Whey Protein Market Size (2024 – 2030)

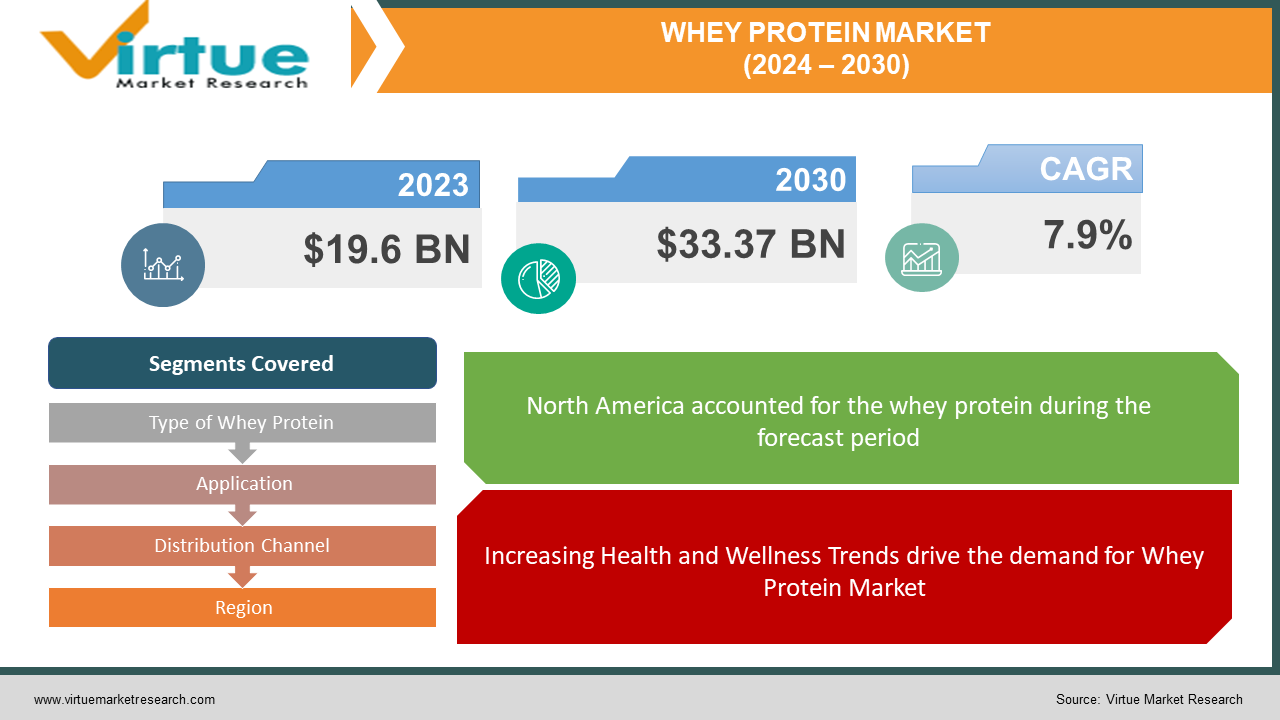

The Global Whey Protein Market was valued at USD 19.6 billion and is projected to reach a market size of USD 33.37 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9%.

Whey protein has a high protein content and is effective in muscle building and recovery. The Whey Protein Market is expected to grow significantly in the coming years due to increasing health awareness, product innovation, and the expanding range of applications beyond traditional sports nutrition. The major well-established key players in the Whey Protein Market are Glanbia plc, Fonterra Co-operative Group, Kerry Group plc, Arla Foods, and Agropur Cooperative.

Key Market Insights:

Increasing health and wellness trends, rising disposable income, expansion of the sports nutrition industry, growing emphasis on muscle building and recovery, product innovation and diversification, expanding applications in the food and beverage industry, rise in demand for plant-based alternatives, e-commerce and retail channel expansion, increasing awareness about health benefits are propelling the Whey Protein Market. The restraints to the Whey Protein Market include the high cost, lactose intolerance, competition from plant-based alternatives, allergen concerns, environmental concerns, regulatory challenges, taste and flavor challenges, and supply chain disruptions. North America occupies the highest share of the Whey Protein Market. Asia-Pacific is the fastest-growing segment during the forecast period.

Whey Protein Market Drivers

Increasing Health and Wellness Trends drive the demand for Whey Protein Market

There is a heightened awareness among people about the importance of proper nutrition and physical fitness. Many individuals are adopting healthier lifestyles. This includes regular exercise and balanced diets. Whey protein is known for its high-quality protein content and essential amino acids. It has gained popularity among health-conscious consumers. It is a convenient and effective way to support muscle growth, recovery, and overall well-being. Aging populations, rising healthcare costs, and increasing prevalence of lifestyle-related diseases are other factors responsible for the adoption of healthier lifestyles and diets. Consumers are seeking products that promote better health and longevity. Whey protein is considered to be one of the healthiest proteins.

Expansion of the Sports Nutrition Industry is propelling the Whey Protein Market

The sports nutrition industry has witnessed remarkable growth in recent years. This is due to a surge in sports participation, fitness activities, and awareness about nutrition's role in athletic performance. Whey protein is a key component of sports nutrition products. It is popular for its rapid absorption and ability to support muscle protein synthesis. Athletes, bodybuilders, and fitness enthusiasts regularly use whey protein supplements in their training to optimize performance, enhance recovery, and achieve their fitness goals. The growing popularity of sports events, fitness competitions, and social media influencers promotes health and fitness This further drives high demand for whey protein products.

Whey Protein Market Restraints and Challenges

The major challenge faced by the Whey Protein Market is the high cost. Whey protein products with higher protein content and additional features can be expensive compared to other protein sources. Another challenge in the Whey Protein Market is lactose intolerance. Whey protein contains lactose. Individuals who are lactose intolerant may experience digestive issues such as bloating, gas, and stomach discomfort. The other restraints to the Whey Protein Market include competition from plant-based alternatives, allergen concerns, environmental concerns, regulatory challenges, taste and flavor challenges, and supply chain disruptions.

Whey Protein Market Opportunities:

The Whey Protein Market has various opportunities in the market. With continuous innovation in product formulations, such as flavor enhancements, texture improvements, and ingredient combinations, the Whey Protein Market is anticipated to witness significant growth in the coming years. Other Opportunities in the Whey Protein Market include expansion in emerging markets, diversification into new application areas, targeting specific consumer demographics, leveraging e-commerce and digital marketing, developing sustainable practices, collaborating with food and beverage manufacturers, and investing in research and development for new protein sources.

WHEY PROTEIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.9% |

|

Segments Covered |

By Type of Whey Protein, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Glanbia plc, Fonterra Co-operative Group, Kerry Group plc, Arla Foods, Agropur Cooperative, Lactalis Ingredients, Hilmar Ingredients, Davisco Foods International (a subsidiary of Agropur), Maple Island Inc., Carbery Group |

Whey Protein Market Segmentation: By Type of Whey Protein

-

Whey Protein Concentrate (WPC)

-

Whey Protein Isolate (WPI)

-

Whey Protein Hydrolysate (WPH)

In 2023, based on market segmentation by Type of Whey Protein, Whey Protein Concentrate (WPC) occupies the highest share of the Whey Protein Market. This is mainly due to its cost-effectiveness compared to other forms of whey protein. It is accessible to a broader consumer base. It contains varying levels of protein, typically from 30% to 80%, and the rest of the composition consists of fats, lactose, and minerals. However, Whey Protein Isolate (WPI) is the fastest-growing segment during the forecast period and is projected to grow at a CAGR of 11%. This is due to higher protein content, typically around 90% or more.

Whey Protein Market Segmentation: By Application

-

Sports Nutrition (protein shakes, bars, supplements)

-

Food & Beverages (functional foods, infant formula, dairy products)

-

Pharmaceuticals (medical nutrition, supplements)

-

Personal Care & Cosmetics (skincare, hair care products)

In 2023, based on market segmentation by application, the Sports Nutrition segment occupies the highest share of the Whey Protein Market. This is mainly due to its health benefits among athletes, bodybuilders, and fitness enthusiasts. A wide range of products including protein shakes, bars, and supplements are tailored toward athletes, bodybuilders, and fitness enthusiasts to enhance muscle growth, recovery, and performance.

However, the Food & Beverages are the fastest-growing segment during the forecast period. This is mainly due to the increasing demand for whey protein-fortified food and beverage options that promote satiety, muscle repair, and overall well-being.

Whey Protein Market Segmentation: By Distribution Channel

-

Online Retail

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Pharmacies/Drugstores

-

Convenience Stores

In 2023, based on market segmentation by the Distribution Channel, the Online Retail segment occupies the highest share of the Whey Protein Market. This is mainly due to the increasing popularity and usage of e-commerce. This offers convenience, accessibility, and a wide variety of whey protein products. The ease of comparison shopping, availability of product reviews, and home delivery options contribute to the popularity of purchasing whey protein supplements online.

However, Specialty Stores is the fastest-growing segment during the forecast period. This growth is driven by the availability of a wide range of high-quality whey protein supplements specifically for fitness enthusiasts, athletes, and bodybuilders. Personalized advice and recommendations from knowledgeable staff also attract consumers seeking expert guidance and premium products.

Whey Protein Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2023, based on market segmentation by region, North America occupies the highest share of the Whey Protein Market. This growth is due to a high awareness of health and wellness trends among consumers. North America is a technologically advanced region with a well-established sports nutrition and fitness industry. The growth is also driven by the growing fitness-conscious population and the availability of a wide range of whey protein supplements in retail outlets and online platforms.

However, Asia-Pacific is the fastest-growing segment during the forecast period. This is mainly due to the increasing disposable incomes, urbanization, and a growing emphasis on healthy lifestyles. Countries like China, India, Japan, and Australia, have significant market shares due to the rising popularity of sports and fitness activities, coupled with the expansion of e-commerce platforms. The large population, rising health awareness, and increasing adoption of Western dietary habits and fitness trends contribute to the growth of the Whey Protein Market in the Asia-Pacific region.

COVID-19 Impact Analysis on the Global Whey Protein Market:

The COVID-19 pandemic had a significant impact on the Whey Protein Market. There were lockdown measures, restrictions on movement, and temporary closures of manufacturing facilities. This affected sourcing raw materials, production, and distribution. This impacted the overall availability of whey protein products in some regions. During the pandemic, there was a notable shift in consumer behavior towards health and wellness. There was increased awareness of the importance of maintaining a strong immune system. Many individuals turned to dietary supplements, including whey protein, to support their overall health and well-being. The pandemic accelerated the adoption of e-commerce channels for purchasing whey protein products. Thus, the pandemic accelerated certain trends in the Whey Protein Market.

Latest Trends/ Developments:

One of the developments, in the Whey Protein Market is the rise in the integration of whey protein into a wide range of functional foods and beverages, including ready-to-drink shakes, protein bars, dairy products, and snacks. This trend meets the consumers' growing interest in convenient, on-the-go nutrition solutions that offer health benefits. Consumers are seeking clean-label products made with natural ingredients and minimal additives. To meet this demand manufacturers are reformulating their whey protein products with natural flavors, sweeteners, and ingredients with transparent labeling. There's a growing trend on personalized nutrition solutions specific to individual dietary preferences, health goals, and lifestyle factors. Whey protein manufacturers are offering customizable products and personalized nutrition services for this trend.

Key Players:

-

Glanbia plc

-

Fonterra Co-operative Group

-

Kerry Group plc

-

Arla Foods

-

Agropur Cooperative

-

Lactalis Ingredients

-

Hilmar Ingredients

-

Davisco Foods International (a subsidiary of Agropur)

-

Maple Island Inc.

-

Carbery Group

Market News:

-

In 2023, FrieslandCampina Ingredients introduced an innovative whey protein ingredient called Nutri Whey ProHeat. This product stands out due to its heat stability, a feature achieved through advanced microparticulation technology. Unlike conventional heat treatments that typically denature most whey proteins, this technology preserves the integrity and functionality of the whey protein, ensuring its stability even under high-temperature processing conditions.

-

In 2024, Vivici is set to revolutionize the whey protein industry with its launch of nature-equivalent whey protein beta-lactoglobulin. Derived sustainably from milk through casein separation or cheese production by-products, this protein offers high nutritional value, rapid absorption, and essential amino acids. It represents a pivotal step towards sustainability in the whey protein market, signaling a promising future for eco-conscious consumers and industry advancements.

Chapter 1. Whey Protein Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Whey Protein Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Whey Protein Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Whey Protein Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Whey Protein Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Whey Protein Market – By Type of Whey Protein

6.1 Introduction/Key Findings

6.2 Whey Protein Concentrate (WPC)

6.3 Whey Protein Isolate (WPI)

6.4 Whey Protein Hydrolysate (WPH)

6.5 Y-O-Y Growth trend Analysis By Type of Whey Protein

6.6 Absolute $ Opportunity Analysis By Type of Whey Protein, 2024-2030

Chapter 7. Whey Protein Market – By Application

7.1 Introduction/Key Findings

7.2 Sports Nutrition (protein shakes, bars, supplements)

7.3 Food & Beverages (functional foods, infant formula, dairy products)

7.4 Pharmaceuticals (medical nutrition, supplements)

7.5 Personal Care & Cosmetics (skincare, hair care products)

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Whey Protein Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Online Retail

8.3 Supermarkets/Hypermarkets

8.4 Specialty Stores

8.5 Pharmacies/Drugstores

8.6 Convenience Stores

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Whey Protein Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type of Whey Protein

9.1.3 By Application

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type of Whey Protein

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type of Whey Protein

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type of Whey Protein

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type of Whey Protein

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Whey Protein Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Glanbia plc

10.2 Fonterra Co-operative Group

10.3 Kerry Group plc

10.4 Arla Foods

10.5 Agropur Cooperative

10.6 Lactalis Ingredients

10.7 Hilmar Ingredients

10.8 Davisco Foods International (a subsidiary of Agropur)

10.9 Maple Island Inc.

10.10 Carbery Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Whey Protein Market was valued at USD 19.6 billion and is projected to reach a market size of USD 33.37 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.9%.

Increasing health and wellness trends, rising disposable income, expansion of the sports nutrition industry, growing emphasis on muscle building and recovery, product innovation and diversification, expanding applications in the food and beverage industry, rise in demand for plant-based alternatives, e-commerce and retail channel expansion, and increasing awareness about health benefits are the market drivers of the Global Whey Protein Market.

Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drugstores, and Convenience Stores are the segments under the Global Whey Protein Market by Distribution Channel.

North America is the most dominant region for the Global Whey Protein Market.

Glanbia plc, Fonterra Co-operative Group, Kerry Group plc, Arla Foods, and Agropur Cooperative are the key players in the Global Whey Protein Market.