandemic's increase in remote work led to a change in commuting patterns. The demand for traditional transport services was significantly impacted by a decrease in the necessity of daily commutes to offices. Smart mobility solutions that prioritize ease of use and flexibility have been adjusted to accommodate evolving work schedules. As more people turned to remote work, urban planners had to reconsider their approaches to transport to provide a more well-rounded approach that suited changing work and lifestyle patterns. The smart mobility market maintained its focus on sustainability despite the pandemic's difficulties. Businesses and governments alike have realized the value of green initiatives.

Latest Trends/Developments:

Hyundai made notable advancements in the field of smart mobility in 2022, presenting creative solutions that caused a revolution in the automotive sector. Hyundai Motor India Ltd.'s introduction of the new Hyundai Venue in New Delhi was one of the notable launches. This was significant because the company demonstrated how to combine comfort, eye-catching design, outstanding performance, and a size that fit in well with modern urban lifestyles. By incorporating cutting-edge features and design elements, Hyundai demonstrated its commitment to remaining at the forefront of smart mobility trends with the renovation of the Hyundai SUV into the Hyundai Venue.

A progressive approach is demonstrated by the Helsinki 2025 Vision (2014), which envisions on-demand, door-to-door mobility that seamlessly integrates multiple modes of transportation.

Key Players:

-

TOYOTA motor corporation

-

Excel fore

-

Cisco Systems, Inc.

-

Ford Motor Company

-

Siemens

-

Robert Bosch Gmbh

-

Qualix Information System

-

Maas Global Oy

-

Tom Tom International N.V

-

Innoviz technologies

Chapter 1. SMART MOBILITY MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SMART MOBILITY MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SMART MOBILITY MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SMART MOBILITY MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SMART MOBILITY MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SMART MOBILITY MARKET – By Smart Infrastructure

6.1 Introduction/Key Findings

6.2 Traffic Management Solutions

6.3 Smart Parking Solutions

6.4 Y-O-Y Growth trend Analysis By Smart Infrastructure

6.5 Absolute $ Opportunity Analysis By Smart Infrastructure, 2024-2030

Chapter 7. SMART MOBILITY MARKET – By Electric Vehicles

7.1 Introduction/Key Findings

7.2 Vehicle Type (Compact Midsize, and Luxury)

7.3 Range (Short and Long Range)

7.4 Y-O-Y Growth trend Analysis By Electric Vehicles

7.5 Absolute $ Opportunity Analysis By Electric Vehicles, 2024-2030

Chapter 8. SMART MOBILITY MARKET – By Element

8.1 Introduction/Key Findings

8.2 Ride Sharing

8.3 Car Sharing

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Element

8.6 Absolute $ Opportunity Analysis By Element, 2024-2030

Chapter 9. SMART MOBILITY MARKET – By Technology

9.1 Introduction/Key Findings

9.2 3G & 4G

9.3 Wi-Fi

9.4 GPS

9.5 RFID

9.6 Embedded System

9.7 Y-O-Y Growth trend Analysis By Technology

9.8 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 10. SMART MOBILITY MARKET , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Smart Infrastructure

10.1.2.1 By Electric Vehicles

10.1.3 By Element

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Smart Infrastructure

10.2.3 By Electric Vehicles

10.2.4 By Element

10.2.5 By Technology

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Smart Infrastructure

10.3.3 By Electric Vehicles

10.3.4 By Element

10.3.5 By Technology

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Smart Infrastructure

10.4.3 By Electric Vehicles

10.4.4 By Element

10.4.5 By Technology

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Smart Infrastructure

10.5.3 By Electric Vehicles

10.5.4 By Element

10.5.5 By Technology

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. SMART MOBILITY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 TOYOTA motor corporation

11.2 Excel fore

11.3 Cisco Systems, Inc.

11.4 Ford Motor Company

11.5 Siemens

11.6 Robert Bosch Gmbh

11.7 Qualix Information System

11.8 Maas Global Oy

11.9 Tom Tom International N.V

11.10 Innoviz technologies

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global smart mobility market was valued at USD 65.4 billion and is projected to reach a market size of USD 241.26 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 20.5%.

The growing need for efficient and environmentally friendly transport options, improvements in connectivity and Internet of Things technologies, and a move towards user-centered, integrated mobility services are the main factors propelling the smart mobility market.

The development and implementation of intelligent transportation systems, which include connected cars, traffic control, and integrated mobility services to improve efficiency and sustainability in urban transportation, is the main application of the smart mobility market.

North America is the dominant region due to the major technological transformation and development in the region.

Toyota Motor Corporation, Excel fore, Cisco Systems, Inc., Ford Motor Company, Siemens, Robert Bosch Gmbh, Qualix Information System, Maas Gobal Oy, Tom Tom International N.V., and Innoviz Technologies are the key players in the global market.