Europe Dyes Market (2024-2030)

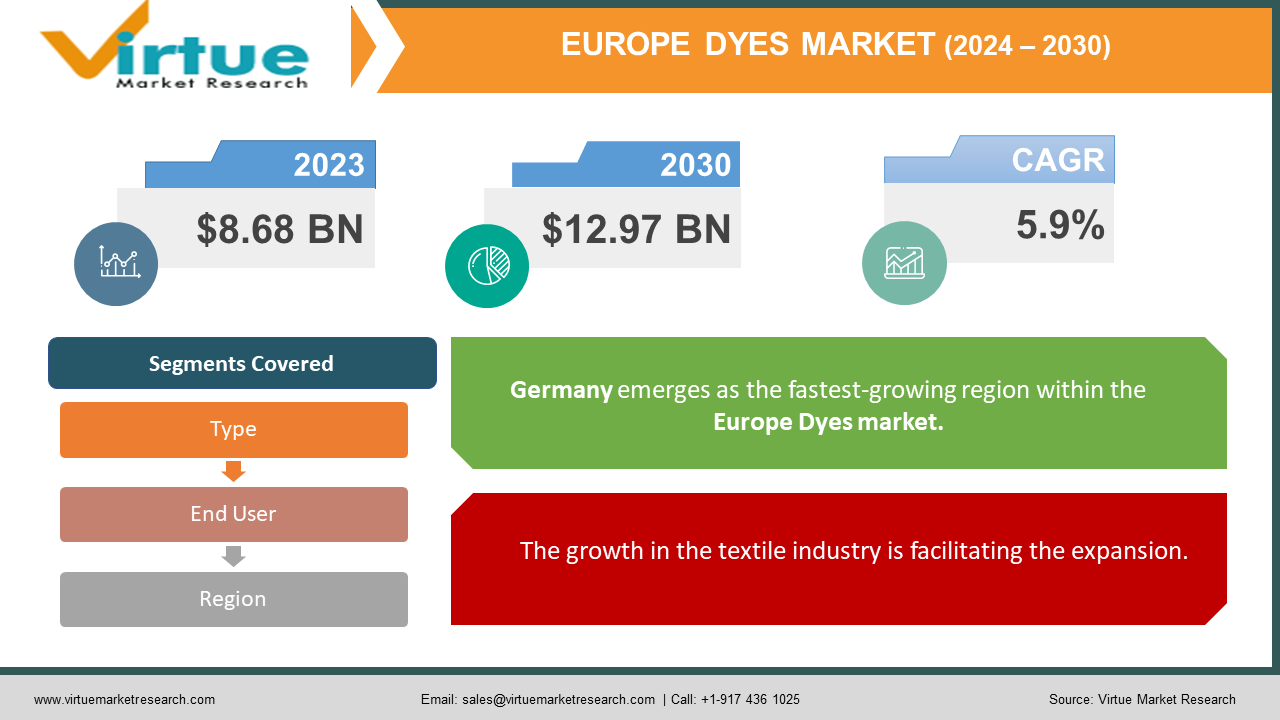

The European dye market was valued at USD 8.68 billion and is projected to reach a market size of USD 12.97 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5.9%.

The growing use of dyes and pigments in textiles, food and drink, paints and coatings, and cosmetic applications is probably what will fuel market expansion. Furthermore, the demand for natural dyes and pigments has grown as a result of the negative effects of producing synthetic dyes and pigments, which pollute waterways by dumping chemicals. Because they are made from naturally occurring components, natural dyes and pigments have less reliance on raw materials obtained from crude oil resources. Due to the elimination of the possibility of supply and demand disruption brought on by unstable oil prices and geopolitical conflicts, this has become a major element impacting the market. Natural pigments and tints come from plants, vegetables, red wine, green tea, fruits, and insects. These raw ingredients are further processed to produce dyes derived from plants, animals, and minerals, as well as pigments such as carotenoids, anthocyanins, battalions, quercetin, chlorophyll, and phycocyanin. Among other things, these dyes are frequently used in printing inks, food and beverage, textiles, and cosmetics.

Key Market Insights:

Germany has made a sizable contribution to the overall revenue made by the European market for natural pigments and dyes. This can be credited to the growing use of natural pigments from fruits, plants, and algae, as well as colors from different plant and animal sources. Due to the increasing need for sustainable raw resources, companies are looking for alternatives and substituting natural ingredients for manufactured compounds. Some businesses have formed collaborations with manufacturers of natural dyes and pigments in response to this trend, especially in the fashion and textile industries, to incorporate natural colors into their goods in a way that is consistent with sustainability goals. One such instance is the partnership between Natural Indigo Finland and MARIMEKKO, a well-known fashion, textile, and home furnishings firm with headquarters in Finland. MARIMEKKO used natural dyes, especially natural indigo, in the ink manufacturing process to print bags, clothes, and home items. The global brand MARIMEKKO, which has stores in Germany, is a prime example of how companies are using sustainable methods and natural substitutes to satisfy customer needs and achieve environmental goals. This collaboration not only emphasizes the value of sustainability in the fashion sector but also the significance that international business collaboration plays in advancing environmentally friendly solutions.

Europe Dyes Market Drivers:

The technological revolution in efficiency and sustainability is accelerating the growth rate.

The European dye market is undergoing a revolution due to technological developments in dye production, which are increasing competitiveness, cutting prices, and improving efficiency. Manufacturing process innovations have reduced environmental impact, maximized resource utilization, and expedited production. Modern technology aids in the creation of high-performance dyes that adhere to environmentally friendly principles and strict regulations. The demands of various end-use industries are met by improved product consistency brought about by automation and precision in color formulation. Operational excellence becomes critical when the sector adopts data-driven and smart manufacturing techniques, promoting scalability and adaptability. These developments put European manufacturers at the forefront of worldwide competition while also improving the quality and sustainability of dyes. Technological advancements are driving the European dye market towards a future marked by innovation, environmental stewardship, and increased market competitiveness in an era where sustainability and efficiency are critical.

The growth in the textile industry is facilitating the expansion.

The market's growth and development are also aided by the textile industry's expansion. Since dyes are essential for adding vivid colors to textiles, the growing textile industry is a major driver of increased demand. The need for dyes grows as consumer tastes change and fashion trends demand a rainbow of hues. The textile and dye industries have a symbiotic relationship that fosters innovation in color formulas and application procedures, as well as market expansion. Strategically positioned to meet the growing demands of a vibrant textile industry are European dye makers. The European dye market is well-positioned to benefit from the robust growth of the textile sector by providing a range of solutions that enhance the aesthetic appeal and diversity of textiles in the area.

Europe's Dyes Market Restraints and Challenges:

The growing cost of raw materials, especially petrochemical-based intermediates, is a major barrier to the growth of the European dye market. Variations in these essential ingredients have a direct effect on dye production costs, putting pressure on producers' profit margins. Petrochemicals are essential to the formulation of dyes; therefore, an increase in their price has a compounding effect on the cost structure as a whole. The industry faces two challenges as a result of this scenario: managing unpredictable costs and maintaining the affordability of final goods. To counteract the effects of growing costs, manufacturers in the European Dyes Market need to take proactive steps, including improving supply chain management and looking into alternative raw materials. Proactive adaptation and cost-effective methods become essential for sustainable competitiveness in the European dye manufacturing sector in an environment where economic dynamics impact production viability. The decline of the business is partly a result of increased health and safety worries about certain dye formulas, especially those that include dangerous compounds. Furthermore, the increasing consciousness among customers regarding possible health hazards possesses the capability to modify market dynamics. Increased regulatory action or a fundamental shift in consumer preferences towards safer, more environmentally friendly options could result from this awareness-raising campaign. As safety requirements change and consumer demand for environmentally friendly activities rises, manufacturers are being forced to review their formulas. As stakeholders negotiate the tightrope between product innovation, regulatory compliance, and satisfying the growing demands of health-conscious customers, the European dye market must adjust to this paradigm change. In a market where health consciousness is progressively defining the landscape, proactive initiatives emphasizing safety, transparency, and environmentally friendly production processes are essential to maintaining market relevance and competitiveness.

Europe Dyes Market Opportunities:

Many factors have contributed to the growth of the textile industry, such as the depletion of available capital globally, rapid changes and climate-related uncertainty, population growth, increased awareness of organic products, and technological advancements. As domestic demand has gradually expanded throughout the region, luxury brands have started to make their way into the European market. Textiles are usually colored to add visual interest. Substratum imprint and dying are the two techniques available for coloring a textile. The technique of using a dye to color a textile item is called dyeing. The materials are colored using this item. There are many different kinds of dyes, each with specific properties and fiber preferences, such as direct dyes, vat dyes, reactive dyes, sulfur dyes, disperse dyes, acid dyes, and metal complex dyes. While similar or significant dyes have a strong affinity for cellulose fibers, acid dyes are mainly used to color linen, silk, and nylon. using dyes and pigments to dye many kinds of synthetic products, including yarns and fibers. Therefore, prospective opportunities for this market are expected to arise from the global textile sector's expansion.

EUROPE DYES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

U.K. , Germany, France , Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

RUDOLF GROUP, BASF SE, Huntsman Corporation, DyStar Group, Clariant AG, Archroma, Kiri Industries Limited, Synthesia, a.s., Atul Ltd., Zhejiang Longsheng Group Co., Ltd., Colortex Industries, Private Limited |

Europe Dyes Market Segmentation:

Europe Dyes Market Segmentation: By Type:

- Reactive Dye

- Disperse Dye

- Sulfur Dye

- Vat Dye

- Acid Dye

- Others

Reactive dyes are both the largest and fastest-growing segment during the forecast period, 2024-2030. This is because of their demand, long-lasting colors, dye-fiber bonding, affordability, variety, ease of use, and speedy drying. To add to their success, these dyes need to be washed only once after being finished.

Europe Dyes Market Segmentation By End-User:

- Paints & coatings

- Leather

- Textile

- Printing ink

- Plastic

- Others

Textiles is the largest end-user by market share. During the forecasted years, the textile sector will rise to the top of the global market share end-user hierarchy, significantly increasing demand for dyes. The industry's innate need for vivid and varied color options to improve the appeal of textiles for fashion, home textiles, and industrial uses is driving this demand. The paint and coatings sector, which has a significant impact on the European dye market share, comes next. Here, pigments are used because of their unmatched opacity and durability, which greatly influence market dynamics. Furthermore, the printing ink industry represents a significant end-user for both pigments and dyes. However, because of their durability, pigments are frequently used above other materials in this field. This is because they are the best option for items that need to maintain color over time, such as promotional materials and packaging. The plastics industry is the fastest-growing. Bright and long-lasting colorants for plastic items are in greater demand as environmental impact and sustainability become more and more of a concern. The expansion of the dye market in this category is also aided by improvements in plastic production technology and an increase in the usage of plastics in a variety of industries, including consumer products, packaging, and the automotive industry.

Europe Dyes Market Segmentation By Region:

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Germany holds the largest market share. In the European Union, Germany has the biggest food and beverage sector. Throughout the projection period, the country's market is expected to develop due to the rising demand for natural dyes and pigments from applications such as textiles, plastic, paints and coatings, and printing ink. Furthermore, it is projected that the growing need for functional foods, along with technical advancements in food processing, could propel market expansion in Germany. The United Kingdom is the fastest-growing. The cosmetics industry is expanding due to a growing emphasis on beauty and a growing willingness to pay more for high-quality personal care items. Additionally, men's grooming and personal care goods—particularly skincare products—are becoming more and more popular in the nation due to several causes, including the growing impact of social media and the expanding selection of skincare products offered by cosmetics brands. Natural hues and dyes aid in preventing the chemical reactions that synthetic cosmetic ingredients generate on the skin. Throughout the forecast period, the aforementioned factors are expected to increase the demand for natural dyes in the nation's cosmetic industry. One of the important industries in Italy is the textile sector. The nation is well known for its exquisite designs and superior craftsmanship, and the production and export of stylish goods play a vital role in the nation's economy. Italy has hosted international fashion shows since it established itself as the world's fashion center. Because dyes come in a variety of colors, they give the fabric an attractive appearance. The Italian market for natural dyes is anticipated to be driven by the rising demand for apparel.

COVID-19 Impact Analysis on the European Dyes Market:

The COVID-19 epidemic presented difficulties for the European dye market, as it did for many other businesses. At first, the industry experienced supply chain interruptions as a result of lockdowns and other limitations that made it more difficult to transfer both raw materials and completed goods. Production was negatively hampered by worker limits and social distancing policies, which also hurt manufacturing operations. In addition, the textile and clothing industries—two major users of dyes—were impacted by a drop in consumer expenditure on non-essential items. Positively, the epidemic forced supply chain methods to be reevaluated, promoting resilience and local sourcing. Moreover, the need for colored textiles was fueled by growing health and hygiene consciousness, especially in the manufacture of personal protective equipment (PPE). Despite the difficult circumstances, the industry's capacity to adjust to shifting market dynamics and its renewed emphasis on innovation and sustainability emerged as positives.

Latest Trends/ Developments:

The European dye market has seen several noteworthy advances and advancements in recent years. The growing need for sustainable and environmentally friendly dye solutions is one notable development that is being fueled by regulatory pressure and rising environmental consciousness. To meet the industry's sustainability targets, European dye producers are allocating resources to research and development to create more environmentally friendly dye formulations and production techniques. In the dye manufacturing industry, digitalization and automation are also becoming more and more important with the goal of increasing production efficiency, cutting costs, and raising product quality. Moreover, new avenues for improving dye performance and broadening application areas are becoming possible with the integration of cutting-edge technologies like biotechnology and nanotechnology. All of these developments show how the European dye market is continuing to evolve towards more technologically sophisticated, efficient, and sustainable solutions.

Key Players:

- RUDOLF GROUP

- BASF SE

- Huntsman Corporation

- DyStar Group

- Clariant AG

- Archroma

- Kiri Industries Limited

- Synthesia, a.s.

- Atul Ltd.

- Zhejiang Longsheng Group Co., Ltd.

- Colortex Industries, Private Limited

Chapter 1. Europe Dyes Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Dyes Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Dyes Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive End-User Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Dyes Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Dyes Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Dyes Market– By Type

6.1. Introduction/Key Findings

6.2. Reactive Dye

6.3. Disperse Dye

6.4. Sulfur Dye

6.5. Vat Dye

6.6. Acid Dye

6.7. Others

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Dyes Market– By End-User

7.1. Introduction/Key Findings

7.2 Paints & coatings

7.3. Leather

7.4. Textile

7.5. Printing ink

7.6. Plastic

7.7. Others

7.8. Y-O-Y Growth trend Analysis By End-User

7.9. Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 8. Europe Dyes Market, By Geography – Market Type , Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By End-User

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Dyes Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. RUDOLF GROUP

9.2. BASF SE

9.3. Huntsman Corporation

9.4. DyStar Group

9.5. Clariant AG

9.6. Archroma

9.7. Kiri Industries Limited

9.8. Synthesia, a.s.

9.9. Atul Ltd.

9.10. Zhejiang Longsheng Group Co., Ltd.

9.11. Colortex Industries, Private Limited

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Based on end-user, type, and region, the European Dyes Market report's segments are covered

In the European dye market, Germany is anticipated to hold the largest share

The European dye market is predicted to reach a value of USD 12.97 billion by 2030.

The European dye market is expected to grow between 2024 and 2030

In 2023, the European dye market was estimated to be worth USD 8.68 million.