Sanitary Pumps and Valves Market Size (2024 – 2030)

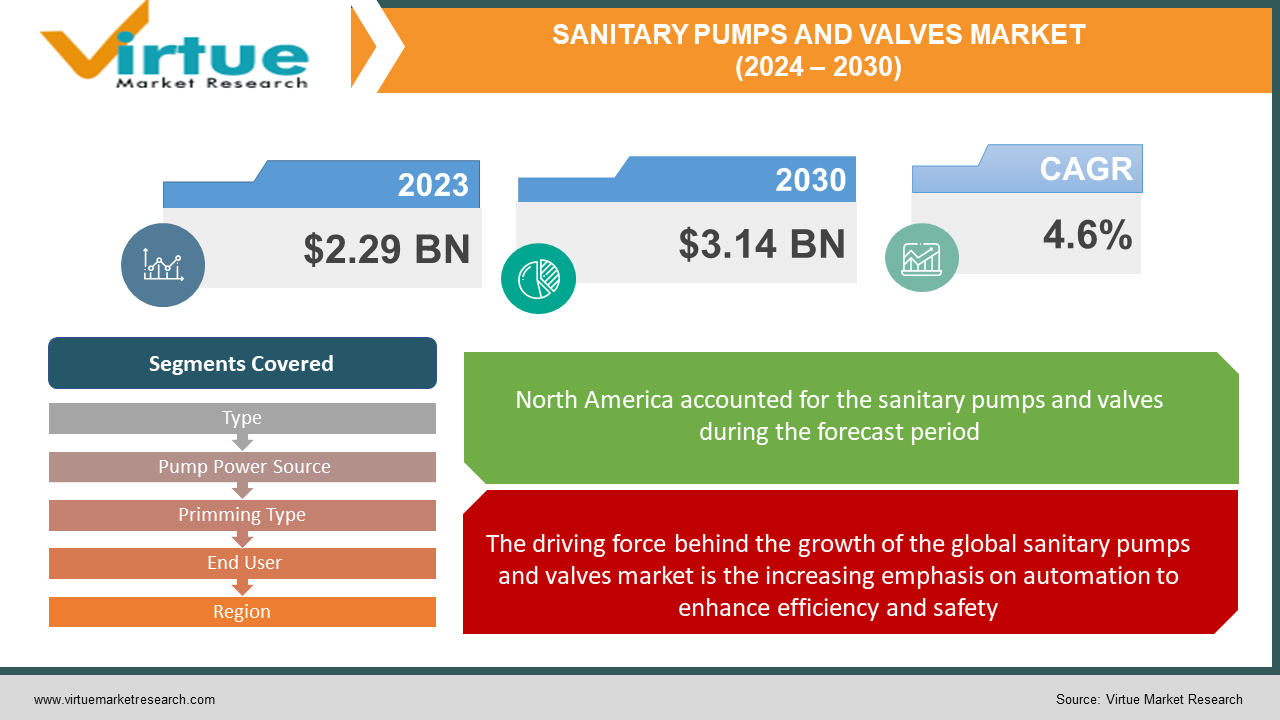

The Global Sanitary Pumps and Valves Market size was exhibited at USD 2.29 billion in 2023 and is projected to hit around USD 3.14 billion by 2030, growing at a CAGR of 4.6% during the forecast period from 2024 to 2030.

Sanitary pumps and valves constitute specialized apparatus employed for the conveyance of slurries and clean liquids within industrial piping systems. The control of fluid flow through the pump is facilitated by pump valves. The expansion of the market is attributed to the global upswing in industrial activities and heightened awareness regarding hygiene across diverse industries. Significant impetuses for the sanitary pump and valve market encompass industrial growth in various sectors, including processed foods, beverages, pharmaceuticals, and dairy products, on a global scale. Furthermore, manufacturers' heightened consciousness of hygiene standards in end-use industries and the delivery of uncontaminated products to end consumers serve as additional drivers for the demand for sanitary pumps and valves in hygiene-centric sectors. The escalating awareness has prompted the formulation of stringent laws and regulations by governmental or affiliated bodies, aimed at upholding safety and hygiene levels in end-use products and industries. These regulatory frameworks can be perceived as catalysts propelling the worldwide expansion of the sanitary pump and valve industry.

Key Market Insights:

The predominant factors steering the global market share of sanitary pumps and valves are rooted in the distinctive attributes of these specialized equipment. Primarily, sanitary pumps operate as specialized apparatus utilizing industrial processing pipelines for the pumping of slurries and hygienic liquids, with pump valves regulating the liquid flow. These components play a pivotal role in the distribution of products intended for human consumption or contact, spanning diverse categories such as dairy products, food, cosmetics, pharmaceuticals, food additives, beverages, fine chemicals, and various other items. Anticipated drivers for the growth of the sanitary pumps and valves market in the foreseeable future include the enforcement of essential government standards to maintain optimal hygiene levels, a growing inclination of businesses towards plant automation, and the introduction of innovative products.

Global Sanitary Pumps and Valves Market Drivers:

The driving force behind the growth of the global sanitary pumps and valves market is the increasing emphasis on automation to enhance efficiency and safety.

Industries are witnessing a pivotal role played by automation, with manufacturers redirecting their focus to incorporate automation strategies for purposes such as ensuring plant safety, elevating operational efficiency, standardizing production processes, and achieving lean manufacturing. The integration of automation facilitates enterprises in curtailing labor, minimizing waste, reducing production costs, averting downtime and inaccuracies, enhancing process quality, and expediting processing times. The incorporation of fluid handling systems, including pumps and valves, stands as a transformative element for process industries. Sectors like food, beverages, pharmaceuticals, and chemicals deploy fluid handling systems to seamlessly transport raw materials and facilitate the conveyance of various fluids or gases during production. Within fluid handling systems, sanitary valves and pumps play pivotal roles, ensuring a seamless transition towards automation. Consequently, the heightened focus on plant automation is fueling the demand for sanitary pumps and valves.

A paramount driver propelling the growth of the global sanitary pumps and valves market is the implementation of stringent government regulations aimed at maintaining optimal hygiene levels.

Manufacturers in the process industry are mandated to adhere to rigorous regulations established by diverse governments to uphold industry hygiene standards and deliver products devoid of contamination to consumers. The food sector, subject to a complex framework of regulations and legislations enacted globally, requires companies within the food chain to meet specific standards to ensure the quality and safety of food products. In the pharmaceutical industry, maintaining high hygiene standards throughout the manufacturing process is imperative to ensure the purity and quality of final products, including materials, equipment, containers, premises, and cleaning and disinfecting products. Adherence to regulations set forth by entities such as the US Food and Drug Administration, the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), and the Thai Food and Drug Administration is mandatory for pharmaceutical manufacturers. Consequently, manufacturers in the pharmaceutical, food, beverage, and dairy sectors are compelled to comply with government rules, leading to the widespread adoption of sanitary equipment and the implementation of hygiene measures within their facilities. This, in turn, amplifies the utilization of various types of sanitary valves and pumps to uphold safety and hygienic protocols, particularly in industrial plants.

Global Sanitary Pumps and Valves Market Restraints and Challenges:

Market growth faces impediments due to considerable fluctuations in the prices of raw materials.

The production of sanitary pumps and valves necessitates the use of odorless, noncorrosive, and nontoxic materials, such as 304L or 316L stainless steel. The pricing of these stainless-steel variants is contingent upon the cost of alloying elements and the quantity of alloy utilized. The unpredictable costs of raw materials impact the overall production expenses of sanitary pumps and valves. Additionally, the significant variability in raw material costs leads to challenges in effective price management and fluctuations in profit margins. These fluctuations in the prices of end-products also have repercussions on the sales of sanitary valves and pumps.

Intense competition from local players and participants in the gray market poses a challenge to market growth.

The sanitary pumps and valves industry is characterized by a high level of fragmentation, with a multitude of players operating within the market. These players extend their offerings globally through robust networks of suppliers and distributors. International manufacturers and distributors contend with various challenges, including transportation costs, pricing differentials, tariffs, sales tax, and additional expenses such as customs duty and shipping charges. The industry ecosystem also encompasses numerous local players and gray market participants, known for procuring products from low-cost regions and distributing them to higher-cost regions through unauthorized channels, bypassing the original manufacturer or trademark proprietor. The heightened competition, especially in emerging regions like Asia Pacific and South America, poses challenges for well-established players in the market.

Global Sanitary Pumps and Valves Market Opportunities:

The adoption of Industrial Internet of Things (IIoT) across process industries presents significant opportunities.

Hygienic pumps and valves equipped with sensors and integrated through IIoT have the potential to assist industry stakeholders in minimizing maintenance and shutdown costs. Traditional monitoring solutions involving retrofitting can be costly, and manual monitoring of diverse hygienic pumps and valves is time-intensive. Remote monitoring of pumps and valves involves various components, including the detection of valve position through retrofit sensor devices attached to the equipment. Integration of a remote monitoring solution in a manufacturing plant enables real-time monitoring of all valves. Hygienic pumps and valves with IIoT capabilities offer advantages such as substantial cost savings, quicker process recovery post-maintenance downtime, enhanced safety, reduced error occurrences and quality deviations, valuable analytics, and prevention of unplanned plant downtime.

SANITARY PUMPS AND VALVES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Type, Pump Power Source, Primming Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Xylem, Inc., Graco, Inc. (Newell Brands Inc.), Alfa Laval AB, KSB SE & Co. KGaA, GEA Group AG, SPX Flow, Inc., Dover Corporation, Spirax Sarco Limited, IDEX Corporation, Verder International B.V. |

Global Sanitary Pumps and Valves Market Segmentation: By Type

-

Centrifugal Pumps

-

Positive Displacement Pumps

The market is categorized by type into centrifugal, positive displacement, and other pump types. In 2023, the positive displacement pumps segment demonstrated significant growth in the market. Positive displacement (PD) pumps, suitable for hygienic and high-purity applications in sanitary end-use industries, are available in various types. These pumps are recognized for transferring fluid by capturing and conveying predetermined amounts of fluid from the pump intake to the pump outlet, utilizing either reciprocating or rotational mechanical force. Efficient pumping of highly viscous fluids is a characteristic shared by positive displacement pumps.

Global Sanitary Pumps and Valves Market Segmentation: By Pump Power Source

-

Electric

-

Air

In terms of pump power source, the market is segmented into electric and air. The electric segment dominated the market in 2023, holding the highest revenue share. Electric sanitary pumps offer precise control over overflow rates and pressure, ensuring reliable performance. This precision is particularly crucial in fields where accurate dosing or handling of delicate materials is required. Electric sanitary pumps often operate more quietly compared to some other pump types, which is advantageous in noise-sensitive environments such as laboratories or tranquil industrial areas.

Global Sanitary Pumps and Valves Market Segmentation: By Primming Type

-

Non-self Primming

-

Self Primming

The market is divided by priming type into self-priming and non-self-priming. The non-self-priming segment achieved the highest revenue share in 2023. Non-self-priming pumps require external priming, involving the pouring of startup liquid into the pump before each initiation. Techniques such as natural priming, priming with a vacuum pump, manual priming, priming with a jet pump, using a separator, installing a foot valve, and priming a pump with an ejector are among the methods employed.

Global Sanitary Pumps and Valves Market Segmentation: By End User

-

Processed Food

-

Dairy

-

Alcoholic Beverage

-

Non-alcoholic Beverage

-

Pharmaceutical

-

Others

Based on end-user, the market is segmented into processed foods, dairy, non-alcoholic beverages, alcoholic beverages, pharmaceuticals, and other end-user industries. The pharmaceutical segment exhibited promising growth in the sanitary pumps and valves market in 2023. The pharmaceutical industry plays a crucial role in significant advancements in human and environmental health, necessitating high-quality and safe product manufacturing. Ensuring the highest product quality mandates a secure, reliable, and efficient production process.

Global Sanitary Pumps and Valves Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Regionally, the market is examined across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific segment captured the maximum revenue share. Over the past two decades, the popularity and consumption of frozen foods and health-focused products have increased. The growth of the processed food industry in the region is fueled by the rising demand for ready-to-eat (RTE) and convenient food options. The expansion of the pharmaceutical, chemical, and processed food sectors is expected to contribute to market growth in this region during the forecast period.

COVID-19 Impact Analysis on the Global Sanitary Pumps and Valves Market:

The advent of the COVID-19 pandemic has led to a global health and economic crisis. The outbreak forced numerous businesses to cease production and suspend operations for the initial two to three months. Industrial purchases, as well as the export and import of consumer goods, were significantly disrupted during this period, impacting the production of sanitary pumps and valves in the first and second quarters of 2020. Companies, faced with the challenges posed by the pandemic, focused on fortifying their operations by exploring safer ways to sustain production or identifying alternative avenues to generate revenue. Notably, the pharmaceutical and food industries experienced a surge in demand during this period. Consequently, two to three months after the initial decline in the pandemic, these sectors rebounded swiftly, leading to a resurgence in demand for sanitary pumps and valves across the market.

Recent Trends and Developments in the Global Sanitary Pumps and Valves Market:

In December 2022, Graco Inc. unveiled QUANTM, an electric-operated double diaphragm pump designed for a broad range of fluid transfer applications. The pump offers a diverse selection of construction materials to support various industrial and hygienic applications, including chemical processing, food and beverage, and pharmaceuticals.

In May 2022, IDEX Corporation announced the acquisition of KZValve, LLC, aimed at expanding precision farming components, including waterproof motorized valves, manifolds, controllers, and related accessories.

In July 2022, Valworx introduced a new line of air-operated sanitary butterfly valves made entirely of stainless steel. These valves, compliant with USDA, FDA, and 3-A standards and featuring Tri-Clamp ends for hygienic connections, are deemed suitable for industries such as pharmaceuticals, food, beverage, personal care, and animal care.

Key Players:

-

Xylem, Inc.

-

Graco, Inc. (Newell Brands Inc.)

-

Alfa Laval AB

-

KSB SE & Co. KGaA

-

GEA Group AG

-

SPX Flow, Inc.

-

Dover Corporation

-

Spirax Sarco Limited

-

IDEX Corporation

-

Verder International B.V.

Chapter 1. SANITARY PUMPS AND VALVES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. SANITARY PUMPS AND VALVES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. SANITARY PUMPS AND VALVES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. SANITARY PUMPS AND VALVES MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. SANITARY PUMPS AND VALVES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. SANITARY PUMPS AND VALVES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Centrifugal Pumps

6.3 Positive Displacement Pumps

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. SANITARY PUMPS AND VALVES MARKET – By Pump Power Source

7.1 Introduction/Key Findings

7.2 Electric

7.3 Air

7.4 Y-O-Y Growth trend Analysis By Pump Power Source

7.5 Absolute $ Opportunity Analysis By Pump Power Source, 2024-2030

Chapter 8. SANITARY PUMPS AND VALVES MARKET – By Primming Type

8.1 Introduction/Key Findings

8.2 Non-self Primming

8.3 Self Primming

8.4 Y-O-Y Growth trend Analysis By Primming Type

8.5 Absolute $ Opportunity Analysis By Primming Type, 2024-2030

Chapter 9. SANITARY PUMPS AND VALVES MARKET – By End User

9.1 Introduction/Key Findings

9.2 Processed Food

9.3 Dairy

9.4 Alcoholic Beverage

9.5 Non-alcoholic Beverage

9.6 Pharmaceutical

9.7 Others

9.8 Y-O-Y Growth trend Analysis By End User

9.9 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 10. SANITARY PUMPS AND VALVES MARKET , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Type

10.1.2.1 By Pump Power Source

10.1.3 By Primming Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Type

10.2.3 By Pump Power Source

10.2.4 By Primming Type

10.2.5 By End User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Type

10.3.3 By Pump Power Source

10.3.4 By Primming Type

10.3.5 By End User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Type

10.4.3 By Pump Power Source

10.4.4 By Primming Type

10.4.5 By End User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Type

10.5.3 By Pump Power Source

10.5.4 By Primming Type

10.5.5 By End User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. SANITARY PUMPS AND VALVES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Xylem, Inc.

11.2 Graco, Inc. (Newell Brands Inc.)

11.3 Alfa Laval AB

11.4 KSB SE & Co. KGaA

11.5 GEA Group AG

11.6 SPX Flow, Inc.

11.7 Dover Corporation

11.8 Spirax Sarco Limited

11.9 IDEX Corporation

11.10 Verder International B.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Sanitary Pumps and Valves Market size is valued at USD 2.29 billion in 2023.

The worldwide Global Sanitary Pumps and Valves Market growth is estimated to be 4.6% from 2024 to 2030.

The Global Sanitary Pumps and Valves Market is segmented By Type (Centrifugal, Positive Displacement, Other Pump Types), By Pump Power Source (Air, Electric), By Priming Type (Self-Priming, Non-Self-Priming), By End-User (Processed Foods, Dairy, Non-Alcoholic Beverages, Alcoholic Beverages, Pharmaceuticals, Other End-User Industries.

Future trends in the Global Sanitary Pumps and Valves Market may include increased adoption of smart technologies, advancements in material sciences for enhanced product durability, and rising demand in emerging markets. Opportunities lie in catering to evolving industry needs, sustainability initiatives, and expanding applications in diverse sectors.

The COVID-19 pandemic significantly disrupted the Global Sanitary Pumps and Valves Market, causing production halts, supply chain disruptions, and fluctuations in demand. However, a post-pandemic rebound was observed, driven by heightened demand in pharmaceutical and food industries, showcasing resilience and recovery.