Latin America Poultry Processing Equipment Market Size (2024-2030)

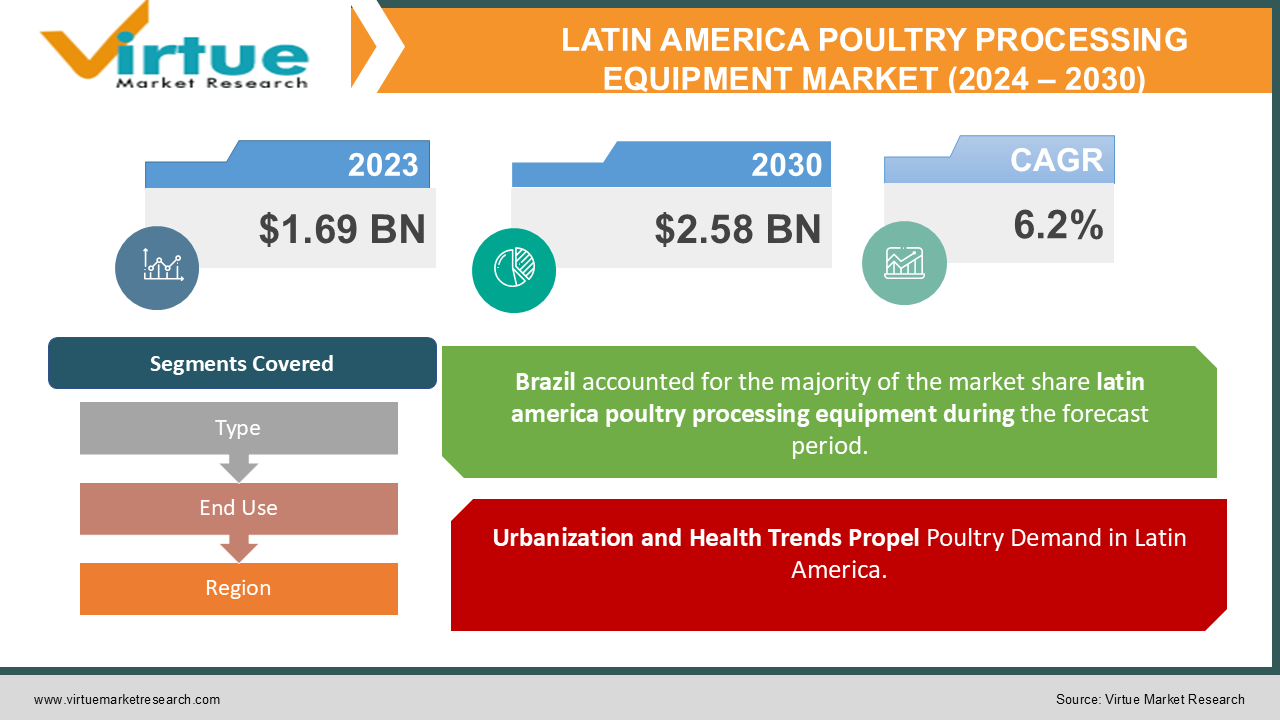

The Latin America Poultry Processing Equipment Market was valued at USD 1.69 Billion in 2023 and is projected to reach a market size of USD 2.58 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.

The Latin American poultry processing equipment market is a dynamic landscape experiencing significant growth. Fueled by a rising demand for poultry meat and growing emphasis on automation and efficiency, this market offers vast potential for equipment manufacturers and technology providers. Poultry processors in Latin America are increasingly seeking automation solutions to enhance processing efficiency, improve hygiene standards, and reduce labour costs. Automated slaughtering lines, robotic picking systems, and automated packaging solutions are gaining traction. Stricter food safety regulations and consumer concerns regarding foodborne illnesses are prompting processors to invest in equipment that ensures hygienic processing and minimizes contamination risks. This includes advanced chilling and freezing systems, metal detectors, and sanitation equipment.

Key Market Insights:

- Due to the demand for effective hatching and rearing technologies, the Latin American market for poultry breeding equipment is projected to reach a value of $380 million.

- As producers concentrate on increasing feed efficiency and cutting costs, it is projected that the poultry industry's need for feed processing equipment would reach $620 million.

- Given the industry's emphasis on sustainability and environmental responsibility, the Latin American market for poultry waste management equipment is expected to be valued $210 million.

- The market for large-scale enterprises' poultry processing equipment is projected to be worth $1.6 billion, serving the requirements of poultry processors operating on an industrial scale.

- The requirement for longer shelf lives and appealing product presentations is expected to fuel the $720 million market for poultry processing equipment with cutting-edge packaging and labelling solutions.

- As processors place a high priority on product safety and uniformity, the market for poultry processing equipment with cutting-edge quality control and inspection systems is projected to be worth $410 million.

- Due to the demand for longer shelf lives and appealing product presentations, the market for poultry processing equipment with cutting-edge packaging and labelling solutions is expected to reach $720 million.

- Due to processors' emphasis on product consistency and safety, it is projected that the market for poultry processing equipment including cutting-edge quality control and inspection systems will reach $410 million.

- The market for equipment used in organic and free-range poultry enterprises for processing poultry is anticipated to expand at a compound annual growth rate (CAGR) of 9.1%.

Latin America Poultry Processing Equipment Market Drivers:

Urbanization and Health Trends Propel Poultry Demand in Latin America.

Latin America is rapidly urbanising, which is creating a middle class that is expanding and has greater disposable income. This group is more inclined to buy convenience foods, which frequently have poultry as a main ingredient, or go out to eat. Customers are looking for protein choices that are less fattening than red meat as they become more health conscious. Poultry fits in nicely with these changing tastes because of its lean cuts and variety of cooking methods. The production and consumption of chicken is being encouraged by some governments in Latin America in an effort to combat hunger and increase food security. This may take the form of educational initiatives emphasising the health advantages of eating poultry meat or subsidies for chicken producers.

Latin American agriculture is undergoing a transformation. Farmers are increasingly embracing modern agricultural practices to improve yields, optimize resource utilization, and enhance overall farm efficiency.

Increases in the minimum wage and a more competitive labor market are pushing processors to automate manual activities. Automated machinery can speed up turnaround times and increase production volumes by drastically cutting processing times. Automation reduces the amount of time that workers spend on the processing line, which lowers the possibility of contamination and fosters a cleaner atmosphere. By accurately managing processing parameters such as chilling temperatures and cutting procedures, automated systems guarantee constant product quality. To find bottlenecks, allocate resources optimally, and make data-driven decisions for ongoing improvement, real-time data gathered from processing equipment can be utilized. More versatile and dexterous robots will be able to handle a larger variety of jobs in the processing line, which will further reduce the need for manual labor.

Latin America Poultry Processing Equipment Market Restraints and Challenges:

The cost of modern chicken processing equipment is high, especially for automated systems from top global manufacturers. For smaller and medium-sized processors who would find it difficult to justify the initial expenditure, this can be a major obstacle. For poultry processors, obtaining funding for equipment purchases can be difficult, particularly in developing Latin American nations. The chicken business may be viewed as high-risk by traditional lenders, and loan interest rates may be unaffordable. The limited financial resources of many processors in Latin America may prevent sophisticated equipment from being widely adopted, which could slow down the growth of the sector as a whole.

Latin America Poultry Processing Equipment Market Opportunities:

Consumers are drawn to pre-seasoned and breaded options like chicken nuggets, tenders, and patties, offering effortless meal preparation. Convenience reigns supreme, and pre-cut and portion-controlled poultry pieces cater to busy lifestyles and single-serve meals. The e-commerce landscape in Latin America is flourishing, and this trend is extending to the poultry sector. Consumers are increasingly purchasing fresh and frozen poultry products online. Direct-to-consumer (D2C) models, where processors sell directly to consumers through online platforms, are also gaining traction. Developing packaging solutions that maintain product quality and freshness during transport through e-commerce delivery channels will be essential.

LATIN AMERICA POULTRY PROCESSING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, End Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile, and Rest of Latin America |

|

Key Companies Profiled |

GEA Group, Marel HF , Baader Group , JBT Corporation, CTB, Inc., TecnoBris, Metalfrio Solutions , Agroindustrial Fac |

Latin America Poultry Processing Equipment Market Segmentation:

Latin America Poultry Processing Equipment Market Segmentation: By Type:

- Large-Scale Processing Plants

- Medium-Scale Processing Plants

- Small-Scale Processing Plants

Large-scale processing plants dominate the Latin American poultry processing equipment market, accounting for a substantial share of approximately 55-60%. These plants are typically operated by major poultry producers and integrators, catering to the high demand for poultry products in domestic and export markets. Large-scale plants benefit from economies of scale, enabling them to produce poultry products at lower costs per unit. This advantage allows them to remain competitive and meet the growing demand for affordable poultry products in the region. Large-scale plants have the financial resources to invest in advanced processing equipment and automation technologies. This not only increases efficiency and productivity but also ensures consistent product quality and food safety compliance.

Small-scale processing plants are experiencing the fastest growth in the Latin American region. Consumers in Latin America are showing a growing preference for locally sourced and artisanal poultry products, perceived as fresher, more natural, and traceable. Small-scale processors are well-positioned to cater to this demand by offering niche and specialty poultry products. The rise of niche markets, such as organic, free-range, and halal poultry products, has created opportunities for small-scale processors to differentiate their offerings and tap into these specialized segments.

Latin America Poultry Processing Equipment Market Segmentation: By End Use:

- Fresh Processed Poultry Products

- Frozen Processed Poultry Products

- Cooked Poultry Products

- Other Processed Poultry Products

The fresh processed poultry products segment is the most dominant end-user in the Latin American poultry processing equipment market, accounting for approximately 40-45% of the market share. This segment encompasses whole birds, cut-up parts, and other fresh poultry products that are chilled and distributed for immediate consumption or further processing. The booming foodservice industry, including restaurants, fast-food chains, and catering services, has a high demand for fresh poultry products. These establishments require a consistent supply of fresh, high-quality poultry to meet the preferences of their customers.

While the fresh processed poultry products segment dominates the market, the cooked poultry products segment is experiencing the fastest growth in the Latin American region. The expansion of the foodservice industry, including quick-service restaurants, convenience stores, and supermarket delis, has driven the demand for cooked poultry products. These establishments require a consistent supply of pre-cooked and ready-to-serve poultry products to meet customer demand for convenience and speed.

Latin America Poultry Processing Equipment Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil's established and thriving poultry sector makes it the clear leader in the Latin American market for poultry processing equipment. Its abundant natural resources, cutting-edge production methods, and ideal climate have made this agricultural powerhouse a consistent global leader in the production and export of poultry meat. Over the past few decades, Brazil's chicken sector has grown remarkably thanks to strong export markets and rising local demand. Modern poultry processing facilities have become increasingly expensive to fulfil this expanding demand, which has increased demand for cutting-edge machinery and technology.

The nation with the quickest rate of growth in this area is Chile. Due to rising export demand and rising local consumption, Chile's chicken sector has expanded rapidly in recent years. The Chilean poultry sector has experienced substantial technological breakthroughs and modernization in response to the growing demand for premium poultry products. This has increased demand for sophisticated processing equipment and resulted in large expenditures in modern facilities and cutting-edge technologies. The market for chicken processing equipment in Chile is distinguished by a significant emphasis on efficiency, automation, and food safety.

COVID-19 Impact Analysis on the Latin America Poultry Processing Equipment Market:

Lockdowns and travel restrictions across the globe disrupted the flow of essential equipment components and finished processing equipment from major manufacturing hubs in Europe and Asia. This led to delays in deliveries and installation of new equipment, impacting processing capacity for poultry producers. Social distancing measures and worker safety concerns led to temporary or permanent closures of processing plants in some regions. Additionally, worker absenteeism due to illness or fear of infection further strained processing capacity. Early in the pandemic, panic buying and disruptions in food service channels caused fluctuations in poultry demand. Processors had to adapt their production processes to meet the changing needs of consumers, potentially impacting their equipment requirements. The pandemic highlighted the vulnerability of labour-intensive processing lines to disruptions. This could lead to an increased focus on automation solutions to minimize reliance on human labour and improve worker safety in the long term.

Latest Trends/ Developments:

Sensors embedded in processing equipment can collect real-time data on performance parameters like temperature, pressure, and vibration. This data can be transmitted to a central platform, enabling remote monitoring and predictive maintenance. Early detection of potential equipment issues can prevent costly breakdowns and ensure optimal processing efficiency. AI algorithms can analyse vast amounts of data collected from various sources throughout the processing line. This analysis can identify areas for improvement, optimize processing parameters, and even predict potential quality control issues. AI-powered systems can continuously learn and adapt, leading to a more efficient and streamlined processing operation. By collecting and analyzing data from various stages of the processing line, including equipment performance, production volumes, and product quality metrics, processors can gain valuable insights. This data can be used to make data-driven decisions regarding resource allocation, production planning, and overall operational strategy. These systems utilize robotics or automated spray technology to apply disinfectants and sanitizing solutions on processing equipment surfaces. This reduces reliance on manual cleaning procedures, minimizing human error and ensuring consistent hygiene standards.

Key Players:

- GEA Group

- Marel HF

- Baader Group

- JBT Corporation

- CTB, Inc.

- TecnoBris

- Metalfrio Solutions

- Agroindustrial Fac

Chapter 1. Latin America Poultry Processing Equipment Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Poultry Processing Equipment Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Poultry Processing Equipment Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Poultry Processing Equipment Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Poultry Processing Equipment Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Poultry Processing Equipment Market– By Type

6.1. Introduction/Key Findings

6.2. Large-Scale Processing Plants

6.3. Medium-Scale Processing Plants

6.4. Small-Scale Processing Plants

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Poultry Processing Equipment Market– By End Use

7.1. Introduction/Key Findings

7.2 Fresh Processed Poultry Products

7.3. Frozen Processed Poultry Products

7.4. Cooked Poultry Products

7.5. Other Processed Poultry Products

7.6. Y-O-Y Growth trend Analysis By End Use

7.7. Absolute $ Opportunity Analysis By End Use , 2024-2030

Chapter 8. Latin America Poultry Processing Equipment Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Poultry Processing Equipment Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. GEA Group

9.2. Marel HF

9.3. Baader Group

9.4. JBT Corporation

9.5. CTB, Inc.

9.6. TecnoBris

9.7. Metalfrio Solutions

9.8. Agroindustrial Fac

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Latin America's population is projected to continue growing in the coming years. This, coupled with rising disposable incomes, is leading to an increased demand for protein sources like chicken, which is generally considered affordable and versatile

Modern poultry processing equipment, particularly automated solutions from leading international manufacturers, comes with a hefty price tag. This can be a significant barrier for smaller and medium-sized processors who may struggle to justify the initial investment

GEA Group, Marel HF, Baader Group, JBT Corporation, CTB, Inc., TecnoBris

Metalfrio Solutions, Agroindustrial Fac

With a market share estimated to be around 45%, Brazil's dominance in the Latin American poultry processing equipment market is undeniable

Chile emerges as the fastest-growing country in this sector