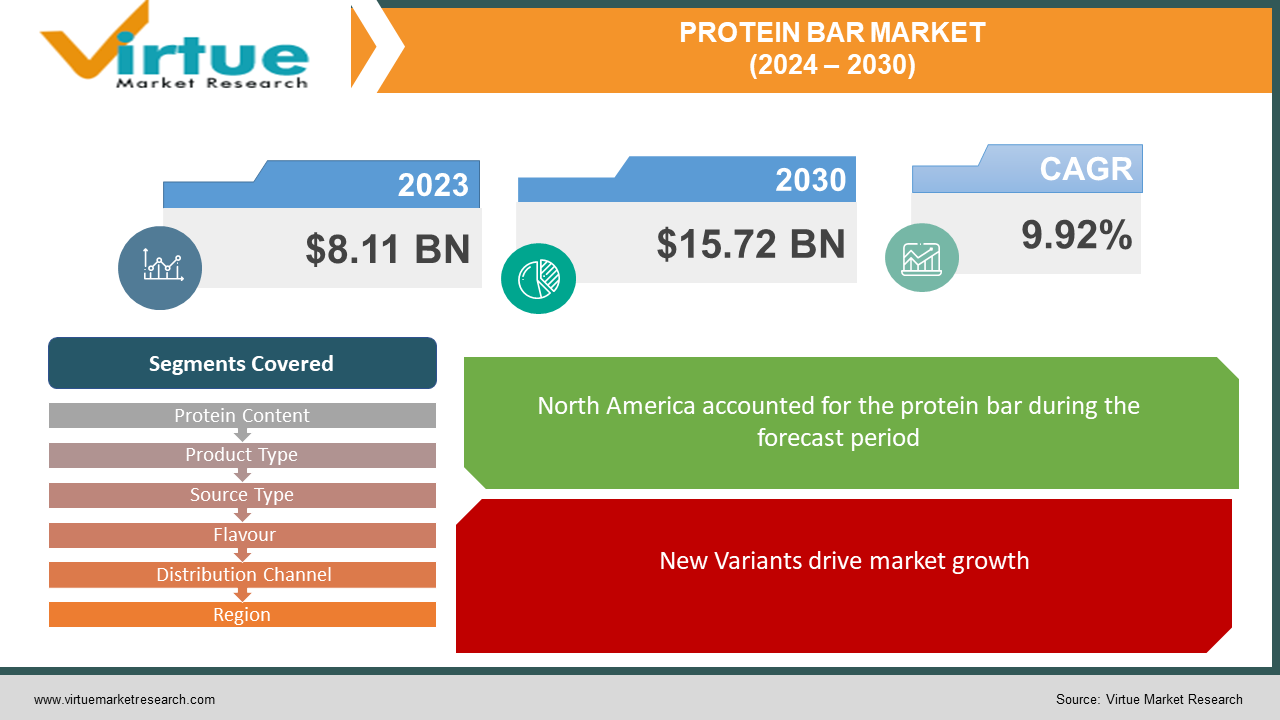

Protein Bar Market Size (2024 – 2030)

The Protein Bar Market was valued at USD 8.11 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 15.72 billion by 2030, growing at a CAGR of 9.92%.

Nutrient-rich protein bars offer vital protein supplements to the body. The growing awareness regarding the advantages of health and nutrition bars, including their role in tissue repair, curbing sudden hunger pangs, managing blood pressure, and facilitating weight loss, contributes significantly to the escalating worldwide interest in these bars.

Key Market Insights:

The surge in demand for convenience foods is driving growth in the global industry. As consumers grapple with increasingly busy lifestyles, protein bars have emerged as a popular choice for a healthy and convenient snack. These bars typically contain protein sourced from plants or animals, alongside other essential nutrients.

The growing inclination towards a healthy and active lifestyle, coupled with the rising demand for convenient yet nutritious food options, constitutes significant drivers of the global protein bars market. The market is also expected to benefit from the impact of advertising and marketing initiatives undertaken by new market entrants. However, challenges such as the relatively high cost of protein bars and potential side effects associated with excessive protein consumption may pose obstacles to market growth. Furthermore, the emergence of substitutes such as cereal bars and energy bars is anticipated to present additional challenges to market expansion during the forecast period.

Protein Bar Market Drivers:

New Variants drive market growth.

As consumer preferences lean towards natural, flavorful, and readily available snacks, the demand for protein-rich and nutritious bars continues to rise. Manufacturers are leveraging technology to reduce lactose content to cater to lactose-sensitive individuals, thereby offering protein-enriched food options tailored to the younger demographic. For example, Dang Foods has unveiled the Dang Bar, a novel plant-based bar comprising almond butter, cocoa butter, coconut, pea protein, sunflower seeds, and chia seeds. Consequently, the development of innovative products featuring unique protein sources and reduced sugar content is poised to present growth opportunities for producers.

An active healthy lifestyle increases the demand of the protein bar market.

The protein bar, a recently introduced product, is widely embraced as a dietary supplement. This convenient, ready-to-consume protein source is becoming increasingly popular among health-conscious individuals, primarily due to the muscle-building properties of its main component, proteins. It serves as an ideal post-workout snack for gym enthusiasts, athletes, and individuals engaged in physically demanding occupations. Athletes and weight trainers rely on protein intake to maintain energy levels and enhance performance. Consequently, the growing global involvement in fitness activities is expected to drive up demand for this product. Moreover, both major players and smaller market participants demonstrate a strong inclination toward product innovation to cater to the specific requirements of athletes.

Protein Bar Market Restraints and Challenges:

The protein bar market encounters notable challenges that pose potential obstacles to its growth and profitability. Fierce competition among numerous established and emerging brands necessitates manufacturers to distinguish themselves via pricing strategies, marketing initiatives, and continuous product innovation. Moreover, securing high-quality ingredients at competitive prices and forging robust supplier relationships are paramount considerations.

Addressing the rising consumer preferences for healthier choices, such as cleaner labels and reduced sugar content, may entail significant investments in research and development as well as reformulation endeavors. Furthermore, ensuring proper storage and efficient distribution logistics is imperative to uphold the quality and extend the shelf life of protein bars. These challenges underscore the importance of strategic planning and adaptability in navigating the complexities of the protein bar market.

Protein Bar Market Opportunities:

The Protein Bar industry holds considerable potential for innovation in product formulations by introducing novel flavors, textures, and ingredients, thereby enriching the overall consumer experience. Additionally, there lies untapped potential in targeting niche consumer segments, such as seniors or children, who possess specific nutritional requirements.

Moreover, the landscape of emerging markets presents a favorable scenario, driven by increasing disposable incomes and a growing population inclined towards health consciousness, thereby fueling the demand for protein bars. This highlights the significance of leveraging online retail platforms and direct-to-consumer sales channels, enabling manufacturers to attain global outreach and deliver personalized engagement to customers.

PROTEIN BAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.92% |

|

Segments Covered |

By Protein Content, Product Type, Source Type, Flavour, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Hershey Company, Caveman Foods LLC, Associated British Foods PLC, Fitshit Health Solutions Pvt. Ltd, GNC Holdings LLC, General Mills Inc., Naturell India Pvt. Ltd, Lotus Bakeries, Stayfit Enterprize Private Limited |

Protein Bar Market Segmentation: By Protein Content

-

Low Protein (0-15 gm)

-

Medium Protein (16 Gm - 25 gm)

-

High Protein (Above 25 Gm)

The high protein content segment, defined as bars containing over 25 grams of protein, is anticipated to dominate the market share. This projection is attributed to the prevailing trend towards adopting a healthy and active lifestyle. Following closely behind, the medium protein bar segment, encompassing bars containing 16 to 25 grams of protein, holds a substantial portion of the market. Finally, the low protein bar segment, comprising bars with protein content ranging from 0 to 15 grams, accounts for the remaining share of the market.

Protein Bar Market Segmentation: By Product Type

-

Energy Protein Bars

-

Meal Replacement Bars

-

Low-Carb Protein Bars

-

Low/No Sugar Bars

-

Functional Immune & Health Bar

-

Others

Within the realm of product types, energy protein bars are anticipated to exert dominance over the market. Meanwhile, meal replacement bars are poised for notable growth, with low-carb protein bars projected to exhibit the highest Compound Annual Growth Rate (CAGR). Additionally, women's protein bars are forecasted to undergo rapid expansion throughout the forecast period.

Protein Bar Market Segmentation: By Source Type

-

Plant Protein

-

Animal Protein

In the realm of protein source types, the animal protein segment currently holds sway over the market. This dominance is primarily attributed to the easy availability of animal protein sources, which serves as a pivotal driver for segmental growth. Conversely, the plant protein segment is anticipated to secure a minimal share of the market. This projection stems from the high costs associated with extracting protein from plant sources for the production of protein bars.

Protein Bar Market Segmentation: By Flavour

-

Chocolate

-

Cranberry

-

Choco Almond

-

Fruit & Nut Bar

-

Others

The fruit & nut bar segment currently holds the leading position in the market. Protein continues to reign as the most sought-after macronutrient in nutrition bars among consumers, catering to a diverse array of needs ranging from satiety to muscle building to support weight loss efforts.

Protein Bar Market Segmentation: By Distribution Channel

-

online

-

supermarkets/hypermarkets

-

convenience stores,

-

retail shops

-

medical stores

-

others

The supermarket/hypermarket segment emerged as the largest distribution channel in the global protein bar market. This prominence is attributed to the widespread presence of multinational brands, fostering market growth. Consumers are increasingly drawn to bars offering various benefits such as energy, weight loss, or sleep support, and they favor purchasing them from retail stores.

Meanwhile, the online retail channel is poised to exhibit the fastest growth rate, with a projected Compound Annual Growth Rate (CAGR) of 0.03% by value over the forecast period. This acceleration is propelled by the expanding global internet penetration, rising smartphone usage, and the extensive network of grocery delivery chains. Online platforms offer consumers access to a diverse range of product offerings, including those marketed under private labels and mainstream brands. Anticipated internet access improvements across key regions are expected to further bolster online sales of protein bars.

Convenience stores secured the second-highest share, witnessing an uptick in protein bar sales. Typically situated in easily accessible locations such as urban centers, gas stations, and busy intersections, convenience stores enable consumers to make swift, on-the-go purchases of protein bars without the need to visit larger retail establishments.

Protein Bar Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America asserts dominance in the global protein bars market, propelled by a sizable population of health-conscious individuals and escalating demand for convenient, healthful food options. The United States is poised to seize the largest market share, closely followed by Canada. Conversely, Mexico is projected to contribute the least to the market share, attributed to relatively lower per capita spending power.

The proliferation of gyms, fitness centers, and health clubs across North America, coupled with a burgeoning community of fitness enthusiasts, is expected to fuel market growth. In the United States particularly, there is a concerted effort towards enhancing health, with a high-protein diet being recognized as a viable strategy. The prevalence of snacking cultures between meals further stimulates the demand for protein-rich bars.

Meanwhile, Asia Pacific emerges as the fastest-growing market for protein bars, owing to its vast population base alongside a significant proportion of overweight individuals. Protein bars are sought after for supplementing dietary needs and facilitating muscle gain activities. Major corporations are targeting this region, leveraging persistent marketing and advertising efforts to capture market share. Increased awareness of protein consumption in countries like China and India is anticipated to drive market volume growth, thereby influencing overall regional expansion.

The Middle East & Africa is poised for steady growth, buoyed by a rising number of health-conscious individuals and increasing per capita income levels. Market leaders are eyeing expansion in this region due to a surge in tourist influx. Conversely, Latin America is anticipated to contribute the least to the global market share, attributed to lower per capita income and limited spending capacity among the populace.

Latest Trends/ Developments:

-

May 2023: General Mills Inc. has announced plans to expand its Nature Valley brand by introducing Nature Valley Savory Nut Crunch Bars.

-

April 2023: The Hershey Company, under its ONE Brands label, has launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly bars are enriched with 20 grams of protein and 1 gram of sugar, and feature the flavors of peanut butter and strawberry jelly.

-

January 2023: The Hershey Company has introduced caffeinated protein bars, available in two flavors: vanilla latte and caramel macchiato.

-

September 2022: Arla Foods Ingredients has unveiled a protein bar model that enables manufacturers to boost the protein content of their bars without compromising on size, flavor, or texture. The plug-and-play system facilitates the creation of indulgent bars with high protein content in each layer.

Key Players:

These are the top 10 players in the Protein Bar Market: -

-

The Hershey Company

-

Caveman Foods LLC

-

Associated British Foods PLC

-

Fitshit Health Solutions Pvt. Ltd

-

GNC Holdings LLC

-

General Mills Inc.

-

Naturell India Pvt. Ltd

-

Lotus Bakeries

-

Stayfit Enterprize Private Limited

Chapter 1. Protein Bar Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Protein Bar Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Protein Bar Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Protein Bar Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Protein Bar Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Protein Bar Market – By Protein Content

6.1 Introduction/Key Findings

6.2 Low Protein (0-15 gm)

6.3 Medium Protein (16 Gm - 25 gm)

6.4 High Protein (Above 25 Gm)

6.5 Y-O-Y Growth trend Analysis By Protein Content

6.6 Absolute $ Opportunity Analysis By Protein Content, 2024-2030

Chapter 7. Protein Bar Market – By Product Type

7.1 Introduction/Key Findings

7.2 Energy Protein Bars

7.3 Meal Replacement Bars

7.4 Low-Carb Protein Bars

7.5 Low/No Sugar Bars

7.6 Functional Immune & Health Bar

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Product Type

7.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 8. Protein Bar Market – By Source Type

8.1 Introduction/Key Findings

8.2 Plant Protein

8.3 Animal Protein

8.4 Y-O-Y Growth trend Analysis By Source Type

8.5 Absolute $ Opportunity Analysis By Source Type, 2024-2030

Chapter 9. Protein Bar Market – By Flavour

9.1 Introduction/Key Findings

9.2 Chocolate

9.3 Cranberry

9.4 Choco Almond

9.5 Fruit & Nut Bar

9.6 Others

9.7 Y-O-Y Growth trend Analysis By Flavour

9.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 10. Protein Bar Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 online

10.3 supermarkets/hypermarkets

10.4 convenience stores,

10.5 retail shops

10.6 medical stores

10.7 others

10.8 Y-O-Y Growth trend Analysis By Distribution Channel

10.9 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. Protein Bar Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Protein Content

11.1.2.1 By Product Type

11.1.3 By Source Type

11.1.4 By Distribution Channel

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Protein Content

11.2.3 By Product Type

11.2.4 By Source Type

11.2.5 By Flavour

11.2.6 By Distribution Channel

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Protein Content

11.3.3 By Product Type

11.3.4 By Source Type

11.3.5 By Flavour

11.3.6 By Distribution Channel

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Protein Content

11.4.3 By Product Type

11.4.4 By Source Type

11.4.5 By Flavour

11.4.6 By Distribution Channel

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Protein Content

11.5.3 By Product Type

11.5.4 By Source Type

11.5.5 By Flavour

11.5.6 By Distribution Channel

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Protein Bar Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 The Hershey Company

12.2 Caveman Foods LLC

12.3 Associated British Foods PLC

12.4 Fitshit Health Solutions Pvt. Ltd

12.5 GNC Holdings LLC

12.6 General Mills Inc.

12.7 Naturell India Pvt. Ltd

12.8 Lotus Bakeries

12.9 Stayfit Enterprize Private Limited

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

As consumer preferences lean towards natural, flavorful, and readily available snacks, the demand for protein-rich and nutritious bars continues to rise.

The top players operating in the Protein Bar Market are - The Hershey Company, Caveman Foods LLC, Associated British Foods PLC, Fitshit Health Solutions Pvt. Ltd, GNC Holdings LLC, General Mills Inc., Naturell India Pvt. Ltd, Lotus Bakeries, Stayfit Enterprize Private Limited.

The landscape of emerging markets presents a favorable scenario, driven by increasing disposable incomes and a growing population inclined towards health consciousness, thereby fueling the demand for protein bars.

Asia Pacific emerges as the fastest-growing market for protein bars, owing to its vast population base alongside a significant proportion of overweight individuals.