Printing Inks Market Size (2025 – 2030)

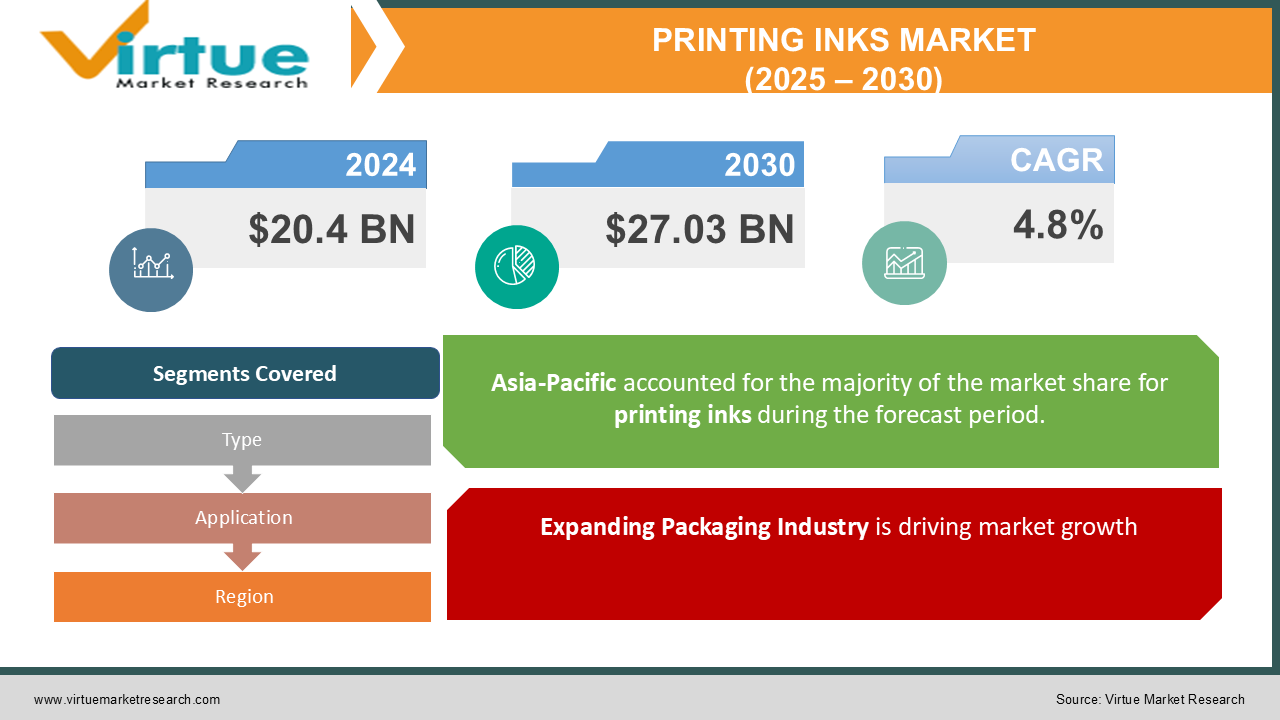

The Global Printing Inks Market was valued at USD 20.4 billion in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2030. The market is expected to reach USD 27.03 billion by 2030.

Printing inks are essential components used in various printing processes, including offset, flexographic, gravure, and digital printing. These inks are applied in packaging, publishing, and industrial printing applications. The industry's growth is driven by the expansion of the packaging industry, advancements in digital printing technology, and the increasing demand for eco-friendly inks in response to environmental concerns.

Key Market Insights:

-

Water-based inks are gaining significant traction, accounting for 25% of the market in 2024, as industries shift toward environmentally sustainable solutions. This segment is expected to grow at a CAGR of 6.5% during the forecast period.

-

Digital printing inks are experiencing robust growth due to the increasing adoption of digital printing technologies in publishing and packaging. The segment saw a 12% increase in demand between 2022 and 2024, driven by the need for cost-effective and customizable printing solutions.

-

Asia-Pacific leads the market, accounting for 38% of the total revenue in 2024, owing to the region's booming packaging and printing industries. China and India are key contributors to this growth.

-

The rise of e-commerce is driving the demand for printed corrugated boxes and flexible packaging, bolstering the demand for high-quality and vibrant printing inks.

-

Regulatory standards, such as those imposed by the European Union, are influencing the shift toward low-VOC (volatile organic compound) and food-safe inks, compelling manufacturers to innovate.

Global Printing Inks Market Drivers

Expanding Packaging Industry is driving market growth:

The packaging industry plays a pivotal role in driving the printing inks market, as the need for visually appealing and functional packaging continues to grow. Flexible packaging, in particular, is gaining popularity due to its lightweight, durability, and environmental benefits. Printing inks are essential in creating attractive designs, brand labeling, and product information on packaging materials such as plastics, paper, and metal. The global shift toward sustainable packaging, driven by consumer preferences and regulatory mandates, further enhances the demand for eco-friendly and biodegradable inks. The rise of e-commerce has also contributed significantly, with the increased use of corrugated boxes and flexible packaging requiring high-quality printing inks for branding and communication.

Technological Advancements in Printing is driving market growth:

Advancements in printing technology, particularly in digital and 3D printing, have revolutionized the printing inks market. Digital printing inks, known for their versatility and precision, are increasingly being used in customized and short-run printing applications. This technology eliminates the need for traditional printing plates, reducing setup costs and turnaround times. Similarly, the adoption of UV-curable inks in industrial printing provides faster drying times and enhanced print quality, driving demand in sectors such as automotive, electronics, and textiles. As industries adopt these advanced printing technologies, the need for compatible, high-performance inks continues to rise.

Growing Demand for Eco-Friendly Inks is driving market growth:

The increasing focus on sustainability has led to a surge in demand for eco-friendly printing inks. Water-based, soy-based, and other biodegradable inks are gaining traction as industries strive to reduce their environmental footprint. Regulatory frameworks, such as the European REACH and U.S. EPA guidelines, emphasize the use of low-VOC and non-toxic inks, encouraging manufacturers to develop innovative and sustainable products. This trend is particularly prominent in the food packaging industry, where food-safe inks are critical to ensuring consumer safety. As sustainability becomes a core value for businesses and consumers alike, the market for eco-friendly inks is poised for substantial growth.

Global Printing Inks Market Challenges and Restraints:

High Costs of Sustainable Inks is restricting market growth:

While the demand for eco-friendly inks is growing, the high production costs associated with these products remain a significant challenge for manufacturers. Water-based, soy-based, and biodegradable inks often involve more complex production processes and require high-quality raw materials, which drive up costs. Additionally, these inks may not always provide the same level of performance as traditional solvent-based inks, particularly in applications requiring high durability or specific aesthetic qualities. Small and medium-sized enterprises (SMEs) often struggle to adopt these sustainable solutions due to their cost constraints, limiting market penetration. Manufacturers face the dual challenge of developing affordable eco-friendly inks without compromising on performance or quality.

Volatility in Raw Material Prices is restricting market growth:

The printing inks industry is heavily dependent on raw materials such as pigments, resins, solvents, and additives, which are subject to price fluctuations due to various factors, including geopolitical tensions, trade policies, and supply chain disruptions. For instance, the global supply chain crisis in 2022 led to a sharp increase in the cost of pigments, impacting profit margins for ink manufacturers. The volatility of crude oil prices further affects the cost of solvent-based inks, adding to the challenges faced by the industry. This uncertainty in raw material prices complicates long-term planning and pricing strategies, particularly for SMEs operating in highly competitive markets.

Market Opportunities:

The printing inks market offers significant growth opportunities, driven by the increasing adoption of digital and eco-friendly printing technologies. The demand for personalized and short-run printing, particularly in packaging and publishing, presents a lucrative opportunity for digital printing inks. Similarly, the rise of sustainable and flexible packaging solutions opens up avenues for manufacturers to develop innovative, biodegradable inks tailored to specific applications. Emerging economies, particularly in Asia-Pacific and Africa, offer untapped potential due to rapid industrialization, urbanization, and expanding retail sectors. The growing adoption of UV-curable and thermochromic inks in niche applications such as security printing, automotive, and textiles also creates opportunities for market diversification. As industries continue to prioritize sustainability and efficiency, the development of advanced, high-performance inks is expected to drive future growth.

PRINTING INKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DIC Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, Sun Chemical Corporation, Tokyo Printing Ink Mfg. Co., Ltd., Huber Group, Sakata INX Corporation, Wikoff Color Corporation, T&K Toka Co., Ltd., Zeller+Gmelin GmbH & Co. KG |

Printing Inks Market Segmentation - By Type

-

Solvent-Based Inks

-

Water-Based Inks

-

UV-Curable Inks

-

Oil-Based Inks

-

Others

Solvent-based inks dominate the market, accounting for 40% of the global revenue in 2024. Known for their versatility and durability, these inks are widely used in applications such as packaging and industrial printing.

Printing Inks Market Segmentation - By Application

-

Packaging

-

Commercial Printing

-

Publishing

-

Industrial Printing

-

Others

The packaging sector is the largest application segment, contributing 45% to the global revenue in 2024. The increasing demand for flexible and visually appealing packaging solutions drives this dominance.

Printing Inks Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in 2024. The rapid industrialization and urbanization in countries like China and India, coupled with the growth of the packaging and publishing sectors, drive the region's leadership. The adoption of advanced printing technologies and the rising demand for sustainable inks further contribute to Asia-Pacific's dominance in the market.

COVID-19 Impact Analysis on the Printing Inks Market:

The COVID-19 pandemic had a mixed effect on the printing inks market, with varying impacts across different sectors. The packaging industry saw an increase in demand, driven by the growth of e-commerce and home delivery services, which became more prevalent during the pandemic. This surge in online shopping led to greater packaging requirements, thus benefiting ink manufacturers catering to this segment. In contrast, the commercial and publishing sectors experienced a downturn. Reduced advertising budgets, the closure of print media outlets, and a general decline in print circulation contributed to lower demand for inks in these industries. At the same time, the pandemic disrupted global supply chains, leading to shortages of key raw materials, such as pigments and solvents. This resulted in production delays and higher costs for ink manufacturers. Despite these challenges, the crisis also accelerated certain industry trends. The increased focus on sustainability and environmental concerns pushed businesses to adopt more eco-friendly inks, which led to a growing interest in water-based and vegetable oil-based options. Additionally, the shift towards digital printing technology gained momentum as businesses sought more efficient and cost-effective solutions in response to changing consumer behavior. As the global economy begins to recover, the printing inks market is expected to stabilize and experience growth. Innovations in digital printing technology and sustainability efforts will play a key role in this recovery. As companies continue to adapt to evolving consumer demands and environmental standards, the market is likely to see an increased focus on developing greener inks and more advanced printing solutions, positioning the industry for a positive future.

Latest Trends/Developments:

The printing inks market is currently evolving with several key trends shaping its future. A notable development is the growing adoption of UV-curable inks, which are gaining traction due to their fast drying times, high-quality print results, and environmental advantages. These inks cure quickly under ultraviolet light, making them ideal for high-speed production processes, and they also produce less waste and emissions, aligning with the increasing demand for sustainable solutions. Digital printing technologies are another significant driver of change, especially in sectors like packaging and publishing. As businesses seek greater precision, customizability, and faster turnaround times, the demand for inks that support these requirements has risen. Digital printing allows for highly personalized designs and smaller production runs, making it an attractive option for brands looking to stay competitive in a dynamic market. Sustainability continues to be a major focus in the industry, leading to the development of water-based, soy-based, and biodegradable inks. These inks offer a greener alternative to traditional petroleum-based options and help companies meet both regulatory standards and consumer preferences for environmentally responsible products. As governments and organizations tighten environmental regulations, these sustainable inks are becoming increasingly important for businesses aiming to reduce their ecological footprint. Additionally, the integration of smart technologies, such as thermochromic and conductive inks, is expanding the potential applications of printing inks. Thermochromic inks, which change color in response to temperature, are gaining popularity in packaging and security printing. Meanwhile, conductive inks are opening up new possibilities in electronics, enabling the development of printed circuits and flexible electronic devices. These innovations are positioning the printing inks market for further growth and diversification.

Key Players

-

DIC Corporation

-

Flint Group

-

Siegwerk Druckfarben AG & Co. KGaA

-

Sun Chemical Corporation

-

Tokyo Printing Ink Mfg. Co., Ltd.

-

Huber Group

-

Sakata INX Corporation

-

Wikoff Color Corporation

-

T&K Toka Co., Ltd.

-

Zeller+Gmelin GmbH & Co. KG

Chapter 1. Printing Inks Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Printing Inks Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Printing Inks Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Printing Inks Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Printing Inks Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Printing Inks Market – By Type

6.1 Introduction/Key Findings

6.2 Solvent-Based Inks

6.3 Water-Based Inks

6.4 UV-Curable Inks

6.5 Oil-Based Inks

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Printing Inks Market – By Application

7.1 Introduction/Key Findings

7.2 Packaging

7.3 Commercial Printing

7.4 Publishing

7.5 Industrial Printing

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Printing Inks Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Printing Inks Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DIC Corporation

9.2 Flint Group

9.3 Siegwerk Druckfarben AG & Co. KGaA

9.4 Sun Chemical Corporation

9.5 Tokyo Printing Ink Mfg. Co., Ltd.

9.6 Huber Group

9.7 Sakata INX Corporation

9.8 Wikoff Color Corporation

9.9 T&K Toka Co., Ltd.

9.10 Zeller+Gmelin GmbH & Co. KG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Printing Inks Market was valued at USD 20.4 billion in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2030. The market is expected to reach USD 27.03 billion by 2030.

Key drivers include the expanding packaging industry, advancements in printing technology, and the growing demand for eco-friendly inks.

The market is segmented by product (solvent-based inks, water-based inks, UV-curable inks, oil-based inks, others) and by application (packaging, commercial printing, publishing, industrial printing, others).

Asia-Pacific is the dominant region, accounting for 38% of the market revenue in 2024, driven by the rapid growth of packaging and publishing sectors in countries like China and India.

Leading players include DIC Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, Sun Chemical Corporation, Tokyo Printing Ink Mfg. Co., Ltd., and Huber Group.