Water Filters Market Size (2024 – 2030)

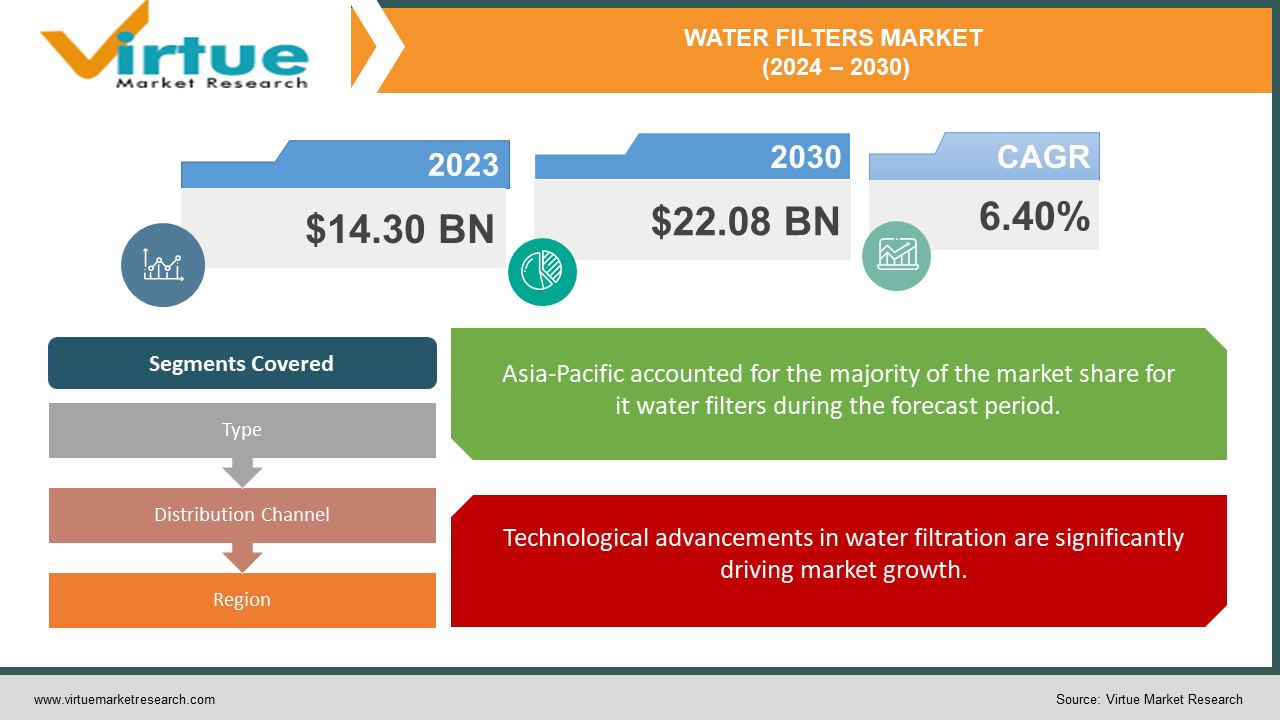

The Global Water Filters Market was valued at USD 14.30 Billion in 2023 and is projected to reach a market size of USD 22.08 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.40%.

The market for water filters worldwide has grown significantly in the last several years, and from 2024 to 2030, this trend is expected to persist. Concerns over the safety and purity of water have led to an increased need for water filters, which are vital tools for eliminating pollutants and impurities from the water. These filters are used in a variety of contexts, such as homes, businesses, and industries, and they are essential to guarantee that people have access to safe and clean drinking water. Significant developments in water filtration technologies have been made in the market, resulting in the creation of filtration systems that are more effective and efficient. The efficacy of water filters has been enhanced by innovations including reverse osmosis, ultraviolet (UV) filtration, activated carbon filters, and nanofiltration, making them more dependable in eliminating a wide range of contaminants.

Key Market Insights:

Reverse osmosis filters hold 25% of the market share by type. Activated carbon filters account for 30% of the market share by type.

UV filters represent 15% of the market share by type. Ceramic filters hold 8% of the market share by type.

Retail stores account for 45% of the distribution channel market share. Direct sales contribute to 15% of the distribution channel market share.

Latin America’s market is expected to grow at a CAGR of 6.5% from 2023 to 2030.

The industrial water filters segment accounts for 28% of the market revenue. The commercial water filters segment holds 32% of the market revenue.

Over 70% of households in the United States use some form of water filtration system. The bottled water industry saw a decline of 5% in regions with high water filter adoption.

The average cost of a reverse osmosis system ranges from $150 to $500.

UV water purification systems cost between $100 and $400 on average.

The average lifespan of an activated carbon filter is 6 to 12 months. The reverse osmosis membrane replacement cycle is typically 2 to 3 years.

The average annual maintenance cost for a home water filter system is $100.

Water filters reduce plastic bottle usage by approximately 50% in households with high adoption rates. Global water filtration systems reduce over 1 million metric tons of plastic waste annually.

Water Filters Market Drivers:

The escalating incidence of waterborne diseases worldwide is a critical driver of the water filters market.

The main cause of waterborne illnesses such cholera, dysentery, and typhoid is drinking tainted water. These illnesses carry serious health hazards, especially in underdeveloped nations with poor access to clean water. Reliable water filtration systems are in greater demand as people become more conscious of the health dangers connected to consuming unclean water. By eliminating dangerous bacteria and impurities from drinking water, water filters are essential in the fight against illnesses spread by contaminated water. Water filtration systems are becoming more and more popular among homes, businesses, schools, and hospitals as a way to guarantee the security of their water supply. As part of their initiatives to enhance public health, governments and non-governmental organizations (NGOs) are also encouraging the use of water filters.

Technological advancements in water filtration are significantly driving market growth.

Through the development of more effective and efficient methods for eliminating impurities from water, innovations like reverse osmosis, UV filtration, and nanofiltration have completely transformed the market for water filters. For example, reverse osmosis (RO) technology uses a semipermeable membrane to eliminate a variety of pollutants, such as hazardous microbes, dissolved solids, and heavy metals. RO filters are widely used in industrial, commercial, and residential settings because of their exceptional ability to provide safe and clean drinking water. UV filtration technique kills bacteria, viruses, and other microbes in water by using ultraviolet light. In order to offer thorough water purification, UV filters are frequently employed in conjunction with other filtering techniques. They are especially good at guaranteeing microbiological safety.

Water Filters Market Restraints and Challenges:

The high upfront cost of sophisticated filtering systems is one of the main issues confronting the water filter business. While more sophisticated systems like UV and reverse osmosis filters can be costly to buy and install, basic water filters are often reasonably priced. Price-conscious customers may be turned off by this high initial cost, which also restricts market penetration in poorer nations. The advantages of water filtration are not well known, and access to water filtration products is sometimes restricted in rural regions. This problem is especially noticeable in developing nations because to their inadequate infrastructure and distribution systems. To overcome this obstacle, initiatives to increase rural residents' awareness of water safety and to expand their access to water filtration devices are crucial.

Water Filters Market Opportunities:

The water filter market has a lot of room to develop in emerging regions including South America, Africa, and Asia. The need for clean drinking water is rising in these areas as a result of urbanization, industrial development, and economic expansion. An environment that is conducive to the adoption of water filtration systems is being created by governments and international organizations investing in water infrastructure and sanitation initiatives. Businesses may get into these markets by providing reasonably priced, effective water filters that are suited to the unique requirements of these areas. There are several chances for market expansion associated with the development of sophisticated filtering technologies. The water filtration business is undergoing a revolution because of innovations like solar-powered purifiers, graphene-based filters, and nanofiltration. These methods decrease energy usage, waste less water, and improve the effectiveness of pollutant removal. By investing in research and development, companies can introduce cutting-edge products that address the evolving needs of consumers and industries.

WATER FILTERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.40% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

3M (US), Culligan International (US), Honeywell International (US), LG Electronics (South Korea), Whirlpool Corporation (US), A.O. Smith Corporation (US), Kent RO Systems Limited (India), Eureka Forbes Ltd (India), Brita LP (US), PUR (US), Aquasana (US), Seychelles (US), LARQ (US) , GRAYL (US) |

Water Filters Market Segmentation: By Types

-

Activated Carbon Filters

-

Reverse Osmosis (RO) Filters

-

Ultraviolet (UV) Filters

-

Sediment Filters

-

Ceramic Filters

In the market, activated carbon filters are widely used, particularly for home use. Their cost, simplicity of use, and effectiveness in enhancing the flavor and aroma of drinking water are the main reasons for their appeal. These filters serve a variety of consumer demands and are frequently found in countertop units, under-sink systems, and pitcher filters. One of the most often used kinds of water filters is activated carbon. They use activated carbon, which is carbon that has been treated to create tiny, low-volume holes that expand the surface area that may be used for chemical reactions or adsorption. The water tastes and smells better thanks to activated carbon filters, which are very good at eliminating chlorine, smells, and volatile organic compounds (VOCs).

UV filters have a lot of room to develop, especially in areas where access to clean water is scarce. They may be used in both residential and business settings because of their great efficacy in getting rid of biological impurities. UV filter use is being driven by rising awareness of waterborne illnesses and the demand for clean drinking water. UV filters purge water of bacteria, viruses, and other pathogens by using ultraviolet light. Microorganisms are unable to reproduce because the UV radiation damages their DNA and enters their cells. For thorough water purification, UV filters are frequently employed in combination with other filtering techniques.

Water Filters Market Segmentation: By Distribution Channel

-

Offline Retail

-

Online Retail

-

Direct Sales

-

Wholesale and Distributors

The most common way that water filters are distributed is still through offline retail. A significant portion of customers are drawn in by the physical shopping experience and the availability of in-store support. To meet a variety of customer demands, retail establishments frequently carry a large assortment of water filter kinds and brands. Brick-and-mortar establishments like supermarkets, specialized shops, and home improvement centers are examples of offline retail channels. Customers may make quick purchases, get professional guidance, and personally inspect things at these businesses.

The water filter distribution channel with the quickest rate of growth is online retail. The COVID-19 epidemic has expedited the trend towards online buying, hence augmenting consumer dependence on e-commerce. This channel is expanding due in large part to the availability of low prices, home delivery options, and comprehensive product information. Because e-commerce platforms are so convenient, online shopping has become a major avenue of distribution. From the comfort of their homes, consumers may peruse an extensive selection of items, evaluate costs, read customer reviews, and make purchases. Important participants in this channel include large e-commerce websites and specialized business websites.

Water Filters Market Segmentation: Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

Middle East & Africa

-

South America

With a dominating 35% market share, the Asia-Pacific region is clearly the leading player in the worldwide water filter industry. Numerous elements that have influenced the water treatment environment in the area over the previous few decades might be credited for this leadership position. The vast and fast-expanding population of Asia-Pacific, together with rising levels of urbanization and industrialization, is one of the main factors contributing to the region's dominance. Many of the world's most populous countries, like China and India, have seen unheard-of levels of urbanization and economic expansion. As a result, there is an increase in water demand in several industries, including commercial, industrial, and residential.

Even though it only accounts for 10% of the worldwide market for water filters, the Middle East and Africa area is expected to develop at the quickest rate in the years to come. Its quick growth trajectory is the result of several reasons, which also make it a major participant in the worldwide water treatment scene. The severe water shortage that many of the Middle East's and Africa's nations experience is one of the main factors fueling this region's growth. Some of the world's most water-stressed nations, with finite freshwater supplies and expanding populations, are found in this region. To maximize the use of limited water sources, this shortage has required large expenditures in water treatment and purification technology.

COVID-19 Impact Analysis on the Water Filters Market:

There were brief shortages of water filters in the early phases of the pandemic due to a spike in panic purchases as people stocked up on necessities. Consumer behavior saw a dramatic change as a result of movement limitations and lockdowns. Individuals were preparing more meals at home, spending more time there, and using less packaged water. The market for home water filters will thus increase, especially for those with sophisticated filtering features. In addition to seeking filters that could eliminate pollutants, consumers also wanted ones that could handle the growing worries about microplastics and other contaminants. E-commerce sites became the main way for people to buy water filters while traditional businesses had to close or scale back operations. Strongly internet-presenced companies and well-known online shops profited from this change.

Latest Trends/ Developments:

Wi-Fi-connected filters that integrate with smartphone apps are becoming more and more popular. These "smart" filters enable remote performance monitoring of the filter as well as real-time information on water quality and filter replacement reminders. Research is being done on the possibilities of Internet of Things (IoT) technology. In the far future, picture a scenario in which your water filter easily integrates with your smart home system to order replacement filters or modify filtration in response to real-time data on water quality. In an effort to reduce plastic waste and promote sustainability, manufacturers are increasingly including recyclable materials into filter components. Water filters with reduced energy requirements and a smaller environmental impact are being developed because to advancements in material and design. By lowering the need for bottled water and cutting down on plastic waste, point-of-use water filters can help create a more sustainable approach to water management.

Key Players:

-

-

3M (US)

-

Culligan International (US)

-

Honeywell International (US)

-

LG Electronics (South Korea)

-

Whirlpool Corporation (US)

-

A.O. Smith Corporation (US)

-

Kent RO Systems Limited (India)

-

Eureka Forbes Ltd (India)

-

Brita LP (US)

-

PUR (US)

-

Aquasana (US)

-

Seychelles (US)

-

LARQ (US)

-

GRAYL (US)

-

Chapter 1. Water Filters Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Water Filters Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Water Filters Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Water Filters Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Water Filters Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Water Filters Market – By Types

6.1 Introduction/Key Findings

6.2 Activated Carbon Filters

6.3 Reverse Osmosis (RO) Filters

6.4 Ultraviolet (UV) Filters

6.5 Sediment Filters

6.6 Ceramic Filters

6.7 Y-O-Y Growth trend Analysis By Types

6.8 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Water Filters Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Offline Retail

7.3 Online Retail

7.4 Direct Sales

7.5 Wholesale and Distributors

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Water Filters Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Water Filters Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 3M (US)

9.2 Culligan International (US)

9.3 Honeywell International (US)

9.4 LG Electronics (South Korea)

9.5 Whirlpool Corporation (US)

9.6 A.O. Smith Corporation (US)

9.7 Kent RO Systems Limited (India)

9.8 Eureka Forbes Ltd (India)

9.9 Brita LP (US)

9.10 PUR (US)

9.11 Aquasana (US)

9.12 Seychelles (US)

9.13 LARQ (US)

9.14 GRAYL (US)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Contamination of water sources with pollutants like lead, chlorine, and microplastics raises concerns about waterborne diseases and potential health risks. Water filters offer a sense of security by removing these contaminants and providing cleaner drinking water.

Improper maintenance, such as neglecting to replace filters regularly, can render them ineffective and potentially even compromise water quality. Educating consumers about proper maintenance is crucial.

3M (US), Culligan International (US), Honeywell International (US), LG Electronics (South Korea), Whirlpool Corporation (US), A.O. Smith Corporation (US), Kent RO Systems Limited (India), Eureka Forbes Ltd (India), Brita LP (US), PUR (US), Aquasana (US), Seychelles (US), LARQ (US), GRAYL (US).

The market is dominated by Asia-Pacific, which commands a market share of around 35%.

With a market share of about 10%, The Middle East is expanding the quickest.