Smart Grid Market Size (2024 – 2030)

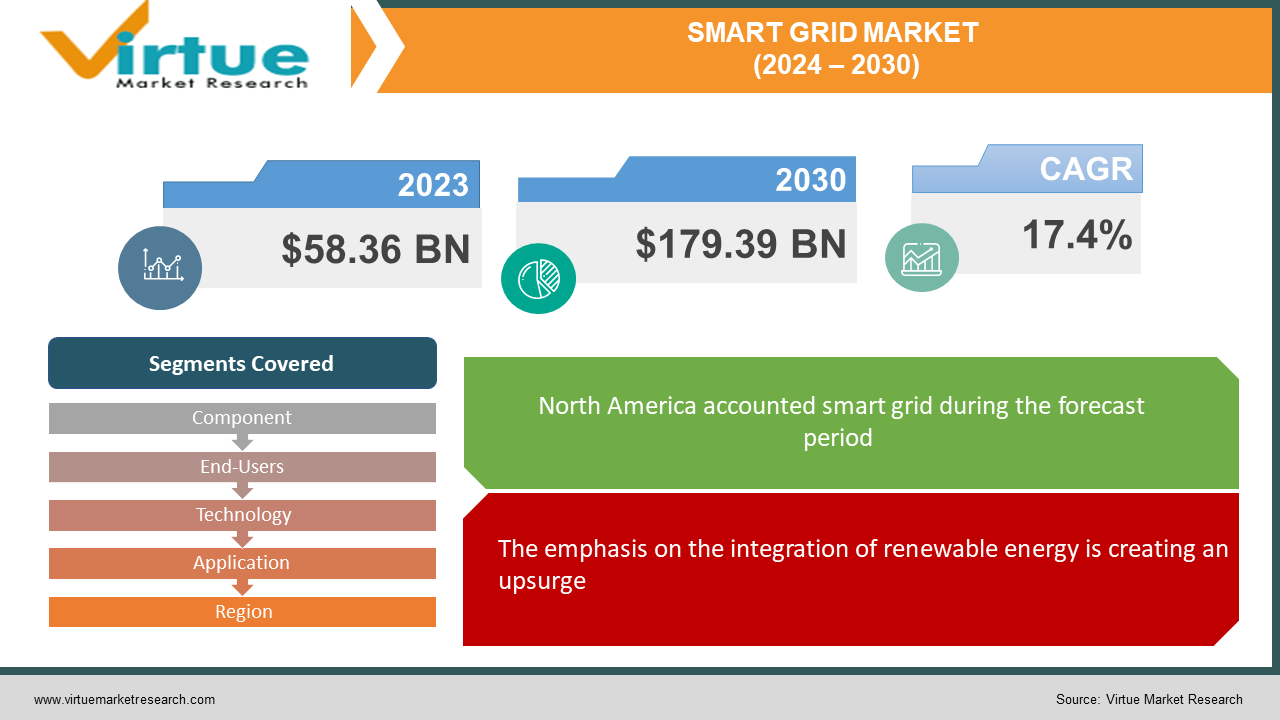

The global smart grid market was valued at USD 58.36 billion and is projected to reach a market size of USD 179.39 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 17.4%.

An electrical network that employs digital technology to track and regulate the movement of energy from production to consumption is known as a smart grid. Power sensors, controllers, data centers, and smart meters are examples of components found in smart grids that enable two-way communication between the utility company and its clients. Additionally, power flows from sites of generation to points of consumption may be monitored and controlled by smart grids in real-time or almost real-time. In the past, they were mainly used in developed economies like the United States, Japan, and a few regions of Europe. Presently, the market has seen an acceleration owing to technological advancements and rapid adoption. In the future, with a focus on emerging fields like AI and IoT, the market is anticipated to witness a notable expansion.

Key Market Insights:

Large gas and electricity providers installed about 915,587 smart meters for residential customers in Great Britain during the last quarter of 2022, as per Statista. With more than 1.37 million smart meters deployed as of April 2023, Bihar has the most in all of India, as per Statista.

According to Statista, global energy generation is expected to rise by about half during the next thirty years, or around forty-two thousand terawatt-hours, by the year 2050. By producing around half of the world's electricity that year, renewable energy is predicted to be the main source.

According to the International Energy Agency, around 8% more was invested in electrical grids in 2022, as both developed and developing nations stepped up their efforts to promote and facilitate the electrification of buildings, industries, and transportation, as well as to integrate variable renewable energy sources into the power system.

The energy industry will have the fifth-highest average cost of any industry in 2024, which is $4.78 million due to data breaches, according to UpGuard. To prevent this, organizations are giving prominence to investing in advanced cybersecurity measures like threat detection systems, encryption technologies, access controls, and network segmentation.

Smart Grid Market Drivers:

The emphasis on the integration of renewable energy is creating an upsurge.

Smart grid technologies are becoming more and more necessary as renewable energy sources like solar and wind power are widely used. Renewable energy sources are intermittent and decentralized, which poses problems for grid stability and management in contrast to traditional power generation. With features like demand response, energy storage management, grid balancing, and real-time monitoring, smart grid systems make it possible to integrate renewable energy sources efficiently. Smart grids are necessary to support and maximize the integration of renewable energy sources as nations work to cut carbon emissions and shift to a more sustainable energy mix.

Grid modernization initiatives have been boosting the market.

Around the world, efforts to modernize grid infrastructure are being propelled by aging infrastructure, rising energy use, and the need for increased resilience and dependability. Conventional power grids are inefficient and prone to disturbances because they frequently have one-way power flow, poor visibility, and manual processes. With the use of smart grid technology, utilities may increase energy efficiency, shorten outage times, and improve grid performance. These advanced features include digital monitoring, automation, predictive analytics, and grid optimization. The smart grid industry is growing as a result of government and utility investments in smart grid installations as part of modernizing and future-proofing energy infrastructure.

Smart Grid Market Restraints and Challenges:

Initial investments, data security, and interoperability are the main issues that the market is currently facing.

One of the major challenges in this market is the associated costs. High expenses are required for installation, deployment, network infrastructure upgrades, software integration, and other security measures. Smaller and medium-sized businesses might face accommodation difficulties with these expenses. Secondly, sensitive data is stored on these grids. Ensuring privacy and confidentiality is a constant concern. Thirdly, the hardware and software components of smart grids come from a variety of suppliers, each with its own proprietary protocols and communication standards. The efficient operation of smart grid infrastructure depends on ensuring these elements integrate and work together seamlessly. The scale and flexibility of smart grid installations might be hindered by the lack of standardized protocols and interoperability frameworks, which can also cause compatibility problems, complicate system integration, and result in vendor lock-in.

Smart Grid Market Opportunities:

Deploying smart grids is greatly aided by the growth of distributed energy resources like wind turbines, battery storage devices, and solar panels on rooftops. With the help of smart grid technology, distributed energy resources (DERs) may be seamlessly integrated and managed, enabling demand response, grid balancing, and optimized use of renewable energy. By using DERs, utilities may lessen their reliance on centralized production and cut carbon emissions while improving grid flexibility, reliability, and resilience. Secondly, emerging technologies like artificial intelligence, the Internet of Things, blockchain, and data analytics are beneficial. By implementing these fields, it is possible to enhance grid operation, monitoring, control, and decision-making processes. Additionally, utilities can better manage load distribution, uncover inefficiencies, and maximize asset utilization with the use of advanced grid analytics, predictive modeling, and optimization algorithms. Furthermore, businesses may increase metering accuracy, billing efficiency, and consumer engagement by implementing sophisticated metering infrastructure, such as smart meters. Real-time energy usage monitoring, remote meter reading, time-of-use pricing, demand response programs, and energy conservation measures may all be implemented with smart meters. This may enhance grid operations, identify irregularities, and enable customers to make knowledgeable decisions about their energy use by utilizing AMI data analytics and insights. This can result in financial savings and positive environmental effects.

SMART GRID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17.4% |

|

Segments Covered |

By Component, End-Users, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric (GE), Siemens AG, ABB Group, Schneider Electric SE, Honeywell International Inc., Cisco Systems Inc., IBM Corporation, Eaton Corporation, Itron Inc., Oracle Corporation |

Smart Grid Market Segmentation: By Component

-

Hardware

-

Software

-

Services

The software segment is the largest and fastest-growing component. Applications for cybersecurity, control, analytics, monitoring, and optimization of the grid are all included in smart grid software. Advanced functions, including real-time grid management, predictive maintenance, and data analytics, are made possible by software solutions. Furthermore, there is an increased need for digitization, analytics-driven decision-making, and grid optimization, driving the demand for the software segment.

Smart Grid Market Segmentation: By End-Users

-

Utility

-

Residential

-

Commercial

-

Industrial

The utility segment is the largest growing end-user. Because grid technology is being deployed more widely around the world, the utility industry is expected to experience tremendous growth. Furthermore, the governments of emerging and undeveloped nations are coming to understand the benefits of strategically placed investments in infrastructure that may simultaneously address the escalating environmental issues brought on by fossil fuel power plants and reduce carbon emission rates. The industrial sector is the fastest-growing. Nonetheless, because of the government's supportive policies and financial investments, it is anticipated that the industrial sector will grow considerably during the projected period. The rapid increase in the use of electric cars is going to have a favorable effect on the segment's growth trajectory.

Smart Grid Market Segmentation: By Technology

-

Wireless

-

Wired

Wireless technology is the largest and fastest-growing category. The market for smart grids is heavily dependent on wireless communication technologies since they provide connection, scalability, and flexibility for a range of grid applications. In remote or difficult areas where wired infrastructure can be problematic or prohibitively expensive, utilities can implement smart grid solutions due to technologies like RF mesh networks, Wi-Fi, and cellular networks (like 5G). Applications like smart metering, distribution automation, and asset monitoring are supported by wireless communication as they make real-time data interchange, remote monitoring, and control of grid assets possible.

Smart Grid Market Segmentation: By Application

-

Generation

-

Transmission

-

Distribution

-

Consumption

Distribution is the largest growing application. Distribution grids transport power from transmission substations to final customers. Advanced metering infrastructure (AMI), distribution automation systems, fault detection, and demand response solutions are examples of smart grid technologies used in distribution grids. Moreover, significant expenditures are being made in distribution grid improvements and smart grid solutions, which are driven by the growing emphasis on grid modernization, dependability, and integration of renewable energy sources. The consumption category is the fastest-growing. This segment entails putting policies in place to regulate peak demand, optimize energy use, and affect consumer behavior. Demand response programs, household energy management systems, smart thermostats, and time-of-use pricing are some examples of smart grid solutions for consumption control. The rapid expansion of this application area is being driven by utilities and consumers embracing consumption techniques and technologies as a result of increased consumer and utility awareness of sustainability, energy efficiency, and grid stability.

Smart Grid Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Due to factors including grid modernization projects, regulatory requirements, and the integration of renewable energy sources, North America is the largest growing market for smart grid technology. The area has well-developed smart grid implementations, especially in the US, where utilities have made investments in grid optimization, distribution automation, and advanced metering infrastructure (AMI). Apart from this, this region has well-established players that have a global presence, increasing revenue generation. Prominent players include ABB Group, Schneider Electric SE, and Honeywell International Inc. The market for smart grids is expanding the fastest in the Asia-Pacific area as a result of factors such as rising energy consumption, industrialization, and urbanization. China, Japan, and South Korea are among the nations making significant investments in smart grid infrastructure to enhance grid stability, lower emissions, and increase energy efficiency. The region's market is expanding due to the use of smart meters, grid automation, and renewable energy integration solutions, which presents opportunities for both domestic and foreign technology suppliers.

COVID-19 Impact Analysis on the Global Smart Grid Market:

The market suffered as a result of the viral outbreak. Among the new norms were social isolation, movement restrictions, and lockdowns. This affects supply chain management, logistics, and transportation. Import-export activities suffered as a result. To limit the illness, all businesses, including manufacturing units, were forced to close. This resulted in the suspension of production and other activities. Remote work was prioritized to stop the virus from spreading. Because the economy was so unpredictable, layoffs were common. Many people lost their jobs. Most of the funds were used for healthcare-related initiatives. This caused delays in collaborations, launches, and other projects. The International Energy Agency (IAE) projected that the world's energy demand would reduce by 5% during the first half of the pandemic, marking the worst drop since the Great Depression. Post-pandemic, the priority on renewable energy sources is anticipated to continue despite temporary setbacks, propelled by environmental concerns and decarbonization objectives. The integration of renewable energy, maintaining grid stability, and optimizing energy flows in an increasingly decentralized energy environment is helping in the normal resuming of smart grid technology.

Latest Trends/ Developments:

The rising adoption of electric vehicles is helping the market. To control EV charging loads, maximize grid capacity, and facilitate the integration of renewable energy sources, companies are using smart charging stations, demand response plans, and grid-to-vehicle (V2G) technology. This facilitates monitoring and determining charging patterns, aiding in reducing transportation-related emissions.

Key Players:

-

General Electric (GE)

-

Siemens AG

-

ABB Group

-

Schneider Electric SE

-

Honeywell International Inc.

-

Cisco Systems Inc.

-

IBM Corporation

-

Eaton Corporation

-

Itron Inc.

-

Oracle Corporation

-

In January 2024, Tantalus Systems, a smart grid technology firm committed to assisting in the development of long-term sustainable utilities, announced the release of TRUSync, an industry-leading grid data management system, as part of the Tantalus Grid Modernization PlatformTM (TGMPTM). A technological platform called TGMP assists utilities in speeding up their grid modernization projects. A smart grid design with linked devices, communications networks, grid data management, apps, and analytics are all part of the platform.

-

In February 2023, to help India achieve its net zero targets, Tata Power and AutoGrid announced that they would be collaborating to extend AI-enabled smart energy management in Mumbai. To reduce peak capacity by 75 MW over the first six months of the program, 55,000 residential customers and 6,000 big C&I customers are expected to participate. By the summer of 2025, the capacity decrease is expected to be increased to 200 MW.

-

In March 2022, R.K. Singh, the union minister of electricity, opened the Virtual Smart Grid Knowledge Centre (VSGKC) in New Delhi. Modern smart grid technology is centrally located at the VSGKC, which also has training facilities and models for hands-on learning.

Chapter 1. Smart Grid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Smart Grid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Smart Grid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Smart Grid Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Smart Grid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Smart Grid Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Smart Grid Market – By Technology

7.1 Introduction/Key Findings

7.2 Wireless

7.3 Wired

7.4 Y-O-Y Growth trend Analysis By Technology

7.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Smart Grid Market – By Application

8.1 Introduction/Key Findings

8.2 Generation

8.3 Transmission

8.4 Distribution

8.5 Consumption

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Smart Grid Market – By End User

9.1 Introduction/Key Findings

9.2 Utility

9.3 Residential

9.4 Commercial

9.5 Industrial

9.6 Y-O-Y Growth trend Analysis By End User

9.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 10. Machine Learning Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.3 By End User

10.1.4 By Application

10.1.5 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Technology

10.2.4 By Application

10.2.5 By End User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Technology

10.3.4 By Application

10.3.5 By End User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Technology

10.4.4 By Application

10.4.5 By End User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Technology

10.5.4 By Application

10.5.5 By End User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Smart Grid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 General Electric (GE)

11.2 Siemens AG

11.3 ABB Group

11.4 Schneider Electric SE

11.5 Honeywell International Inc.

11.6 Cisco Systems Inc.

11.7 IBM Corporation

11.8 Eaton Corporation

11.9 Itron Inc.

11.10 Oracle Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global smart grid market was valued at USD 58.36 billion and is projected to reach a market size of USD 179.39 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 17.4%.

Emphasis on the integration of renewable energy and grid modernization initiatives are the main factors propelling the global smart grid market.

Based on components, the global smart grid market is segmented into hardware, software, and services.

North America is the most dominant region for the global smart grid market.

General Electric (GE), Siemens AG, and ABB Group are the key players operating in the global smart grid market.