Poultry Processing Equipment Market Size (2024 – 2030)

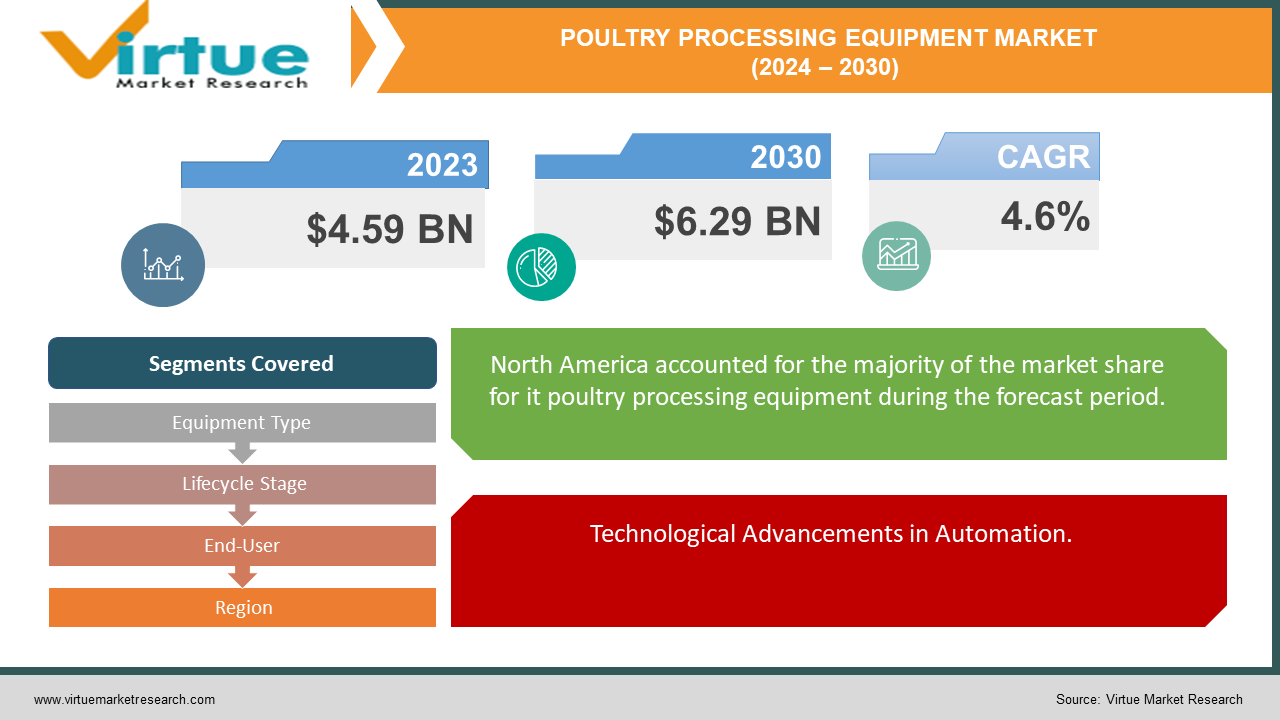

The global poultry processing equipment market is projected to grow from an estimated USD 4.59 billion in 2023 to USD 6.29 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 4.6% over the forecast period of 2024-2030.

The global poultry processing equipment market is poised for substantial growth from 2023 to 2030, driven by increasing demand for processed poultry products worldwide. This growth is fueled by factors such as a rising global population, urbanization, and dietary shifts towards protein-rich foods. Technological advancements in poultry processing equipment, including automation and efficiency improvements, are enhancing production capabilities and meeting stringent food safety regulations. Emerging markets in Asia Pacific and Latin America are expected to lead growth, supported by expanding poultry production capacities and rising consumption of processed poultry products. Developed regions like North America and Europe are also anticipated to contribute to market expansion through continuous technological innovation and adherence to high-quality standards. Overall, the poultry processing equipment market is positioned for steady growth, driven by evolving consumer preferences and the increasing need for efficient and sustainable food processing solutions globally.

Key Insights:

Technological advancements in automation and robotics are expected to drive efficiency gains in poultry processing plants, reducing labor costs by up to 15% over the next five years.

Rising consumer demand for value-added poultry products, such as pre-packaged cuts and ready-to-cook meals, is boosting the adoption of advanced portioning and packaging equipment, with an expected market penetration of 35% by 2025.

Despite technological advancements, the poultry processing industry faces challenges related to wastewater management, with up to 25% of processing plants globally failing to meet regulatory discharge standards. Implementing advanced water treatment technologies and stricter monitoring protocols are crucial to mitigating environmental impacts.

Global Poultry Processing Equipment Market Drivers:

Technological Advancements in Automation.

The integration of advanced automation technologies such as robotics and artificial intelligence (AI) is revolutionizing the poultry processing equipment market. Automated systems enhance efficiency, reduce labor costs, and improve product quality and consistency. For instance, robotic systems for deboning and portioning are becoming increasingly sophisticated, enabling faster processing speeds and higher yields while ensuring precision and hygiene standards.

Increasing Consumer Demand for Processed Poultry Products.

Rising consumer preference for convenience foods and protein-rich diets is driving the demand for processed poultry products globally. Poultry processing equipment plays a crucial role in meeting this demand by enabling efficient production of a wide range of value-added products such as fillets, nuggets, and ready-to-cook items. This trend is particularly prominent in urban areas where busy lifestyles and changing dietary habits emphasize convenience and nutrition.

Stringent Food Safety Regulations and Standards.

Stringent regulatory requirements regarding food safety and hygiene are compelling poultry processors to invest in advanced processing equipment. Modern equipment facilitates compliance with strict standards by incorporating features such as automated cleaning systems, sanitary design principles, and real-time monitoring of critical control points (HACCP). Adherence to these regulations not only ensures consumer safety but also enhances market competitiveness by building trust and credibility with customers and regulatory authorities.

Global Poultry Processing Equipment Market Restraints and Challenges:

High Initial Investment Costs.

Investing in modern poultry processing equipment requires substantial capital expenditure, which can be a barrier for smaller poultry processors or those operating in emerging markets. The cost includes not only purchasing the equipment but also installation, maintenance, and training of personnel to operate these advanced systems.

Labor Intensity and Workforce Skills.

Despite automation advancements, certain aspects of poultry processing still rely on manual labor, particularly in tasks requiring dexterity and judgment. This reliance on labor can lead to challenges in finding skilled workers willing to perform physically demanding and sometimes hazardous tasks, especially in regions facing labor shortages or high turnover rates.

Regulatory Compliance and Environmental Concerns.

Poultry processing facilities must adhere to stringent regulatory requirements regarding food safety, sanitation, and environmental sustainability. Meeting these standards often involves significant operational adjustments and ongoing investments in technologies for wastewater treatment, waste management, and emissions control. Non-compliance can lead to fines, sanctions, and reputational damage.

Global Poultry Processing Equipment Market Opportunities:

Technological Advancements and Innovation.

Continuous advancements in technology, including automation, robotics, and AI, offer significant opportunities to enhance efficiency, reduce labor costs, and improve product quality in poultry processing. Innovations such as smart sensors for real-time monitoring, predictive maintenance systems, and automated sorting and packaging solutions can optimize operations and meet evolving consumer demands.

Expansion in Emerging Markets.

Emerging economies in Asia Pacific, Latin America, and Africa are experiencing rapid urbanization, rising disposable incomes, and increasing consumption of poultry products. This demographic shift presents a substantial growth opportunity for poultry processing equipment manufacturers to expand their presence, invest in local production facilities, and tailor their product offerings to meet regional preferences and regulatory requirements.

Rising Demand for Value-added Products.

There is a growing consumer preference for convenient, ready-to-cook, and value-added poultry products such as marinated cuts, portioned pieces, and processed chicken nuggets. This trend not only drives demand for advanced processing equipment capable of producing these products efficiently but also opens avenues for innovation in packaging, labeling, and marketing strategies to appeal to diverse consumer tastes and preferences.

POULTRY PROCESSING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.6% |

|

Segments Covered |

By Equipment Type, Lifecycle Stage, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Marel HF, Linco Food Systems (Part of BAADER Group), Key Technology, Inc. (Part of Duravant LLC), Baader Group, John Bean Technologies Corporation (JBT Corporation), CTB, Inc. (Part of Berkshire Hathaway), Meyn Food Processing Technology B.V., Brower Equipment, Bayle SA, Prime Equipment Group, Inc., CG Manufacturing and Distribution Limited, Foodmate B.V. |

Poultry Processing Equipment Market Segmentation: By Equipment Type

-

Killing and de-feathering

-

Evisceration

-

Chilling and Freezing

-

Cut-Up and Deboning

-

Others

Among the various types of equipment in the global poultry processing equipment market, chilling and freezing systems stand out as crucial for maintaining product quality and safety. These systems play a pivotal role in rapidly cooling or freezing poultry carcasses and products, preserving freshness, texture, and nutritional value while extending shelf life. Advanced technologies such as blast chilling and spiral freezing ensure uniform cooling rates, essential for inhibiting microbial growth and complying with stringent food safety regulations. Efficient chilling and freezing not only enhance food safety but also optimize processing efficiency, reducing energy consumption and operational costs for poultry processors worldwide.

Poultry Processing Equipment Market Segmentation: By Lifecycle Stage

-

New Installations

-

Replacement and Upgrades

In the market segmentation of the global poultry processing equipment industry by lifecycle stage, new installations represent a particularly effective segment driving market growth. As emerging markets expand their poultry production capacities and existing facilities seek to modernize or establish new processing lines, there is a substantial demand for state-of-the-art equipment. New installations allow processors to incorporate the latest technological advancements in automation, food safety standards, and efficiency, thereby improving overall operational capabilities and product quality. This segment not only fosters innovation within the industry but also supports sustainable growth by meeting evolving consumer demands for safe and high-quality poultry products globally.

Poultry Processing Equipment Market Segmentation: By End-User

-

Large-scale Poultry Processing Plants

-

Small & Medium-sized Enterprises (SMEs)

-

Integrated Poultry Companies

Among the segments based on end-users in the global poultry processing equipment market, large-scale poultry processing plants stand out as particularly impactful. These facilities, characterized by their high-volume processing capacities and extensive operations, drive significant demand for advanced equipment to enhance efficiency and maintain stringent food safety standards. Large-scale plants benefit from economies of scale, allowing them to invest in state-of-the-art technologies such as automated processing lines, sophisticated chilling and freezing systems, and comprehensive quality control measures. By adopting these innovations, large-scale processors can optimize production throughput, minimize labor costs, and meet the diverse demands of global markets for processed poultry products. Their substantial influence in the market not only drives technological advancements but also sets benchmarks for operational excellence and sustainability across the poultry processing industry.

Poultry Processing Equipment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global poultry processing equipment market is segmented across several key regions, with North America leading with a significant market share of 35%. This dominance is driven by stringent food safety regulations, high levels of automation, and a strong emphasis on product quality and efficiency within poultry processing facilities. Europe follows closely with a market share of 26%, characterized by robust consumer demand for premium poultry products and investments in sustainable processing technologies. Asia-Pacific holds 23% of the market share, experiencing rapid growth due to increasing urbanization, rising incomes, and expanding poultry production capacities in countries like China and India. South America and the Middle East & Africa regions contribute 9% and 8%, respectively, driven by growing poultry industries and investments in modernizing processing facilities to meet local and export market demands. These regional insights underscore the diverse dynamics shaping the global poultry processing equipment market, highlighting opportunities for manufacturers to align their strategies with regional preferences and regulatory landscapes.

COVID-19 Impact Analysis on the Global Poultry Processing Equipment Market:

The COVID-19 pandemic had a significant impact on the global poultry processing equipment market, disrupting supply chains, production schedules, and consumer demand dynamics. Initially, lockdown measures and workforce limitations caused operational challenges for poultry processing plants, leading to temporary closures and reduced processing capacities. However, as the food supply chain adapted to the new normal, there was a heightened focus on automation and hygiene practices within processing facilities to ensure worker safety and maintain production continuity. Moreover, the pandemic accelerated trends towards convenience foods and packaged poultry products, driving investments in modern processing equipment capable of meeting evolving consumer preferences for safe and efficiently processed poultry. Looking forward, the industry continues to navigate uncertainties, emphasizing resilience and adaptability in response to future disruptions while leveraging technological advancements to enhance operational efficiency and food safety standards.

Latest Trends/ Developments:

The global poultry processing equipment market is currently experiencing dynamic trends and developments that are reshaping its operational landscape. Key trends include the rapid adoption of automation and robotics to enhance processing efficiency and product quality, alongside heightened investments in food safety measures to meet stringent regulatory requirements and consumer expectations. Sustainability has become a critical focus, driving innovations in energy-efficient equipment and eco-friendly packaging solutions. Moreover, there is a growing consumer preference for convenient, value-added poultry products, prompting manufacturers to innovate in portioning and packaging technologies. These trends underscore a proactive industry response to evolving market demands, emphasizing technological innovation, sustainability, and consumer-centric strategies as pivotal drivers of growth in the poultry processing equipment sector.

Key Players:

-

Marel HF

-

Linco Food Systems (Part of BAADER Group)

-

Key Technology, Inc. (Part of Duravant LLC)

-

Baader Group

-

John Bean Technologies Corporation (JBT Corporation)

-

CTB, Inc. (Part of Berkshire Hathaway)

-

Meyn Food Processing Technology B.V.

-

Brower Equipment

-

Bayle SA

-

Prime Equipment Group, Inc.

-

CG Manufacturing and Distribution Limited

-

Foodmate B.V.

Chapter 1. Poultry Processing Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Poultry Processing Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Poultry Processing Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Poultry Processing Equipment Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Poultry Processing Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Poultry Processing Equipment Market – By Equipment Type

6.1 Introduction/Key Findings

6.2 Killing and de-feathering

6.3 Evisceration

6.4 Chilling and Freezing

6.5 Cut-Up and Deboning

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Equipment Type

6.8 Absolute $ Opportunity Analysis By Equipment Type, 2024-2030

Chapter 7. Poultry Processing Equipment Market – By Lifecycle Stage

7.1 Introduction/Key Findings

7.2 New Installations

7.3 Replacement and Upgrades

7.4 Y-O-Y Growth trend Analysis By Lifecycle Stage

7.5 Absolute $ Opportunity Analysis By Lifecycle Stage, 2024-2030

Chapter 8. Poultry Processing Equipment Market – By End-User

8.1 Introduction/Key Findings

8.2 Large-scale Poultry Processing Plants

8.3 Small & Medium-sized Enterprises (SMEs)

8.4 Integrated Poultry Companies

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Poultry Processing Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Equipment Type

9.1.3 By Lifecycle Stage

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Equipment Type

9.2.3 By Lifecycle Stage

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Equipment Type

9.3.3 By Lifecycle Stage

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Equipment Type

9.4.3 By Lifecycle Stage

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Equipment Type

9.5.3 By Lifecycle Stage

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Poultry Processing Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Marel HF

10.2 Linco Food Systems (Part of BAADER Group)

10.3 Key Technology, Inc. (Part of Duravant LLC)

10.4 Baader Group

10.5 John Bean Technologies Corporation (JBT Corporation)

10.6 CTB, Inc. (Part of Berkshire Hathaway)

10.7 Meyn Food Processing Technology B.V.

10.8 Brower Equipment

10.9 Bayle SA

10.10 Prime Equipment Group, Inc.

10.11 CG Manufacturing and Distribution Limited

10.12 Foodmate B.V.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global poultry processing equipment market is projected to grow from an estimated USD 4.59 billion in 2023 to USD 6.29 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 4.6% over the forecast period of 2024-2030.

The primary drivers of the global poultry processing equipment market include increasing poultry consumption, technological advancements in automation, and stringent food safety regulations.

The key challenges facing the global poultry processing equipment market include high initial investment costs, labor intensity, regulatory compliance, and supply chain disruptions.

In 2023, North America held the largest share of the global poultry processing equipment market.

Marel HF, Linco Food Systems (Part of BAADER Group), Key Technology, Inc. (Part of Duravant LLC), Baader Group, John Bean Technologies Corporation (JBT Corporation), CTB, Inc. (Part of Berkshire Hathaway), Meyn Food Processing Technology B.V., Brower Equipment, Bayle SA, Prime Equipment Group, Inc., CG Manufacturing and Distribution Limited, Foodmate B.V. are the main players.