Silage Additives Market Size (2025 – 2030)

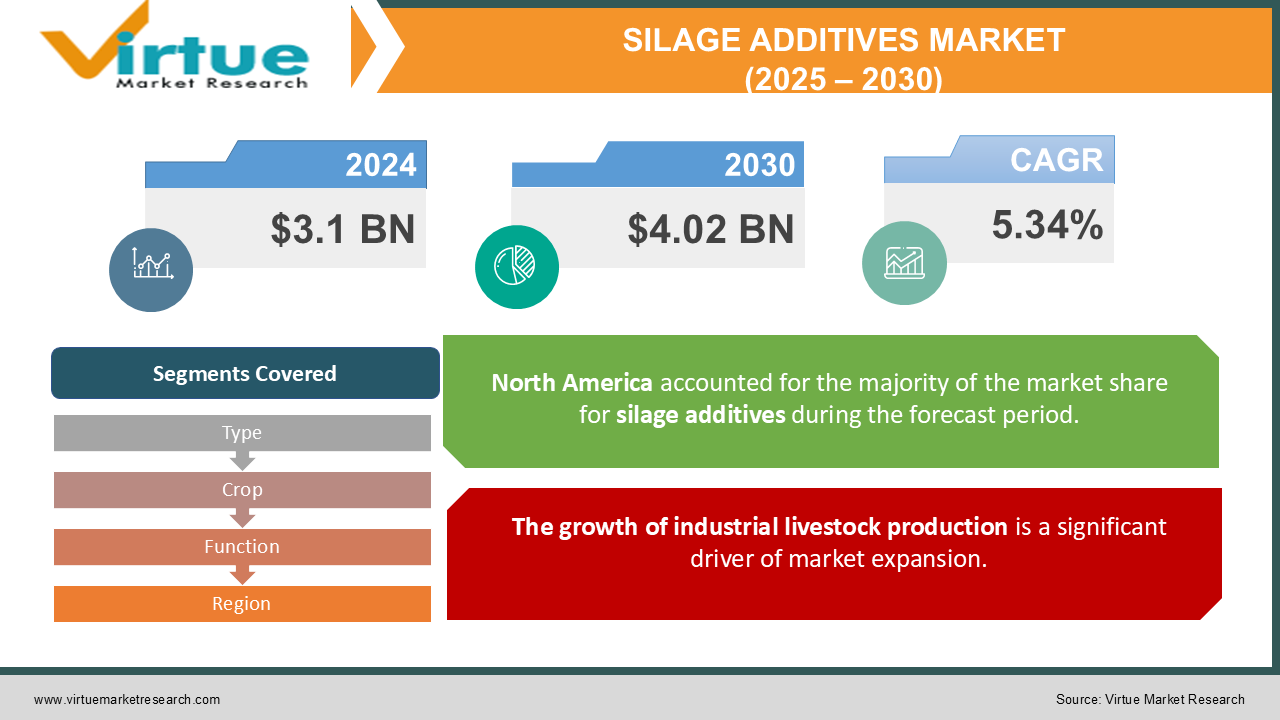

The Silage Additives Market was valued at USD 3.1 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 4.02 billion by 2030, growing at a CAGR of 5.34%.

Silage additives are incorporated into fermented forage products derived from grass, maize, and other crops to enhance their quality, stability, and nutritional content. These additives contribute to the preservation process by using various inhibitors, such as non-protein nitrogen (NON) and propionates, which help prevent undesirable silage deterioration. Additionally, they accelerate and improve the fermentation process while assisting in the breakdown of complex carbohydrates, thereby increasing nutrient availability and making silage more digestible and beneficial for livestock. Commonly utilized silage additives include organic acids, mineral acids, enzymes, sugars, absorbents, and bacterial inoculants, which can be homofermentative, heterofermentative, or a combination of both.

Key Market Insights:

The key factors driving market growth include the rising demand for high-quality animal feed, the need for better silage preservation, advancements in livestock farming techniques, efforts to reduce feed costs, heightened awareness of animal health and welfare, the expansion of the livestock industry, government support and regulations, and technological innovations.

Silage Additives Market Drivers:

The growth of industrial livestock production is a significant driver of market expansion.

The global livestock production sector is increasingly becoming industrialized, with herd sizes expanding and animal productivity rising across various regions. This transition has placed greater emphasis on developing nutrition programs that provide optimal nutrients to animals year-round. Silage additives play a pivotal role in enhancing feed quality, preventing spoilage, and boosting nutritional value, aligning with the goals of industrialized farming. In 2024, the global livestock industry produced over 340 million metric tons of meat, as reported by FAOSTAT. The growing demand for meat, especially in Asia-Pacific and North America, has fueled the expansion of large-scale livestock operations. To efficiently meet this demand, producers have adopted silage additives to improve feed conversion rates and minimize feed waste. Additionally, industrial dairy farming, which yielded over 950 million metric tons of milk in 2024 (FAOSTAT), has heightened the need for silage additives. The quality of silage directly impacts milk yield and quality in dairy operations. According to the Open Journal of Applied Sciences, additives, particularly inoculants, promote lactic acid production during fermentation, thereby improving silage preservation and digestibility.

Silage Additives Market Restraints and Challenges:

The market growth is restrained by knowledge gaps and limited adoption.

The lack of awareness regarding the benefits of silage additives, particularly in developing countries, hinders market growth. To address this knowledge gap, manufacturers and agricultural extension services need to initiate educational campaigns to promote understanding and encourage broader adoption.

Silage Additives Market Opportunities:

The growing need for enhanced silage preservation is creating significant opportunities for market expansion.

The growing demand for improved silage preservation is driving the expansion of the silage additives market. Silage, a widely used livestock feed made from freshly harvested forage crops that undergo fermentation for preservation, can be influenced by several factors during the process, such as moisture levels, oxygen exposure, and microbial activity. Proper preservation is essential to maintaining silage's nutritional value, flavor, and digestibility, making it a cost-effective and practical feed option for livestock producers.

One of the primary challenges in silage preservation is the degradation caused by undesirable microbial activity. Improper fermentation conditions can lead to the growth of harmful microbes, which produce toxic by-products, including butyric acid, acetic acid, and ammonia. These by-products reduce the nutritional quality of the silage while making it unpalatable for livestock. If animals refuse to consume spoiled silage, it can result in wasted feed additives and potential health issues. This highlights the importance of silage additives that prevent spoilage-causing bacteria and foster a healthy fermentation process.

SILAGE ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.34% |

|

Segments Covered |

By Type, Crop, Function, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ADM Animal Nutrition, Biomin Holding GmbH, American Farm Products, Inc. , Chr. Hansen Holding A/S , Cargill, Incorporated, ForFarmers N.V., Dupont de Nemours, Inc. (DuPont), Lallemand, Inc., Kemin Industries, Inc., Novozymes A/S |

Silage Additives Market Segmentation: By Type

-

Inoculants

-

Organic Acids

-

Sugar

-

Enzymes

-

Preservative

The inoculants segment has emerged as the dominant force in the market, driven by significant research and development efforts aimed at improving silage quality. Inoculants play a crucial role in preserving higher concentrations of essential compounds, such as proteins, carbohydrates, and vitamins, by promoting a faster and more controlled fermentation process. The rapid growth of the inoculants segment in the silage additive market can be attributed to several key factors.

One major driver is the shift toward sustainable agricultural practices, which has led to an increased adoption of inoculants as eco-friendly solutions for silage preservation. Additionally, advancements in microbial technology have resulted in the development of more efficient and specialized inoculant formulations, improving their ability to enhance both the fermentation process and silage quality.

Rising awareness among farmers about the advantages of inoculants, including reduced dry matter losses, improved nutrient retention, and better feed digestibility, has further fueled their popularity. As livestock producers aim to optimize feed efficiency and reduce production costs, the demand for inoculants continues to grow. Together, these factors underscore the pivotal role of inoculants in driving innovation and sustainability within the agricultural sector, supporting their continued dominance in the silage additive market.

Silage Additives Market Segmentation: By Crop

-

Corn

-

Alfalfa

-

Sorghum

-

Oats

-

Barley

-

Rye

The corn category has emerged as the top revenue generator in the silage additive market, owing to the high nutritional and energy content of corn silage. Rich in carbohydrates, corn serves as an excellent energy source for animals, while its balanced protein content further enhances its nutritional profile, making it a popular choice for farmers looking to optimize animal productivity.

Several key factors contribute to the rapid growth of the corn segment in the silage additive industry. First, the widespread cultivation of maize across various agricultural regions ensures a stable and abundant supply for silage production. Second, the rising demand for corn silage additives is driven by the clear preference of animal producers, who favor maize for its nutritional richness and versatility.

Technological advancements in agriculture have led to improvements in maize cultivation, resulting in higher yields and better quality crops, which in turn supports the increased use of corn in silage production. Additionally, farmers' growing awareness of the benefits of corn silage, including enhanced feed efficiency and improved livestock productivity, has fueled its adoption. Collectively, these factors are driving the expansion of the corn market segment within the silage additive industry, underscoring its significant role in the ongoing growth of the agricultural sector.

Silage Additives Market Segmentation: By Function

-

Stimulation

-

Inhabitation

The cereals segment has emerged as the dominant force in the silage additives market. Cereal crops are adaptable to various climatic conditions and geographic regions, ensuring their widespread availability to farmers across the globe. This versatility is a key factor in the cereals segment's leadership within the silage additives industry. The robust growth of this segment can be attributed to several significant factors.

First, there is increasing awareness among farmers and agricultural professionals about the importance of optimizing silage fermentation processes to improve feed quality and livestock performance. Stimulation additives play a vital role in encouraging beneficial microbial activity, which leads to faster and more efficient fermentation of silage.

As livestock production intensifies and profit margins become more competitive, there is a greater focus on maximizing the nutritional value and shelf life of silage, driving demand for stimulation additives. Additionally, advancements in formulation technologies have resulted in the creation of highly effective and specialized stimulation additives that cater to the unique needs and challenges of modern silage production.

Moreover, the growing emphasis on sustainability within the agricultural sector has further boosted the appeal of stimulation additives, which offer environmentally friendly solutions for enhancing silage preservation and reducing waste. Together, these factors highlight the crucial role of stimulation additives in promoting innovation and efficiency within the silage additive market, positioning them as a rapidly growing segment with strong potential for future expansion.

Silage Additives Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America holds a dominant position in the silage additives market due to several key factors that contribute to its market growth and prominence within the region. The region benefits from a strong agricultural sector, which includes a vast network of livestock farming operations such as dairy, beef, and poultry production. The widespread presence of these industries generates a significant demand for silage additives to preserve and improve the nutritional value of animal feed. Additionally, North America's technological advancements and innovative farming practices have led to a higher adoption rate of silage additives, as farmers strive to enhance feed efficiency and improve animal health and productivity.

On the other hand, the Asia-Pacific region is projected to experience the fastest growth rate (CAGR) in the silage additives market, driven by population growth and rapid urbanization. Changing lifestyles and a growing livestock industry in the region are expected to further propel the demand for silage additives. Among the Asia-Pacific nations, China holds the largest market share in the silage additives market, while India is experiencing the fastest growth in the segment within the region.

COVID-19 Pandemic: Impact Analysis

The impact of the COVID-19 pandemic on the silage additives market has been mixed, characterized by significant volatility in supply and demand across different regions. At the onset of the pandemic, there was a sudden surge in demand for products like animal feed as consumers stockpiled supplies. However, the supply of silage additives was restricted, leading to limited availability of high-quality animal feed in the market.

Furthermore, the pandemic resulted in increased transportation and logistics costs. Many transportation providers imposed higher charges for shipping materials, leading to a rise in logistics rates. This, in turn, caused delays in shipments globally, disrupting supply chains and affecting the movement of products both inbound and outbound. As a result, the cost of livestock products increased, which reduced the purchasing power of consumers and, to a significant extent, hindered the growth of the silage additives market during this period.

Latest Trends/ Developments:

May 2023: FM BioEnergy launched Silasil SG, a silage additive specifically developed to enhance biogas production from British grass. This additive helps preserve the biogas potential of grass during storage, allowing on-farm anaerobic digestion (AD) operators to increase methane generation and improve profitability.

November 2022: Alltech introduced Egalis, a new line of premium silage inoculants aimed at maximizing nutrient quality retention while minimizing dry matter loss. These inoculants are designed to improve the overall quality of silage and enhance its efficiency in livestock feed production.

Key Players:

These are top 10 players in the Silage Additives Market :-

-

ADM Animal Nutrition

-

Biomin Holding GmbH

-

American Farm Products, Inc.

-

Chr. Hansen Holding A/S

-

Cargill, Incorporated

-

ForFarmers N.V.

-

Dupont de Nemours, Inc. (DuPont)

-

Lallemand, Inc.

-

Kemin Industries, Inc.

-

Novozymes A/S

Chapter 1. Silage Additives Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Silage Additives Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Silage Additives Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Silage Additives Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Silage Additives Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Silage Additives Market – By Type

6.1 Introduction/Key Findings

6.2 Inoculants

6.3 Organic Acids

6.4 Sugar

6.5 Enzymes

6.6 Preservative

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Silage Additives Market – By Crop

7.1 Introduction/Key Findings

7.2 Corn

7.3 Alfalfa

7.4 Sorghum

7.5 Oats

7.6 Barley

7.7 Rye

7.8 Y-O-Y Growth trend Analysis By Crop

7.9 Absolute $ Opportunity Analysis By Crop, 2025-2030

Chapter 8. Silage Additives Market – By Function

8.1 Introduction/Key Findings

8.2 Stimulation

8.3 Inhabitation

8.4 Y-O-Y Growth trend Analysis By Function

8.5 Absolute $ Opportunity Analysis By Function, 2025-2030

Chapter 9. Silage Additives Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Crop

9.1.4 By Function

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Crop

9.2.4 By Function

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Crop

9.3.4 By Function

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Crop

9.4.4 By Function

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Crop

9.5.4 By Function

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Silage Additives Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ADM Animal Nutrition

10.2 Biomin Holding GmbH

10.3 American Farm Products, Inc.

10.4 Chr. Hansen Holding A/S

10.5 Cargill, Incorporated

10.6 ForFarmers N.V.

10.7 Dupont de Nemours, Inc. (DuPont)

10.8 Lallemand, Inc.

10.9 Kemin Industries, Inc.

10.10 Novozymes A/S

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The key factors driving market growth include the rising demand for high-quality animal feed, the need for better silage preservation, advancements in livestock farming techniques, efforts to reduce feed costs, heightened awareness of animal health and welfare, the expansion of the livestock industry, government support and regulations, and technological innovations.

The top players operating in the Silage Additives Market are - ADM Animal Nutrition, Biomin Holding GmbH and American Farm Products, Inc.

The impact of the COVID-19 pandemic on the silage additives market has been mixed, characterized by significant volatility in supply and demand across different regions.

AThe growing need for enhanced silage preservation is creating significant opportunities for market expansion.

Asia-Pacific is the fastest-growing region in the Silage Additives Market.