Quinoa Market Size (2024 – 2030)

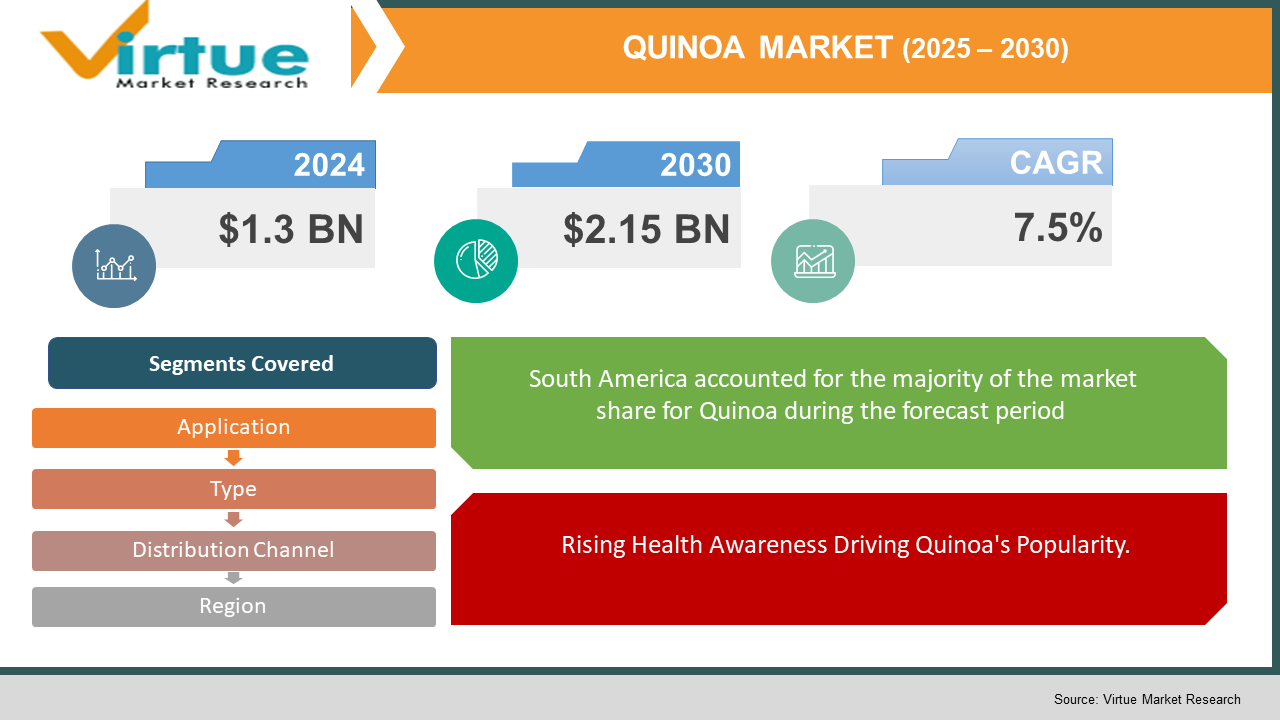

The Global Quinoa Market was valued at USD 1.3 billion in 2023 and is projected to reach a market size of USD 2.15 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.5% between 2024 and 2030.

The global quinoa market has experienced remarkable growth in recent years, driven by the increasing demand for healthy, nutrient-rich foods. Quinoa, often referred to as a superfood, is known for its high protein content, essential amino acids, fiber, and various vitamins and minerals, making it a popular choice among health-conscious consumers. Initially cultivated in the Andean region of South America, quinoa has now gained worldwide recognition due to its versatility and nutritional benefits. It is used in a variety of products ranging from cereals, salads, and snacks to gluten-free and plant-based foods, catering to the growing trends of veganism and gluten-free diets. The market's expansion is also fueled by rising awareness about quinoa's ability to adapt to different climatic conditions, making it an attractive crop for sustainable agriculture. Furthermore, governments and organizations are promoting quinoa as a potential solution to food security challenges in regions affected by climate change. As a result, production is increasing in countries beyond its traditional origins, including North America, Europe, and Asia. The global quinoa market is expected to continue its upward trajectory as consumers prioritize health and sustainability, positioning quinoa as a staple in the global food industry.

Key Market Insights:

- Over 90% of global quinoa production comes from South American countries, primarily Peru and Bolivia.

- The demand for quinoa increased by 12% annually over the past decade, driven by its popularity as a superfood.

- 30% of quinoa exports are destined for the North American market, where health-conscious consumers are driving growth.

- The gluten-free food industry contributes to around 25% of global quinoa consumption.

- Organic quinoa accounts for nearly 40% of the total quinoa market, catering to the rising demand for organic and non-GMO products.

Global Quinoa Market Drivers:

Rising Health Awareness Driving Quinoa's Popularity.

One of the key drivers of the global quinoa market is the growing health consciousness among consumers worldwide. As awareness of the benefits of nutritious diets increases, quinoa has emerged as a popular superfood due to its high protein content, essential amino acids, and rich supply of vitamins and minerals. The shift towards plant-based, gluten-free, and non-GMO diets, especially in developed regions like North America and Europe, has further boosted quinoa's demand. Health-conscious individuals are opting for quinoa as a versatile and nutrient-dense alternative to grains like rice and wheat, making it a staple in many diets focused on wellness and longevity.

Increasing Demand for Gluten-Free Products Fuelling the market growth

Another significant driver is the rising demand for gluten-free products, which has fueled the quinoa market's growth. As more people are diagnosed with gluten intolerance and celiac disease, or choose gluten-free diets for health reasons, quinoa has become a preferred alternative due to its naturally gluten-free properties. The food industry has responded to this demand by incorporating quinoa into a wide range of gluten-free products, including snacks, pasta, and baked goods. This trend is particularly strong in regions like North America and Europe, where gluten-free diets are rapidly gaining popularity.

Global Quinoa Market Restraints and Challenges:

The global quinoa market faces several restraints and challenges that could hinder its growth. One of the main challenges is the high cost of quinoa compared to traditional grains like rice, wheat, and corn. This price difference limits its accessibility to a wider consumer base, particularly in developing regions where affordability is a key concern. Additionally, fluctuations in quinoa prices due to varying crop yields and supply shortages can further impact market stability. Another significant challenge is the sustainability of quinoa production, as increased global demand has led to environmental concerns, including soil degradation and the overuse of water resources in key producing regions like Peru and Bolivia. Farmers in these areas often face difficulties maintaining sustainable practices while meeting rising global demand. Moreover, expanding quinoa cultivation to new regions presents challenges related to adapting the crop to different climatic and soil conditions. Lastly, competition from alternative superfoods such as chia seeds, amaranth, and millet also poses a restraint on market growth. These alternatives often provide similar nutritional benefits at lower costs, drawing consumers away from quinoa. Addressing these challenges will be essential for sustaining the market’s growth trajectory.

Global Quinoa Market Opportunities:

The global quinoa market presents several opportunities for growth, driven by increasing consumer interest in health, sustainability, and global food security. One major opportunity lies in expanding quinoa production beyond its traditional growing regions in South America. Countries in Africa, North America, and Europe are exploring quinoa cultivation, capitalizing on the crop's adaptability to diverse climatic conditions. This could help stabilize supply and reduce price volatility, making quinoa more accessible to a broader audience. Additionally, the growing popularity of plant-based diets, fueled by trends such as veganism and the increasing demand for protein-rich alternatives, offers a promising opportunity for quinoa to solidify its position as a nutritional powerhouse in the food industry. The food processing sector can also leverage quinoa’s versatility by incorporating it into a wider range of products, including snacks, beverages, and ready-to-eat meals. Organic quinoa, in particular, is seeing rising demand as consumers increasingly prioritize non-GMO and sustainably sourced foods. Another significant opportunity is in the development of new quinoa-based products targeting the gluten-free market, which continues to grow globally. By addressing sustainability concerns and enhancing production capacity, the quinoa market can capitalize on these trends and achieve long-term growth.

QUINOA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Andean Valley Corporation, Alter Eco, Quinoa Corporation (Ancient Harvest), Inca Organics, COMRURAL XXI S.A., NorQuin (Northern Quinoa Production Corporation), The British Quinoa Company, Quinoabol S.R.L., Keen One Quinoa, Andean Naturals, Inc., Organic Farmers Co., Andean Valley S.A., Arrowhead Mills |

Global Quinoa Market Segmentation: By Type

-

White Quinoa

-

Red Quinoa

-

Black Quinoa

In 2023, based on market segmentation by Type, White Quinoa had the highest share of the Global Quinoa Market. White quinoa remains the most widely recognized and consumed type of quinoa, largely due to its mild flavor, neutral color, and versatility in various culinary applications. Its light, fluffy texture when cooked makes it an ideal substitute for grains like rice and couscous, appealing to a broad range of consumers. One of the key factors contributing to white quinoa’s dominance in the market is its widespread availability. It is more readily found in grocery stores and food markets worldwide compared to the less common red and black varieties, making it the go-to choice for most consumers. Additionally, white quinoa is generally more affordable than its red or black counterparts, increasing its accessibility to a wider audience, especially in regions where cost plays a significant role in food choices. While red and black quinoa have unique flavors, firmer textures, and higher nutritional content, they are often priced higher, making them more of a specialty option. Despite the growing interest in these more distinct varieties, white quinoa’s affordability, versatility, and ease of use in everyday cooking likely cement its position as the leading type in the global quinoa market.

Global Quinoa Market Segmentation: By Application

-

Food

-

Beverages

-

Personal Care

In 2023, based on market segmentation by Application, Food had the highest share of the Global Quinoa Market. Quinoa's versatility is one of its key advantages, allowing it to be incorporated into a wide variety of food products, from cereals and snacks to pasta, baked goods, and even salads. Its adaptability to different cooking methods and recipes makes it a favorite among health-conscious consumers seeking nutritious alternatives. Quinoa's high protein content, along with its complex carbohydrates and essential amino acids, makes it a satisfying and nutritious food choice for those looking to maintain a balanced diet. It is particularly favored by vegetarians, vegans, and those following plant-based diets for its protein-rich profile. Additionally, quinoa’s naturally gluten-free properties cater to the rapidly growing demand for gluten-free products, especially among consumers with celiac disease or gluten sensitivity. Its mild flavor and chewy texture blend well with a variety of cuisines, from Mediterranean to Latin American and Asian dishes, further enhancing its global appeal. While quinoa is also being explored in new applications such as beverages and personal care products, its primary consumption driver remains the food sector. Consumers are drawn to quinoa for its combination of versatility, health benefits, and ability to fit seamlessly into both traditional and modern diets.

Global Quinoa Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Online Retailers

-

Specialty Stores

In 2023, based on market segmentation by Distribution Channel, Supermarkets and Hypermarkets had the highest share of the Global Quinoa Market. Supermarkets and hypermarkets continue to dominate as the primary distribution channels for quinoa, thanks to their vast reach and accessibility to a wide range of consumers. These stores have a broad customer base, making quinoa easily available to both health-conscious buyers and general shoppers. One of the key advantages of supermarkets and hypermarkets is the variety they offer, often stocking a diverse selection of food products, including different quinoa varieties and quinoa-based items like snacks, pasta, and flour. This variety allows consumers to explore multiple options in one place, enhancing convenience and ease of purchase. Furthermore, these large retail outlets typically carry well-known brands of quinoa, which fosters trust and confidence among consumers who may be more likely to buy products from recognized names. The convenience factor also plays a significant role, as shoppers can find all their grocery needs, including quinoa, in a single location, making it easier to incorporate quinoa into their regular diets. While online retailers and specialty stores are growing in importance, particularly for niche products and organic varieties, supermarkets and hypermarkets remain the leading distribution channels for quinoa due to their wide reach, product variety, and consumer convenience.

Global Quinoa Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by Region, South America had the highest share of the Global Quinoa Market. South America, particularly the Andean region, remains the leading producer of quinoa due to its deep-rooted history and favorable growing conditions. Quinoa has been cultivated in the Andean highlands for centuries, giving South American producers, especially in Peru and Bolivia, a significant head start in both expertise and scale. This indigenous knowledge, combined with the region’s ideal climate for quinoa cultivation, allows for efficient and sustainable production. The cool temperatures, high altitudes, and well-drained soils of the Andes create optimal conditions for growing high-quality quinoa. Furthermore, many South American countries have recognized the growing global demand for quinoa and have strategically focused on export markets. As a result, they have established strong export infrastructures, making them key suppliers to regions such as North America, Europe, and Asia, where quinoa consumption continues to rise. Despite increasing cultivation efforts in other parts of the world, including North America and Europe, South America’s long-standing involvement in quinoa production and its ability to consistently meet international demand have solidified its position as the dominant quinoa-producing region. This strong production base ensures that South America remains at the forefront of the global quinoa market, even as global demand continues to expand.

COVID-19 Impact Analysis on the Global Quinoa Market.

The COVID-19 pandemic had a mixed impact on the global quinoa market. Initially, the market faced disruptions due to supply chain interruptions, labor shortages, and transportation restrictions, which affected quinoa production and distribution. Lockdowns and border closures in major quinoa-producing countries like Peru and Bolivia contributed to delays in export shipments, leading to price fluctuations and supply shortages in global markets. However, the pandemic also accelerated consumer demand for healthy, nutrient-dense foods, which benefited the quinoa market. As people became more health-conscious and focused on strengthening their immune systems, quinoa, known for its high protein, vitamins, and minerals, saw increased demand. The surge in home cooking and the shift towards plant-based diets during the lockdown period also contributed to quinoa's rising popularity. Additionally, e-commerce platforms and online grocery shopping played a significant role in maintaining quinoa sales as consumers shifted to digital channels for food purchases. Despite the initial supply chain challenges, the global quinoa market rebounded as demand remained strong, especially in health-focused and gluten-free product segments. Moving forward, the quinoa market is expected to continue growing as consumer preferences for healthy, sustainable foods remain strong post-pandemic.

Latest trends / Developments:

The global quinoa market is witnessing several key trends and developments driven by changing consumer preferences and advancements in agriculture. One major trend is the increasing demand for organic quinoa, as consumers prioritize clean-label and non-GMO products that promote sustainability and environmental responsibility. This shift is particularly strong in developed regions like North America and Europe, where health-conscious consumers are driving the organic food movement. Another significant trend is the growing popularity of quinoa-based products in the convenience food sector. Companies are introducing quinoa in snacks, ready-to-eat meals, and beverages to cater to time-constrained consumers who want nutritious yet quick meal options. Furthermore, innovation in food processing technologies has allowed manufacturers to enhance quinoa’s shelf life and versatility, making it easier to incorporate into a wider range of products. The trend towards plant-based diets and gluten-free foods also continues to boost quinoa’s demand, as it is widely recognized for its high protein content and naturally gluten-free properties. Additionally, quinoa cultivation is expanding beyond its traditional regions of South America, with countries in Africa, Asia, and North America increasing production to meet global demand. These trends are shaping the future of the quinoa market, ensuring its sustained growth.

Key Players:

-

Andean Valley Corporation

-

Alter Eco

-

Quinoa Corporation (Ancient Harvest)

-

Inca Organics

-

COMRURAL XXI S.A.

-

NorQuin (Northern Quinoa Production Corporation)

-

The British Quinoa Company

-

Quinoabol S.R.L.

-

Keen One Quinoa

-

Andean Naturals, Inc.

-

Organic Farmers Co.

-

Andean Valley S.A.

-

Arrowhead Mills

Chapter 1. Quinoa Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Quinoa Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Quinoa Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Quinoa Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Quinoa Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Quinoa Market – By Type

6.1 Introduction/Key Findings

6.2 White Quinoa

6.3 Red Quinoa

6.4 Black Quinoa

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Quinoa Market – By Application

7.1 Introduction/Key Findings

7.2 Food

7.3 Beverages

7.4 Personal Care

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Quinoa Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3 Online Retailers

8.4 Specialty Stores

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Quinoa Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Quinoa Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Andean Valley Corporation

10.2 Alter Eco

10.3 Quinoa Corporation (Ancient Harvest)

10.4 Inca Organics

10.5 COMRURAL XXI S.A.

10.6 NorQuin (Northern Quinoa Production Corporation)

10.7 The British Quinoa Company

10.8 Quinoabol S.R.L.

10.9 Keen One Quinoa

10.10 Andean Naturals, Inc.

10.11 Organic Farmers Co.

10.12 Andean Valley S.A.

10.13 Arrowhead Mills

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

By 2023, the Global Quinoa market is expected to be valued at US$ 1.3 billion.

Through 2030, the Global Quinoa market is expected to grow at a CAGR of 7.5%.

By 2030, Global Quinoa Market is expected to grow to a value of US$ 2.15 billion.

South America is predicted to lead the Global Quinoa market.

The Global Quinoa Market has segments By Application, Type, Distribution Channel, and Region.