Recycled Plastics Market Size (2024-2030)

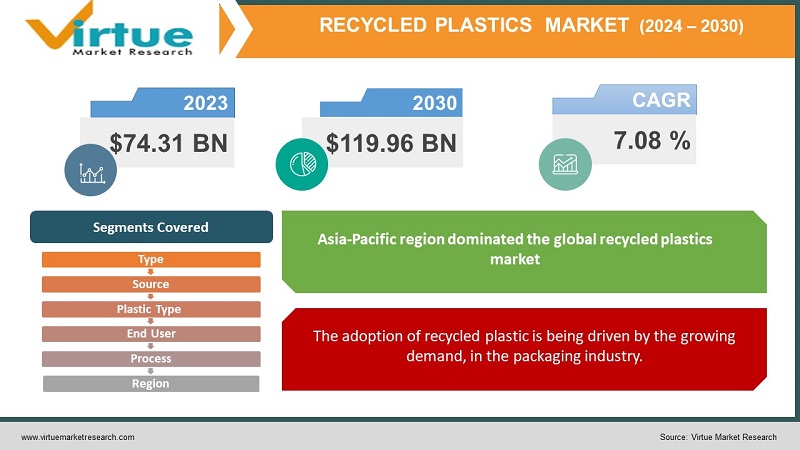

According to the report published by Virtue Market Research in Global Recycled Plastics Market was valued at USD 74.31 billion and is projected to reach a market size of USD 119.96 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.08%.

The growing use of plastic, in the production of components across industries like construction, automotive, electronics, and others is expected to drive the demand for plastics in the future. Additionally, due to the COVID-19 pandemic, there has been an increased demand for packaging products with the rise in online purchases of electronics, personal care items, and protective equipment like gloves and face masks. Consequently, there is a need for plastics in various packaging applications.

The increasing popularity of consumer electronics has also contributed to the demand for plastics in both devices and packaging. This trend is projected to boost the demand, for plastics over time. The expansion of the construction sector, in developing nations like Brazil, China, India, and Mexico is anticipated to boost the need for producing components such as insulation, fixtures, structural lumber, windows, fences, and more in the coming years. The rise of the recycled plastic market in building and construction can be attributed to a surge in investments in the construction industry of these countries. This increase is a result of direct investment regulations and requirements, for revamping public and industrial infrastructure.

Key Market Insights:

In 2021 the European Union (E.U.) introduced a tax, on packaging that has not been recycled. The United Kingdom (U.K.) also implemented a charge on packaging that does not contain 30% recycled material by April 2022.

Similar regulations have been put in place in the United States with California leading the way. California announced that starting from 2022 PET bottles must have a minimum of 15% recycled plastic content.

The E.U.s Strategy for Plastic in a Circular Economy aims to promote the use, reuse, and recycling of plastics throughout their lifecycle. The goal is to achieve 100% recyclable packaging in the E.U. Market by 2030.

In 2018 Nestlé committed to ensure that all its packaging is either recyclable or reusable by 2025 while also reducing its reliance on plastics by 33%.

According to an article from The Verge, there has been an increase in demand for consumer electronics such as laptops, mobile phones, modems, and other devices, through e-commerce websites.

Recycled Plastics Market Drivers:

The adoption of recycled plastic is being driven by the growing demand, in the packaging industry.

Various sectors, including food and beverage as consumer goods, are increasingly opting for recycled materials. In the food and beverage industry specifically, there is a need for packaging materials that are safe for storing food. These recyclable polymers serve as an alternative to plastics providing a protective barrier between food products and environmental factors. This trend ultimately leads to an expansion in the market. Recycled polyethylene terephthalate (PET) is particularly favored for manufacturing water bottles and beverage packaging due to its suitability. Additionally, these recycled polymers are utilized in packaging sports equipment, fashion accessories, toys, and other products to enhance their durability. Furthermore, they have gained popularity in the packaging of personal care items like soaps, shampoos, and surfactants due to their reactive properties. As a result of increased usage, in manufacturing consumer goods packaging products the market is expected to experience growth.

The increasing utilization of plastics, by players in the packaging, automotive, and electrical & electronics sectors will significantly contribute to the rising demand for these plastics. Collectively these companies consume over 6 million tons of plastic packaging annually. Therefore it is expected that the market for plastics will continue to grow due to their growing adoption, in the packaging, electrical & electronics industries.

Recycled Plastics Market Restraints and Challenges:

The market growth is expected to be limited due, to the preference for plastics over their recycled alternatives.

Virgin plastics are widely used in applications, such as food packaging and automotive components because of their superior quality. Despite mandates promoting the use of PCR plastics in packaging manufacturers remain skeptical about their use due to impurities. Moreover, applications requiring compositions and additives tend to favor virgin polymers. Additionally, the decline in crude oil prices caused by the pandemic has made virgin plastics more cost-effective compared to recycled options. These factors collectively contribute to the anticipated restrictions on market growth, within the review period.

Recycled Plastics Market Opportunities:

Favorable actions in developed nations to promote the usage of recycled plastics.

In developed countries, like North America and Europe there are regulations and incentives aimed at encouraging the recycling of plastics. Additionally, some states in the US offer tax benefits and credits to support plastic recycling efforts. These measures are anticipated to lead to increases in funding for waste-related projects. As a result, these positive initiatives taken by developed economies are expected to generate opportunities, for the growth of plastics.

RECYCLED PLASTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.08% |

|

Segments Covered |

By Type, Source, Plastic Type, End User, Process, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Jayplas, Cabka, Biffa, Far Eastern New Century Corporation, Indorama Ventures, Alpek, Loop Industries, Inc., Veolia, Republic Services, Stericycle, MBA Polymers Inc., , Plastipak Holdings, Inc. |

Recycled Plastics Market Segmentation:

Recycled Plastics Market Segmentation: By Source:

- Bottles

- Films

- Foams

- Fibers

- Others

In 2022, based on the source, the Bottles segment accounted for the largest revenue share by almost 40% and has led the market. Bottles are commonly recycled because they can be easily collected and sorted. These bottles are typically made from types of plastic resins, such, as PET, HDPE, and PP all of which are recyclable. When these plastics are recycled they can be transformed into materials, like rPET. This recycled material has a variety of uses including the production of bottles, food packaging, and textiles. The use of films is experiencing growth as a source, of recycled plastics. Films have a range of applications, such as packaging, bags, and agricultural mulch. The demand for recycled film materials is rapidly increasing due to the rising preference for packaging solutions among businesses and consumers.

In addition to films, there are sources of recycled plastics including foams, fibers, and various others. Foams find their usage in insulation, packaging, and cushioning products while fibers are commonly found in textiles, carpets, and geotextiles. The market for recycled foams and fibers is expected to witness growth in the years owing to the growing demand, for eco-friendly products.

Recycled Plastics Market Segmentation: By Plastic Type:

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

In 2022, based on the Plastic Type, the Polyethylene Terephthalate (PET) segment accounted for the largest revenue share by almost 50% and has led the market. It finds its use, in products like bottles for food and beverages packaging materials, and textiles. Recycled PET (rPET) holds value as it can be transformed into a range of new products. Among plastics, polypropylene (PP) is the fastest-growing type in the market. PP is extensively used in packaging, automotive components, and textiles. The demand for recycled PP is rapidly increasing as businesses and consumers seek alternatives.

Aside from PET and PP types like polyethylene (PE) polyvinyl chloride (PVC) and polystyrene (PS) are also recycled. In the coming years, there is a growth in the market for PE, PVC, and PS due to the rising demand, for eco-friendly products.

Recycled Plastics Market Segmentation: By Process:

- Mechanical

- Chemical

In 2022, based on the process, the Mechanical segment accounted for the largest revenue share by almost 90% and has led the market. In the field of recycling plastic waste undergoes a cleaning process before being shredded and melted. These transformed materials are then molded into pellets that can be utilized for creating products.

Chemical recycling has emerged as an expanding method, for plastic recycling. This innovative process involves breaking down waste into its chemical components. These components can subsequently be repurposed to produce plastic resins or even other chemicals of value.

Recycled Plastics Market Segmentation: By Type:

- Post-Consumer Recyclate

- Industrial Recyclate

In 2022, based on the type, the Post-Consumer Recyclate segment accounted for the largest revenue share by almost 60% and has led the market. Post-consumer recycling refers to waste that is collected from consumers after they have finished using the product. The type of plastics experiencing rapid growth is known as industrial recyclate. Industrial recycling on the other hand refers to waste generated during the manufacturing process. According to forecasts it is projected to experience a compound growth rate (CAGR) of, more than 10%, over the forecast period.

Recycled Plastics Market Segmentation: By End-user Industry:

- Packaging

- Building & Construction

- Textiles

- Automotive

- Electrical & Electronics

- Others

In 2022, based on the End-user Industry, the Packing segment accounted for the largest revenue share by almost 40% and has led the market. The demand, for packaging is on the rise across industries like food and beverage consumer goods and pharmaceuticals. One of the reasons for this is that plastic packaging waste can be easily recycled. Additionally, there is an increasing supply of quality recycled plastics that can be used to manufacture packaging materials.

Among all industries, construction has seen maximum growth in the use of plastics. It constitutes more than 10% of the market for recycled plastics and is projected to grow at a compound annual growth rate (CAGR) of over 10% in the forecast period. This growth can be attributed to factors, including the growing need for building materials and innovative applications of recycled plastics in construction projects such, as decking, roofing, and insulation. Moreover, these recycled plastics meet the requirements set by the construction industry. Other sectors that utilize plastics include the textile industry, automotive sector, and electrical and electronics industry, among others. These industries are projected to experience growth in the future due to the rising demand, for products and the increasing availability of top-notch recycled plastics.

Recycled Plastics Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2022, the Asia-Pacific region dominated the global recycled plastics market with a revenue of 47%. The Asia Pacific region has a population that contributes significantly to the production of waste. This is due, to the growth in the area, which fuels the demand for plastic products. In times there has been a rising awareness about the advantages of recycling plastic in Asia Pacific. Some Asian countries even offer government subsidies and incentives to encourage plastic recycling.

Moving on to the plastics market North America stands out as the growing region. It is projected to experience a compound growth rate (CAGR) of over 9% during the forecast period. Several factors contribute to this growth, including an increasing demand for products, advancements in technology for recycling plastic waste, and government support through subsidies and incentives.

Europe, South America the Middle East, and Africa are also expected to witness growth in their recycled plastics markets in the coming years. This will be driven by an increasing demand, for products and greater availability of quality recycled plastics.

COVID-19 Impact Analysis on the Global Recycled Plastics Market:

The pandemic has had an impact, on plastic recycling due to challenges in collecting waste plastic products during lockdown. With transportation activities halted there has been a decrease in the amount of waste reaching processing plants. Moreover, the COVID-19 crisis has exacerbated the issue of pollution as governments have restrictions on single-use plastics leading to their increased use for health and safety reasons. Retail stores and supermarkets are now using single-use materials to package fruits and vegetables to maintain hygiene standards. As a result, there is demand from consumers. However, governments are now devising strategies to tackle pollution amidst the COVID-19 cases. For example, the U.K. Government has introduced the Plastic Packaging Tax 2022 which requires that 30% of recycled material be used in packaging products in the market. Such an initiative is expected to boost demand, for recycled materials.

Latest Trends/ Developments:

Regulations set forth by governments and bodies, in North America and Europe are playing a role in promoting the use of recycled plastic across various applications. For example, European countries have implemented regulations that focus on developing recycling processes establishing collection systems, and encouraging innovation in product designs. Additionally, several countries including the U.S., Brazil, India, and Canada have taken steps to enforce bans on single-use plastics as part of their efforts to combat plastic pollution. These initiatives provide support to the market. Moreover, it is worth noting that the plastic recycling rates in countries, like India, China, and Mexico reached 60%, 25%, and 24% in 2018. The increasing rates of recycling in developing nations will create opportunities, for recyclers worldwide. As a result, the efforts made by countries to promote recycling will encourage market growth.

In April 2022 Faurecia, a company affiliated with the FORVIA Group and Veolia entered into a partnership to work together on the research and development of materials, for components. Their objective is to reach an average of 30% recycled content by the year 2026. The partnership aims to accelerate the implementation of solutions in Europe in instrument panels, door panels, and center consoles. Veolia has announced its plans to commence production of these recycled materials at its recycling facilities, in France with operations set to begin in 2024. During the K 2022 fair held in Dusseldorf, Germany Veolia introduced a brand called 'PlastiLoop'. This brand brings together Veolia's network of experts and its 37 plastic recycling plants, across the world. PlastiLoop offers a variety of recycled resins, including PET, PP, HDPE, PS, ABS, LDPE, and PC that are readily available for customers to use.

Key Players:

- Jayplas,

- Cabka,

- Biffa,

- Far Eastern New Century Corporation,

- Indorama Ventures,

- Alpek,

- Loop Industries, Inc.,

- Veolia,

- Republic Services,

- Stericycle,

- MBA Polymers Inc.,

- Plastipak Holdings, Inc.

In November 2022 Plastipak Holdings, Inc. shared news, about the launch of a recycling facility in Toledo, Spain. The primary purpose of this plant is to transform PET into quality recycled PET (PET) pellets for immediate use, in preforms, bottles, and containers.

Chapter 1. Global Recycled Plastics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Recycled Plastics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Recycled Plastics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Recycled Plastics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Recycled Plastics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Recycled Plastics Market– By Source

6.1. Introduction/Key Findings

6.2. Bottles

6.3. Films

6.4. Foams

6.5. Fibers

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Source

6.8. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 7. Global Recycled Plastics Market– By Plastic Type

7.1. Introduction/Key Findings

7.2. Polyethylene Terephthalate (PET)

7.3. Polyethylene (PE)

7.4. Polypropylene (PP)

7.5. Polyvinyl Chloride (PVC)

7.6. Polystyrene (PS)

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Plastic Type

7.9. Absolute $ Opportunity Analysis By Plastic Type , 2023-2030

Chapter 8. Global Recycled Plastics Market– By Process

8.1. Introduction/Key Findings

8.2. Mechanical

8.3. Chemical

8.4. Y-O-Y Growth trend Analysis Process

8.5. Absolute $ Opportunity Analysis Process , 2024-2030

Chapter 9. Global Recycled Plastics Market– By Type

9.1. Introduction/Key Findings

9.2. Post-Consumer Recyclate

9.3. Industrial Recyclate

9.4. Y-O-Y Growth trend Analysis Type

9.6. Absolute $ Opportunity Analysis Type , 2024-2030

Chapter 10. Global Recycled Plastics Market– By End-user Industry

10.1. Packaging

10.2. Building & Construction

10.3. Textiles

10.4. Automotive

10.5. Electrical & Electronics

10.6. Others

10.7. Y-O-Y Growth trend Analysis End-user Industry

10.8. Absolute $ Opportunity Analysis End-user Industry, 2024-2030

Chapter 11. Global Recycled Plastics Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Source

11.1.3. By Plastic Type

11.1.4. By Type

11.1.5. Process

11.1.6. End-user Industry

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Source

11.2.3. By Plastic Type

11.2.4. By Type

11.2.5. Process

11.2.6. End-user Industry

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.2. By Country

11.3.2.2. China

11.3.2.2. Japan

11.3.2.3. South Korea

11.3.2.4. India

11.3.2.5. Australia & New Zealand

11.3.2.6. Rest of Asia-Pacific

11.3.2. By Source

11.3.3. By Plastic Type

11.3.4. By Type

11.3.5. Process

11.3.6. End-user Industry

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.3. By Country

11.4.3.3. Brazil

11.4.3.2. Argentina

11.4.3.3. Colombia

11.4.3.4. Chile

11.4.3.5. Rest of South America

11.4.2. By Source

11.4.3. By Plastic Type

11.4.4. By Type

11.4.5. Process

11.4.6. End-user Industry

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.4. By Country

11.5.4.4. United Arab Emirates (UAE)

11.5.4.2. Saudi Arabia

11.5.4.3. Qatar

11.5.4.4. Israel

11.5.4.5. South Africa

11.5.4.6. Nigeria

11.5.4.7. Kenya

11.5.4.11. Egypt

11.5.4.11. Rest of MEA

11.5.2. By Source

11.5.3. By Plastic Type

11.5.4. By Type

11.6.5. Process

11.5.6. End-user Industry

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Global Recycled Plastics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Jayplas,

12.2. Cabka,

12.3. Biffa,

12.4. Far Eastern New Century Corporation,

12.5. Indorama Ventures,

12.6. Alpek,

12.7. Loop Industries, Inc.,

12.8. Veolia,

12.9. Republic Services,

12.10. Stericycle,

12.11. MBA Polymers Inc.,

12.12. Plastipak Holdings, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

According to the report published by Virtue Market Research in Global Recycled Plastics Market was valued at USD 74.31 billion and is projected to reach a market size of USD 119.96 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.08%.

The adoption of recycled plastic is being driven by the growing demand, in the packaging industry

The segments under the Global Recycled Plastics Market based on Source, Bottles, Films, Foams, Fibers, Others

Asia-Pacific is the most dominant region for the Global Recycled Plastics Market.

Alpek, Biffa, Cabka, Far Eastern New Century Corporation, and Indorama Ventures are the key players operating in the Global Recycled Plastics Market