Solenoid Valve Market Size (2024 – 2030)

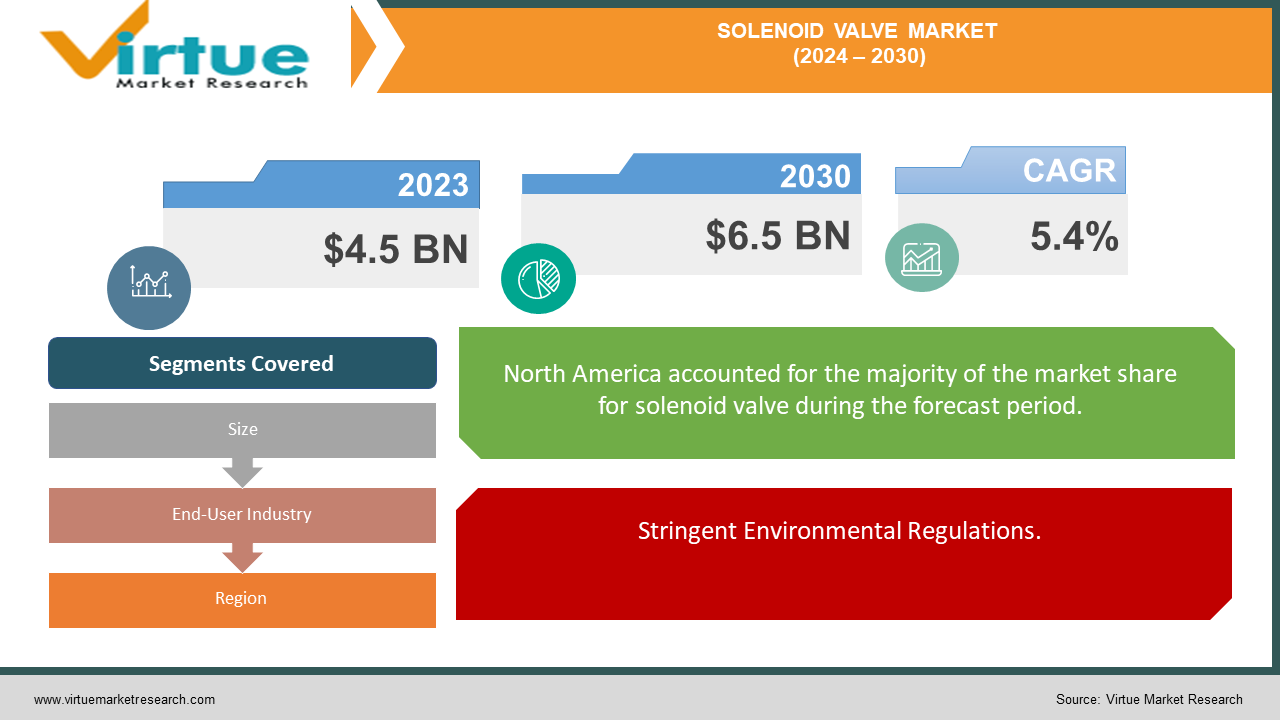

The Global Solenoid Valve Market was valued at USD 4.5 billion in 2023 and is projected to reach a market size of USD 6.5 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 5.4% between 2024 and 2030.

The Global Solenoid Valve Market has experienced significant growth, driven by the increasing demand for automation across various industries such as oil and gas, water and wastewater, chemicals, and automotive. Solenoid valves, known for their reliability and efficiency, play a crucial role in controlling the flow of fluids and gases in industrial processes. Their ability to provide precise control and quick response times has made them indispensable in modern automation systems. Technological advancements have led to the development of more robust and versatile solenoid valves, catering to a wide range of applications. Additionally, the rise of Industry 4.0 and the growing adoption of smart manufacturing practices are further propelling the market. With the integration of IoT and AI, solenoid valves are becoming smarter, enabling real-time monitoring and predictive maintenance, thus enhancing operational efficiency and reducing downtime. Environmental regulations and the need for energy-efficient solutions are also boosting the adoption of solenoid valves, as they contribute to sustainable practices by minimizing energy consumption. As industries continue to evolve and demand more sophisticated fluid control solutions, the global solenoid valve market is poised for sustained growth, offering ample opportunities for innovation and advancement.

Key Market Insights:

Over 40% of demand is driven by the need for efficient and precise control systems in industrial automation.

The oil and gas sector accounts for about 25% of the market share, valued for reliability and high-pressure handling.

Approximately 20% of sales are attributed to water and wastewater management, essential for water flow regulation and environmental compliance.

Asia-Pacific holds a 35% market share, followed by North America with 30% and Europe with 25%.

15% of new products feature smart technology, including IoT connectivity and real-time monitoring.

The adoption of energy-efficient solenoid valves is growing at 6% annually, reducing energy consumption and operational costs.

The automotive industry represents around 10% of the market, used in fuel injection and HVAC systems.

Compliance with environmental regulations is driving adoption, contributing to 4% annual market growth.

Global Solenoid Valve Market Drivers:

Increasing Industrial Automation.

The surge in industrial automation is a key driver propelling the Global Solenoid Valve Market. As industries across the globe adopt automated systems to enhance efficiency, productivity, and precision, the demand for solenoid valves has risen sharply. These valves are integral components in automated control systems, providing reliable and accurate regulation of fluid and gas flow. Industries such as manufacturing, pharmaceuticals, and food processing are increasingly utilizing solenoid valves to achieve seamless operations and reduce human intervention. The integration of solenoid valves with advanced technologies like the Internet of Things (IoT) and artificial intelligence (AI) has further enhanced their functionality, enabling real-time monitoring and predictive maintenance. This technological synergy not only optimizes operational performance but also minimizes downtime and maintenance costs. Consequently, the push towards Industry 4.0 and smart manufacturing is expected to continue driving the demand for solenoid valves, as companies strive for greater operational efficiency and competitive advantage.

Stringent Environmental Regulations.

Stringent environmental regulations imposed by governments and regulatory bodies worldwide are another significant driver for the Global Solenoid Valve Market. These regulations aim to mitigate environmental impact and promote sustainable practices across various industries, including oil and gas, chemical, and water treatment. Solenoid valves play a crucial role in ensuring compliance with these regulations by providing precise control over the release of fluids and gases, thereby reducing emissions and preventing contamination. In the oil and gas sector, for instance, solenoid valves are used to control the flow of hazardous materials, ensuring safe and environmentally friendly operations. Similarly, in water and wastewater management, these valves help in efficiently managing water resources and preventing water pollution. The increasing focus on environmental sustainability has led to a growing adoption of energy-efficient solenoid valves, which not only comply with regulatory standards but also help industries reduce their carbon footprint. As environmental concerns continue to rise, the demand for solenoid valves that facilitate regulatory compliance and promote eco-friendly operations is expected to grow steadily.

Global Solenoid Valve Market Restraints and Challenges:

The Global Solenoid Valve Market faces several restraints and challenges that could hinder its growth. One of the primary challenges is the high cost associated with the installation and maintenance of solenoid valves, especially in advanced applications requiring specialized materials and technologies. This cost factor can be a significant deterrent for small and medium-sized enterprises (SMEs), limiting widespread adoption. Additionally, the susceptibility of solenoid valves to malfunction in harsh environments, such as extreme temperatures or corrosive conditions, poses a reliability issue. These malfunctions can lead to operational downtimes and increased maintenance costs, impacting the overall efficiency of industrial processes. Another restraint is the competition from alternative technologies, such as motorized valves and pneumatic actuators, which offer similar functionalities with varying advantages and disadvantages. The need for skilled personnel to operate and maintain solenoid valve systems also presents a challenge, as the shortage of trained technicians can impede optimal utilization. Moreover, global supply chain disruptions, driven by geopolitical tensions and economic uncertainties, can affect the availability of raw materials and components, leading to production delays and increased costs. Addressing these challenges requires continuous innovation, investment in robust materials, and the development of cost-effective solutions to ensure the sustainable growth of the solenoid valve market.

Global Solenoid Valve Market Opportunities:

The Global Solenoid Valve Market presents significant opportunities driven by the rapid advancements in technology and the increasing demand for automation across various sectors. One of the key opportunities lies in the integration of solenoid valves with smart technologies such as the Internet of Things (IoT) and artificial intelligence (AI). This integration enables real-time monitoring, predictive maintenance, and enhanced operational efficiency, making solenoid valves more attractive to industries seeking to optimize their processes and reduce downtime. Additionally, the growing emphasis on energy efficiency and sustainability is creating a demand for innovative solenoid valve designs that minimize energy consumption and support eco-friendly operations. The expanding applications of solenoid valves in emerging sectors such as renewable energy, electric vehicles, and smart water management systems also offer lucrative growth prospects. Furthermore, the increasing infrastructure development in developing regions, particularly in Asia-Pacific and Latin America, provides a substantial market opportunity as industries in these regions modernize and adopt advanced fluid control solutions. The continuous evolution of manufacturing practices and the rise of Industry 4.0 further underscore the potential for solenoid valves to become integral components in smart manufacturing ecosystems. By leveraging these opportunities, companies can drive growth, enhance market presence, and meet the evolving needs of diverse industries.

SOLENOID VALVE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.4% |

|

Segments Covered |

By Size, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ASCO Valve, Inc., Emerson Electric Co., Parker Hannifin Corporation, Danfoss A/S, Christian Bürkert GmbH & Co. KG, IMI Precision Engineering, Festo AG & Co. KG, SMC Corporation, Honeywell International Inc., Bosch Rexroth AG |

Global Solenoid Valve Market Segmentation: By Size

-

Micro-miniature

-

Sub-miniature

-

Miniature

-

Small diaphragm

-

Large diaphragm

The Global Solenoid Valve Market by Size and sub-miniature market share last year and is poised to maintain its dominance throughout the forecast period. Technological advancements in manufacturing processes have significantly impacted the solenoid valve market, leading to cost reductions and performance enhancements across various valve sizes, making them more competitive. Industry trends are also shaping the demand for different valve sizes; for instance, a shift towards larger-scale industrial operations can increase the need for larger solenoid valves capable of handling higher flow rates and pressures. Emerging applications, particularly those requiring high flow or pressure capabilities, further drive the demand for larger valves. Regional variations play a crucial role as well, with market preferences and growth rates differing across regions, which impacts the demand for specific valve sizes. Although the sub-miniature solenoid valve segment has seen growth, it is expected to coexist with other valve sizes, each experiencing unique growth trajectories influenced by industry-specific trends and technological developments. A comprehensive understanding of the sub-miniature solenoid valve market requires an analysis of industry-specific needs, geographical market trends, and recent market reports. By considering these factors, one can achieve a nuanced assessment of the market, reflecting the balanced perspective that different valve sizes will continue to serve distinct applications and regions.

Global Solenoid Valve Market Segmentation: By End-User Industry

-

Oil & gas

-

Chemical & petrochemical

-

Power generation

-

Automotive

-

Food & beverage

-

Pharmaceutical

-

Medical

The Global Solenoid Valve Market by End-User Industry, Oil& gas market share last year and is poised to maintain its dominance throughout the forecast period. Fluctuations in oil prices have a significant impact on the solenoid valve market, particularly within the oil and gas sector. A decline in oil prices often leads to reduced investments in exploration and production, which in turn affects the demand for solenoid valves used in these processes. Additionally, the global shift towards renewable energy sources can divert investments from traditional fossil fuels, influencing the growth of the oil and gas industry and consequently, the demand for solenoid valves. Technological advancements also play a role, as improvements in valve technology and the development of alternative valve types may impact the preference for solenoid valves in this sector. However, the rapid growth of other end-user industries such as chemical processing, water treatment, and automotive is increasing their demand for solenoid valves. As these sectors expand, they contribute to a more balanced distribution of solenoid valve demand across various industries. To gain a clearer understanding of the oil and gas industry's role in the solenoid valve market, it is essential to consider regional variations in industry influence, specific valve types and applications, and long-term industry trends. By incorporating these factors, a more accurate assessment of the market dynamics and the oil and gas sector's position can be achieved.

Global Solenoid Valve Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global Solenoid Valve Market by Region, North America market share last year and is poised to maintain its dominance throughout the forecast period. Economic conditions in North America significantly influence the demand for solenoid valves across various industries, as economic fluctuations can impact industrial investments and operational budgets. Additionally, the global trend of manufacturing shifting to regions with lower labor costs could affect the production and consumption of solenoid valves in North America, potentially leading to changes in market dynamics and supply chains. Conversely, rapid industrialization in emerging markets such as China and India is driving increased demand for solenoid valves, as these regions expand their infrastructure and industrial capabilities. Technological advancements in solenoid valve technology also present both challenges and opportunities, potentially disrupting existing market structures while creating new growth avenues in different regions. While North America remains a substantial market for solenoid valves, it is essential to acknowledge the growing influence of other regions, particularly emerging economies, which are playing an increasingly significant role in the global market. To gain a clearer picture of North America's position, it is crucial to consider specific industry demands within the region, compare its market share with other regions, and analyze long-term industry trends to predict future market dynamics. By considering these factors, a more accurate assessment of North America's role and the overall competitive landscape in the solenoid valve market can be achieved.

COVID-19 Impact Analysis on the Global Solenoid Valve Market.

The COVID-19 pandemic had a multifaceted impact on the Global Solenoid Valve Market. Initially, the market experienced significant disruptions due to lockdowns, supply chain interruptions, and halted manufacturing activities. These disruptions led to delays in production and delivery of solenoid valves, adversely affecting market growth. Industries such as automotive, oil and gas, and manufacturing, which are major consumers of solenoid valves, faced operational challenges, reducing their demand temporarily. However, the pandemic also highlighted the critical need for automation and remote monitoring to maintain operational continuity with minimal human intervention. As a result, there was a surge in demand for solenoid valves in sectors like pharmaceuticals, healthcare, and water treatment, which were essential for pandemic response efforts. The increased focus on enhancing healthcare infrastructure and ensuring an uninterrupted supply of essential utilities drove the adoption of solenoid valves for precise fluid control and automation. Additionally, the acceleration of Industry 4.0 and smart manufacturing initiatives during the pandemic underscored the importance of advanced fluid control solutions. As economies gradually recover and industrial activities resume, the solenoid valve market is poised for a rebound, driven by the sustained demand for automation, energy efficiency, and resilient supply chain strategies to mitigate future disruptions.

Latest trends / Developments:

The Global Solenoid Valve Market is witnessing several latest trends and developments that are shaping its future landscape. One significant trend is the increasing integration of solenoid valves with the Internet of Things (IoT) and artificial intelligence (AI) technologies. This integration allows for real-time monitoring, predictive maintenance, and enhanced operational efficiency, making solenoid valves smarter and more responsive to industrial needs. Another notable development is the growing demand for energy-efficient and environmentally friendly solenoid valves, driven by stringent regulatory standards and the global push towards sustainability. Innovations in materials and design, such as the use of corrosion-resistant alloys and miniaturization, are enhancing the durability and performance of solenoid valves in harsh environments. The rise of Industry 4.0 and smart manufacturing is further propelling the adoption of advanced solenoid valves that offer precise control and automation capabilities. Additionally, the expansion of applications in emerging sectors like renewable energy, electric vehicles, and smart water management systems is creating new growth opportunities. The market is also seeing increased investment in research and development to develop customized solutions that cater to specific industry requirements. These trends highlight the dynamic nature of the solenoid valve market, driven by technological advancements and evolving industrial demands.

Key Players:

-

ASCO Valve, Inc.

-

Emerson Electric Co.

-

Parker Hannifin Corporation

-

Danfoss A/S

-

Christian Bürkert GmbH & Co. KG

-

IMI Precision Engineering

-

Festo AG & Co. KG

-

SMC Corporation

-

Honeywell International Inc.

-

Bosch Rexroth AG

Chapter 1. Solenoid Valve Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Solenoid Valve Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Solenoid Valve Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Solenoid Valve Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Solenoid Valve Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Solenoid Valve Market – By Size

6.1 Introduction/Key Findings

6.2 Micro-miniature

6.3 Sub-miniature

6.4 Miniature

6.5 Small diaphragm

6.6 Large diaphragm

6.7 Y-O-Y Growth trend Analysis By Size

6.8 Absolute $ Opportunity Analysis By Size, 2024-2030

Chapter 7. Solenoid Valve Market – By End-User Industry

7.1 Introduction/Key Findings

7.2 Oil & gas

7.3 Chemical & petrochemical

7.4 Power generation

7.5 Automotive

7.6 Food & beverage

7.7 Pharmaceutical

7.8 Medical

7.9 Y-O-Y Growth trend Analysis By End-User Industry

7.10 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. Solenoid Valve Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Size

8.1.3 By End-User Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Size

8.2.3 By End-User Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Size

8.3.3 By End-User Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Size

8.4.3 By End-User Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Size

8.5.3 By End-User Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Solenoid Valve Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ASCO Valve, Inc.

9.2 Emerson Electric Co.

9.3 Parker Hannifin Corporation

9.4 Danfoss A/S

9.5 Christian Bürkert GmbH & Co. KG

9.6 IMI Precision Engineering

9.7 Festo AG & Co. KG

9.8 SMC Corporation

9.9 Honeywell International Inc.

9.10 Bosch Rexroth AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global Solenoid Valve market is expected to be valued at US$ 4.5 billion.

Through 2030, the Global Solenoid Valve market is expected to grow at a CAGR of 5.4%.

By 2030, the Global Solenoid Valve Market is expected to grow to a value of US$ 6.5 billion.

North America is predicted to lead the Global Solenoid Valve market.

The Global Solenoid Valve Market has segments By Mounting Type, Product Type, Application, and Region.