Resistant Starch Market Size (2024 – 2030)

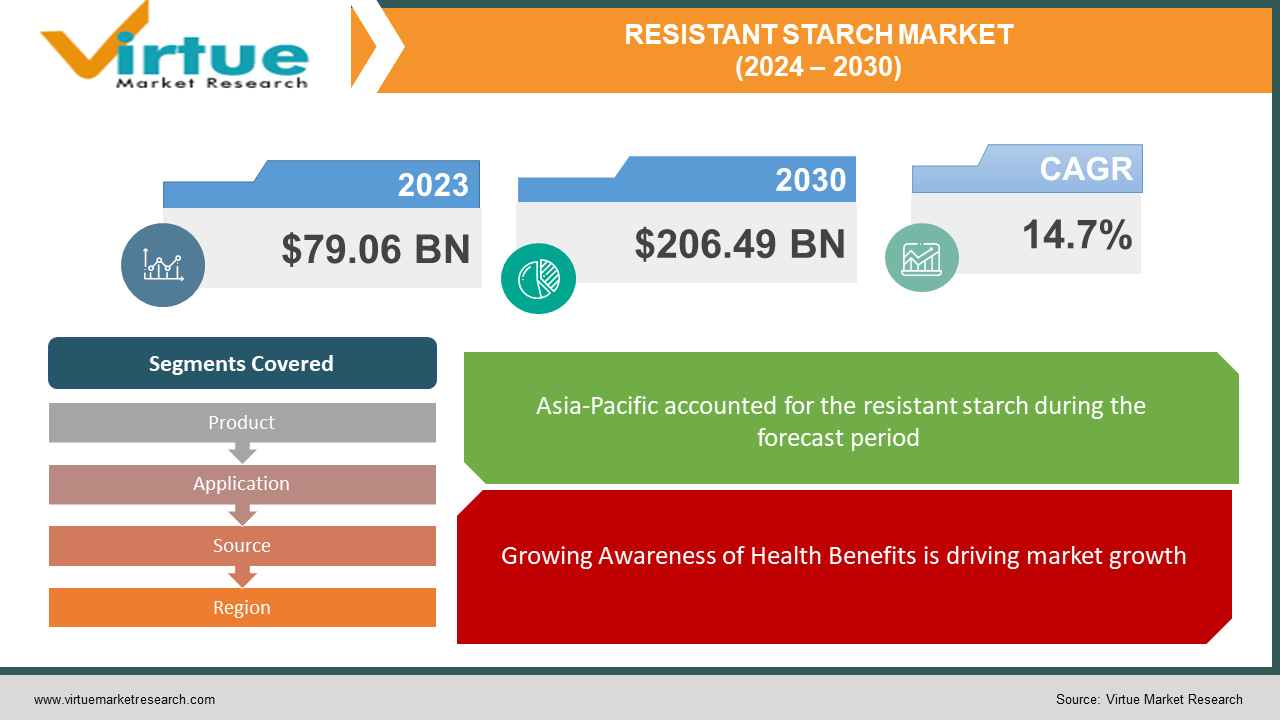

The Global Resistant Starch Market size was exhibited at USD 79.06 billion in 2023 and is projected to hit around USD 206.49 billion by 2030, growing at a CAGR of 14.7% during the forecast period from 2024 to 2030.

Resistant starch, a natural fiber resistant to absorption or breakdown in the small intestine, undergoes bacterial conversion to produce fatty acids. Instead of being fully absorbed in the small intestine, it moves to the large intestine for fermentation by bacteria, resulting in the creation of short-chain fatty acids with presumed benefits for the body. This starch aids the human body in reducing blood fat and cholesterol, limiting the generation of new fat cells, promoting digestion and insulin sensitivity, maintaining stable appetite, assisting in the body's rehydration process, and enhancing immunity. Noteworthy is its role in preventing diseases like diabetes, cancer, and heart disease. Resistant starch can be found in fiber-rich foods like legumes and grains, as well as in food additives and carbohydrate-rich foods.

Key Market Insights:

The global resistant starch market is witnessing growth due to increasing awareness of its health advantages and its rising usage in diverse products such as bakery items, confectionery, dairy products, breakfast cereals, processed foods, and beverages. The expanding applications of resistant starch across industries have positioned it as a coveted 'superfood,' endorsed for its manifold health benefits. Numerous studies suggest that incorporating resistant starch in one's diet may potentially reduce postprandial glycemic and insulinemic responses, lower plasma cholesterol and triglyceride concentrations, enhance whole-body insulin sensitivity, increase satiety, and diminish fat storage.

The incorporation of resistant starch in various food products not only enhances their quality but also boosts their nutritional content. This has proven instrumental in helping manufacturers obtain certifications such as HACCP in alignment with the Global Food Safety Initiative (GFSI) Standard/BRCGS, the Allergen/Gluten-Free Certification Program (GFCP), Non-GMO Project Verified program certification, and Kosher certification.

Global Resistant Starch Market Drivers:

Growing Awareness of Health Benefits is driving market growth.

The global resistant starch market is witnessing a surge due to the increasing awareness of its health benefits. Resistant starch, known for its ability to improve digestive health, regulate blood sugar levels, and aid in weight management, is gaining popularity among health-conscious consumers. As individuals become more conscious of their well-being, there is a growing demand for food products that offer nutritional advantages. The resistant starch market is expected to benefit from this trend, with food manufacturers incorporating resistant starch into various products to meet consumer preferences. The rising interest in functional foods and the acknowledgment of resistant starch as a prebiotic further drives its market growth, creating opportunities for innovation and development within the food industry.

Surging Demand for Low-Glycemic Index Foods propelling the market.

Another significant driver for the global resistant starch market is the increasing demand for low-glycemic index foods. As consumers strive to manage and prevent conditions such as diabetes and obesity, there is a heightened interest in foods that have a minimal impact on blood sugar levels. Resistant starch, with its low-glycemic index, has emerged as a preferred ingredient in formulating such foods. The demand for healthier carbohydrate options is fueling the adoption of resistant starch in food products, including bread, pasta, and snacks. This driver is propelling the market forward as consumers make conscious choices to maintain a balanced diet and reduce the risk of lifestyle-related diseases, boosting the overall growth of the resistant starch market worldwide.

Global Resistant Starch Market Restraints and Challenges:

Limited Consumer Awareness and Understanding hindering market growth.

A key restraint in the resistant starch market is the limited awareness and understanding among consumers regarding its benefits. Despite the growing interest in health and wellness, many consumers are unfamiliar with the concept of resistant starch and its positive impact on digestive health and blood sugar regulation. This lack of awareness hinders the widespread adoption of resistant starch-containing products. Manufacturers face the challenge of educating consumers and promoting the advantages of incorporating resistant starch into their diets. Overcoming this restraint requires comprehensive marketing strategies and educational campaigns to bridge the knowledge gap and create a market environment where consumers actively seek and choose starch resistant products.

Technological and Formulation Challenges hinder market growth.

The incorporation of resistant starch into various food products poses technological and formulation challenges for manufacturers. Resistant starch has unique properties that can affect the texture, taste, and overall quality of food items. Achieving the desired product attributes while maintaining the functional benefits of resistant starch requires extensive research and development. Manufacturers need to invest in innovative processing technologies to overcome these formulation challenges. Additionally, ensuring the stability of resistant starch in different food applications, such as baked goods and beverages, presents a hurdle. This restraint requires ongoing efforts to refine production processes and develop solutions that enhance the compatibility of resistant starch with a wide range of food products.

Global Resistant Starch Market Opportunities:

Rising Bakery Product Consumption

The resistant starch market, categorized by applications into dairy products, bakery products, sugar confections, and convenience foods, is anticipated to experience notable growth. Within this categorization, bakery products are expected to undergo substantial expansion due to the increasing demand for natural, healthy, and gluten-free bakery items worldwide. Bakery products encompass a range of items such as cookies, pies, bread, rolls, muffins, and pastries, typically crafted from flour or meal derived from various grains. Bread, given its high nutritional value and widespread use as a staple food globally, is poised to emerge as the foremost type of bakery product in the forthcoming years. In addition to bakery products, the forecast period is likely to witness robust growth in the dairy products segment. This growth is closely linked to the expanding urban population, the perceived value of products, and the introduction of new products by key players in the industry.

RESISTANT STARCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14.7% |

|

Segments Covered |

By Product, Application, Source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, Ingredion Incorporated, MGP Ingredients, Tate & Lyle Plc, Arcadia Biosciences, Roquette Frères, Lodaat Pharmaceuticals, Emsland Group, Penford Corporation, MSP Starch Products Inc., Others |

Global Resistant Starch Market Segmentation: By Product

-

RS1

-

RS2

-

RS3

-

RS4

In 2023, the RS2 segment emerged as the dominant force in the industry, capturing a substantial share of more than 38.85% of the total revenue. This segment is poised for further expansion, maintaining a steady Compound Annual Growth Rate (CAGR) throughout the forecast period. The robust growth of RS2 can be attributed to its high crystallinity and significant amylose content derived from grain sources, endowing it with resistance to enzymatic hydrolysis. Notable industry player Ingredion contributes to this trend by offering high amylose-resistant starch, exemplified by their product "HI-Maize," derived from high-amylose corn. This resistant starch, characterized by a neutral taste and low water-holding capacity, is gaining traction in various food applications.

The surge in popularity of high amylose starches can be traced to the inherent resistance of the starch granule in RS2 types. RS2 is meticulously produced from high-amylose variants found in wheat and rice grains. The nutritional attributes of RS2, particularly its contribution to lowering the risk of type 2 diabetes, make it an appealing choice for food manufacturers. The anticipated demand for RS2-resistant starches is further bolstered by its positive effects on glycemic response and its potential to reduce the risk of diabetes, thereby establishing a growing preference for its incorporation in food products.

Global Resistant Starch Market Segmentation: By Application

-

Bakery Products

-

Bread

-

Biscuits & Cookies

-

Crackers

-

Other Bakery Products

-

Confectionery

-

Beverages

-

Breakfast Cereals

-

Pasta & Noodles

-

Dairy Products

-

Nutrition Bars

-

Meat & Processed Food

-

Meat Substitutes

-

Soups, Dressings, & Condiments

-

Others

In 2023, the segment of soups, dressings, and condiments secured the highest market share, surpassing 20.70%. This segment is expected to experience significant growth with a noteworthy Compound Annual Growth Rate (CAGR) over the forecast period, attributed to the global increase in the consumption of soups and salads. The changing dietary habits prompted by rising obesity and chronic diseases contribute to the accelerated growth of this segment. Among the application segments, meat substitutes show rapid growth and are projected to have the fastest CAGR. The plant-based industry's steady expansion and the growing popularity of veganism globally are major factors contributing to this growth.

Resistant starch, employed as an additive in meat substitutes, plays a crucial role in controlling texture, stability, and uniformity in the final product. The escalating popularity of meat substitutes has led manufacturers to focus on producing substitutes with desirable texture, flavor, and color, fostering the use of resistant starches as functional ingredients. Notable commercially available meat substitutes utilizing starch include Like Schnitzel, Vivera Plant Steak, and Tofurky Chick’n, incorporating corn, potato, and wheat starch to enhance water-holding capacity and improve functionality.

Global Resistant Starch Market Segmentation: By Source

-

Fruits & Nuts

-

Banana

-

Cashew Nut

-

Others

-

Grains

-

Corn

-

Wheat

-

Rice

-

Others

-

Vegetables

-

Potato

-

Cassava

-

Others

-

Cereal Food

-

Beans & Legumes

-

Peas

-

Others

-

Others

Key sources for resistant starch production include corn, wheat, rice, potatoes, cereals, and beans, with the selection dependent on crop production in specific regions. For instance, North America favors corn starch, while Europe predominantly utilizes wheat starch, and cassava gains popularity in Thailand due to increased cassava production. The grains source segment dominated the market in 2023, accounting for over 71.80% of the overall revenue. Whole grains like wheat, corn, rice, oats, barley, quinoa, sorghum, and rye contribute to this dominance.

The escalating demand for functional ingredients is propelling the need for resistant starch derived from grains. Additionally, growing consumer interest in specialty and ancient grains, such as buckwheat and quinoa, further supports the growth of this segment.

Global Resistant Starch Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The industry was led by Asia Pacific in 2023, capturing a substantial share exceeding 32.35% of the total revenue. Asia Pacific is anticipated to maintain a consistent growth rate throughout the forecast period. Notably, countries such as China and Japan are expected to be prominent contributors to the regional market's expansion, driven by an upsurge in product consumption within the packaged food industry. The growth of the processed food sector in the region is a key factor propelling the demand for resistant starch. North America, on the other hand, stands as one of the leading markets for resistant starch.

In North America, key food sources of resistant starch include pasta and noodles, bread and bakery products, and vegetables such as potatoes. A research paper published on PubMed, titled "Resistant Starch Intakes in the United States," reveals that Americans aged 1 year and older had a dietary intake of 4.9 grams of resistant starch per day. Bread, pasta, cooked cereals, and vegetables (excluding legumes) contributed 21%, 19%, and 19%, respectively, to this intake. The region's high starch consumption renders it a lucrative market.

COVID-19 Impact on the Global Resistant Starch Market:

The impact of COVID-19 on the resistant starch market has varied effects on different segments. Food and beverage manufacturers may face challenges due to labor and raw material shortages, while retail and catering outlets encounter intensified challenges. Restaurants need to navigate irregular consumer influx and assess the storage of food and beverages to ensure continuous consumer access. Some processed food manufacturers anticipate increased sales due to the growing trend of home catering, driven by consumers isolating themselves or being quarantined. Restaurants, however, experience reduced consumer visits, labor shortages, and concerns about virus transmission through public contact.

Recent Trends and Innovations in the Global Resistant Starch Market:

Archer Daniels Midland Company has announced a long-term partnership with General Starch Limited (GSL), a leading tapioca starch producer in Thailand. This collaboration grants ADM exclusive distribution rights for GSL-modified tapioca starch products across most European countries, the Middle East, and Africa.

Megazyme introduces a new test method for resistant starch, an indigestible carbohydrate component that reaches the large intestine and undergoes fermentation. It is considered a part of the total dietary fiber.

In January 2022, Lodaat Pharma, based in Chicago, launched PotatoDaat, a potato prebiotic-resistant starch targeting sports nutrition and weight management. With 78% weight-resistant starch, the ingredient is designed to enhance butyrate production in the large intestine, catering to food and beverage brands.

Key Players:

-

Cargill, Incorporated

-

Ingredion Incorporated

-

MGP Ingredients

-

Tate & Lyle Plc

-

Arcadia Biosciences

-

Roquette Frères

-

Lodaat Pharmaceuticals

-

Emsland Group

-

Penford Corporation

-

MSP Starch Products Inc.

-

Others

Chapter 1. Resistant Starch Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Resistant Starch Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Resistant Starch Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Resistant Starch Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Resistant Starch Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Resistant Starch Market – By Product

6.1 Introduction/Key Findings

6.2 RS1

6.3 RS2

6.4 RS3

6.5 RS4

6.6 Y-O-Y Growth trend Analysis By Product

6.7 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Resistant Starch Market – By Application

7.1 Introduction/Key Findings

7.2 Bakery Products

7.3 Bread

7.4 Biscuits & Cookies

7.5 Crackers

7.6 Other Bakery Products

7.7 Confectionery

7.8 Beverages

7.9 Breakfast Cereals

7.10 Pasta & Noodles

7.11 Dairy Products

7.12 Nutrition Bars

7.13 Meat & Processed Food

7.14 Meat Substitutes

7.15 Soups, Dressings, & Condiments

7.16 Others

7.17 Y-O-Y Growth trend Analysis By Application

7.18 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Resistant Starch Market – By Source

8.1 Introduction/Key Findings

8.2 Fruits & Nuts

8.3 Banana

8.4 Cashew Nut

8.5 Others

8.6 Grains

8.7 Corn

8.8 Wheat

8.9 Rice

8.10 Others

8.11 Vegetables

8.12 Potato

8.13 Cassava

8.14 Others

8.15 Cereal Food

8.16 Beans & Legumes

8.17 Peas

8.18 Others

8.19 Y-O-Y Growth trend Analysis By Source

8.20 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 9. Resistant Starch Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Application

9.1.4 By By Source

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Application

9.2.4 By Source

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Application

9.3.4 By Source

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Application

9.4.4 By Source

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Application

9.5.4 By Source

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Resistant Starch Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cargill, Incorporated

10.2 Ingredion Incorporated

10.3 MGP Ingredients

10.4 Tate & Lyle Plc

10.5 Arcadia Biosciences

10.6 Roquette Frères

10.7 Lodaat Pharmaceuticals

10.8 Emsland Group

10.9 Penford Corporation

10.10 MSP Starch Products Inc.

10.11 Others

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Resistant Starch Market size is valued at USD 79.06 billion in 2023.

The worldwide Global Resistant Starch Market growth is estimated to be 14.7% from 2024 to 2030.

The Global Resistant Starch Market is segmented By Source (Fruits & Nuts, Vegetables, Grains, Cereal Food, Beans & Legumes, and Others), By Product (RS1, RS2, RS3, RS4), By Application (Bakery Products, Confectionery, Beverages, Breakfast Cereals, Pasta & Noodles, Dairy Products, Nutrition Bars, Meat & Processed Food, Meat Substitutes, Soups, Dressings, & Condiments, Others).

Future trends in the Global Resistant Starch Market may see increased demand fueled by growing awareness of health benefits. Opportunities lie in innovative applications, such as plant-based and gluten-free products. Collaborations, like Archer Daniels Midland's partnership, and advancements in testing methods, as seen with Megazyme, contribute to market growth and diversification.

The COVID-19 pandemic impacted the Global Resistant Starch Market, affecting production due to labor and raw material shortages. Restaurants faced decreased consumer influx, while processed food manufacturers witnessed increased sales, driven by the rising trend of home catering as consumers sought safe alternatives during lockdowns.