Middle-East and Africa Silage Additives Market Size (2023-2030)

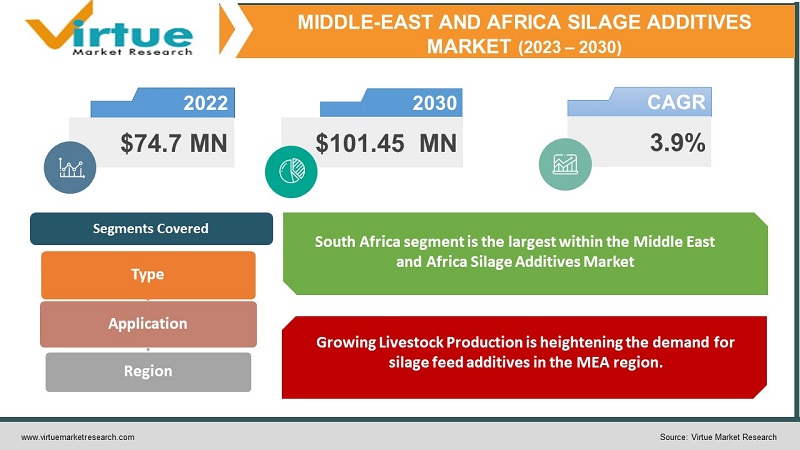

The Middle East and Africa Silage Additives Market was valued at USD 74.7 Million and is projected to reach a market size of USD 101.45 Million by the end of 2030. Over the outlook period of 2023-2030, the market is anticipated to grow at a CAGR of 3.9%.

The Middle East and Africa Silage Additives Market encompasses the industry focused on products designed to improve the quality, preservation, and nutritional value of silage, which is vital for livestock feed. This market reflects the growing importance of efficient forage conservation and storage practices in the region. Silage additives, including inoculants, acids, and preservatives, are essential to inhibit spoilage, reduce dry matter loss, and enhance the overall nutritional content of silage, particularly in the context of dairy and beef farming. Factors such as the expanding livestock sector, increased awareness of silage preservation techniques, and the need for reliable feed sources are driving the demand for silage additives. As the Middle East and Africa continue to modernize and intensify their agriculture and livestock industries, the silage additives market is expected to play a crucial role in ensuring high-quality feed for the growing livestock population.

Key Market Insights:

The Middle East and Africa currently contribute the smallest share to global compound feed production, accounting for approximately 5.9% with an output of around 75 million tons. However, these regions are emerging as promising areas for development. Notably, in 2022, the Middle East experienced a substantial 24.7% increase in compound feed production compared to 2021, surpassing the growth seen in other regions. In contrast, Africa saw a modest 3.86% decline in feed production, primarily due to reductions in Egypt, Morocco, Kenya, and Nigeria. Nevertheless, South Africa reported a growth of over 2%, and Namibia also noted an increase in feed production in 2022.

The animal feed additives industry is seeing the increased usage of precision feeding or smart feeding technologies. These technologies leverage data analytics, sensors, and automation to precisely tailor the nutritional content of animal feed based on real-time data about the specific needs of each animal. For example, sensors can monitor an animal's weight, health, and behavior, and this data is then used to adjust the composition of their feed to optimize growth and health. Precision feeding not only improves the efficiency of feed utilization but also reduces waste and environmental impact by minimizing overfeeding. This trend is driven by a growing emphasis on sustainability, animal welfare, and the need to meet the nutritional requirements of each animal in a more precise and efficient manner.

Middle-East and Africa Silage Additives Market Drivers:

Growing Livestock Production is heightening the demand for silage feed additives in the MEA region.

The region has been experiencing a notable increase in livestock production, driven by rising demand for animal products like meat, milk, and eggs. To meet this demand, there is a growing need for high-quality and nutritionally dense animal feed. Silage, which is a critical component of livestock feed, is being produced and preserved more extensively. As a result, the demand for silage additives to enhance the quality and shelf life of silage is on the rise.

Increasing awareness of forage conservation is a major factor in increasing the growth of silage feed additives.

There is a growing recognition of the importance of efficient forage conservation techniques to ensure a stable and cost-effective feed supply, especially during periods of drought or feed scarcity. Farmers and livestock producers in the Middle East and Africa are increasingly adopting silage preservation methods as a means to secure a reliable feed source for their animals. This heightened awareness is spurring the use of silage additives to optimize the preservation process and minimize nutrient loss in stored forage, further driving the market's growth.

Middle-East and Africa Silage Additives Market Restraints and Challenges:

Climate variability in the Middle East and Africa region could pose challenges to the effectiveness of silage additives affecting the market.

The region often experiences extreme climatic conditions, including high temperatures and droughts. Such conditions can lead to difficulties in achieving ideal moisture content and quality of forage for ensiling. Inconsistent weather patterns make it challenging for farmers to produce high-quality silage consistently, which can affect the effectiveness of silage additives in preserving and enhancing nutritional content.

Lack of knowledge and adoption associated with silage additives could limit the full potential of silage additives.

Many farmers in the Middle East and Africa may lack the knowledge and awareness of modern silage preservation techniques and the benefits of using silage additives. Promoting the adoption of these products and educating farmers on best practices for ensiling can be a significant challenge. Additionally, some farmers may be resistant to change and traditional methods, making it difficult to implement new silage preservation technologies effectively.

Middle-East and Africa Silage Additives Market Opportunities:

The Middle East and Africa Silage Additives Market presents compelling opportunities, driven by several factors. As the region's livestock and dairy industries expand to meet the growing demand for animal products, there is a heightened focus on optimizing feed quality. Silage additives offer a solution for preserving and enhancing forage quality, essential for livestock nutrition. The market offers prospects for innovation, as the industry explores advanced additives that can address specific regional challenges like high temperatures and moisture variability. The emphasis on sustainable agriculture and reduced food waste aligns with the role of silage additives in minimizing forage spoilage. The market's growth potential is underscored by a shift toward modernized farming practices and increasing awareness of the benefits of silage preservation, creating a fertile ground for investment, product development, and expanding the silage additives market across the Middle East and Africa.

MIDDLE-EAST AND AFRICA SILAGE ADDITIVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of MEA |

|

Elantas GmbH (Germany), Axalta Coating Systems (the U.S.), Von Roll Holdings AG (Switzerland), Hitachi Chemicals Company Ltd. (Japan), 3M Company (the U.S.), and Kyocera Corporation (Japan) |

Middle-East and Africa Silage Additives Market Segmentation:

Middle-East and Africa Silage Additives Market Segmentation: By Type:

- Silage Inoculants

- Silage Acids

- Silage Preservatives

- Silage Enzymes

- Silage Aerobic Stability Enhancers

- Others

The largest segment by type of silage additives in the Middle East and Africa Silage Additives Market is Silage Inoculants having a market share of 39.4%. This is primarily because silage inoculants are widely used to enhance forage fermentation, inhibit spoilage, and improve feed quality. As farmers in the region increasingly prioritize efficient and high-quality silage preservation, silage inoculants play a crucial role in promoting desirable lactic acid bacteria, which results in reduced dry matter loss and higher nutritional value. Their effectiveness in optimizing forage fermentation and ensuring feed safety makes silage inoculants the dominant choice in the market. The Silage Inoculants segment is the fastest-growing with a CAGR of 14.5%. This is primarily because silage inoculants contain beneficial bacteria that can enhance fermentation, reduce dry matter loss, and improve overall silage quality. With an increasing focus on improving forage preservation, particularly in challenging climatic conditions of the Middle East and Africa, farmers are turning to silage inoculants to optimize silage quality, ensuring better feed for livestock, thus driving the growth of this segment.

Middle-East and Africa Silage Additives Market Segmentation: By Application

- Cereals

- Corn

- Barley

- Oats

- Wheat

- Sorghum

- Legumes

- Peas

- Faba beans

- Alfalfa

- Clover

- Others

The Cereal Crops segment, including corn, barley, oats, wheat, and sorghum, is the largest segment having a market share of around 41%. This is primarily because cereals are staple forage crops in many parts of the world, including the Middle East and Africa. They serve as essential components of livestock diets, making them a high-demand segment for silage additives. Cereal silages are widely utilized due to their availability and nutritional value, thereby driving the need for additives to preserve and enhance their quality for livestock feed. The fastest-growing segment among these application categories is also Cereal Crops, encompassing corn, barley, oats, wheat, and sorghum. This growth can be attributed to the increasing demand for silage additives to optimize the preservation and nutritional value of cereal-based silages, as these crops are widely cultivated and essential components of livestock feed in the Middle East and Africa. Cereal crops often face specific preservation challenges, and the use of silage additives has become pivotal in ensuring quality forage and animal nutrition in the region's evolving agricultural landscape.

Middle-East and Africa Silage Additives Market Segmentation: Regional Analysis:

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The South Africa segment is the largest within the Middle East and Africa Silage Additives Market having a market share of 31%. South Africa has a well-established and sizable agricultural sector, including livestock farming and silage production. The country's advanced agriculture practices and prominent livestock industry contribute significantly to the demand for silage additives, making it one of the most substantial segments in the regional market.

Saudi Arabia stands as the fastest-growing segment in the Middle East and Africa Silage Additives Market due to its expanding livestock industry, marked by increasing demand for high-quality animal products. The country's commitment to modernizing its agricultural practices and enhancing feed quality aligns with the necessity of silage additives to preserve and improve forage. Moreover, the government's initiatives to support the agricultural sector are fostering the adoption of advanced silage preservation techniques, driving the demand for silage additives, and making Saudi Arabia a pivotal growth area within the region.

COVID-19 Impact Analysis on the Middle-East and Africa Silage Additives Market:

The COVID-19 pandemic has had a mixed impact on the Middle East and Africa Silage Additives Market. While the essential nature of animal agriculture kept the demand for silage additives relatively stable, disruptions in supply chains, logistics, and labor shortages affected the industry's operations. Additionally, economic uncertainties led to cost-conscious spending among farmers, potentially impacting their willingness to invest in silage additives. On the positive side, the pandemic underscored the importance of feed quality and preservation, reinforcing the need for effective silage additives to ensure a reliable and nutritious food supply for livestock. As the region recovers from the pandemic, the market is expected to rebound as farmers continue to prioritize feed quality and adopt advanced silage preservation techniques.

Latest Trends/ Developments:

There is a growing trend towards the use of bio-based and eco-friendly silage additives in the region. These additives are often derived from natural sources, such as lactic acid bacteria, enzymes, or plant extracts. This shift aligns with the broader sustainability movement in agriculture, as farmers and producers seek to minimize the environmental impact of silage preservation while maintaining feed quality and animal health. Bio-based silage additives offer a sustainable alternative to traditional chemical additives, appealing to both environmentally conscious consumers and those adhering to organic farming practices.

To address the region's diverse climatic conditions and forage varieties, a trend is emerging in offering more customized silage additives. Manufacturers are developing additives tailored to specific challenges and regional needs, such as additives designed to combat high temperatures, low moisture content, or particular forage types. This strategy allows businesses to provide solutions that are better suited to the unique conditions of the Middle East and Africa, ultimately improving the effectiveness of silage preservation and feed quality for local farmers. Customized additives can be a valuable tool in optimizing silage outcomes under varying conditions.

Key Players:

- Cargill, Incorporated

- Archer Daniels Midland Company

- Kemin Industries

- Selko (a division of Trouw Nutrition)

- Volac International Limited

- Alltech, Inc.

- Nutreco

- Chr. Hansen Holding A/S

- Lallemand Inc.

- Silostop (a division of RKW Group)

In March 2021, Kemin Industries, a global ingredient manufacturer, strengthened its position in the global vaccine market by acquiring a majority stake in MEVAC, an animal vaccine manufacturer in Cairo, Egypt. Additionally, Kemin is also becoming a shareholder in UVAC, a sister company of MEVAC. This move is part of Kemin's strategy to expand its presence and product portfolio in the global animal vaccine market, aligning with its goal to improve the quality of life worldwide through its products and services

Chapter 1. Middle-East and Africa Silage Additives Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle-East and Africa Silage Additives Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Middle-East and Africa Silage Additives Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle-East and Africa Silage Additives Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Middle-East and Africa Silage Additives Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle-East and Africa Silage Additives Market– By Type

6.1. Introduction/Key Findings

6.2. Silage Inoculants

6.3. Silage Acids

6.4. Silage Preservatives

6.5. Silage Enzymes

6.6. Silage Aerobic Stability Enhancers

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Middle-East and Africa Silage Additives Market– By Application

7.1. Introduction/Key Findings

7.2. Cereals

7.2.1. Corn

7.2.2. Barley

7.2.3. Oats

7.2.4. Wheat

7.2.5. Sorghum

7.3. . Legumes

7.3.1 Peas

7.3.2. . Faba beans

7.3.3. Alfalfa

7.3.4. Clover

7.3.5. Others

7.4. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2023-2030

Chapter 8. Middle-East and Africa Silage Additives Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle-East and Africa Silage Additives Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Incorporated

9.2. Archer Daniels Midland Company

9.3. Kemin Industries

9.4. Selko (a division of Trouw Nutrition)

9.5. Volac International Limited

9.6. Alltech, Inc.

9.7. Nutreco

9.8. Chr. Hansen Holding A/S

9.9. Lallemand Inc.

9.10. Silostop (a division of RKW Group)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East and Africa Silage Additives Market was valued at USD 74.7 Million and is projected to reach a market size of USD 101.45 Million by the end of 2030. Over the outlook period of 2023-2030, the market is anticipated to grow at a CAGR of 3.9%.

Growing livestock production and increasing awareness of forage conservation are expanding the Middle East and Africa Silage Additives market.

Based on type, the Middle East and Africa Silage Additives market is divided into Silage Inoculants, Silage Acids, Silage Preservatives, Silage Enzymes, Silage Aerobic Stability Enhancers, and Others.

South Africa is the most dominant region for the Middle East and Africa Silage Additives Market.

Cargill, Incorporated, Archer Daniels Midland Company, and Kemin Industries are a few of the key players operating in the Middle East and Africa Silage Additives Market