Powder Protein Hydrolysates Market Size (2024 - 2030)

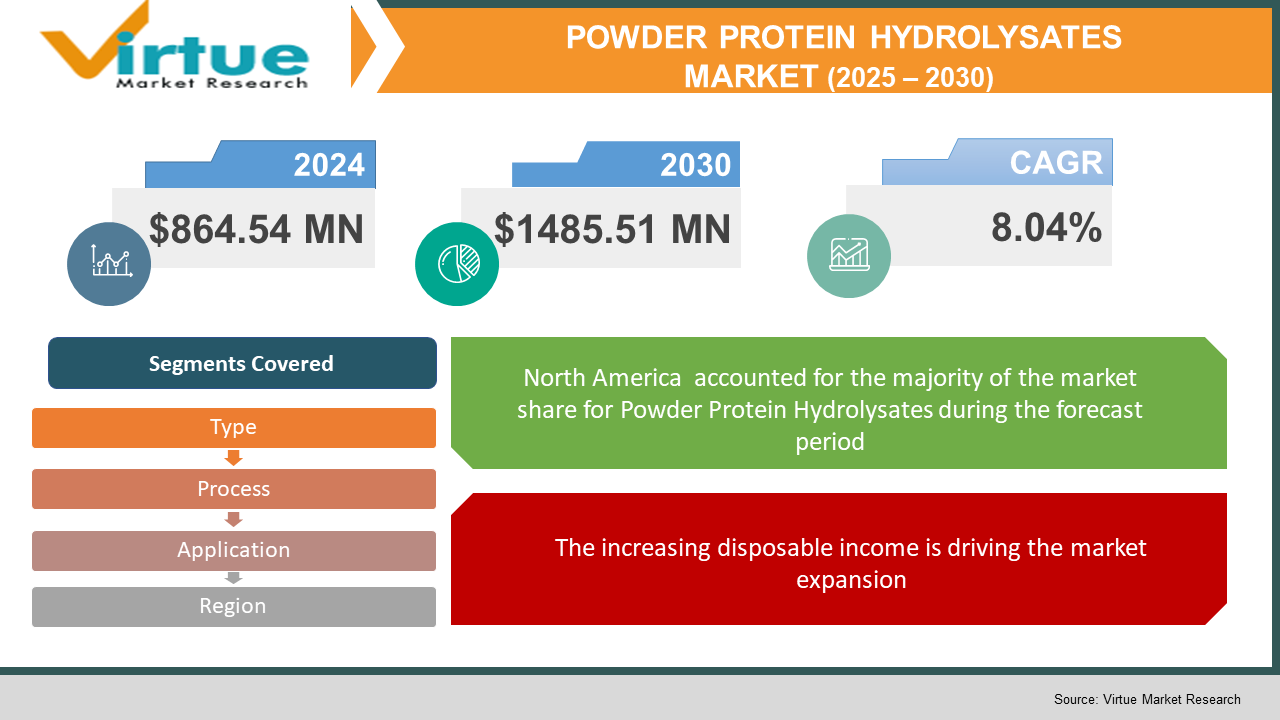

In 2023, the Global Powder Protein Hydrolysates Market was valued at USD 864.54 million and is projected to reach a market size of USD 1485.51 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.04%.

INDUSTRY OVERVIEW

Molecules are broken down chemically via hydrolysis, which uses water. When a protein is hydrolyzed, it produces a protein hydrolysate. Protein hydrolysates are characterized as a complex combination of oligopeptides, peptides, and free amino acids that are generated by partial or thorough hydrolysis, whereas biopeptides or bioactive peptides are characterized as peptides with advantageous pharmacological characteristics. By cleaving a protein with an acid, an alkali, or an enzyme, a combination of amino acids is created. The protein hydrolysates can be referred to as a complicated combination of peptides and amino acids with varying chain lengths. Purified sources of protein are processed to create protein hydrolysates. By heating these acidic protein sources or by including proteolytic enzymes in them, these protein sources are purified. The heated protein sources are then purified using certain techniques. Proteins are broken down into their amino acids in protein hydrolysates using an alkali, enzyme, or acid. This procedure aids in giving the consumer's body the same quantity of nutrients as the original amino acid-containing material. As a result, protein hydrolysates are utilised in special diets as nutrients as well as fluid replenishers in drinks. These preparations are employed as nutritional and fluid replenishers in special diets or for patients unable to consume regular dietary proteins. They supply the nutritive equivalent of the original material in the form of its constituent amino acids. They maximize nutrient delivery and have a variety of uses in the food and beverage industries. They offer several health advantages since they aid the body in absorbing amino acids more quickly than intact protein. Additionally, it is utilised in the biotechnology sector as an addition to cell culture.

Because they are good for food items and people's health, protein hydrolysates are of interest to the food industry. As a result of their gentler nature and the intrinsic specificity of different proteases, enzymatic hydrolysis is preferable because it allows for precise control over the kind and degree of treatment. The nutritional, practical, and bioactive properties of protein hydrolysates have made them quite popular. While controlled enzymatic hydrolysis, which focuses on certain peptide bonds, may also produce hydrolysates, it is the preferable approach. Protein hydrolysates are employed in a variety of processes because they facilitate the body's easy absorption of amino acids. The food and beverage industries are using it more frequently since it aids in the optimal delivery of nutrients right to the muscles. Aside from that, the sports business is seeing an increase in demand for both animal- and plant-based proteins. The cause is the growing understanding of the advantages of organic food items for health. High processing costs and the availability of competing goods, however, are impeding market demand.

COVD-19 IMPACT ON THE POWDER PROTEIN HYDROLYSATES MARKET

The dynamics of demand have changed exclusively as a result of the coronavirus epidemic. More and more consumers are looking for goods that improve physical and mental health, including gut health, immunity, individualized diet, and emotional wellbeing. For instance, during the COVID-19 pandemic, 18% of protein consumers in the United States bought their first plant-based protein. 80 % of customers in Germany, the UK, and the Netherlands said they would probably continue eating plant-based meat substitutes after COVID-19. However, following the new government directives, the COVID-19 (Coronavirus) pandemic has forced a large number of firms in the Protein Hydrolysates sector to completely halt their commercial operations. This pause in work directly affects the market for powder protein hydrolysates' revenue flow.

MARKET DRIVERS:

An increase in knowledge of the benefits of a protein-rich diet for immune and health development is fueling the market growth

More people are purchasing protein-based supplements to boost their health and immunity as a result of the pandemic scenario and a growing understanding of the value of boosting immunity. The demand has greatly increased the requirement for components like powder protein hydrolysates. A study that was published in Research Gate found that protein supplements were the most popular type of dietary supplement among those who admitted to having used them in the past. The industry is estimated to develop more quickly as consumers become more aware of the value of protein-based supplements for maintaining health. The worldwide protein hydrolysates market is expanding as a result of rising health consciousness among consumers and their consumption of nutrient-dense foods.

The demand for bovine collagen peptides is growing which is positively impacting the product demand

Due to the rising demand for goods made from amino acids in the food and beverage sector, bovine collagen peptides are being used in a broad range of applications, including drinks, sports nutrition, and high protein diets. Bovine collagen peptides also provide several health advantages, including better bone health, arthritis treatment, and the prevention of bone loss. This is one of the key drivers boosting the powder protein hydrolysates Market's expansion.

The increasing disposable income is driving the market expansion

Demand from end-user sectors such as animal feed, clinical nutrition, and newborn nutrition is anticipated to be driven by growth in population and per capita income in China and India, along with a growing trend toward protein hydrolysate products.

MARKET RESTRAINTS:

High selling price and R&D costs are high which may impede the market growth

As powder protein hydrolysates have a significant potential utility as a protein source for human consumption, the market's biggest difficulty is that their production processes involve dehydration, which demands a high energy supply and is, thus, quite expensive. Because industrial enzymes are expensive, another technique called enzymatic hydrolysis is equally expensive. This cost is also being increased by the need for additional processing to deactivate enzymatic hydrolysis and the challenging nature of the procedure to create hydrolysates with a certain molecular mass. Furthermore, this drives up the price of finished goods and encourages the market to see an increase in less expensive fake food products, which has a negative influence on the market. As a result, the market will face challenges from high R&D and production costs between 2022 and 2030.

POWDER PROTEIN HYDROLYSATES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.04% |

|

Segments Covered |

By Type, Process, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABBOTT NUTRITION, KONINKLIJKE DSM N.V, KERRY GROUP PLC, FRIESLANDCAMPINA, ARLA FOODS, TATE & LYLE PLC, ARCHER DANIELS MIDLAND COMPANY, GLABNIA PLC, DANONE NUTRICIA, NESTLE SA |

POWDER PROTEIN HYDROLYSATES MARKET – BY TYPE

-

Milk Protein Hydrolysate

-

Plant Protein Hydrolysate

-

Animal Protein Hydrolysate

Based on the type, the Powder Protein Hydrolysates Market is segmented into Milk Protein Hydrolysate, Plant Protein Hydrolysate and Animal Protein Hydrolysate. In 2021, the milk-based powder protein hydrolysate retained the biggest market share, accounting for 49.20 %. Due to its multifunctional properties, it is employed in the preparation of several goods in the food and beverage business. The need for milk-based hydrolysate in baby nutrition, sports nutrition, and other dietary supplements is rising quickly. But between 2022 and 2030, plant-based protein hydrolysates are anticipated to develop rapidly. The category is expanding due to the rising demand for high-quality organic food items.

POWDER PROTEIN HYDROLYSATES MARKET - BY PROCESS

-

Acid & Alkaline Hydrolysis

-

Enzymatic Hydrolysis.

Based on the process, the Powder Protein Hydrolysates Market is segmented into Acid & Alkaline Hydrolysis and Enzymatic Hydrolysis. In 2021, the enzymatic process dominated the market and had the highest market share with 69.22%. The acid and alkaline approach was first discovered, but the enzymatic procedure was proven to be more effective. Numerous vital nutrients, including serine, arginine, and threonine, are eliminated throughout the alkaline and acid process. As a result, the enzymatic method has been embraced by the industrial industries.

POWDER PROTEIN HYDROLYSATES MARKET - BY APPLICATION

-

Infant Nutrition

-

Sports Nutrition

-

Clinical Nutrition

-

Dietary Supplements

-

Animal Feed

Based on the process, the Powder Protein Hydrolysates Market is segmented into Infant Nutrition, Sports Nutrition, Clinical Nutrition, Dietary Supplements and Animal Feed. According to Application type, the baby nutrition segment had the largest revenue share of the market and is anticipated to expand at a CAGR of 7.2 % over the forecast period. The necessity for protein in the synthesis and healthy development of newborn tissues is thought to be the cause. Additionally, a lack of protein causes malnutrition, which is linked to the sharp rise in the usage of hydrolysates in infant formula. Protein hydrolysates are also intended for infants who cannot take formulas based on soy or cow's milk. Babies with a protein allergy have a choice of formulas that have been extensively hydrolyzed. The market is forecasted to grow throughout the forecast period of 2022–2030 because hydrolyzed proteins are more similar to breast milk proteins, making them easier for the infant to digest while still educating their stomach and intestines on how to handle protein.

POWDER PROTEIN HYDROLYSATES MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Powder Protein Hydrolysates Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. With sales of $302.2 million in 2021 and an anticipated CAGR of 5.0 % from 2023 - 2030, North America is the key area driving the Powder Protein Hydrolysates market. Due to the region's flourishing food sector and growing public awareness of its health advantages, use is on the rise. A significant amount of end-user manufacturing firms, such as Mead Johnson and Hill Pharma, are also present in the area, which is anticipated to lead to a huge increase in demand for the product there. Additionally, the high cost of production results in higher-end product costs, which are absorbed by the consumer. Because customers have more purchasing capacity, more developed countries are accepting the goods. The market in this area is expanding as a result of the leading players' increased R&D efforts and the supporting policies in place. 69 % of infants who are fed regular milk or formula consume cow's milk formula, and 12.0 % consume soy formula with protein hydrolysate as ingredients, according to a report published by the National Health and Nutrition Examination Survey of the US in 2019. This directly impacts market growth. According to estimates, the U.S.'s favorable government laws will accelerate market expansion. However, it is anticipated that the Asia-Pacific region would expand at the fastest CAGR of 7.5 % from 2022 to 2030. This is because the market for protein hydrolysate in the Asia Pacific area is being driven by rising consumer awareness and disposable income.

POWDER PROTEIN HYDROLYSATES MARKET - BY COMPANIES

Some of the major players operating in the Powder Protein Hydrolysates market include:

-

ABBOTT NUTRITION

-

KONINKLIJKE DSM N.V

-

KERRY GROUP PLC

-

FRIESLANDCAMPINA

-

ARLA FOODS

-

TATE & LYLE PLC

-

ARCHER DANIELS MIDLAND COMPANY

-

GLABNIA PLC

-

DANONE NUTRICIA

-

NESTLE SA

NOTABLE HAPPENING IN THE POWDER PROTEIN HYDROLYSATES MARKET

-

COLLABORATION- Novozymes and Novo Nordisk Pharmatech established a strategic partnership in November 2021 that combines the businesses' shared expertise and passion for creating specialized enzymes for use in biopharmaceutical processing and regenerative treatments. Novozymes will be able to better serve its clients thanks to this relationship.

-

PRODUCT LAUNCH- A novel whey protein component that is clinically shown to prevent the loss of muscle mass with ageing was introduced by Arla Foods Ingredients in 2020. Lacprodan® HYDRO. Whey protein that has been completely hydrolyzed is called Rebuild. It provides a high level of branched-chain amino acids and critical amino acids, such as leucine, which are crucial for muscle synthesis in elder people.

-

COLLABORATION - FrieslandCampina Ingredients strengthened its regional alliance with IMCD in Indonesia in 2020. Through this collaboration, it expands its presence in one of the region's marketplaces for performance and active nutrition that is expanding at the quickest rate.

-

ACQUISITION- Kerry purchased Pevesa Biotech in 2020, a Spanish business that specialized in organic, non-allergenic plant protein components for newborn, general, and therapeutic nutrition.

Chapter 1. POWDER PROTEIN HYDROLYSATES MARKET– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. POWDER PROTEIN HYDROLYSATES MARKET– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. POWDER PROTEIN HYDROLYSATES MARKET– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. POWDER PROTEIN HYDROLYSATES MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. POWDER PROTEIN HYDROLYSATES MARKET– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. POWDER PROTEIN HYDROLYSATES MARKET– By Type

6.1 Introduction/Key Findings

6.2 Milk Protein Hydrolysate

6.3 Plant Protein Hydrolysate

6.4 Animal Protein Hydrolysate

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. POWDER PROTEIN HYDROLYSATES MARKET– By PROCESS

7.1 Introduction/Key Findings

7.2 Acid & Alkaline Hydrolysis

7.3 Enzymatic Hydrolysis.

7.4 Y-O-Y Growth trend Analysis By PROCESS

7.5 Absolute $ Opportunity Analysis By PROCESS, 2024-2030

Chapter 8. POWDER PROTEIN HYDROLYSATES MARKET– By APPLICATION

8.1 Introduction/Key Findings

8.2 Infant Nutrition

8.3 Sports Nutrition

8.4 Clinical Nutrition

8.5 Dietary Supplements

8.6 Animal Feed

8.7 Y-O-Y Growth trend Analysis APPLICATION

8.8 Absolute $ Opportunity Analysis APPLICATION, 2024-2030

Chapter 9. POWDER PROTEIN HYDROLYSATES MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By PROCESS

9.1.4 By APPLICATION

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By PROCESS

9.2.4 By APPLICATION

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By PROCESS

9.3.4 By APPLICATION

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By PROCESS

9.4.4 By APPLICATION

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By PROCESS

9.5.4 By APPLICATION

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. POWDER PROTEIN HYDROLYSATES MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 ABBOTT NUTRITION

10.2 KONINKLIJKE DSM N.V

10.3 KERRY GROUP PLC

10.4 FRIESLANDCAMPINA

10.5 ARLA FOODS

10.6 TATE & LYLE PLC

10.7 ARCHER DANIELS MIDLAND COMPANY

10.8 GLABNIA PLC

10.9 DANONE NUTRICIA

10.10 NESTLE SA

Download Sample

Choose License Type

2500

4250

5250

6900