Dyes Market Size (2024 – 2030)

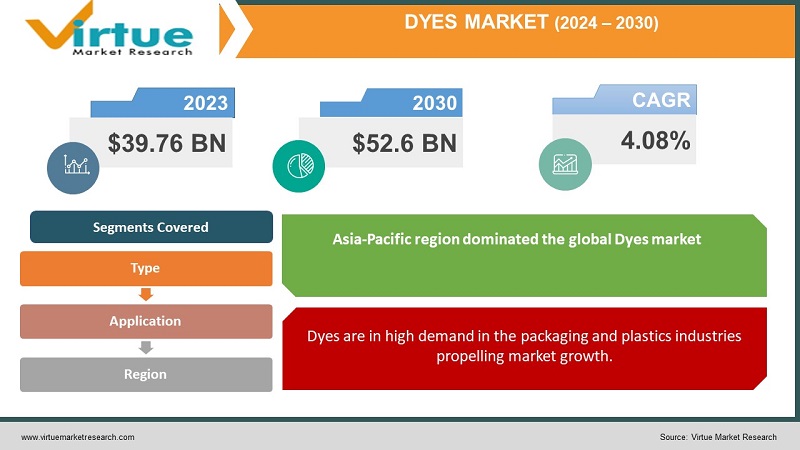

The Global Dyes Market was valued at USD 39.76 billion and is projected to reach a market size of USD 52.6 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.08%.

Dyes are substances, with color that are used in form on surfaces for various purposes. They find applications in industries like food processing printing inks, wood stains, and textile processing. Compared to pigments and other materials that add color dyes can absorb liquids and adhere to surfaces. When applied to substrates dyes exhibit absorption properties. May lose some of their physical and structural characteristics. It's worth noting that dyes generally have lightfastness and a short shelf life. For this reason, they are commonly used in surface coating, food production, and printing processes where transparency is crucial, for creating the products.

Key Market Insights:

A great opportunity awaits the textile dyes market with the emergence of cost-effective methods, for dyeing textiles. These innovative processes not only promote production but also contribute to reducing costs, for businesses. The textile sector is the buyer of dyes making up, over half of the dyes market.

The annual report, on the U.S. Chemical Industry by the United States International Trade Commission (USITC) includes data about the dyes market.

Additionally, there is a trade organization called the Society of Dyers and Colourists (SDC) which offers information and resources related to the dyes industry.

Huntsman Corporation plans to increase its production capacity, for dyes in India while BASF SE has made investments in a facility dedicated to dyes production, in China. Additionally, Clariant AG has introduced a line of friendly dyes.

Dyes Market Drivers:

Dyes are in high demand in the packaging and plastics industries propelling market growth.

Indeed dyes have become quite prominent across industries due, to their colors and impressive versatility. One industry that particularly stands out is packaging and plastics, where dyes play a role in shaping aesthetics, branding, and the overall consumer experience. By offering a range of colors and dyes packaging designers evoke emotions convey messages and establish a visual identity that truly resonates with consumers.

In today's world consumers are increasingly seeking personalized experiences and packaging has become a platform to meet this demand. With the help of dyes, packaging can now be tailored for occasions or even individual consumers. Whether it's creating limited edition packaging for products or designing customized labels for gift dyes provide the flexibility and creativity to captivate consumers. Furthermore, as sustainability becomes more important in the industry there has been progress in developing eco-packaging materials such as biodegradable plastics and recycled paper. This shift towards practices further emphasizes the role of dyes, in enabling the creation of environmentally friendly packaging solutions. Dyes play a role, in adding color to these materials while still maintaining their friendliness. This collaboration between dyes and sustainable packaging materials contributes to reducing the impact of the industry. Additionally, the plastics industry, closely connected with manufacturing recognizes the power of dyes. Dyes are essential in shaping the appearance, functionality, and usefulness of plastic products ranging from consumer goods to components. Apart from their value dyes also serve purposes in the plastics industry. For instance, they can be used as tracers during production processes to monitor flow and identify defects. Moreover, specialized dyes can be incorporated into materials to provide UV protection, flame resistance, or other desired properties. In sectors like automotive and electronics where plastics play a role dyes are widely employed. In applications, dyes enhance the appeal of vehicle interior components such as dashboard panels and seat covers. Similarly in the electronics industry dyes are used for casings, connectors, and accessories to align products, with brand identity and consumer preferences.

Dyes are in high demand in the cosmetics and personal care industries fueling market demand.

Color has always had an impact, on the world of cosmetics and personal care items. Lipsticks, eyeshadows, shampoos, and skincare creams all attract consumers with their vibrant and visually appealing options. Dyes have become crucial in achieving the desired intensity, vibrancy, and range of colors that consumers crave. The cosmetics and personal care industry thrives on customization and dyes play a role in providing an array of shades to suit different skin tones, preferences, and trends. Additionally, dyes allow brands to stand out by offering colors and packaging designs that enhance their efforts and make them easily recognizable to consumers. Bold and captivating colors can leave a lasting impression on customers while contributing to the brand experience. As the demand for sustainable products continues to grow there is an increasing interest in using plant-based and naturally derived dyes, in cosmetics. These dyes offer a way to achieve colors that are in line, with the preferences of environmentally conscious consumers. Moreover, modern dyes go beyond adding color. They can also provide benefits, such as antioxidants or UV-blocking properties, which enhance the functionality of products. This combination of color and functionality adds value for consumers. With the increasing demand for products due to urbanization rising income and evolving beauty standards, there is a continued need for dyes, in the industry.

Dyes are in high demand in infrastructure and construction projects augmenting market growth.

Due, to the growth of infrastructure and construction activities the dye market is experiencing significant expansion. Dyes play a role in adding color and vibrancy to construction materials like concrete, textiles, coatings, and plastics. In the realm of infrastructure and construction projects, aesthetics and visual appeal have become incredibly important influencing design choices and the preferences of end users. Architects, designers, and project managers benefit from a range of colors offered by dyes which enable them to create structures that resonate with modern aesthetic sensibilities. Infrastructure projects such as bridges, roads, and public buildings often serve as symbols for cities and regions. By incorporating dyes in these projects they can be customized to reflect nuances, local identities, or branding preferences. Many dyes are formulated to be resistant to UV rays and weather conditions ensuring that their vibrant hues remain intact, in challenging environments. The durability and ability to maintain their color over time make dyes a practical choice, for construction materials that need to keep looking good. They can be used to create markings, signs, and floor coatings that help guide people and vehicles making crowded areas and high-traffic zones safer. Dyes are also useful for designating lanes pedestrian crossings and emergency exits contributing to safety in the built environment. Additionally, dyes are being used in heat-reflective coatings to reduce the heat island effect in urban areas improving energy efficiency and creating more comfortable living spaces. Textiles are now being integrated into construction frequently providing solutions for shading façade cladding and sound insulation. Dyes play a role in enhancing the appeal of textile-based construction materials allowing architects to create impressive structures with practical benefits. Moreover, the increasing urbanization worldwide is leading to infrastructure development and construction activities. As cities and regions invest in modernizing their infrastructure there will be a growing demand for dyes, in construction materials which will further drive the growth of the dyes market.

Dyes Market Restraints and Challenges:

The dye industry relies on materials that are typically derived from petrochemicals or plants. However, the prices of these materials can fluctuate unexpectedly creating disruptions, throughout the supply chain. Manufacturers often encounter difficulties in obtaining a supply of materials at consistent prices. This in turn can result in delays in production complexities in managing inventory and strained relationships, between manufacturers and suppliers. The fluctuations, in prices, can create uncertainties when it comes to setting the prices of products like textiles and plastics. This in turn can affect consumer behavior. Lead to changes, in demand patterns as prices go up and down. Many dyes used in processes contain chemicals and heavy metals. When these are released into water bodies they can have effects, on life. These pollutants build up in the environment causing disruptions to ecosystems and even entering the human food chain. Excessive water consumption along with water management practices can lead to the overuse of freshwater resources and the release of water into natural bodies of water. Some dyes are not biodegradable meaning they persist in the environment for periods increasing their likelihood of accumulating in water bodies and worsening pollution levels. Additionally, water pollution disrupts ecosystems, resulting in a decrease in species diversity reduced oxygen levels, and degradation of habitat quality. This imbalance has consequences, for both terrestrial ecosystems.

Dyes Market Opportunities:

Dyes are typically distributed through channels owned by the companies themselves. They also utilize third-party distribution channels. These companies place an emphasis, on expanding their operations to increase market share and drive revenue. The market includes several corporations as well as small manufacturers who operate with large production volumes. The dye market is expected to experience growth during the forecast period due to increasing consumer preference, for products. There is a growing demand, for cutting-edge products, like high-performance dyes, which is expected to open up market opportunities in the coming years. The global consumption of dyes is projected to rise.

DYES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.08% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Clariant AG, Archroma, Sudarshan Chemical Industries Limited, Atul Ltd. Huntsman Corp., JAY Chemical Industries Private Limited, Lanxess AG, Kiri Industries Limited, Meghmani Group |

Dyes Market Segmentation: By Type

-

Reactive Dye

-

Disperse Dye

-

Sulfur Dye

-

Vat Dye

-

Acid Dye

-

Others

In 2022, based on the type, the Reactive Dye segment accounted for the largest revenue share by almost 40% and has led the market. They are primarily utilized for coloring cotton and other cellulosic fibers. Reactive dyes have gained popularity due, to their ability to provide colors and lasting results. The demand for dyes is growing rapidly. These dyes are derived from resources. The increasing awareness among consumers and businesses about the textile industry's footprint is driving the popularity of dyes.

Other prominent types of dyes include disperse, sulfur, vat, and acid dyes. Disperse dyes are specifically used for polyester and other synthetic fibers. Sulfur dyes are employed in dyeing cotton and other cellulosic fibers. Vat dyes find applications in dyeing cotton along, with wool and other natural fibers. Acid dyes are commonly used for dyeing wool, silk, and other natural fibers.

Dyes Market Segmentation: By Application

-

Paints & Coatings

-

Textile

-

Printing Inks

-

Plastics

-

Others

In 2022, based on the application, the Textile segment accounted for the largest revenue share by almost 50% and has led the market. Dyes are employed for adding color to textile items such, as garments, household furnishings, and technical fabrics. Among the applications of dyes, printing inks are experiencing growth. Dyes find usage in coloring a range of printing inks, including inkjet inks, flexographic inks, and gravure inks. The increasing prominence of the printing sector is fueling the demand, for printing inks.

Dyes find uses in industries, like paints and coatings, plastics as well as food and beverages. They are employed to add color to an assortment of paints and coatings including those used for buildings, industries, and automobiles. Additionally, dyes are utilized to give a hue to types of plastics such as polyethylene, polypropylene, and PVC. Moreover, they play a role in adding appealing colors to food and beverage items, like sodas, candies, and baked goods.

Dyes Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In 2022, the Asia-Pacific region dominated the global medical tourism market with a revenue of 40%. The strong presence of the textile industry, in the area along with the rising need for dyes from sectors like plastics and printing inks has led to this situation. South America is experiencing growth in the dyes market. This can be attributed to the region's expanding economies and the escalating demand for dyes from industries such as textiles and plastics. North America, Europe, and the Middle East & Africa are also players in the dyes market. While North America and Europe are already established markets they are still projected to grow at a pace in the upcoming years. On the other hand, despite being a smaller market the Middle East & and Africa region is anticipated to experience rapid growth due, to increasing urbanization and industrialization efforts.

COVID-19 Impact Analysis on the Global Dyes Market:

The dye industry is experiencing a decline, in demand and productivity amid the COVID-19 situation. The overall demand for chemicals, in sectors has decreased because only essential products are currently permitted for processing. The dye market has been impacted by the COVID-19 situation leading to a decrease, in demand and productivity. The current scenario only permits products to be processed resulting in a decline in the demand for chemicals across various industries. This closure has posed challenges such as distribution costs being affected labor shortages including contractors, difficulties with working capital, and a decrease in export demands. The outbreak of COVID-19 has also disrupted logistics and transportation causing a halt in shipments from China. Consequently, raw material prices have increased globally due to delays adversely affecting the dye and pigment industry. Compared to 2019 the prices of dyes have risen by more than 30% during this period. This negative impact is expected to cascade down to sectors like textiles printing inks, papers, and other related products that were already facing disruptions, before COVID-19.

Latest Trends/ Developments:

Consumers are becoming more aware of the consequences of their consumption choices. As a result, they are opting for environmentally friendly products. This growing preference is fueling the need, for eco dyes derived from sources like plants, vegetables, and fruits. Natural dyes do not biodegrade easily. Also have a significantly lower impact, on the environment compared to synthetic alternatives. Producers are starting to realize the importance of offering less harmful products, to the environment and consider it their social responsibility to reduce their carbon footprint. They are investing in research and development to create dyes that are eco-friendly meeting the increasing demand for sustainable products. The future growth of the dye market is expected to be driven by the rising demand for derived-friendly dyes. Manufacturers are focused on developing quality, cost natural dyes that align with the growing demand for sustainability. Consequently, significant growth is anticipated in the dye market in the coming years.

Therefore this emerging trend of eco goods presents opportunities for synthetic dye producers. For example, Archromia has introduced synthetic dyes using its EarthColors technology. There is an increasing consumer awareness and preference for purchasing clothing and garments made with eco materials. Dyeing professionals are adopting low-VOC technologies and eco-friendly products as a solution to this demand. Consumers are also willing to pay more for these types of products. Hence this new wave of low VOC options brings prospects, for clothing manufacturers involved in developing eco dyestuffs. The revenue growth of the Dyes Market is expected to be driven by the increasing availability of sustainable products, in the market.

Key Players:

-

BASF SE

-

Clariant AG

-

Archroma

-

Sudarshan Chemical Industries Limited

-

Atul Ltd.

-

Huntsman Corp.

-

JAY Chemical Industries Private Limited

-

Lanxess AG

-

Kiri Industries Limited

-

Meghmani Group

In October 2022 Archroma and Panatronix a company specializing in cleaning for the denim textile industry joined forces to create an alternative, to traditional yarn-washing processes. The aim is to reduce water consumption and contamination associated with this method.

Back in October 2020 Huntsman Textile Effects and Phong Phu International (PPJ) formed a partnership to promote PPJs growth in Vietnam. PPJ aims to become a leading manufacturer of high-performance textiles and garments for global brands and retailers.

Chapter 1. Dyes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Dyes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Dyes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Dyes Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Dyes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Dyes Market – By Type

6.1 Introduction/Key Findings

6.2 Reactive Dye

6.3 Disperse Dye

6.4 Sulfur Dye

6.5 Vat Dye

6.6 Acid Dye

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Type

6.9 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Dyes Market – By Application

7.1 Introduction/Key Findings

7.2 Paints & Coatings

7.3 Textile

7.4 Printing Inks

7.5 Plastics

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Dyes Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.1.4 By Type

8.1.2 By Application

8.1.3 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Dyes Market – Company Profiles – (Overview, Dyes Market Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Clariant AG

9.3 Archroma

9.4 Sudarshan Chemical Industries Limited

9.5 Atul Ltd.

9.6 Huntsman Corp.

9.7 JAY Chemical Industries Private Limited

9.8 Lanxess AG

9.9 Kiri Industries Limited

9.10 Meghmani Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Dyes Market was valued at USD 39.76 billion and is projected to reach a market size of USD 52.6 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.08%.

Dyes are in high demand in the packaging and plastics industries, Dyes are in high demand in the cosmetics and personal care industries, and Dyes are in high demand in infrastructure and construction projects.

Based on application, the Global Dyes Market is segmented into Paints & Coatings, Textiles, Printing Inks, Plastics, and Others.

Asia-Pacific is the most dominant region for the Global Dyes Market.

BASF SE, Clariant AG, Archroma, Sudarshan Chemical Industries Limited, Atul Ltd., and Huntsman Corp. are the key players operating in the Global Dyes Market.