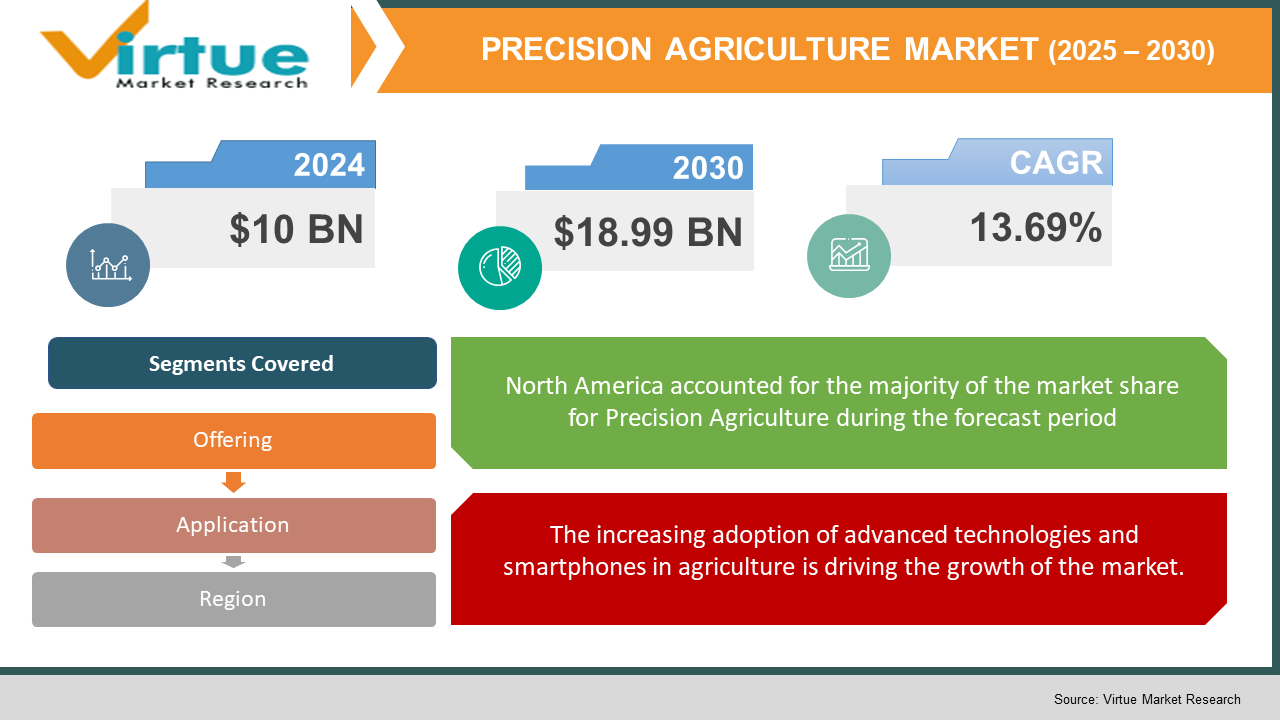

Precision Agriculture Market Size (2025-2030)

The Precision Agriculture Market was valued at USD 10 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 18.99 billion by 2030, growing at a CAGR of 13.69%.

Precision agriculture, often referred to as satellite agriculture, precision ag, precision farming, on-demand agriculture, or site-specific crop management, is an agricultural management approach focused on monitoring, responding to, and measuring plant and intra-field crop variations. This method leverages the latest technological advancements and research techniques to enhance agricultural practices in developing countries. The primary objective of precision agriculture is to promote environmental sustainability, safeguard natural resources, and ensure the economic viability of agricultural operations.

Key Market Insights:

- Precision agriculture relies on advanced systems, software, and IT services to function effectively. This approach involves gathering real-time data on crop conditions, soil health, atmospheric factors, and other relevant information, including hyperlocal weather forecasts, labor costs, and equipment availability.

- The collected data is analyzed by specialized software that utilizes predictive analytics to offer farmers recommendations on crop rotation, optimal planting and harvesting times, and soil management practices.

- In the fields, sensors monitor soil moisture levels and air temperature, while satellites and robotic drones provide real-time imagery of individual plants.

- These images, when combined with data from sensors and other sources, help generate actionable insights for both immediate and long-term decision-making, such as determining which fields require irrigation or identifying the best locations for planting specific crops.

Precision Agriculture Market Drivers:

The increasing adoption of advanced technologies and smartphones in agriculture is driving the growth of the market.

The growing demand for smartphone integration in precision agriculture can be attributed to the increasing popularity of smartphones. Companies have developed advanced applications compatible with a wide range of smartphones. This integration allows farmers to remotely monitor their fields, with all data stored securely in the cloud. Smartphones, equipped with Bluetooth, USB, and Wi-Fi connectivity, effectively meet the needs of farmers. As a result, the rise in smartphone usage has opened significant opportunities for the global precision agriculture market. Technological advancements have played a key role in enhancing agricultural practices, particularly through the development of monitoring systems and protocols to oversee farm operations and workers. For instance, a survey conducted in December 2020 by the prominent news agency "The Print" highlighted that Indian farmers' adoption of advanced technology, particularly smartphones, led to nearly double the income and output compared to their peers who did not use such technology.

Precision Agriculture Market Restraints and Challenges:

The high costs associated with the process pose a constraint on market growth.

The high cost of precision farming equipment is a major barrier to market growth. Technologies and tools used in precision agriculture, including smart sensors, drones, VRT, GPS, GNSS, guidance systems, and receivers, are highly effective but also expensive. Additionally, specialized personnel are required for the installation and operation of this advanced equipment. Consequently, farmers in developing countries like India, China, and Brazil, which face resource limitations in agricultural practices, often opt for traditional farming methods instead of adopting technology-driven solutions due to the significant capital investment required. Furthermore, precision agriculture generates vast amounts of data, such as variable-rate seeding, yield monitoring, soil testing, mapping, and crop rotation history, all of which are essential for informed decision-making. The success of precision agriculture heavily relies on the analysis of this data, which necessitates proper storage and management. However, managing such a large volume of data presents a considerable challenge, as it demands a high level of expertise that many farmers lack, hindering their ability to effectively utilize the data for farm management decisions.

Precision Agriculture Market Opportunities:

AI-based solutions are expected to shape the future of precision agriculture and create significant opportunities within the market.

The adoption of AI-based applications and tools enables controlled and precise farming by providing farmers with essential guidance on various aspects, such as fertilizer usage, water management, crop rotation, pest control, crop selection based on soil conditions, nutrition management, and optimal planting times. AI-driven tools are employed on farms to manage pest control, utilizing satellite imagery and AI algorithms to analyze historical data and identify the presence and type of insects. Additionally, AI plays a vital role in weather forecasting, helping farmers determine the most suitable crops to grow. It also supports the monitoring of soil quality and nutrient levels. By leveraging AI-based precision farming techniques, farmers are able to monitor crop health more effectively, leading to high-quality harvests.

PRECISION AGRICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

13.69% |

|

Segments Covered |

By offering, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Deere & Company, Trimble Navigation Limited and CropMetrics LLC |

Precision Agriculture Market Segmentation:

Precision Agriculture Market Segmentation By Offering:

- Software

- Hardware

- Service

The hardware segment holds the largest revenue share and is projected to maintain its dominance throughout the forecast period. This segment is further divided into automation and control systems, sensing devices, antennas, and access points. Hardware components such as automation systems, sensing devices, and drones play a crucial role in assisting farmers. For example, the GIS guidance system is highly beneficial for growers, as it enables the visualization of agricultural workflows and the surrounding environment. Additionally, VRT technology helps farmers identify areas that require more pesticides and seeds, ensuring even distribution across the field.

The software segment is divided into web-based and cloud-based precision farming solutions. Cloud computing, which relies on shared networks, servers, and storage devices, helps eliminate the high costs associated with maintaining hardware and software infrastructure. As a result, the software segment is expected to register a compound annual growth rate (CAGR) of over 15.5% during the forecast period. Predictive analytics software is particularly valuable in guiding farmers on crop rotation, soil management, optimal planting times, and harvesting schedules.

Precision Agriculture Market Segmentation By Application:

- Yield Monitoring

- Crop Scouting

- Field Mapping

- Irrigation Management

The yield monitoring segment holds the largest revenue share and is expected to maintain its dominance throughout the forecast period, as it enables farmers to make informed decisions about their fields. This segment is further divided into on-farm yield monitoring and off-farm yield monitoring. On-farm yield monitoring provides farmers with real-time data during harvest and helps create a historical spatial database. This sub-segment is anticipated to capture the largest market share in precision farming, as it facilitates fair landlord negotiations, ensures documentation for environmental compliance, and maintains food safety track records.

The irrigation management segment is expected to experience significant growth during the forecast period. Smart irrigation utilizes a range of technologies, such as rain sensors, weather-based controllers, sensor-based controllers, and water meters, to estimate the optimal amount of irrigation water needed. These advantages are likely to drive the adoption of irrigation drones. Meanwhile, the weather tracking and forecasting segment is projected to grow at a CAGR of 17.4% during the forecast period. The use of sensors allows for accurate weather readings and forecasts. Moreover, the integration of machine learning techniques and advanced data analytics services has enhanced the reliability and precision of weather predictions, further boosting market growth.

Precision Agriculture Market Segmentation- by region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

North America holds the largest revenue share, driven by its status as an early adopter of advanced technologies. The region benefits from factors such as growing government initiatives that promote the adoption of modern agricultural technologies and well-developed infrastructure, which have significantly contributed to its high market revenue. For instance, in May 2022, the Government of Canada announced an investment of USD 441,917.5 to develop an integrated system for precision fruit tree farming. This investment also aimed to provide sustainable solutions to address the emerging challenges faced by Canada's apple industry.

The Asia Pacific region is expected to experience substantial growth during the forecast period. Several government initiatives in developing countries such as India, Sri Lanka, are being implemented to encourage the adoption of modern precision farming technologies, thus enhancing productivity. Additionally, China and Israel signed a trade agreement in September 2017 worth USD 300 million to facilitate the export of environmentally friendly Israeli technology to China. Furthermore, a robust administrative framework is helping farmers acquire the necessary knowledge to effectively use and maintain precision farming equipment.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has caused significant disruption to the global supply chain, leading to food shortages and inflation. These challenges highlight the need for measures to strengthen the food supply chain and prepare for future crises. The pandemic has underscored the importance of conducting agricultural operations remotely. As smart agricultural practices offer farmers the ability to recover losses more quickly, they are expected to drive market growth in the future.

The COVID-19 outbreak has negatively impacted the global precision farming market, with numerous manufacturing units across China, India, European countries, Japan, and the U.S. temporarily shutting down. This has resulted in a notable slowdown in the production of precision farming equipment. Government-imposed lockdowns during the pandemic disrupted manufacturing activities and dampened consumer demand for capital-intensive equipment.

Despite these setbacks, the post-COVID-19 period may see increased adoption of farm management software tools and remote sensing technologies. Companies have already started focusing on wireless platforms to support real-time decision-making for crop health monitoring, yield monitoring, irrigation scheduling, field mapping, and harvesting management.

Latest Trends/ Developments:

In July 2023, Deere & Company, a global leader in agriculture and construction equipment, announced the acquisition of Smart Apply Inc., an agricultural technology solution provider. The acquisition aims to leverage Smart Apply’s precision spraying solutions to help growers address challenges related to regulatory compliance, input costs, and labor. This move is expected to enhance Deere & Company’s ability to attract new customers.

In April 2023, AGCO Corporation, a leading provider of agricultural equipment, and Hexagon, an industrial technology solutions provider, revealed their strategic collaboration. This partnership focuses on expanding AGCO’s factory-fit and aftermarket guidance offerings, further enhancing precision farming capabilities.

In May 2023, AgEagle Aerial Systems Inc., a global provider of agricultural technology solutions, announced the establishment of a new supply agreement with Wingtra AG. The two-year supply agreement aims to securely provide RedEdge-P sensor kits for integration with WingtraOne VTOL drones, supporting precision agriculture efforts.

Key Players:

These are top 10 players in the Precision Agriculture Market :-

- Deere & Company

- Trimble Navigation Limited

- CropMetrics LLC

- AgSmarts Inc

- AGCO Corporation

- CropX

- AgSense LLC

- Monsanto Company

- Ag Leader Technology

- DICKEY-john

Chapter 1. PRECISION AGRICULTURE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. PRECISION AGRICULTURE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. PRECISION AGRICULTURE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. PRECISION AGRICULTURE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. PRECISION AGRICULTURE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. PRECISION AGRICULTURE MARKET – By Offering

6.1 Introduction/Key Findings

6.2 Software

6.3 Hardware

6.4 Service

6.5 Y-O-Y Growth trend Analysis By Offering

6.6 Absolute $ Opportunity Analysis By Offering , 2025-2030

Chapter 7. PRECISION AGRICULTURE MARKET – By Application

7.1 Introduction/Key Findings

7.2 Yield Monitoring

7.3 Crop Scouting

7.4 Field Mapping

7.5 Irrigation Management

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. PRECISION AGRICULTURE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Offering

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Offering

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Offering

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Offering

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Offering

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. PRECISION AGRICULTURE MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Deere & Company

9.2 Trimble Navigation Limited

9.3 CropMetrics LLC

9.4 AgSmarts Inc

9.5 AGCO Corporation

9.6 CropX

9.7 AgSense LLC

9.8 Monsanto Company

9.9 Ag Leader Technology

9.10 DICKEY-john

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Precision agriculture relies on advanced systems, software, and IT services to function effectively. This approach involves gathering real-time data on crop conditions, soil health, atmospheric factors, and other relevant information, including hyperlocal weather forecasts, labor costs, and equipment availability.

The top players operating in the Precision Agriculture Market are - Deere & Company, Trimble Navigation Limited and CropMetrics LLC

The COVID-19 pandemic has caused significant disruption to the global supply chain, leading to food shortages and inflation. These challenges highlight the need for measures to strengthen the food supply chain and prepare for future crises.

AI-based solutions are expected to shape the future of precision agriculture and create significant opportunities within the market.

The Asia Pacific region is expected to experience substantial growth during the forecast period.