North America Quinoa Market Size (2024-2030)

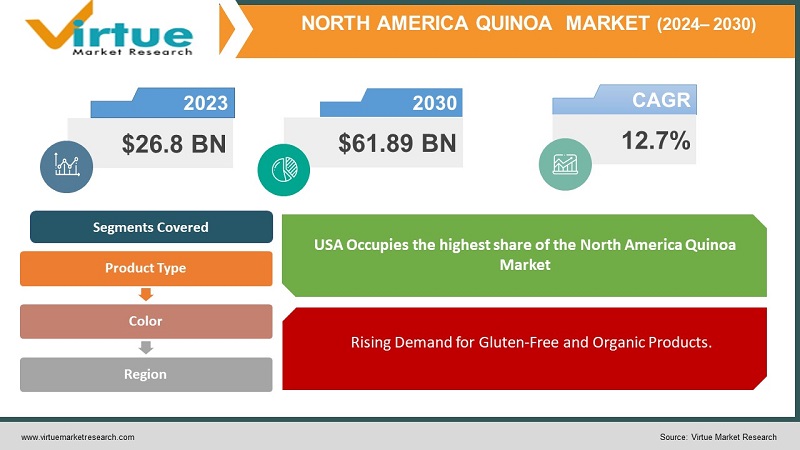

The North America Quinoa Market was valued at USD 26.8 billion in 2023 and is projected to reach a market size of USD 61.89 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 12.7% between 2024 and 2030.

The North America Quinoa Market is experiencing significant growth, driven by increasing consumer awareness of the grain’s nutritional benefits and versatility. As a complete protein rich in essential amino acids, fiber, and vitamins, quinoa has gained popularity among health-conscious consumers and those seeking plant-based dietary options. The rise in demand for gluten-free and organic products has further fueled the market, with quinoa being a preferred choice due to its natural gluten-free properties and its appeal to those following vegan or vegetarian diets. Additionally, the growing trend towards sustainable and environmentally friendly agricultural practices has spotlighted quinoa as a crop that requires less water compared to traditional grains, making it an attractive option for eco-conscious consumers. The expansion of quinoa-based products in supermarkets and health food stores, along with increased awareness through various media channels, is driving further adoption. As the North American market continues to evolve, innovations in quinoa product offerings and a broader range of applications in both culinary and processed foods are expected to sustain and enhance market growth, meeting the rising demand for nutritious and sustainable food choices.

Key Market Insights:

25% increase in quinoa consumption in North America over the past five years, driven by growing health and wellness trends.

40% of quinoa sold in North America is organic, reflecting rising demand for natural and chemical-free products.

30% growth in quinoa-based product offerings, including snacks, cereals, and ready-to-eat meals, in the last three years.

50% of consumers report buying quinoa primarily for its nutritional benefits, such as high protein and fiber content.

15% of North American households now regularly include quinoa in their diets, indicating a shift towards healthier eating habits.

North America Quinoa Market Drivers:

Health and Nutritional Benefits.

The North America Quinoa Market is significantly driven by the grain's impressive health and nutritional benefits. Quinoa is a complete protein, containing all nine essential amino acids, which makes it an attractive option for those seeking plant-based sources of protein. Additionally, it is rich in dietary fiber, vitamins, and minerals, including magnesium, potassium, and iron, which contribute to overall health and well-being. This nutritional profile appeals to health-conscious consumers and those with dietary restrictions, such as gluten intolerance or a need for low-GI foods. The increasing prevalence of health-related conditions, such as obesity and diabetes, has prompted more individuals to seek out nutritious and functional foods, further boosting the demand for quinoa. As consumers become more aware of the benefits of incorporating superfoods into their diets, quinoa’s role as a versatile, nutritious ingredient continues to gain popularity. This growing awareness and emphasis on healthier eating habits drive market growth, with quinoa becoming a staple in health food aisles and culinary applications across North America.

Rising Demand for Gluten-Free and Organic Products.

Another significant driver of the North America Quinoa Market is the rising demand for gluten-free and organic products. Quinoa's natural gluten-free properties make it a preferred choice for individuals with celiac disease or gluten sensitivity, contributing to its increased popularity among health-conscious consumers. Additionally, the trend towards organic food consumption is on the rise, with more people seeking products that are free from synthetic pesticides and fertilizers. Quinoa, being available in organic varieties, aligns perfectly with this growing consumer preference for clean and sustainably sourced foods. The expansion of organic and gluten-free product lines in grocery stores and health food markets has made quinoa more accessible and appealing to a broader audience. This trend is supported by growing awareness of the benefits of organic farming and the environmental impact of food production, driving consumers to choose quinoa as part of their commitment to healthier, more sustainable eating practices. The confluence of these factors continues to fuel the growth of the quinoa market in North America.

North America Quinoa Market Restraints and Challenges:

The North America Quinoa Market faces several restraints and challenges that could impact its growth. One significant challenge is the relatively high price of quinoa compared to other staple grains. The cost of quinoa, driven by factors such as production costs and import tariffs, can be a barrier for price-sensitive consumers and limit its widespread adoption. Additionally, the market is affected by supply chain issues, including fluctuations in quinoa production and distribution. As a crop primarily grown in South America, any disruptions in the supply chain, such as adverse weather conditions or geopolitical issues, can lead to shortages and price volatility. Another challenge is competition from other superfoods and alternative grains that offer similar health benefits at lower costs. The need for widespread consumer education about quinoa’s benefits and versatility is also crucial, as lack of awareness can hinder market expansion. Furthermore, the environmental impact of quinoa farming, such as the potential for soil degradation in its native growing regions, raises sustainability concerns that may affect consumer perceptions and demand. Addressing these challenges is essential for sustaining and enhancing growth in the North American quinoa market.

North America Quinoa Market Opportunities:

The North America Quinoa Market presents several promising opportunities for growth and expansion. One significant opportunity lies in the development of innovative quinoa-based products, such as ready-to-eat meals, snacks, and beverages. As consumer preferences shift towards convenient and health-conscious food options, incorporating quinoa into a diverse range of products can cater to this demand and expand market reach. Additionally, the growing trend of personalized nutrition offers potential for quinoa to be marketed as a superfood tailored to specific dietary needs and health goals. The increasing focus on sustainability and eco-friendly practices provides another avenue for growth, as quinoa’s low water usage compared to other crops can be highlighted to appeal to environmentally conscious consumers. Furthermore, the expansion of e-commerce platforms and online grocery shopping presents an opportunity to reach a broader audience, making quinoa more accessible to consumers who may not find it in local stores. Exploring partnerships with food service providers, such as restaurants and meal kit companies, can also drive demand by introducing quinoa into mainstream dining options. Leveraging these opportunities can enhance market presence and capitalize on the rising consumer interest in nutritious and sustainable food choices.

NORTH AMERICA QUINOA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.7% |

|

Segments Covered |

By Product Type, color, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA MEXICO |

|

Key Companies Profiled |

Ancient Harvest, Quinoa Corporation (Inca Organics), Bob's Red Mill, Nature’s Path Foods, The Chia Co., Grain Place Foods,Keenan Farms, Navitas Organics, Terrasoul Superfoods, Pural Organic Foods |

North America Quinoa Market Segmentation:

North America Quinoa Market segmentation By Product Type:

- Whole Quinoa

- Quinoa Flour

- Quinoa Flakes

- Quinoa Puffs

- Quinoa Protein Powder

In 2023, based on market segmentation by Product Type, Whole Quinoa Occupies the highest share of the North America Quinoa Market. Whole quinoa holds a prominent position in the North American market due to its remarkable versatility, nutritional value, and consumer familiarity. As a highly adaptable ingredient, whole quinoa can be used in a wide array of culinary applications, from nutritious salads and hearty soups to wholesome breakfast bowls and baked goods. This flexibility makes it a favored choice among both home cooks and professional chefs, catering to diverse dietary preferences and meal ideas. Nutritionally, whole quinoa stands out as a complete protein, providing all nine essential amino acids, which aligns perfectly with the growing health-conscious trends in North America. It is also rich in dietary fiber, essential minerals such as magnesium and iron, and vitamins, making it a valuable addition to a balanced diet. Furthermore, its status as the most recognizable form of quinoa enhances its market appeal, as consumers are more likely to choose familiar and trusted products. The combination of these factors—versatility in cooking, robust nutritional benefits, and widespread recognition—contributes to whole quinoa's strong market share and sustained popularity in North America.

North America Quinoa Market segmentation By Color:

- White Quinoa

- Red Quinoa

- Black Quinoa

In 2023, based on market segmentation by Colour, White Quinoa Occupies the highest share of the North America Quinoa Market. White quinoa dominates the North American market largely due to its familiarity, mild flavor, and widespread availability. As the most commonly known and consumed type of quinoa, white quinoa benefits from a high level of consumer recognition, which contributes to its leading position in the market. Its mild, nutty flavor makes it an incredibly versatile ingredient that can easily be incorporated into a variety of culinary applications, from savory dishes like salads and soups to sweet options such as breakfast bowls and baked goods. This adaptability enhances its appeal across diverse dietary preferences and cooking styles. Additionally, white quinoa's broader availability compared to red or black quinoa further supports its market dominance. It is more commonly stocked in grocery stores and health food markets, making it a readily accessible option for consumers. While red and black quinoa have gained traction for their distinctive flavors and nutritional benefits, white quinoa remains the go-to choice for many due to its established familiarity, versatility in recipes, and ease of procurement. These factors collectively contribute to white quinoa's sustained prominence and popularity in the North American quinoa market.

North America Quinoa Market segmentation By Region:

- USA

- Canada

- Mexico

In 2023, based on market segmentation by Region, USA Occupies the highest share of the North America Quinoa Market. The United States, with its large and diverse population, has emerged as a dominant market for quinoa in North America. This substantial population creates a significant demand for a variety of food products, including nutritious and plant-based options like quinoa. The growing health-conscious culture in the US further amplifies this demand, as more consumers seek out healthy, nutrient-rich foods that align with their wellness goals. Additionally, the country's well-developed retail infrastructure, encompassing supermarkets, health food stores, and online platforms, ensures that quinoa products are easily accessible to a wide range of consumers. The US food industry, known for its innovation and willingness to experiment, has also played a crucial role in the proliferation of quinoa-based products, offering consumers diverse and appealing options. While Canada remains an important market for quinoa within North America, the USA's larger population, combined with its health-focused culture and robust retail infrastructure, solidifies its dominance in the region, making it a key player in the global quinoa market.

COVID-19 Impact Analysis on the North America Quinoa Market.

The COVID-19 pandemic had a mixed impact on the North America Quinoa Market. On one hand, the pandemic heightened consumer awareness of health and nutrition, leading to increased demand for nutrient-dense foods like quinoa. With growing concerns about immunity and overall wellness, more consumers turned to quinoa for its high protein and fiber content, contributing to a surge in sales, particularly in the retail sector. The focus on home cooking and the expansion of online grocery shopping also boosted quinoa’s visibility and availability. However, the pandemic also posed challenges, including disruptions in supply chains and fluctuations in quinoa prices. Lockdowns and restrictions affected production and distribution, leading to temporary shortages and increased costs. Additionally, economic uncertainties and shifts in consumer spending patterns led some individuals to prioritize more affordable staple foods over premium products like quinoa. Despite these challenges, the long-term impact of the pandemic is expected to be positive, as heightened health awareness and ongoing interest in nutritious and versatile foods continue to drive demand. As the market recovers and stabilizes, the increased consumer focus on health and sustainability is likely to sustain growth in the North American quinoa sector.

Latest trends / Developments:

The North America Quinoa Market is evolving with several notable trends and developments. One significant trend is the rising innovation in quinoa-based products, such as ready-to-eat meals, snacks, and beverages, driven by increasing consumer demand for convenient and healthy food options. Companies are also exploring new flavors and formulations to enhance quinoa’s versatility and appeal. Additionally, there is a growing emphasis on sustainability, with a focus on promoting quinoa’s environmental benefits, such as its lower water usage compared to traditional grains. This aligns with the broader consumer shift towards eco-friendly and ethically sourced products. The expansion of organic quinoa offerings is another key development, reflecting the rising consumer preference for natural and chemical-free foods. The growth of e-commerce and direct-to-consumer sales channels is also transforming the market, making quinoa more accessible to a wider audience and enabling companies to reach consumers who may not have access to specialty stores. Furthermore, there is increasing interest in incorporating quinoa into various cuisines and dietary plans, including gluten-free and plant-based diets, further driving its adoption. These trends highlight quinoa’s growing role in the North American food landscape, driven by innovation, sustainability, and changing consumer preferences.

Key Players:

- Ancient Harvest

- Quinoa Corporation (Inca Organics)

- Bob's Red Mill

- Nature’s Path Foods

- The Chia Co.

- Grain Place Foods

- Keenan Farms

- Navitas Organics

- Terrasoul Superfoods

- Pural Organic Foods

Chapter 1. North America Quinoa Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Quinoa Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Quinoa Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Quinoa Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Quinoa Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Quinoa Market– By Product Type

6.1. Introduction/Key Findings

6.2. Whole Quinoa

6.3. Quinoa Flour

6.4. Quinoa Flakes

6.5. Quinoa Puffs

6.6. Quinoa Protein Powder

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. North America Quinoa Market– By Color

7.1. Introduction/Key Findings

7.2. White Quinoa

7.3. Red Quinoa

7.4. Black Quinoa

7.5. Y-O-Y Growth trend Analysis By Color

7.6. Absolute $ Opportunity Analysis By Color , 2024-2030

Chapter 8. North America Quinoa Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Color

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Quinoa Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Ancient Harvest

9.2. Quinoa Corporation (Inca Organics)

9.3. Bob's Red Mill

9.4. Nature’s Path Foods

9.5. The Chia Co.

9.6. Grain Place Foods

9.7. Keenan Farms

9.8. Navitas Organics

9.9. Terrasoul Superfoods

9.10. Pural Organic Foods

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

By 2023, the North America Quinoa market is expected to be valued at US$ 26.8 billion.

Through 2030, the North America Quinoa market is expected to grow at a CAGR of 12.7%.

By 2030, the North America Quinoa Market is expected to grow to a value of US$ 61.89 billion.

The USA is predicted to lead the North America Quinoa market.

The North America Quinoa Market has segments By Product type, Colour, and Region.