Reverse Osmosis Membranes Market Size (2025-2030)

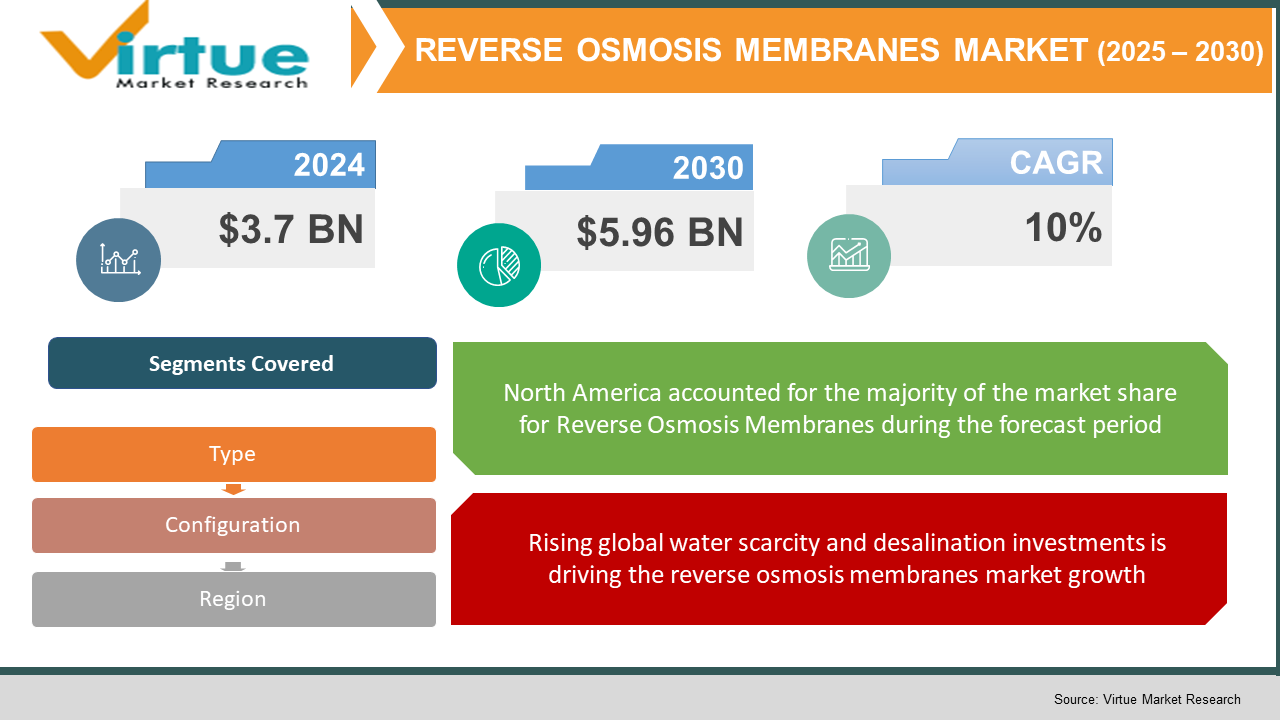

The Global Reverse Osmosis Membranes Market was valued at USD 3.7 billion in 2024 and is projected to reach approximately USD 5.96 billion by 2030, growing at a CAGR of 10% during the forecast period, 2025-2030.

Reverse osmosis membranes are semi‑permeable filtration components—primarily thin‑film composites (TFC) and cellulose‑based—used in desalination, municipal and industrial water purification, and wastewater treatment. Applications include potable drinking water, brackish/saline sources, and industrial process water. Growth is driven by rising water scarcity, environmental regulations, desalination infrastructure investments, and industrial demand from sectors like power, pharmaceuticals, and food & beverage.

Key market insights:

According to a study published on ScienceDirect, there are approximately 16,000 to 23,000 desalination plants operating worldwide, producing nearly 95 million cubic meters of freshwater per day.

Seawater RO membranes operate at pressures of 800–1,200 psi, while brackish water membranes require only 200–400 psi, influencing energy and equipment design. Energy recovery systems used in RO plants can reduce energy consumption by up to 60%, improving the cost-efficiency of RO membrane operations.

Membrane replacement cycles typically range from 3 to 5 years, depending on application and maintenance, generating recurring revenue for manufacturers.

Membrane fouling is responsible for up to 30–50% of total operating costs in RO systems, underscoring the demand for fouling-resistant technologies.

With global freshwater availability dropping below 4,000 cubic meters per capita in many countries, the urgency to adopt RO technologies continues to grow.

As reported by The Source Magazine, global desalination capacity is projected to double by 2030, exceeding 250 million cubic meters per day, largely driven by advancements in membrane technology.

According to a report by The Source Magazine, global freshwater output from desalination has increased from about 80 million cubic meters per day in 2016 to around 120 million cubic meters per day in 2022.

Global Reverse Osmosis Membranes Market Drivers

Rising global water scarcity and desalination investments is driving the reverse osmosis membranes market growth

With over 2 billion people lacking access to safe drinking water and more projected to experience shortages by 2050, governments and industries are ramping up desalination infrastructure. Seawater reverse osmosis (SWRO) now supplies roughly 69 % of desalinated water globally, and arid regions like the Middle East and North Africa rely on it for up to 90 % of potable water needs. Large‑scale projects—such as those in GCC and Chile’s mining sites—are deploying advanced thin‑film nanocomposite membranes (e.g., LG NanoH2O) to lower pressure operation, energy use, and operational costs. Investments in municipal water reuse and wastewater reclamation are also increasing due to strict discharge regulations, enhancing demand for robust reverse osmosis modules capable of handling industrial effluents.

Shift toward thin-film composite and spiral-wound modules is accelerating the reverse osmosis membranes market growth

Membrane technology advancements are reshaping the market landscape like never before. Thin‑film composite (TFC) membranes dominate due to superior salt rejection, flux rates, and fouling resistance. Spiral‑wound configuration leads due to modularity, high packing density, and maintenance ease, capturing large module demand.

Industrial and municipal environmental regulations is driving the reverse osmosis membrane market growth

Industries such as pharmaceuticals, power, food & beverage, and chemicals require ultra‑pure and treated water, driving uptake of RO membranes. ZLD (zero liquid discharge) requirements and stricter effluent standards in North America, Europe, and China intensify the need for efficient RO systems capable of high rejection and wastewater volume reduction. Municipal initiatives for water reuse, recycling, and desalination projects—such as Dubai’s solar-powered Hassyan plant—further support consistent market expansion.

Global Reverse Osmosis Membranes Market Challenges and Restraints

Membrane fouling and scaling is restricting otherwise reverse osmosis membrane market growth.

Membrane fouling—caused by biological, organic, particulate, or scaling agents—remains a primary technical challenge in RO operations. Scaling, particularly from sparingly soluble salts, can halve permeate flux, urging frequent cleaning cycles, and accelerating module replacement. Fouling also degrades mechanical integrity, increasing brittleness and reducing lifespan. Pretreatment systems, chemical cleaning, or membrane modifications raise capital and operational costs. Fouling-induced downtimes hinder efficiency and ROI, especially in industrial environments.

High capital and operational expenditures is hindering the reverse osmosis membrane market growth.

RO systems—especially industrial or desalination plants—require substantial upfront investment. Industrial-scale installations often cost between USD 0.5 and 3 million, with membranes accounting for 25–30 % of long-term operation costs. Energy costs remain significant despite improved efficiency; RO plants account for about 0.5 % of global electricity usage. These expenses inhibit deployment in small municipalities or resource-constrained regions. Additionally, alternatives like forward osmosis and advanced oxidation offer competitive routes in low-salinity water treatment, limiting RO penetration in those segments.

Market Opportunities

With increasing water stress, environmental mandates, and industrial water quality needs, the RO membranes market offers numerous opportunities. Developing regions—particularly Asia-Pacific, Middle East, and Africa—present greenfield potential as governments invest in desalination and water reuse infrastructure. Asia-Pacific already holds 32–55 % of market revenue and is expanding rapidly due to urbanization and industrial growth. This growth can be captured through locally built manufacturing capacity, as seen in the Toray–Saudi JV, and tailored solutions for brackish water applications in rural or agricultural sectors. Technological differentiation offers additional prospects. Ultra-low energy and nanocomposite membranes reduce energy footprint and operational expenses, appealing to energy-conscious desalination plants. Strategic partnerships—like LG’s work at the Minera Escondida plant—showcase successful performance validation. Vertical integration with pretreatment, monitoring, and analytics can differentiate offerings. As sustainability becomes central, opportunity lies in carbon-neutral desalination, solar-powered RO plants, and traceable recycling. Finally, graphyne and advanced nanomaterials represent future breakthroughs, promising membranes with vastly improved flux and selectivity. By addressing fouling, reducing lifecycle costs, and expanding into underserved regions, providers can capture significant market share.

REVERSE OSMOSIS MEMBRANES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Type, configuration, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

|

Reverse Osmosis Membranes Market segmentation

Reverse Osmosis Membranes Market Segmentation By Type:

- Thin‑film composite (TFC) membranes

- Cellulose‑based membranes

By type, the reverse osmosis membranes market is segmented into two segments – thin-film composite (TFC)membranes, and cellulose-based membranes. Thin‑film composite membranes dominate the Reverse Osmosis market, accounting for approximately 57–70 % of global share. Their multi-layered polyamide-based design delivers high salt rejection, excellent permeability, and robust resistance to fouling and chemical degradation. These properties make TFC membranes the preferred choice for high-demand applications including seawater and brackish desalination, municipal purification, and industrial processes.

Ongoing R&D is focused on nanomaterials—like nanocomposite layers and graphyne—to increase permeability and durability while lowering energy consumption. These innovation trends support adoption across municipal, industrial, and desalination sectors, reinforcing growth trajectories.

Reverse Osmosis Membranes Market Segmentation By Configuration:

- Spiral‑wound

- Hollow‑fiber

- Tubular

- Plate and frame

By configuration, the reverse osmosis membranes market is segmented into four segments – spiral-wound, hollow-fiber, tubular, plate and frame. Spiral‑wound modules are the leading configuration in the Reverse Osmosis Membranes Market, capturing roughly 40–55 % of module demand. Their compact, modular design maximizes membrane surface area per vessel, enabling efficient operation in space‑constrained plants. The configuration supports easy installation, replacement, and scalability, which streamlines maintenance and lowers operational costs. Spiral‑wound modules are extensively used in municipal water treatment, desalination, and various industrial applications. Manufacturers are further enhancing durability and chemical resistance in modern spiral modules . Their proven performance, flexibility, and user-friendly design make them the preferred module across sectors.

Reverse Osmosis Membranes Market Regional Segmentation

- North America

- Asia‑Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the reverse osmosis membranes market, accounting for around 35–43% of global revenue in 2024. The United States of America and Canada maintain leadership through large-scale municipal and industrial deployments supported by robust environmental regulations, high digital maturity, and presence of key players. Regulatory pressure for wastewater reuse, desalination, and zero-liquid discharge has spurred investment in advanced RO systems. North America hosts many membrane manufacturers and R&D centers—such as Dow/DuPont (FilmTec), Toray North America, Hydranautics, and Pentair—ensuring continuous technological innovations. Municipal projects, industrial growth, and infrastructure upgrades enable broad adoption. While Asia-Pacific shows strongest growth momentum, North America retains its edge through mature infrastructure, regulatory frameworks, and innovation pipelines, positioning it for sustained leadership through 2030.

COVID‑19 Impact Analysis on the Reverse Osmosis Membranes Market

The COVID‑19 pandemic highlighted global water supply challenges and disrupted industrial operations, which turned areas of water treatment into strategic priorities. As healthcare, sanitation, and manufacturing facilities experienced surges in demand, pressure rose on existing water purification systems. Lockdowns slowed new plant construction, delaying membrane system deployments in 2020. However, the crisis also accelerated digitization and remote monitoring of water infrastructure. Industries fast‑tracked reverse osmosis membrane investments to support hospital water supplies, essential manufacturing operations, and emergency municipal water treatment programs. Governments in water‑stressed regions allocated stimulus funds for infrastructure resilience, directing resources toward decoupling water treatment from labor‑intensive operations, and emphasizing energy‑efficient reverse osmosis systems. The pandemic underscored vulnerabilities in supply chains. Lockdowns in China and India affected membrane component availability, prompting focus on local manufacturing and supplier diversification—as seen with the Toray–Saudi JV to build regional capacity . By 2022, postponed projects resumed with renewed urgency lines on continued water security. Companies opted for smart, modular reverse osmosis deployments with remote diagnostics and advanced pre‑treatment to handle future disruptions. Though COVID‑19 vaccine rollout reduced emergency demand, structural shifts—digital-enabled plants, localized production, automation, energy optimization—persist. The pandemic elevated reverse osmosis membranes from operational component to strategic asset in water resiliency and infrastructure planning moving forward.

Latest trends/Developments

Several trends are shaping the reverse osmosis membranes market landscape. First, nanocomposite and ultra‑low energy TFC membranes—such as LG NanoH2O—are being deployed in large desalination sites, lowering operating pressure, energy consumption, and total costs. Second, nascent materials research like graphyne monolayers promise near‑perfect salt rejection and water permeability orders of magnitude above current membranes. Third, modular spiral‑wound configurations are being enhanced with anti‑fouling coatings and improved chemical resistance to reduce downtime and maintenance. Fourth, smart reverse osmosis systems incorporating IoT sensors, remote monitoring, and AI‑based maintenance scheduling are gaining traction, enabling predictive servicing and continuous optimization. Fifth, sustainability is moving beyond energy efficiency to include solar‑driven desalination and carbon‑neutral plant designs, as in Dubai’s Hassyan solar‑powered reverse osmosis project . Sixth, geographical diversification is underway through local JV plants, such as Toray–Saudi and LG in Chile, reducing supply chain risk and supporting regional development . Finally, integration of reverse osmosis into wastewater reuse and industrial ZLD systems addresses tightening effluent regulations. Combined, these trends make the market more resilient, innovative, and aligned with global challenges like water scarcity, carbon emissions, and supply chain security.

Key Players:

- Dow/DuPont (FilmTec)

- Toray Industries

- LG Chem

- SUEZ Water Technologies & Solutions

- Hydranautics (Nitto Group)

- Pentair

- Veolia

- Toyobo

- Koch Membrane Systems

- LANXESS

Chapter 1. Reverse Osmosis Membranes Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary source

1.5. Secondary source

Chapter 2. REVERSE OSMOSIS MEMBRANES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. REVERSE OSMOSIS MEMBRANES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. REVERSE OSMOSIS MEMBRANES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. REVERSE OSMOSIS MEMBRANES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. REVERSE OSMOSIS MEMBRANES MARKET – By Type

6.1 Introduction/Key Findings

6.2 Thin film composite (TFC) membranes

6.3 Cellulose based membranes

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. REVERSE OSMOSIS MEMBRANES MARKET – By Configuration

7.1 Introduction/Key Findings

7.2 Spiral wound

7.3 Hollow fiber

7.4 Tubular

7.5 Plate and frame

7.6 Y-O-Y Growth trend Analysis By Configuration

7.7 Absolute $ Opportunity Analysis By Configuration , 2025-2030

Chapter 8. REVERSE OSMOSIS MEMBRANES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Configuration

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Configuration

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Configuration

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Configuration

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Configuration

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. REVERSE OSMOSIS MEMBRANES MARKET – Company Profiles – (Overview, Product Type , Portfolio, Financials, Strategies & Developments)

9.1 Dow/DuPont (FilmTec)

9.2 Toray Industries

9.3 LG Chem

9.4 SUEZ Water Technologies & Solutions

9.5 Hydranautics (Nitto Group)

9.6 Pentair

9.7 Veolia

9.8 Toyobo

9.9 Koch Membrane Systems

9.10 LANXESS

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Reverse Osmosis Membranes Market was valued at USD 3.7 billion in 2024 and is projected to reach approximately USD 5.96 billion by 2030, growing at a CAGR of 10% during the forecast period, 2025-2030.

Rising global water scarcity and desalination investments, shift toward thin-film composite and spiral-wound modules, industrial and municipal environmental regulations are the key factors driving the reverse osmosis membrane market growth.

Segments under the global reverse osmosis membranes market include Type (Thin film composite (TFC) membranes, Cellulose based membranes), and Configuration (Spiral wound, Hollow fiber, Tubular, Plate and frame),

North America leads with approximately 35–43 % share in 2024, driven majorly by infrastructure maturity, strict regulation, and presence of major manufacturers in the region.

Leading players in the global osmosis membranes market include Dow/DuPont (FilmTec), Toray Industries, LG Chem, SUEZ, Hydranautics, Pentair, Veolia, Toyobo, Koch Membrane Systems, and LANXESS.