Microgrid Market Size (2024 – 2030)

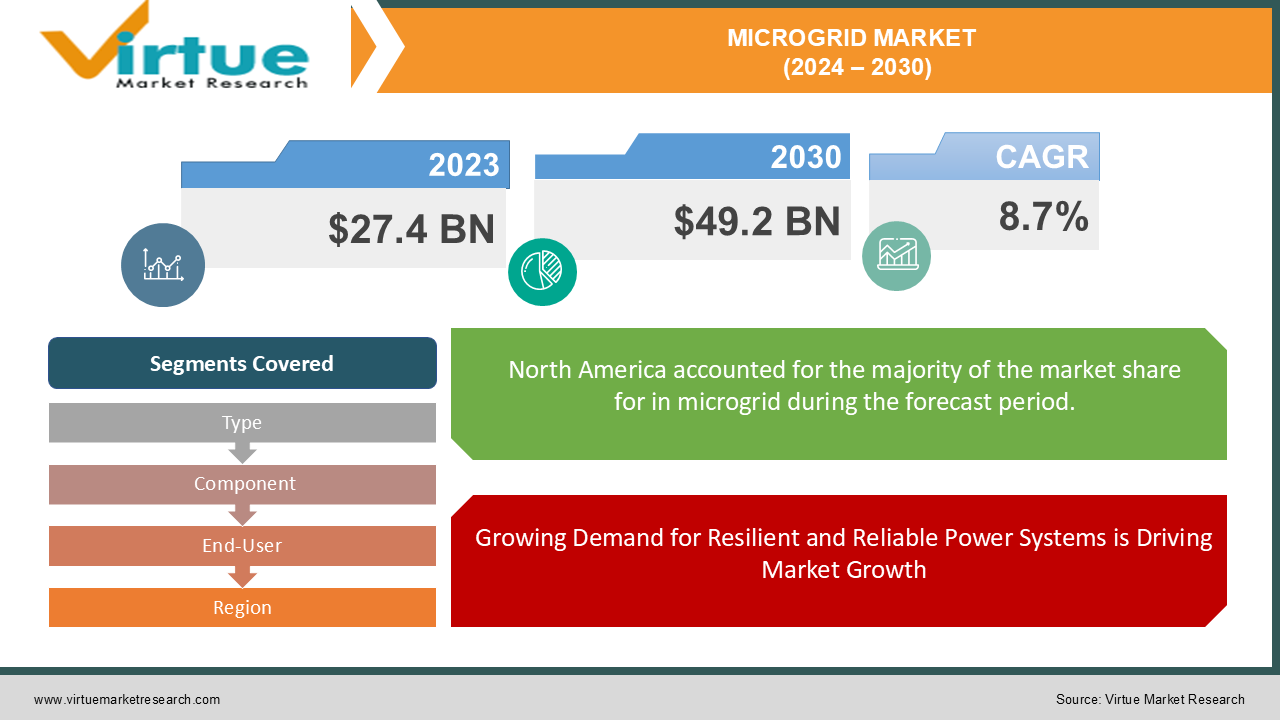

The Microgrid Market was valued at USD 27.4 billion in 2023 and is projected to reach USD 49.2 billion by 2030, expanding at a compound annual growth rate (CAGR) of 8.7% during the forecast period.

The Global Microgrid Market is experiencing significant growth due to the rising demand for reliable and resilient power systems, the integration of renewable energy sources, and advancements in microgrid technologies. A microgrid is a localized grid that can operate independently or in conjunction with the main power grid, providing enhanced reliability and sustainability. Microgrids serve a wide range of industries, including commercial, industrial, healthcare, military, and residential sectors. These systems are gaining traction as they offer energy independence, improved energy efficiency, and the ability to incorporate renewable energy sources like solar and wind power. With the growing concerns about power outages, climate change, and energy security, the microgrid market is poised for robust expansion.

Key Market Insights:

Grid-connected microgrids dominate the market, contributing over 60% of the total revenue, as they offer the ability to integrate renewable energy while providing backup power during grid failures.

Energy storage systems (ESS), particularly lithium-ion batteries, are witnessing high demand, driven by the need for efficient energy management and the growing penetration of renewable energy.

The industrial sector is the largest end-user, accounting for 40% of the overall demand, due to the need for continuous power supply, cost reduction, and enhanced energy management systems.

North America leads the global market, generating more than 35% of the market revenue, owing to favorable government policies, incentives for renewable energy adoption, and significant investments in microgrid infrastructure.

Renewable energy integration, particularly solar photovoltaics (PV) and wind, is expected to drive the market growth as governments and industries push for decarbonization and energy resilience.

Global Microgrid Market Drivers:

- Growing Demand for Resilient and Reliable Power Systems is Driving Market Growth The increasing incidence of natural disasters, grid failures, and power outages has fueled the demand for microgrids, which provide uninterrupted power supply and ensure energy resilience. For industries such as healthcare, military, and critical infrastructure, the ability to operate independently of the central grid is crucial to maintaining operational continuity during emergencies. Microgrids allow facilities to manage and optimize their energy resources, reducing dependence on the main grid and improving energy security. With climate change exacerbating the frequency and intensity of extreme weather events, the need for resilient energy infrastructure has become more urgent. Governments and businesses are turning to microgrids as a solution to ensure a reliable power supply, particularly in disaster-prone and remote areas.

- Integration of Renewable Energy Sources is Driving Market Growth The integration of renewable energy sources such as solar and wind into microgrid systems is a key factor driving the market. Renewable energy provides a sustainable and cost-effective power supply, reducing reliance on fossil fuels and lowering greenhouse gas emissions. Microgrids enable the efficient integration of distributed energy resources (DERs) by optimizing the use of solar, wind, and other renewables with energy storage systems. As governments implement stricter environmental regulations and renewable energy targets, the adoption of microgrids is accelerating. In addition, microgrids help businesses and communities achieve their sustainability goals by providing clean and reliable energy solutions. Countries around the world are investing in renewable energy projects, and microgrids are playing a pivotal role in enabling the transition to a low-carbon energy future.

- Technological Advancements in Energy Storage and Control Systems is Driving Market Growth The development of advanced energy storage technologies and intelligent control systems is propelling the growth of the microgrid market. Energy storage systems, particularly lithium-ion batteries, have become more efficient and cost-effective, allowing microgrids to store excess energy generated from renewable sources and dispatch it when needed. This enhances the stability and reliability of microgrids, particularly in off-grid and remote locations. Furthermore, advancements in control systems, such as microgrid controllers, enable real-time monitoring, optimization, and automation of energy resources. These technologies enhance the flexibility and efficiency of microgrids, ensuring seamless integration of renewable energy, load management, and grid interaction. The evolution of energy storage and control technologies is expected to unlock new opportunities for microgrid deployments, particularly in regions with limited grid infrastructure.

Global Microgrid Market Challenges and Restraints:

- High Initial Capital Investment is Restricting Market Growth The deployment of microgrid systems requires significant upfront capital investment, which can be a major barrier for widespread adoption. The costs associated with designing, installing, and maintaining microgrids, particularly in remote or off-grid locations, can be prohibitively high. While the long-term benefits of energy savings and reliability are attractive, many businesses and communities may find it difficult to justify the initial investment. In addition, integrating advanced energy storage and control systems adds to the cost, making microgrids less accessible for smaller entities. To overcome this challenge, financing models such as energy-as-a-service (EaaS) and third-party ownership are being explored to reduce the financial burden on end-users. However, until these models become more widespread, the high cost of microgrid systems will continue to be a significant restraint on market growth.

- Complex Regulatory and Policy Frameworks is Restricting Market Growth The global microgrid market faces regulatory challenges as different countries and regions have varying policies and standards for distributed energy resources (DERs). The lack of standardized regulations for grid interconnection, energy storage, and renewable integration creates complexities for microgrid developers and operators. In many regions, existing grid codes and regulatory frameworks are not designed to accommodate microgrids, leading to uncertainties around grid interconnection, tariffs, and incentives. Moreover, the role of utilities in microgrid projects remains a contentious issue, as utilities may view microgrids as a competitive threat to their traditional business models. Navigating the complex regulatory landscape is challenging for market players, and the absence of clear policies can slow down the pace of microgrid deployments. To facilitate market growth, policymakers must develop supportive frameworks that incentivize microgrid adoption and address regulatory barriers.

Market Opportunities:

The Global Microgrid Market offers several key opportunities, particularly in the areas of renewable energy integration, energy storage solutions, and off-grid applications. The push toward decarbonization and renewable energy adoption presents significant growth prospects for microgrid developers, as microgrids enable efficient utilization of distributed energy resources. With the declining cost of solar PV and energy storage technologies, microgrids are becoming increasingly viable solutions for off-grid and remote areas, particularly in regions with limited or unreliable grid infrastructure. Additionally, there is a growing opportunity for commercial and industrial end-users to deploy microgrids for energy cost savings, enhanced reliability, and sustainability. The microgrid-as-a-service (MaaS) model is gaining traction as a way to overcome the high capital investment required for microgrid installations. This model allows businesses to deploy microgrids without owning the infrastructure, reducing upfront costs while benefiting from reliable and resilient power systems.

MICROGRID MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.7% |

|

Segments Covered |

By Type, Component, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

General Electric Company, Schneider Electric SE, Siemens AG, ABB Group, Eaton Corporation PLC, Hitachi Energy Ltd., Honeywell International Inc., Tesla, Inc., HOMER Energy LLC, PowerSecure, Inc. |

Microgrid Market Segmentation: By Type

-

Grid-Connected

-

Off-Grid

While both segments offer distinct advantages, the off-grid segment is currently dominating the market. This predominance can be attributed to several factors. Off-grid microgrids provide a reliable and sustainable power supply to remote areas, often lacking access to the main grid. This autonomy eliminates dependence on the grid, reducing vulnerability to power outages and fluctuations. Furthermore, off-grid microgrids can integrate renewable energy sources like solar and wind more effectively, contributing to environmental sustainability and energy independence. These factors, coupled with the growing demand for localized power solutions, have propelled the off-grid segment to the forefront of the microgrid market.

Microgrid Market Segmentation: By Component

-

Power Generation

-

Energy Storage (Batteries, Flywheels, Supercapacitors)

-

Controllers

The most dominant market in the microgrid sector is power generation. This is because microgrids are decentralized energy systems that require a reliable and efficient source of electricity to operate. While energy storage and controllers are essential components, their market share is relatively smaller compared to power generation. Power generation technologies, such as solar panels, wind turbines, and diesel generators, are the backbone of microgrids.

Microgrid Market Segmentation: By End-User

-

Industrial

-

Commercial

-

Residential

-

Military

-

Healthcare

The industrial sector is currently the most dominating market for microgrids. This dominance can be attributed to several factors. First, industrial facilities often have a significant demand for reliable and consistent power, making microgrids an attractive option for ensuring uninterrupted operations. Second, industries can benefit from the economic advantages of microgrids, such as reduced energy costs and increased energy efficiency. Finally, the increasing focus on sustainability and renewable energy has driven industrial facilities to adopt microgrids as a means to reduce their carbon footprint and improve their environmental performance.

Microgrid Market Segmentation: Regional Segmentation

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America Holds the largest market for microgrids, driven by favorable government incentives, strong renewable energy adoption, and significant investments in resilient energy infrastructure. Experiencing growth due to the push for renewable energy and decarbonization, with countries like Germany and the UK leading microgrid deployment. A rapidly growing market with increasing investments in microgrid projects, particularly in China, Japan, and India, driven by industrial expansion and energy security concerns. Gaining traction with the adoption of off-grid microgrids in remote areas, particularly in regions with unreliable grid infrastructure.

COVID-19 Impact Analysis on the Global Microgrid Market:

The COVID-19 pandemic had a mixed impact on the Global Microgrid Market. On one hand, the pandemic led to delays in project implementation due to supply chain disruptions, travel restrictions, and reduced workforce availability. On the other hand, the increased focus on energy security and resilience during the pandemic has accelerated the adoption of microgrids in critical infrastructure sectors such as healthcare, military, and utilities. As countries recover from the pandemic, the demand for microgrids is expected to increase, driven by the need for reliable and decentralized energy systems.

Latest Trends/Developments:

The microgrid market is witnessing several transformative trends, including the growing adoption of renewable energy sources such as solar and wind, coupled with energy storage technologies. The increasing focus on decarbonization and sustainability is driving demand for microgrids that can seamlessly integrate renewable energy and improve grid resilience. Furthermore, digitalization and smart grid technologies are enabling real-time monitoring and optimization of microgrids, enhancing their efficiency and performance. The rise of microgrid-as-a-service (MaaS) models is also reshaping the market, allowing businesses to access microgrid solutions without bearing the capital costs. Additionally, the integration of blockchain technology in microgrids is gaining traction, enabling peer-to-peer energy trading and enhancing energy management capabilities.

Key Players:

-

General Electric Company

-

Schneider Electric SE

-

Siemens AG

-

ABB Group

-

Eaton Corporation PLC

-

Hitachi Energy Ltd.

-

Honeywell International Inc.

-

Tesla, Inc.

-

HOMER Energy LLC

-

PowerSecure, Inc.

Chapter 1. Microgrid Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Microgrid Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Microgrid Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Microgrid Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Microgrid Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Microgrid Market – By Type

6.1 Introduction/Key Findings

6.2 Grid-Connected

6.3 Off-Grid

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Microgrid Market – By Component

7.1 Introduction/Key Findings

7.2 Power Generation

7.3 Energy Storage (Batteries, Flywheels, Supercapacitors)

7.4 Controllers

7.5 Y-O-Y Growth trend Analysis By Component

7.6 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 8. Microgrid Market – By End-User

8.1 Introduction/Key Findings

8.2 Industrial

8.3 Commercial

8.4 Residential

8.5 Military

8.6 Healthcare

8.7 Y-O-Y Growth trend Analysis By End-User

8.8 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Microgrid Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Component

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Component

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Component

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Component

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Component

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Microgrid Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 General Electric Company

10.2 Schneider Electric SE

10.3 Siemens AG

10.4 ABB Group

10.5 Eaton Corporation PLC

10.6 Hitachi Energy Ltd.

10.7 Honeywell International Inc.

10.8 Tesla, Inc.

10.9 HOMER Energy LLC

10.10 PowerSecure, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Microgrid Market was valued at USD 27.4 billion in 2023 and is projected to reach USD 49.2 billion by 2030, growing at a CAGR of 8.7%.

Key drivers include the growing demand for reliable and resilient power systems, the integration of renewable energy sources, and advancements in energy storage and control technologies.

The market is segmented by type (grid-connected, off-grid), component (power generation, energy storage, controllers), and end-user (industrial, commercial, residential, military, healthcare).

North America is the most dominant region, accounting for more than 35% of the global market, driven by government incentives, renewable energy adoption, and investments in resilient infrastructure.

Leading players include General Electric Company, Schneider Electric SE, Siemens AG, ABB Group, and Eaton Corporation PLC.