Protein Hydrolysates Market Size (2025 - 2030)

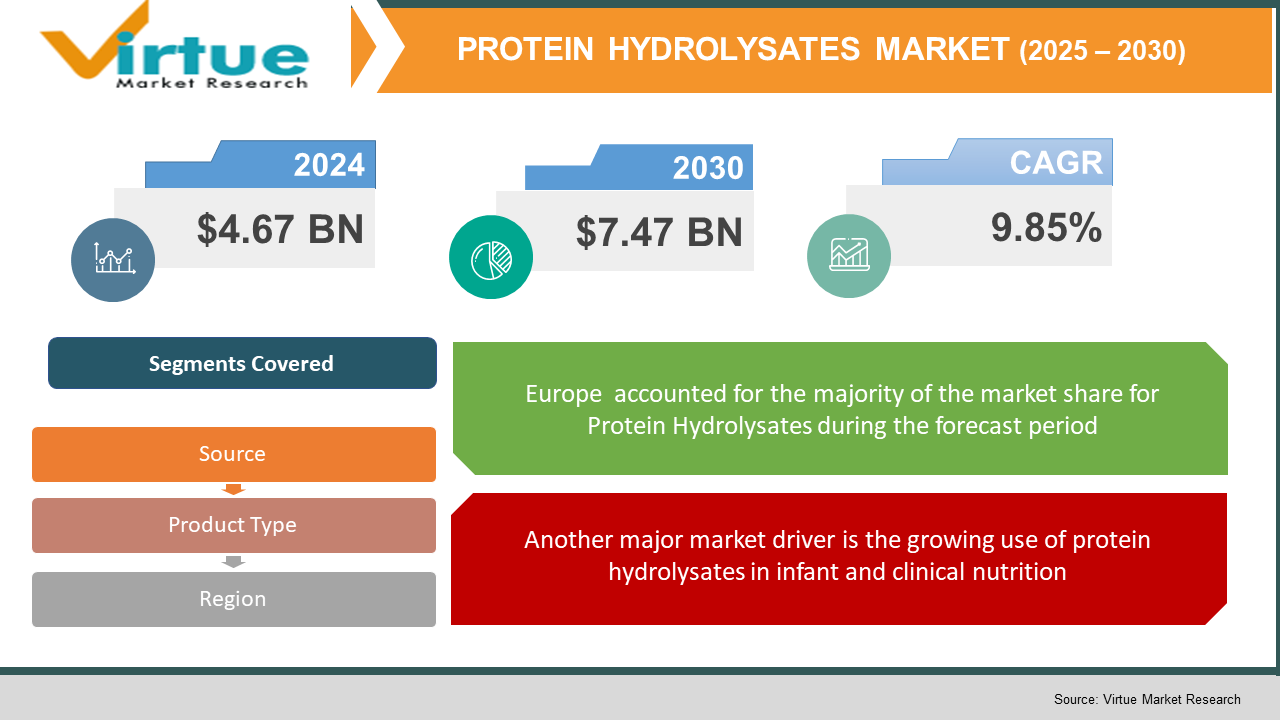

The Global Protein Hydrolysates Market was valued at USD 4.67 billion in 2024 and is projected to reach a market size of USD 7.47 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.85%.

The Global Protein Hydrolysates Market is growing steadily with increasing demand for high-quality, low-digestible proteins in different industries such as infant nutrition, sports nutrition, clinical nutrition, and functional foods. Protein hydrolysates are enzymes or chemically hydrolysed proteins that are reduced to lower peptides and amino acids from which they are derived, with better bioavailability and reduced allergenicity. This makes them a perfect fit for patients with dietary sensitivities, infants, sportspeople, and patients who need specialised nutrition. The market is further being driven by rising health awareness, rising emphasis on muscle recovery and weight management, and a spurt in demand for plant-based and clean-label food products. With consumers moving toward preventive healthcare and nutrition-based lifestyles, the market for protein hydrolysates is set to experience tremendous growth over the next few years.

Key Market Insights:

The infant nutrition application held over 30% of the market share in 2023 due to increased demand for hypoallergenic and easily digestible formulas.

North America accounts for approximately 20–25% of the global market, led by the sports nutrition and dietary supplement industries.

The sports nutrition segment contributes to over 25% of total revenue in the protein hydrolysates market. This is due to the increasing focus on fitness and muscle recovery, especially among millennials and athletes worldwide.

Global Protein Hydrolysates Market Drivers:

One of the primary drivers of the protein hydrolysates market is the increasing global demand for functional and sports nutrition products.

Consumers, especially athletes and bodybuilders, are increasingly health-oriented and look for supplements that facilitate muscle recovery, performance, and overall health. Protein hydrolysates are quickly absorbed by the body because they have shorter peptide chains, making them perfect for post-exercise recovery and enhancing nutrient bioavailability. This advantage is particularly vital in sports nutrition, where effectiveness and timing matter. In addition, the ageing population is also fueling this demand as they want easily digestible high-protein foods to avoid muscle wasting (sarcopenia) and promote health. The movement toward pro-active health and wellness, which is fueled by greater awareness through digital media and influencers, is propelling hydrolysed proteins into protein powders, bars, shakes, and even into functional beverages. This growing base of consumers is forcing manufacturers to innovate and provide varied product formats and flavours to cater to different tastes.

Another major market driver is the growing use of protein hydrolysates in infant and clinical nutrition.

For infants, particularly those with cow milk protein allergy (CMPA) or other digestive sensitivities, protein hydrolysates are preferred because of their lowered allergenicity and enhanced digestibility. Extensively hydrolysed forms are commonly recommended for infants who are at high risk of allergic reactions, so this segment is extremely important to healthcare professionals and parents as well. In addition, in clinical environments, patients with gastrointestinal illnesses, malabsorption diseases, or undergoing surgical recovery receive the benefit of hydrolysed proteins' easy assimilation and nutritional effectiveness. Hospitals and care facilities incorporate these formulas into patient diets more and more for quicker recovery and better nutritional yield. With escalating healthcare costs, emphasis on early-stage nutrition, and increased sensitivity to food intolerance, this demand is gradually rising in this space. The faith in hydrolysates as a safer and more effective alternative to normal proteins continues to fuel market expansion worldwide.

Global Protein Hydrolysates Market Restraints and Challenges:

One of the key restraints in the global protein hydrolysates market is the high production cost and complex processing technology involved in manufacturing these products.

Protein hydrolysates are manufactured in enzymatic hydrolysis or acid hydrolysis processes, requiring sophisticated equipment, controlled environments, and superior raw materials. All these contribute significantly to higher production costs, resulting in relatively high-priced final products compared with other protein supplements such as concentrates or isolates. The price sensitivity can restrict their uptake, particularly in cost-sensitive markets and among lower-income consumer bases. In addition, ensuring product consistency in terms of quality and bioactivity during processing is technically demanding. The bitter flavour of protein hydrolysates, especially from animal sources, also influences product acceptability in the food and beverage industry, necessitating extra masking agents or flavour enhancers. Moreover, stringent regulatory standards for labelling, sourcing (particularly for infant nutrition), and health claims present another level of complexity for manufacturers. These issues could discourage small- and medium-sized operators from participating or growing in the market, thus influencing general growth potential.

Global Protein Hydrolysates Market Opportunities:

The global market for protein hydrolysates is set for significant growth, fueled by emerging opportunities in a range of industries. One of the major trends is the surging demand for plant-derived protein hydrolysates, including those derived from soy, pea, and rice, moving in tandem with the global shift towards sustainable and vegan dietary habits. These plant-sourced alternatives are gaining traction due to their digestibility, hypoallergenic nature, and environmental benefits. Technological advances have led to the development of antimicrobial protein hydrolysates that act as natural preservatives in food products and personal care products. These bioactive peptides play a role in increasing shelf life and improving product safety, hence meeting the growing consumer trend for clean-label ingredients. The Asia-Pacific region, and countries like India and China in particular, are an emerging key market for protein hydrolysates, fueled by an increasing awareness of health and a booming culture of fitness. This regional growth is also complemented by the global trend towards personalised nutrition, with advances in genetic testing and digital technologies allowing for protein hydrolysate products to be tailored to meet personal health goals.

PROTEIN HYDROLYSATES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

9.85% |

|

Segments Covered |

By Product Type, source, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Arla Foods Ingredients Group P/S, Abbott Laboratories, Kerry Group plc, FrieslandCampina Ingredients, and Nestlé Health Science |

Global Protein Hydrolysates Market Segmentation:

Protein Hydrolysates Market Segmentation: By Source

- Animal-Based

- Plant-Based

- Marine-Based

Animal-Based Protein Hydrolysates are the market leaders because they have a better amino acid composition and bioavailability. They are sourced primarily from milk (whey and casein), eggs, and meat and are in extensive use in sports and clinical nutrition. Milk protein hydrolysates are specifically used in large quantities in infant formulas of children suffering from cow milk protein allergy (CMPA). Nonetheless, lactose intolerance, allergens, and ethical concerns are driving some consumers away from animal-derived products. Plant-Based Protein Hydrolysates are increasingly on the rise, driven by the trend of veganism and a growing preference for sustainable, allergen-free alternatives. Soy, pea, rice, and wheat are typical sources, usually preferred for their hypoallergenic nature and digestibility. While their amino acid composition can be slightly less than animal sources, processing breakthroughs are narrowing the gap. Marine-Based Protein Hydrolysates, sourced from fish, krill, and algae, are proving useful bioactive ingredients in functional foods and nutraceuticals. These are high in omega-3 fatty acids and antioxidant, anti-inflammatory peptides. In this space, however, markets remain niche and frequently constrained by flavour, source, and consumer acceptance issues.

Protein Hydrolysates Market Segmentation: By Product Type

- Milk Protein Hydrolysates

- Meat Protein Hydrolysates

- Marine Protein Hydrolysates

- Plant Protein Hydrolysates

- Egg Protein Hydrolysates

Milk Protein Hydrolysates are the most recognised product form, particularly because they are commonly applied in infant and clinical nutrition. Whey and casein hydrolysates are highly digestible and provide quality protein with outstanding muscle-building and recovery properties. They are also a leading favourite among sports nutrition products. Meat Protein Hydrolysates are utilised in clinical and pet nutrition applications, providing high peptide content for growth and recovery. Yet, taste, price, and dietary considerations have restricted their application in conventional consumer products. They continue to be more dominant in speciality health and therapeutic sectors. Marine Protein Hydrolysates are increasingly known for their bioactive activity, particularly in skin, joint, and cardiovascular health. Obtained largely from fish and seafood, hydrolysates of these are being increasingly researched for functional beverages and supplements, but are plagued by difficulty in masking strong taste and odour. Plant Protein Hydrolysates, such as soy, pea, and rice, are fast becoming the most sought-after in vegan and vegetarian food and nutrition markets due to their clean label nature, non-GMO label, and low allergenic potential, making them attractive for use in functional foods and beverages. Flavour masking innovation and peptide maximisation are fueling their share in the market. Egg Protein Hydrolysates are less used but are desired for their intense amino acid composition and low fat content. They have good scope in sports nutrition and medical applications, but are struggling with allergenicity issues as well as manufacturing scalability. Irrespective of this, they are investigated in speciality dietary supplements and clinical trials.

Protein Hydrolysates Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

In 2024, Europe was the top market for protein hydrolysates owing to a highly developed consumer base with high levels of health awareness, nutrition concern, and concern for clean labels. The stringent regulatory environment of the region, emphasis on sustainable sourcing, and demand for specialist nutrition, particularly infant and clinical usage, continue to keep it on top. In the meantime, the Asia-Pacific region is growing at the fastest rate, driven by expanding health awareness, urbanisation, and rising disposable incomes in nations like China, India, and Japan. The increasing popularity of functional and plant-based foods in these markets is also driving adoption. North America has a robust market presence, driven primarily by its established sports nutrition market, prevalent consumption of dietary supplements, and early introduction of high-protein functional foods. In contrast, South America and the Middle East & Africa are developing markets, where rising awareness of health trends, slow but steady improvement in healthcare infrastructure, and expanding middle-class populations are generating new opportunities for market growth.

COVID-19 Impact Analysis on the Global Protein Hydrolysates Market:

The COVID-19 pandemic had a diversified impact on the world protein hydrolysates market. Initially, there was a steep surge in demand for products derived from protein hydrolysates as a result of heightened consumer concern about health and immunity. The trend was most evident in the market for functional foods and dietary supplements, where the digestibility of protein hydrolysates and their fast absorption attracted health-conscious consumers.

However, the pandemic created a host of issues. Disruptions in the supply chain, particularly initially, created raw material shortfalls and slowed production and delivery. This was particularly problematic for animal-derived hydrolysates, as meat and dairy processing plants were vulnerable to closure and reduced capacity as a result of infection with the COVID-19 virus among staff. Moreover, the closure of gyms and sports facilities reduced short-term demand for sports nutrition products and impacted the protein supplement market. Despite these problems, the market turned online with the growth in e-commerce as consumers increasingly started purchasing more nutritional supplements and specialist foods online. This favoured established companies with solid digital infrastructures while challenging players utilising outdated retail channels. Besides, the pandemic accelerated trends such as personalised nutrition and clean-label products, and businesses were forced to innovate and keep pace with evolving consumer trends.

Latest Trends/ Developments:

The global protein hydrolysate market is increasing exponentially with changing consumer behaviour and technological advancements. One of the trends is increasing demand for plant protein hydrolysates, such as soy, pea, and rice, owing to the world's shift towards green and vegan diets. Plant protein hydrolysates are increasing in popularity due to their digestibility, hypoallergenicity, and eco-friendliness. In the sports nutrition segment, protein hydrolysates are used owing to their rapid absorption and high bioavailability, which facilitates muscle recovery and performance enhancement. Their application in functional foods and beverages, such as protein bars and ready-to-drink shakes, is due to the increasing demand for convenience and healthy food.

Key Players:

- Arla Foods Ingredients Group

- Abbott Laboratories

- Kerry Group plc

- FrieslandCampina Ingredients

- Nestle Health Science

- Glanbia plc

- Tate & Lyle PLC

- Danone Nutricia

- Ajinomoto Co. Inc.

- Hilmar Ingredients

Chapter 1. Protein Hydrolysates Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. PROTEIN HYDROLYSATES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. PROTEIN HYDROLYSATES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. PROTEIN HYDROLYSATES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. PROTEIN HYDROLYSATES MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. PROTEIN HYDROLYSATES MARKET – By Source

6.1 Introduction/Key Findings

6.2 Animal-Based

6.3 Plant-Based

6.4 Marine-Based

6.5 Y-O-Y Growth trend Analysis By Source

6.6 Absolute $ Opportunity Analysis By Solution, 2025-2030

Chapter 7. PROTEIN HYDROLYSATES MARKET – By Product Type

7.1 Introduction/Key Findings

7.2 Milk Protein Hydrolysates

7.3 Meat Protein Hydrolysates

7.4 Marine Protein Hydrolysates

7.5 Plant Protein Hydrolysates

7.6 Egg Protein Hydrolysates

7.7 Y-O-Y Growth trend Analysis By Product Type

7.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 8. PROTEIN HYDROLYSATES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Product Type

8.1.3. By Source

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Source

8.2.3. By Product Type

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Source

8.3.3. By Product Type

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Source

8.4.3. By Product Type

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Source

8.5.3. By Product Type

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. PROTEIN HYDROLYSATES MARKET – Company Profiles – (Overview, Source Type , Portfolio, Financials, Strategies & Developments)

9.1 Arla Foods Ingredients Group

9.2 Abbott Laboratories

9.3 Kerry Group plc

9.4 FrieslandCampina Ingredients

9.5 Nestle Health Science

9.6 Glanbia plc

9.7 Tate & Lyle PLC

9.8 Danone Nutricia

9.9 Ajinomoto Co. Inc.

9.10 Hilmar Ingredients

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Protein Hydrolysates Market was valued at USD 4.67 billion in 2024 and is projected to reach a market size of USD 7.47 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.85%.

The Global Protein Hydrolysates Market is driven by increasing consumer demand for clean-label, chemical-free ingredients and rising health awareness.

Based on Service Provider, the Global Protein Hydrolysates Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers.

Europe is the most dominant region for the Global Protein Hydrolysates Market.

Arla Foods Ingredients Group P/S, Abbott Laboratories, Kerry Group plc, FrieslandCampina Ingredients, and Nestlé Health Science are the key players in the Global Protein Hydrolysates Market