Digital Agriculture Market Size (2025 – 2030)

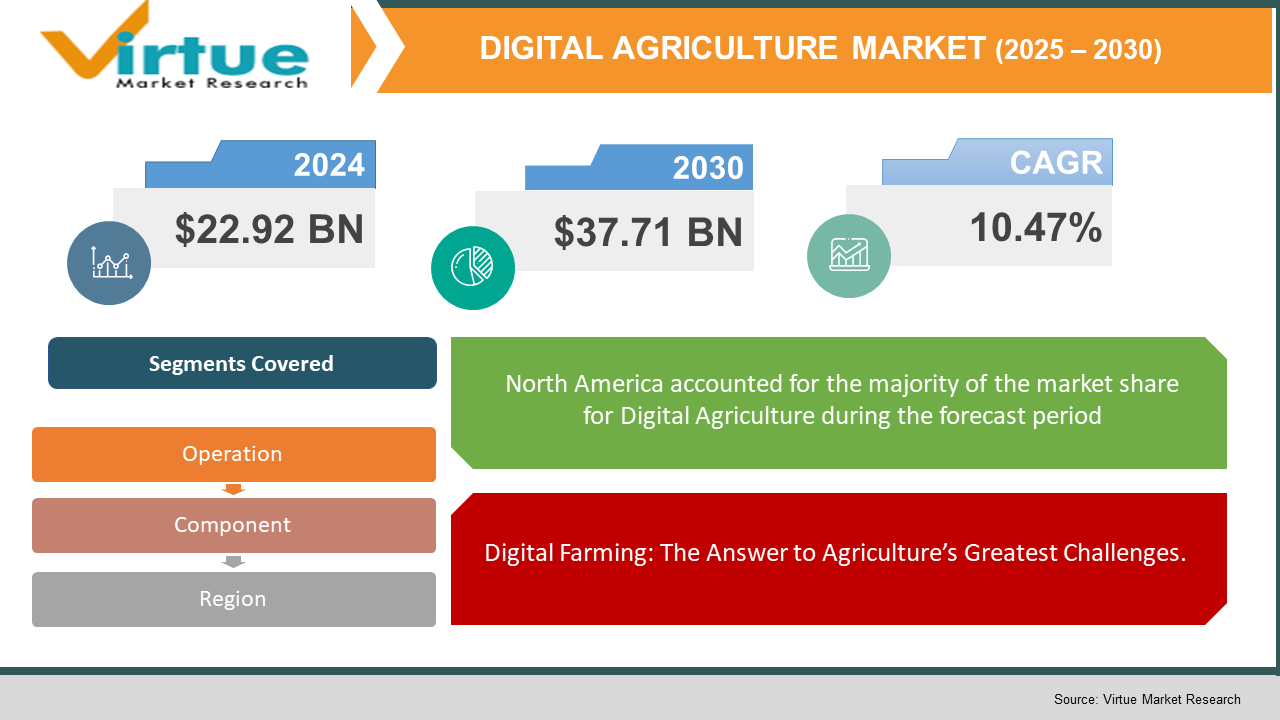

The Global Digital Agriculture Market was valued at USD 22.92 billion in 2024 and is projected to reach a market size of USD 37.71 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.47%.

Digital agriculture uses digital technologies and data analytics to drive farming processes. To feed the world's population, which is estimated at 9.7 billion in the year 2050, food production has to increase by over 70%. Climate change and a lack of labor are, however, slowing down the farming sector despite the rising need for it. Digital farming will help farmers all over the globe overcome these challenges. Information technology is applied in smart farming, or digital farming, or farming 4.0, to revolutionize farm processes. Farmers, for instance, can now acquire data through the use of Internet of Things (IoT) technology to optimize their overall production processes, optimize efficiency, and prepare for emergencies. Using the data, farmers can also establish processes that can be automated. The data can be used to develop means of cooperation and alliances with other farms, which will enhance production by directing resources where it is most required.

Key Market Insights:

- By 2025, the global adoption of precision farming technologies such as sensors, drones, and smart irrigation systems is projected to increase by over 25%, particularly in North America and Europe.

- The market is experiencing a surge in investment, with $10 billion being invested annually in agri-tech startups, which is helping accelerate innovation in digital farming tools and solutions.

- The market for cloud-based farm management software is projected to grow at a CAGR of 18% by 2030, as more farmers seek data-driven insights and remote monitoring solutions.

Global Digital Agriculture Market Drivers:

Digital Farming: The Answer to Agriculture’s Greatest Challenges.

The world's agricultural industry is under tremendous pressure to produce food for an increasing population while fighting the ill effects of climate change, water shortages, and soil erosion. This challenge has driven the need for sustainable and precision agriculture practices, which are aimed at maximizing resource utilization and productivity. Digital agriculture technologies such as GPS-enabled machinery, remote sensing, and variable rate technology enable farmers to apply fertilizers, pesticides, and water only where and when required. This not only saves costs but also minimizes damage to the environment, enhancing soil quality and biodiversity. Governments and international organizations are increasingly promoting these practices through subsidies, policies, and campaigns. The potential of digital agriculture to produce greater yields using less input exactly matches contemporary sustainability objectives and is fast becoming the bedrock of farming systems of the future. With environmental regulation increasing globally, the demand for sustainable precision agriculture is likely to emerge as one of the most compelling drivers of growth for the digital agriculture sector.

The modern farming landscape is being reshaped by the integration of Artificial Intelligence (AI), Internet of Things (IoT) devices, and Big Data analytics.

The face of modern farming is being transformed through the integration of Artificial Intelligence (AI), Internet of Things (IoT) devices, and Big Data analytics. The technologies are turning farms into smart, self-sustaining systems able to make decisions in real-time and predictive planning. IoT devices track soil moisture levels, nutrient levels, weather conditions, and crop health, and AI algorithms sort this data to provide actionable insights that enable farmers to anticipate issues before they arise. Big Data platforms enable farmers further by examining past patterns, market trends, and climate changes, facilitating improved planning and risk avoidance. This technology-led change is facilitating precision farming on an entirely new scale minimizing human error, increasing operational efficiency, and enhancing long-term profitability. Increasing affordability and availability of cloud solutions and connected devices are driving this trend, making digital intelligence a top growth driver for the global market of digital agriculture.

Global Digital Agriculture Market Restraints and Challenges:

Despite the promising growth of the Global Digital Agriculture Market, limited digital infrastructure in rural and developing regions remains a significant challenge.

In spite of the encouraging expansion of the Global Digital Agriculture Market, poor digital infrastructure in rural and developing areas continues to pose a major problem. Most small and medium-scale farmers do not have access to high-speed internet, stable power supply, and low-cost smart devices, limiting the use of precision farming technology. Moreover, the initial investment costs of adopting advanced equipment such as drones, IoT sensors, and automation technologies tend to discourage smallholders from adopting digital solutions. Coupled with economic constraints, farmers' limited technical knowledge and lack of digital proficiency impede the process of integrating these technologies into conventional agricultural practices. Closing the gap will involve public-private collaborations, capacity-building initiatives, and low-cost technology models that make digital agriculture accessible and scalable globally.

Global Digital Agriculture Market Opportunities:

The Global Digital Agriculture Market offers huge opportunities as the industry shifts towards data-driven and climate-smart agriculture solutions. Increasing global food demand, combined with decreasing arable land and volatile climate patterns, has created a compelling requirement for precision agriculture technologies that maximize yield while saving resources. The increasing IoT device penetration, AI-driven analytics, and cloud-based farm management systems provide farmers with actionable insights for improved decision-making and risk mitigation. Emerging economies, particularly in Asia-Pacific, Latin America, and Africa, have untapped potential for digital agriculture adoption as governments and private stakeholders promote sustainable agriculture and rural digitization. Furthermore, the proliferation of agricultural drones, autonomous equipment, and blockchain-based traceability systems is creating new avenues for investment and innovation. As demand for transparency, food safety, and sustainable sourcing increases among consumers, the digital agriculture ecosystem is well placed to become a key driver of future-proof, resilient food production globally.

DIGITAL AGRICULTURE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.47% |

|

Segments Covered |

By operation, component, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DTN, Farmers Edge Inc., Taranis, Eurofins Scientific, AgriWebb, Monsanto, Bayer AG, Deere & Company and Accenture |

Global Digital Agriculture Market Segmentation:

Digital Agriculture Market Segmentation: By Operation

- Farming & Feeding

- Monitoring & Scouting

- Marketing & demand generation

The Global Digital Agriculture Market is operationally divided into Farming & Feeding, Monitoring & Scouting, and Marketing & Demand Generation each an essential phase in the agri-business cycle. Farming & Feeding employs smart devices, precision technology, and AI-powered machinery to automate key farm activities like seeding, fertilizing, irrigation, and animal feeding. Monitoring & Scouting uses advanced sensor equipment, drones, satellite imaging, and IoT networks to collect real-time data on plant health, pest infestation, soil condition, and weather, enabling early detection of issues and reducing crop loss. Marketing & Demand Generation offers producers information about consumer behavior, global supply chain activity, and price forecasting, ensuring the produce reaches the right market at the right time. This operational division enables farmers to maximize output, reduce waste, and maximize farm-to-market activities, ensuring higher profitability and more sustainable agriculture.

Digital Agriculture Market Segmentation: By Component

- Hardware

- Automation & Control Systems

- Sensing & Monitoring devices

- Software

- Services

The Global Digital Agriculture Market is segmented into different Components, namely, Hardware, Automation & Control Systems, Sensing & Monitoring Devices, Software, and Services. Hardware includes precision agriculture machinery like smart tractors, GPS, drones, automated irrigation controllers, and climate monitoring stations that make up the physical underpinning of digital agriculture systems. Automation & Control Systems automate farm processes, from tilling to harvesting, with improved efficiency and less human error through the integration of robotics and machine learning technologies. Sensing & Monitoring Devices gather critical field information, such as temperature, soil moisture content, crop maturity, and pest infestation, thus making real-time actionable insights possible. Software platforms, normally cloud-based, enable decision-making processes, data visualization, forecasting, and workflow optimization, offering digital dashboards for holistic farm management. Services form the backbone of this ecosystem through the provision of analytics, consulting, maintenance, and training, thus enabling even traditional farmers to implement innovative digital solutions with confidence and efficacy.

Digital Agriculture Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

The Global Digital Agriculture Market demonstrates high regional diversity, with North America taking the lead due to early adoption of cutting-edge technologies, strong infrastructure, and government policies encouraging precision farming and automation. Asia-Pacific is growing rapidly, driven by increasing food demand, population pressure, and a thriving ecosystem of agri-tech startups providing innovative, scalable solutions for farmers. Europe is concentrating strongly on sustainability, sustainable farming practices, and stringent regulatory policies that promote the use of green digital solutions. In South America, digital agriculture is slowly gaining momentum as farmers aim to improve crop quality, achieve export requirements, and maximize scarce resources. While that is happening, the Middle East and Africa are emerging markets where digital farming solutions are increasingly crucial to addressing food security issues, climate resilience, and effective resource management. Both regions have unique roles to play in defining the future of digital agriculture on the global front.

COVID-19 Impact Analysis on the Global Digital Agriculture Market:

The COVID-19 pandemic has had a mixed but revolutionary effect on the Global Digital Agriculture Market. While the initial lockdowns had created supply chain disruptions, availability of labor, and on-ground farming activities, the crisis hastened the demand for automation, remote monitoring, and data-driven decision-making on farms globally. Social distancing protocols and manpower shortages compelled agriculturalists and agriculture businesses to switch to digital tools like drones to monitor fields, IoT sensors for monitoring crop health in real time, and cloud-based farm management software to ensure business continuity. The pandemic exacerbated the weaknesses in conventional farming patterns and consolidated the position of digital agriculture in making food available and supply chain reliability. Consequently, the post-COVID era has seen a burst of investment and innovation in agri-tech technology solutions, which have made digital agriculture a backbone of future-ready farm strategies for both developed and emerging economies.

Latest Trends/ Developments:

The Global Digital Agriculture Market is currently experiencing accelerated innovation fueled by technological advancements and increasing demands for sustainable and effective agriculture. Among the most noticeable trends is the incorporation of Machine Learning and Artificial Intelligence for predictive analytics in weather modeling, yield forecasting, and crop health. IoT-driven smart farming solutions are increasingly popular, allowing for real-time soil condition, water level, and crop growth monitoring using connected devices. Another emerging trend is the use of drones and satellite imaging for precision farming, which facilitates improved field scouting, pest management, and fertilizer application. Blockchain technology is also picking up steam, providing end-to-end farm-to-fork traceability and enhancing food safety and supply chain integrity. Further, the market is witnessing the increase in subscription farm management software platforms and agriculture-as-a-service (AaaS) models, enhancing access to sophisticated digital tools among small and medium-sized farmers. These all are indicative of an emerging trend towards data-driven, climate-resilient, and profit-maximized farming worldwide.

Key Players:

- DTN

- Farmers Edge Inc.

- Taranis

- Eurofins Scientific

- AgriWebb

- Monsanto Company

- Bayer AG

- Deere & Company.

- Accenture

- Syngenta AG

Chapter 1. DIGITAL AGRICULTURE MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. DIGITAL AGRICULTURE MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. DIGITAL AGRICULTURE MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. DIGITAL AGRICULTURE MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. DIGITAL AGRICULTURE MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. DIGITAL AGRICULTURE MARKET – By Operation

6.1 Introduction/Key Findings

6.2 Farming & Feeding

6.3 Monitoring & Scouting

6.4 Marketing & demand generation

6.5 Y-O-Y Growth trend Analysis By Operation

6.6 Absolute $ Opportunity Analysis By Operation , 2025-2030

Chapter 7. DIGITAL AGRICULTURE MARKET – By Component

7.1 Introduction/Key Findings

7.2 Hardware

7.3 Automation & Control Systems

7.4 Sensing & Monitoring devices

7.5 Software

7.6 Services

7.7 Y-O-Y Growth trend Analysis By Component

7.8 Absolute $ Opportunity Analysis By Component , 2025-2030

Chapter 8. DIGITAL AGRICULTURE MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Component

8.1.3. By Operation

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Operation

8.2.3. By Component

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Operation

8.3.3. By Component

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Operation

8.4.3. By Component

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Operation

8.5.3. By Component

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. DIGITAL AGRICULTURE MARKET – Company Profiles – (Overview, Product , Portfolio, Financials, Strategies & Developments)

9.1 DTN

9.2 Farmers Edge Inc.

9.3 Taranis

9.4 Eurofins Scientific

9.5 AgriWebb

9.6 Monsanto Company

9.7 Bayer AG

9.8 Deere & Company.

9.9 Accenture

9.10 Syngenta AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Digital Agriculture Market was valued at USD 22.92 billion in 2024 and is projected to reach a market size of USD 37.71 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.47%.

The Global Digital Agriculture Market is driven by the increasing demand for sustainable farming practices and the integration of AI, IoT, and Big Data for enhanced decision-making and resource optimization. These technologies enable farmers to improve yields, reduce waste, and increase operational efficiency.

Based on Service Provider, the Global Digital Agriculture Market is segmented into material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers

North America is the most dominant region for the Global Digital Agriculture Market.

DTN, Farmers Edge Inc., Taranis, Eurofins Scientific, AgriWebb, Monsanto, Bayer AG, Deere & Company and Accenture are the key players in the Global Digital Agriculture Market.