Asia-Pacific Recycled Plastics Market Size (2024-2030)

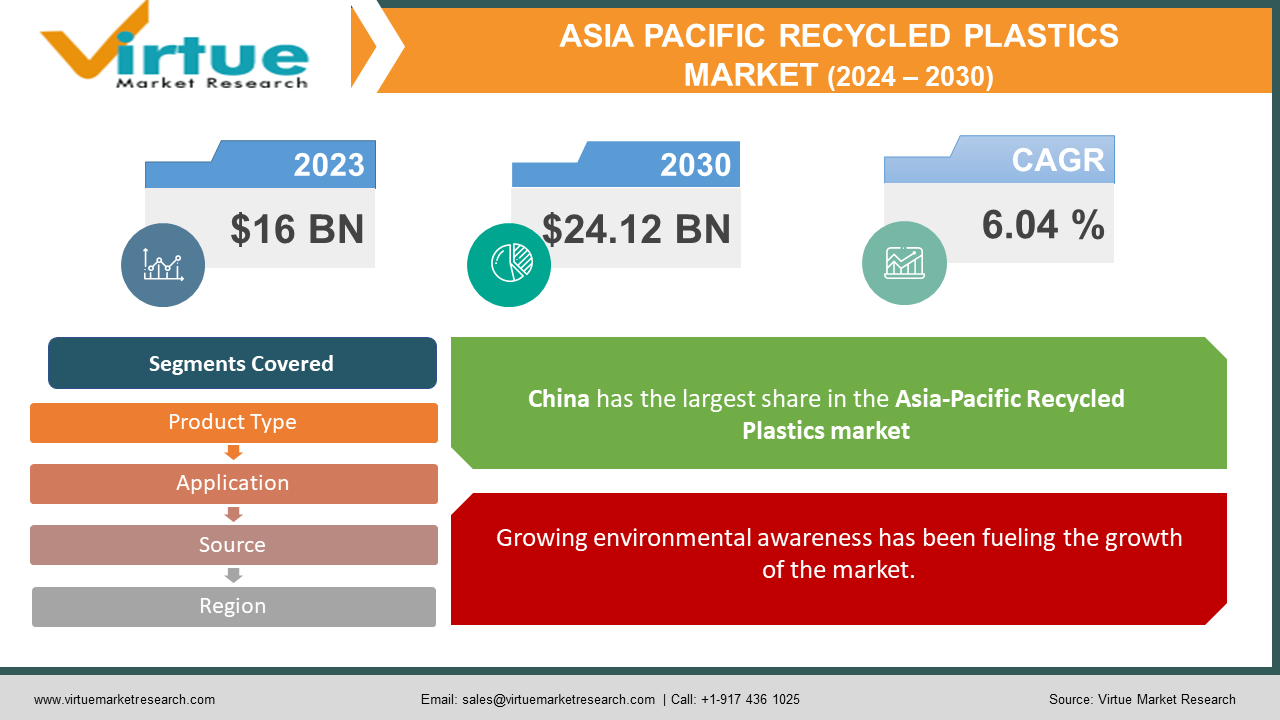

The Asia-Pacific Recycled Plastics Market was valued at USD 16 billion and is projected to reach a market size of USD 24.12 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.04%.

Plastic that has been recovered from trash or scrap and processed again to create new goods is known as recycled plastic. Plastic recycling aims to save resources and lessen plastic pollution. In the past, even though sustainability in Asia-Pacific countries was prioritized, due to limited infrastructure and other resources, there was a limited presence. Presently, this market has grown tremendously owing to policy changes, implementation, and increasing awareness. In the future, with a growing focus on technological innovations, the circular economy, and extensive research activities, this market is set to see good growth.

Key Market Insights:

- 24,500,000 tons of plastic per year are recycled in China.

- Of the 3.4 million metric tons of plastic garbage produced in India each year, thirty percent is recycled.

- The Asia-Pacific area was able to recycle more than 18 million metric tons of plastic trash in 2022.

- 7.4 cubic yards of landfill space may be saved by recycling one tonne of plastic.

- The Asia-Pacific area was able to recycle more than 18 million metric tons of plastic trash in 2022.

- Packaging uses around 36% of all plastic manufactured, with 85% of that packaging ending up in landfills. To tackle this, many organizations have been changing their choice of packaging materials to recyclable and other environmentally friendly materials.

Asia-Pacific Recycled Plastics Market Drivers:

Growing environmental awareness has been fueling the growth of the market.

Over the years, a greater percentage of the population has shown an interest in knowing more about green initiatives. Social media has played an important role in generating statistics and videos about the impact plastic can have on our planet. Plastic takes years to decompose, causing land and soil pollution. Additionally, plastic packaging for food and beverages is associated with a lot of health concerns like metabolic disorders, birth defects, and reduced fertility due to the chemicals present in them. Consumers as well as business firms have started to encourage and use eco-friendly materials for packaging their products. For instance, few companies have taken initiatives to reduce plastic packaging and use recycled materials for products that are ordered online. Besides, many organizations and NGOs have been formed to address and reduce the issue. Volunteering for these tasks has become more prevalent. These volunteers go to the beach, home, and other drives where they collect the plastic material and hand it out to suitable companies that are engaged in recycling the product. Furthermore, various governmental policies have been implemented, banning the use of plastic and mandating the use of recycled materials.

Technological innovations have been accelerating market expansion.

To gather and remove plastic garbage from rivers, seas, and other bodies of water, sophisticated methods are being created. These technologies for cleanup use a variety of techniques, including autonomous surface vessels, large-scale floating barriers, and passive drift systems. By capturing and gathering plastic waste, these tools can stop it from further damaging marine habitats. To address the issue, several projects are also looking at the possibility of turning ocean plastic garbage into goods that can be used. Secondly, in chemical recycling, processes including gasification, pyrolysis, and depolymerization are becoming more popular. These methods facilitate an easy breakdown and help with the conversion of plastic into feedstock. Thirdly, plastic recycling is being revolutionized by automated sorting systems that have been integrated with sensors, machine learning algorithms, and artificial intelligence. These technologies are capable of precisely identifying and classifying various plastic kinds according to their form, color, chemical makeup, and other unique qualities. Apart from this, many emerging startups have been playing a crucial role in discovering new methods that minimize energy consumption and the costs required for the process.

Asia-Pacific Recycled Plastics Market Restraints and Challenges:

Material quality, a lack of infrastructure, and incomplete knowledge are the main obstacles that the market is currently experiencing.

In water bodies, there are typically seven types of plastic. Each type has different properties and, therefore, a unique degradation behavior. People involved in the collection might not know the exact plastic kind, leading to the accumulation of all types during recycling. This can create inconsistencies in the material and waste essential resources. Secondly, many Asian countries have inadequate technologies for segregation and collection. Handpicking can lead to inefficient results. Besides, manually picking the plastic can pose risks to an individual's health because it might contain harmful compounds. Thirdly, few developed Asia-Pacific countries have advanced equipment available. However, a lack of expertise can create barriers to market growth.

Asia-Pacific Recycled Plastics Market Opportunities:

Reusable construction blocks, known as eco-bricks, are created from plastic drinking bottles. This concept has been gaining prominence and has been providing possibilities for the market. This is used for furniture, walls, and other structures. They serve as an eco-friendly alternative to conventional bricks. Additionally, they help reduce the amount of plastic accumulated in landfills. Secondly, plastic roads are being created. By adding recycled plastic trash to the asphalt mix, these roads prolong the life of the pavement and lessen the requirement for fresh resources. These roads are durable, flexible, and resistant to cracks. They can be a potential transportation route in the future. Apart from this, 3D printing is being emphasized. Customizable and eco-friendly designs may be produced using 3D printing, for which plastic filament is derived from recycled plastic. Furthermore, to attract a broader consumer base, there are many websites and other platforms that provide employment opportunities in the environmental sector.

ASIA-PACIFIC RECYCLED PLASTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.04% |

|

Segments Covered |

By Product Type, Source, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacific |

|

Key Companies Profiled |

Suez SA, Veolia Environment SA, KW Plastics, Indorama Ventures Public Company Limited, SUEZ NWS Limited, Biffa plc, DSM Engineering Plastics, Cleanaway Waste Management Limited, Jiangsu Zhongji Lamination Materials Co., Ltd., Evergreen Plastics |

Asia-Pacific Recycled Plastics Market Segmentation:

Asia-Pacific Recycled Plastics Market Segmentation: By Product Type:

- Polyethylene Terephthalate

- High-Density Polyethylene

- Polypropylene

- Low-Density polypropylene

- Others

Based on product type, polyethylene terephthalate is considered to be the largest segment in the market. This material is a popular packaging choice for food and beverage products because it is light in weight, making it easy to carry. Secondly, it has a reduced cost, making it an attractive choice. Moreover, this is one of the non-toxic types, making it a safe choice. Furthermore, it is known to emit very little carbon dioxide emissions, contributing to a lower carbon footprint. Recycling this material is easier, making it a sustainable option. High-density polyethylene (HDPE) is the fastest-growing segment. HDPE is used in bottles, pipes, and other toys. This material has superior quality, making it an appealing option for customers. This is durable because it has a long life and is weather-resistant. Besides, it can be molded easily. HDPE is environmentally friendly and one of the easiest products to recycle. There are a lot of companies that recycle HDPE, thereby increasing revenue in this category.

Asia-Pacific Recycled Plastics Market Segmentation: By Source:

- Plastic Bottles

- Plastic Films

- Polymer Foam

- Others

Based on the source, plastic bottles are the largest category, with a share exceeding 60% in 2023. This is because they are the first choice for beverages and other cooking utilities. They are affordable and light in weight. These bottles come in various shapes and sizes, thereby giving enough space to hold the content. Additionally, due to the space available, all the important product descriptions are usually printed on them. However, with the increased usage of these bottles, many firms have come forward to promote the recycling of these materials. Recycling these bottles reduces landfill waste. Many environmentalists have come up with incredible solutions that involve upcycling and the formation of new products from this source. Plastic films are the fastest-growing segment. This finds application in many industries. It is used in furniture, bags, labels, electronic devices, etc. They are very lightweight materials. Additionally, they are associated with superior barrier properties, i.e., they can resist the absorption of environmental factors like light, moisture, and oxygen. They can be recycled with ease as well as reused.

Asia-Pacific Recycled Plastics Market Segmentation: By Application:

- Building and Construction

- Packaging

- Electrical and Electronics

- Textiles

- Automotive

- Others

In 2023, based on application, the packaging segment is the largest segment. The main use of plastic falls into this category. They are used for the packaging of a variety of materials. This can include food products, beverages, accessories, shoes, bags, perfumes, and many more. This is because of their advantages, like being cost-effective, which encourages many manufacturers to use them. Secondly, they are light in weight, making them an ideal choice. Apart from this, they have absorption properties against water and sunlight. Therefore, with the immense amount of plastic used, it becomes vital to recycle it to reduce degradation. This segment holds a share exceeding 30%. The building and construction category is the fastest-growing. Due to improving economic conditions, there has been a drastic increase in construction activities. People can afford a luxurious life, which has changed their standard of living. Therefore, the demand has seen an augmentation. Apart from this, various sustainable initiatives like plastic roads, bio-concrete, and eco-bricks have come into existence, which has increased awareness about the benefits of recycling and reusing.

Asia-Pacific Recycled Plastics Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

Based on region, China has the largest share in the regional market. This country holds a rough share of 28% in 2023. The primary reason for this is the huge amounts of plastic imports and exports from this country. Therefore, it became crucial to manage plastic by finding effective solutions to minimize land dumping and waste generation. Secondly, this region, being a developed country, has the well-equipped infrastructure, resources, and technology that is required for recycling plastic. This is mainly because of its economy. Therefore, investing in maintenance, innovations, and other upgrades becomes easier. Popular key players like Sinopec Group, Tongji Petrochemical Co., Ltd., Plastic Recycling Corporation, China Resources (Holdings) Co., Ltd., and Shanghai Pret Composites Co., Ltd. have been involved in various projects, funding, and collaborations to improve the existing procedures. India is the fastest-growing region, with an approximate share of 19% in terms of revenue. The economy of India has seen significant progress. Due to this, investments have risen, and many startups have emerged to find the most creative solutions for managing plastic. For example, a startup in Kanpur called Phool focuses on upcycling floral waste into fleather, a cruelty-free bio-alternative to animal leather that attempts to reduce the number of conventional, extremely unsustainable, downstream leather tanning processes. Furthermore, a lot of people are showing interest in volunteering in various walkathons, campaigns, and other such events to spread awareness about the importance of recycling.

COVID-19 Impact Analysis on the Asia-Pacific Recycled Plastics Market:

The outbreak of the virus hurt the market. The new norm was lockdowns, movement restrictions, and social isolation. This resulted in disruptions in the supply chain, transportation, and other logistics affecting the import-export trade. The demand for plastic depends on the industry. In the construction industry, there was a huge decline because all activities were on hold owing to the temporary closing of factories and manufacturing units. However, in the healthcare industry, the need has increased heavily. PPE kits, masks, and other essential utilities require some kind of plastic for production. Wearing masks became mandatory, due to which a lot of waste was accumulated. But people were afraid to step out to prevent the virus contamination. Therefore, all sorts of campaigns, awareness programs, and volunteering activities were postponed, leading to landfills. Besides, many companies that had expertise in plastic recycling were closed due to guidelines and restrictions. There was a lot of uncertainty, due to which there wasn't enough labor to carry out the end-to-end operations. Besides, there weren't many collaborations and initiatives, as most of the funds were allocated towards healthcare applications. R&D activities saw a decline. Apart from this, a few countries indulge in illegal dumping of waste. As per a report by the World Economic Forum, the overall percentage of recycling bottles decreased by 1.5%. Post-pandemic, the market has seen an upsurge because all the plastic that was generated had to be recycled soon. Furthermore, many people lost their jobs, making them pursue their interests. Many startups started coming up with innovative solutions.

Latest Trends/ Developments:

- The companies in this market are motivated to achieve a higher market share by implementing different strategies, such as acquisitions, partnerships, and investments. Companies are also spending heavily to improve existing technologies while maintaining competitive pricing. This has further resulted in increased enlargement.

- Bioplastics, which provide sustainable substitutes for conventional plastics derived from petroleum, have become a prominent development in the recycling of plastics. These compostable or biodegradable polymers come from sugarcane, corn flour, or algae, which are renewable resources. Some businesses are creating bioplastics that can be recycled with regular plastics, facilitating a smooth switch to environmentally friendly plastics.

Key Players:

- Suez SA

- Veolia Environment SA

- KW Plastics

- Indorama Ventures Public Company Limited

- SUEZ NWS Limited

- Biffa plc

- DSM Engineering Plastics

- Cleanaway Waste Management Limited

- Jiangsu Zhongji Lamination Materials Co., Ltd.

- Evergreen Plastics

- In June 2023, to develop a polyethylene terephthalate (PET) recycling facility in Central Java, PT ALBA Tridi Plastics Recycling Indonesia, an ALBA Group Asia firm, and the Asian Development Bank (ADB) inked a $44.2 million blue loan agreement. The project will be funded in part by ADB and in part by Leading Asia's Private Infrastructure Fund (LEAP), each contributing $22.1 million.

- In January 2023, New Life Plastics Limited (NLP), the biggest plastic recycling plant in Hong Kong, started recycling food-grade plastic. Swire Coca-Cola Limited, ALBA Group (Asia) Limited (ALBA), and Baguio Waste Management and Recycling Limited are partners in this initiative.

- In April 2022, Act No. 60 of 2021, Japan's Act on Promotion of Resource Circulation for Plastics, became operative. The goal of the law is to enhance the flow of plastics from product design to disposal. Additionally, it involves all relevant parties in advancing 3R+Renewable and boosting circularity.

Chapter 1. Asia-Pacific Recycled Plastics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia-Pacific Recycled Plastics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysi

Chapter 3. Asia-Pacific Recycled Plastics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia-Pacific Recycled Plastics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia-Pacific Recycled Plastics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia-Pacific Recycled Plastics Market– By Product Type

6.1. Introduction/Key Findings

6.2. Polyethylene Terephthalate

6.3. High-Density Polyethylene

6.4. Polypropylene

6.5. Low-Density polypropylene

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Asia-Pacific Recycled Plastics Market– By Application

7.1. Introduction/Key Findings

7.2. Building and Construction

7.3. Packaging

7.4. Electrical and Electronics

7.5. Textiles

7.6. Automotive

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Application

7.9. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Asia-Pacific Recycled Plastics Market– By Source

8.1. Introduction/Key Findings

8.2. Plastic Bottles

8.3. Plastic Films

8.4. Polymer Foam

8.5. Others

8.6. Y-O-Y Growth trend Analysis Source

8.7. Absolute $ Opportunity Analysis Source , 2024-2030

Chapter 9. Asia-Pacific Recycled Plastics Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.1.1. China

9.1.1.2. Japan

9.1.1.3. South Korea

9.1.1.4. India

9.1.1.5. Australia & New Zealand

9.1.1.6. Rest of Asia-Pacific

9.1.2. By Source

9.1.3. By Application

9.1.4. By Product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia-Pacific Recycled Plastics Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Suez SA

10.2. Veolia Environment SA

10.3. KW Plastics

10.4. Indorama Ventures Public Company Limited

10.5. SUEZ NWS Limited

10.6. Biffa plc

10.7. DSM Engineering Plastics

10.8. Cleanaway Waste Management Limited

10.9. Jiangsu Zhongji Lamination Materials Co., Ltd.

10.10. Evergreen Plastics

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Asia-Pacific Recycled Plastics Market was valued at USD 16 billion and is projected to reach a market size of USD 24.12 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.04%.

Growing environmental awareness and technological innovations are the main factors propelling the Asia-Pacific Recycled Plastics Market drivers

Based on Application, the Asia-Pacific Recycled Plastics Market is segmented into Building and Construction, Packaging, Electrical and Electronics, Textiles, Automotive, and Others.

China is the most dominant region for the Asia-Pacific Recycled Plastics Market

Suez SA, Veolia Environment SA, and KW Plastics are the key players operating in the Asia-Pacific Recycled Plastics Market