Asia-Pacific Protein Bar Market Size (2024-2030)

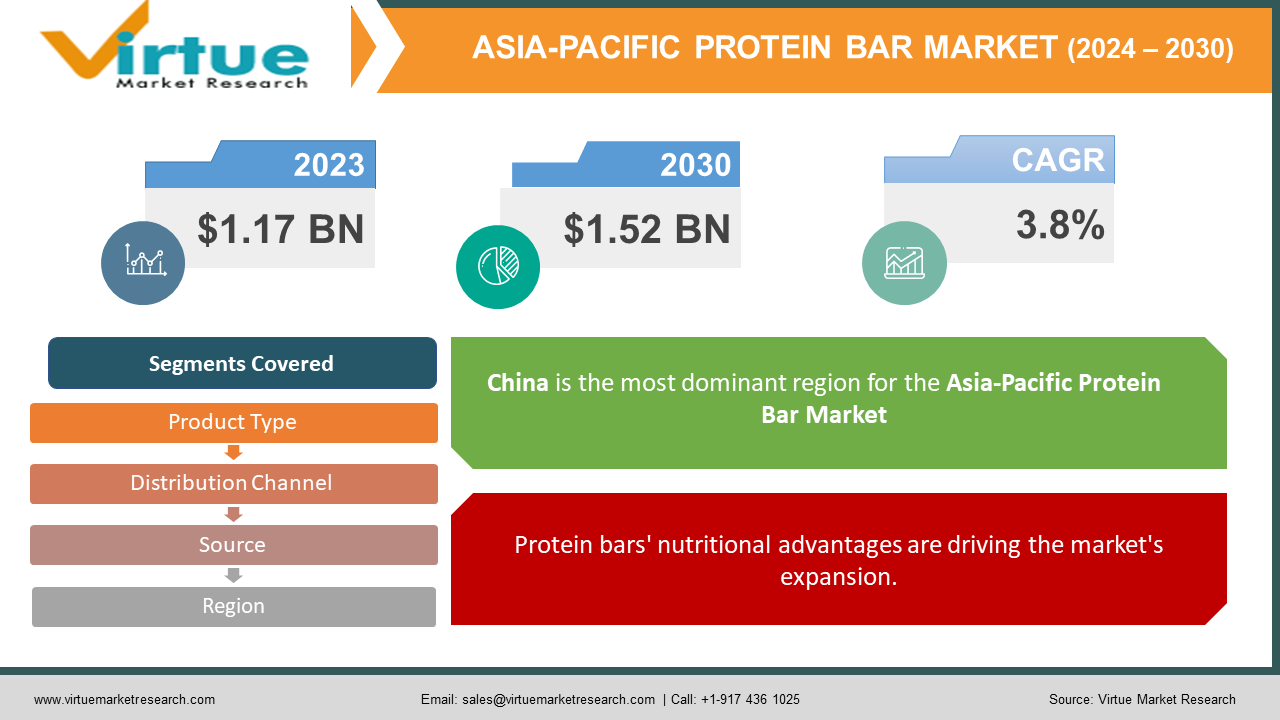

The Asia-Pacific Protein Bar Market was valued at USD 1.17 billion and is projected to reach a market size of USD 1.52 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.8%.

The market for protein bars has seen tremendous growth over the years. In the past, this market had a limited scope, confined mainly to the sports industry, owing to its benefits. However, with globalization and market expansion, this market started to gain prominence. People started to consume these bars, which were high in protein content. In the future, with creativity, innovations, and other culinary explorations, this market is set to witness a significant elevation. During the forecast period, a notable growth rate is predicted.

Key Market Insights:

China is the Asian market with the biggest demand for protein, with approximately 56 million metric tonnes of protein required in 2019. Under all scenarios, China was predicted to be the largest market by 2030.

Despite the many advantages, 70% of study participants stated that they would instantly classify a snack as healthier if it fell into a category where additional protein was added.

About one-third of the snacks that were introduced in the Asia-Pacific area last year claimed to have high protein content or to include additives.

Up to 41% of customers desire to incorporate protein into their diets.

With 206 million people between the ages of 20 and 79 suffering from diabetes as of 2021, the Western Pacific is the region with the largest number of diabetics globally. Some protein bars include a lot of calories and sugar. This dose exceeds the suggested amount. Organizations are concentrating on developing viable substitutes for these bars that have less or no sugar to solve this problem.

Asia-Pacific Protein Bar Market Drivers:

Protein bars' nutritional advantages are driving the market's expansion.

Protein bars are simple, long-lasting, and available in a wide range of flavors. 5–10 grams of fat, 25–35 grams of carbs, and 5–10 grams of fiber make up an average protein bar. They even provide a good amount of calorie intake, ranging between 150 and 400. Calcium, iron, magnesium, potassium, phosphorus, vitamin E, and B vitamins are the main vitamins and minerals found in these bars. Certain studies indicate that diets rich in protein encourage healthy weight loss more than diets with normal protein consumption. However, few studies even indicate that consumption of these bars helps with increasing muscle mass. Furthermore, they are considered to be a good replacement for snacks and other junk food.

A changing lifestyle contributes to the success of the protein bars market.

Over the years, there have been several changes in the standard of living. People have a variety of options available concerning the food and beverages they consume. However, with these choices, some options contain processed food, items with a high level of oil, calorie-rich beverages, and others. This has increased the incidence of chronic illnesses like diabetes, hypertension, and other heart diseases. Additionally, changing environmental factors and hectic work pressures contribute to the prevalence of these diseases. This has heightened the awareness of having good physical and mental health. A greater percentage of the population has started to go to gyms to align with various fitness goals. To keep up with this trend, a lot of gyms and other workout places are being opened. These places have skilled trainers and nutritionists who have the right knowledge about consumption and nutrition. They recommend protein bars as a pre and post-workout meal because they provide an essential energy boost. As a result, sales of these bars have seen an upsurge.

Product diversity and innovation are increasing the growth rate.

The food industry is keen to experiment with different product categories. Significant progress has been achieved in flavor, texture, quality, and blending over time. The food and beverage industry promotes a variety of fitness goals. They are creating healthier substitutes to market them. While some bars employ plant-based ingredients like soy, pea, or brown rice, others use dairy proteins, including whey and casein, yogurt powder, and milk. Some use egg whites as their main source of protein, while others get their protein mostly from nuts and seeds. Furthermore, some protein bars contain extremely concentrated protein sources, such as soy or whey. Besides, several snacks are being customized to satisfy the needs of certain individuals. Consequently, a wider consumer base is being formed.

Asia-Pacific Protein Bar Market Restraints and Challenges:

Health concerns and waste generation are the main issues that the market is currently experiencing.

Regular use of protein bars may result in certain metabolic problems. Many protein bars contain artificial sweeteners like sucralose and aspartame, which have been linked to metabolic problems and an increased risk of metabolic syndrome. Two examples of metabolic disorders that can have a long-term impact on a person's overall health and well-being are insulin resistance and dyslipidemia. Secondly, eating too much protein can lead to an increased calorie load, increasing the risk of diabetes. Thirdly, certain protein bars may contain high amounts of fiber or sugar alcohols like sorbitol or maltitol to enhance their nutritional profile. These ingredients can also cause digestive issues in those with sensitive stomachs, such as gas, bloating, or diarrhea. In addition, businesses package their products using plastic and other non-recyclable materials. Waste builds up as a result of this. Concerns about sustainability arise from this.

Asia-Pacific Protein Bar Market Opportunities:

Veganism is the practice of consuming plant-based diets. Vegan-friendly products, such as plant-based dairy substitutes, are gaining popularity. Secondly, the market has benefited from the expansion of e-commerce. Shipping both domestically and internationally is achievable using internet methods. A greater amount of revenue is generated due to this. An upsurge in sales is being created due to the rising popularity of subscription boxes that contain these bars. They are usually taken in bulk by corporate sectors, increasing sales. In addition, beneficial compounds are increasingly being used owing to their health benefits. This covers reduced dairy, low-calorie sugar substitutes, gluten-free choices, and various protein substitutes.

ASIA-PACIFIC PROTEIN BAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.8% |

|

Segments Covered |

By Product Type, Source, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

China, Japan, South Korea, India, Australia & New Zealand, Rest of Asia-Pacifi |

|

Key Companies Profiled |

Nestlé, Mars, Incorporated, Kellogg Company, General Mills, Abbott Laboratories, Glanbia plc, Olimp Laboratories, Yakult Honsha Co., Ltd, Food Empire Holdings, Quest Nutrition LLC. |

Asia-Pacific Protein Bar Market Segmentation:

Asia-Pacific Protein Bar Market Segmentation: By Source:

- Plant-Based

- Animal-Based

The plant-based segment is the largest in the market. Environmentalists and social media have played a huge role in raising awareness about the cruelties that are faced by the animal industry. During the pandemic, there was a significant rise in the number of people who incorporated plant-based diets owing to health reasons. Several research studies have shown that vegan products contain the same amount of nutrition. Besides, R&D activities are being conducted to find new products. The animal-based segment is the fastest-growing. This is because of historical relevance, increased accessibility, market demand, and the high nutritional content of dairy products such as milk and eggs.

Asia-Pacific Protein Bar Market Segmentation: By Product Type:

- Sports Nutrition

- Meal-Replacement

- Others

Based on product type, sports nutrition is both the largest and fastest-growing market. The protein and carbohydrate content present in these bars helps give an instant energy boost and increase the player's performance. Additionally, certain bars have useful components that are essential for anxiety relief and stress management. Meal-replacement snacks are becoming more and more popular. They offer a high nutritional profile for weight loss and are tasty. This is usually consumed as a popular option. However, it is important to remember that this shouldn't be continuously substituted for meals since this might result in unhealthful weight loss and other detrimental effects.

Asia-Pacific Protein Bar Market Segmentation: By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Supermarkets/hypermarkets are the largest distribution channel segment. Their overall market share is higher than 55%. This is due to factors like availability, presence, accessibility, originality, authenticity, face-to-face interaction, and visual inspection. Online retail is growing at the fastest rate due to the continuous digital transformation. They account for around 35% of the market share. A growing number of consumers are choosing online delivery services as a result of growing consumer knowledge and the availability of a variety of choices. They may place orders conveniently from the comfort of their own homes. This facilitates the purchase of essential food products for people who live in remote areas. Furthermore, local and international shipping is facilitated, strengthening the economy.

Asia-Pacific Protein Bar Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China is the largest growing market based on region, holding a nearly 32% market share. This is due to several factors, including population, the presence of key players, bulk manufacturing, demand, uniqueness, innovations, cultural importance, attractiveness, and flavor advances. India is the fastest-growing region due to factors such as the rise in the number of eateries offering protein bars, population growth, emerging companies, global operations, and the increasing appeal of veganism, investments, and culinary explorations. Roughly 22% of the total is made up of this region.

COVID-19 Impact Analysis on the Asia-Pacific Protein Bar Market:

Lockdowns, restrictions on movement, and social isolation became the new normal. Transportation, logistics, and the supply chain were disrupted, affecting the import-export trade. To stop the virus from spreading, hotels, fast-food franchises, and restaurants had to be closed due to guidelines and standards. As a result, the food and beverage industry suffered huge losses. Furthermore, a large number of people experienced job losses as a result of financial restraints. In addition, fewer protein bars were sold since gyms were closed. As per a report by Fortune Business Insights, the worldwide market for protein bars shrank by 5.3% in 2020 over 2019. However, post-pandemic, the market has begun to pick up owing to the upliftment of guidelines and protocols. Internet retail caused the market to begin to improve.

Latest Trends/ Developments:

Companies are also spending heavily to improve existing creations while maintaining competitive pricing. Paper-based packaging materials are becoming more popular since they are ecological and recyclable. They are authorized for direct food contact and are approved by agencies. Moreover, they provide advantages such as excellent barrier qualities. Though this is just the beginning, significant development is expected during the forecast period.

Key Players:

- Nestlé

- Mars, Incorporated

- Kellogg Company

- General Mills

- Abbott Laboratories

- Glanbia plc

- Olimp Laboratories

- Yakult Honsha Co., Ltd

- Food Empire Holdings

- Quest Nutrition LLC.

In October 2023, a second protein bar made from over 40% salvaged materials will be released by sustainable e-commerce platform Matsmart and food tech startup Nick's as a follow-up to their wildly popular peanut caramel bar that was introduced earlier. Nick's leftover cookie crumbles from making ice cream are used to flavor the new bar. By working together, the food industry supports more sustainable food production that makes excellent use of production waste.

In September 2023, after a successful first partnership with Oreo earlier this year, Grenade introduced an Oreo White protein bar. The new 60-gram bar has an Oreo-filled protein dough foundation, an Oreo vanilla-flavored crème layer, Oreo bits on top, and a smooth white chocolate layer in between. It also contains less than 2g of sugar and more than 20g of protein.

In February 2020, the RXBAR division of Kellogg Co. introduced RXBAR Select, a new platform that features a selection of distinctive flavors produced in small quantities with a limited shelf life. The goal was to alter how protein bars are marketed.

Chapter 1. Asia Pacific Protein Bar Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Protein Bar Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Protein Bar Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Protein Bar Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Protein Bar Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Protein Bar Market– By Product Type

6.1. Introduction/Key Findings

6.2. Sports Nutrition

6.3. Meal-Replacement

6.4. Others

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Asia Pacific Protein Bar Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets/hypermarkets

7.3. Others

7.4. Online retail

7.5. Specialty stores

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Asia Pacific Protein Bar Market– By Source

8.1. Introduction/Key Findings

8.2. Plant-Based

8.3. Animal-Based

8.4. Y-O-Y Growth trend Analysis Source

8.5. Absolute $ Opportunity Analysis Source , 2024-2030

Chapter 9. Asia Pacific Protein Bar Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Asia Pacific

9.1.1. By Country

9.1.2.1. China

9.1.2.2. Japan

9.1.2.3. South Korea

9.1.2.4. India

9.1.2.5. Australia & New Zealand

9.1.2.6. Rest of Asia-Pacific

9.1.2. By Product Type

9.1.3. By Distribution Channel

9.1.4. By Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Asia Pacific Protein Bar Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé

10.2. Mars, Incorporated

10.3. Kellogg Company

10.4. General Mills

10.5. Abbott Laboratories

10.6. Glanbia plc

10.7. Olimp Laboratories

10.8. Yakult Honsha Co., Ltd

10.9. Food Empire Holdings

10.10. Quest Nutrition LLC.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Asia-Pacific Protein Bar Market was valued at USD 1.17 billion and is projected to reach a market size of USD 1.52 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3.8%.

Protein bars' nutritional advantages, a changing lifestyle, and product diversity as well as innovation are the main factors propelling the Asia-Pacific Protein Bar Market

Based on the Distribution Channel, the Asia-Pacific Protein Bar Market is segmented into Supermarkets/Hypermarkets, Specialty Stores, Online Retail, and Others

China is the most dominant region for the Asia-Pacific Protein Bar Market

Nestlé, Mars, Incorporated, and Kellogg Company are the key players operating in the Asia-Pacific Protein Bar Market