Potato Chips and Crisps Market Size (2024 – 2030)

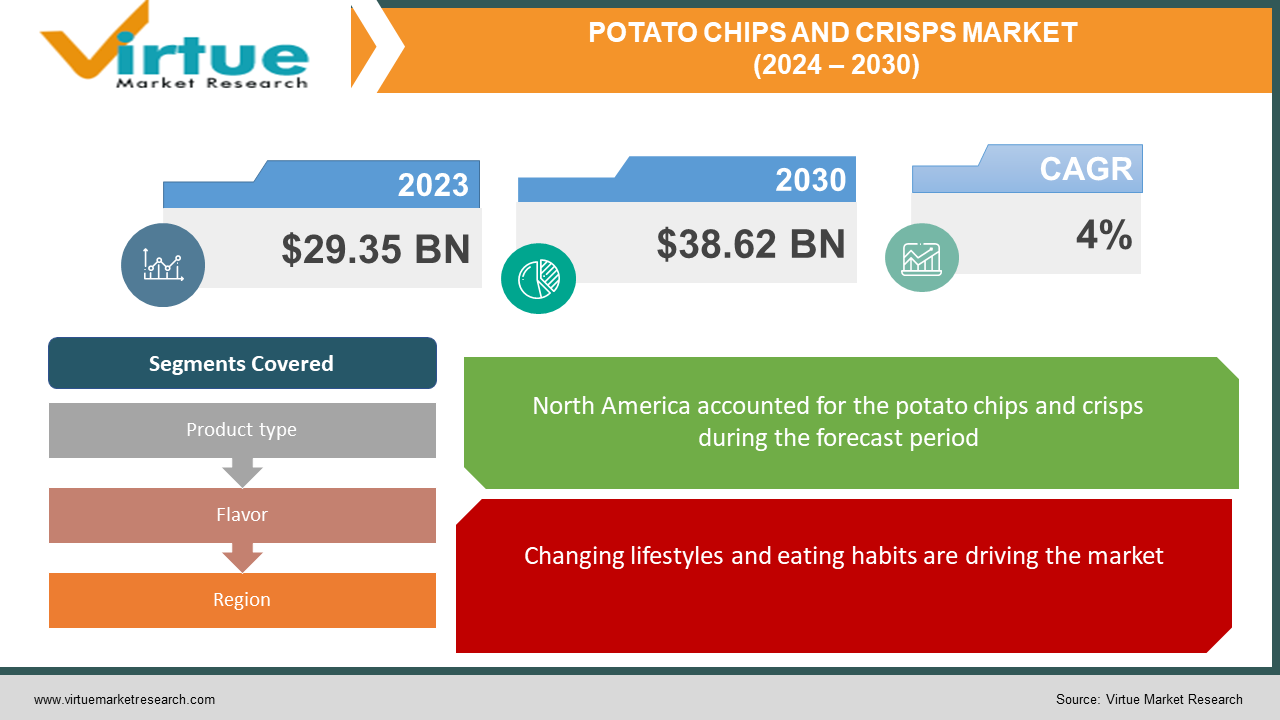

The Global Potato Chips and Crisps Market was valued at USD 29.35 billion in 2023 and will grow at a CAGR of 4% from 2024 to 2030. The market is expected to reach USD 38.62 billion by 2030.

Key Market Insights:

The potato chip and crisp market is a multi-billion dollar snacking giant, expected to reach over $39 billion by 2030. This salty favorite is driven by factors like rising disposable income, busy lifestyles, and a preference for convenient packaged foods. North America currently holds the top spot, but growth in developing economies is strong. Flavored varieties reign supreme, offering a kaleidoscope of taste sensations to keep consumers coming back for more. However, health concerns about fat and sodium are a potential roadblock, with some turning to baked or veggie chips for a lighter indulgence. Overall, the market is poised for steady growth, fueled by our insatiable desire for a satisfying and portable crunch.

Global Potato Chips and Crisps Market Drivers:

Changing lifestyles and eating habits are driving the market

The traditional sit-down breakfast, lunch, and dinner are slowly becoming relics of the past. Busy schedules, long work hours, and the ever-present hustle culture have fueled a significant rise in snacking. This shift in eating habits creates a perfect storm for the potato chip and crisp market. These crispy treats are champions of convenience - no prep work, mess-free, and perfectly portioned for a quick bite between meetings, errands, or after-school activities. Their portability makes them ideal for on-the-go consumption, fitting seamlessly into backpacks, purses, and lunch boxes. Whether it's a midday pick-me-up or a satisfying after-dinner treat, potato chips, and crisps offer a convenient and delicious way to curb hunger pangs whenever and wherever they strike, perfectly aligning with the fast-paced, snack-centric lifestyle of today's consumers.

Growing demand for convenience food is driving the market

Our modern lives crave convenience, and nowhere is this more evident than in the rise of easy-to-prepare and store pantry staples. In this arena, potato chips and crisps reign supreme. Unlike fresh produce that requires meticulous storage and preparation, a bag of chips needs no chopping, washing, or cooking. They're grab-and-go perfection, ideal for when time is tight or culinary inspiration is lacking. This simplicity extends to storage as well. Unlike perishables with limited shelf life, chips boast a long lifespan, often lasting for weeks or even months. This allows for worry-free stockpiling, ensuring there's always a satisfying snack on hand and no last-minute grocery trips required. This marriage of convenience and extended shelf life makes potato chips and crisps a godsend for busy households, college students, or anyone who appreciates a well-stocked pantry. They bridge the gap between a healthy meal and a quick bite, offering a readily available source of energy and flavor without the hassle of elaborate preparation or the stress of impending spoilage.

Increasing urbanization is driving the market

The rapid rise of cities plays a significant role in the booming potato chip and crisp market. Urban dwellers often juggle demanding careers, long commutes, and social lives, leaving little time for elaborate home-cooked meals. This fast-paced environment fuels a reliance on convenience foods, and potato chips and crisps perfectly fit the bill. They require no prep work, offer a satisfying burst of flavor, and are readily available at supermarkets and corner stores. With limited access to fresh ingredients and smaller living spaces that may lack full kitchens, urbanites find these packaged snacks a convenient and delicious solution for busy schedules and quick bites on the go.

Global Potato Chips and Crisps Market challenges and restraints:Fluctuating Potato Prices is restricting the market growth

Potato price fluctuations pose a significant threat to potato chip and crisp manufacturers' profitability. When potato prices surge due to factors like bad weather or disease outbreaks, it can eat into their bottom line. Since potatoes are a substantial ingredient cost, absorbing these price hikes entirely might not be feasible. Manufacturers are then forced to make tough decisions. They could try to raise chip prices, potentially deterring cost-conscious consumers. Alternatively, they might have to reduce chip portion sizes or use less desirable potato varieties, both of which could impact product quality and consumer satisfaction. Finding the right balance between maintaining profit margins and offering an appealing product is crucial for navigating these potato price fluctuations.

Increasing health awareness is restricting the market growth

The indulgence factor of potato chips and crisps is facing a health-conscious consumer backlash. Traditionally high in fat, sodium, and calories, these snacks don't exactly scream "nutritious." As consumers become more aware of the link between diet and health, they're increasingly wary of these elements. This shift is particularly prominent among younger generations who prioritize wellness. This health focus translates into a growing demand for better-for-you alternatives. Baked versions or vegetable chips made from sweet potato or kale offer a lighter option without sacrificing the satisfying crunch. Manufacturers are also reformulating classic recipes, using healthier oils, and reducing sodium content. The challenge lies in creating chips that are both delicious and align with this evolving health consciousness.

Market Opportunities:

The potato chip and crisp market offer a wealth of opportunities for innovative brands. Health-conscious consumers are driving demand for baked options, veggie chips made from sweet potato or kale, and varieties with whole grains and limited sodium. Ethnic flavors and global inspiration present exciting possibilities, while catering to dietary restrictions like gluten-free or vegan can attract new customer segments. Interactive packaging with resealable options or built-in portion control caters to the on-the-go lifestyle. The rise of e-commerce allows for direct-to-consumer sales and subscription boxes with unique flavor combinations, while strategic partnerships with delivery services can tap into the growing demand for convenient snacking options.

POTATO CHIPS AND CRISPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Product type, Flavor, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

PepsiCo, Calbee Inc., The Hershey Company Mondelez International, Utz Brands, Inc., Intersnack Group GmbH & Co. KG, Lorenz Bahlsen Snack-World Group, Synder's-Lance, Diamond Foods, Kettle Foods |

Potato Chips and Crisps Market Segmentation - by Product Type

-

Fried

-

Baked

While both fried and baked potato chips hold a place in the market, fried chips remain the undisputed king. Their crispy texture, intense flavor, and familiar taste have secured them the dominant market share. However, baked chips are making significant strides as health-conscious consumers seek out alternatives. Their lighter fat content and perception of being a "healthier" option are fueling their growth, posing a challenge to the fried chip's reign. This trend suggests a potential future shift, but for now, fried chips hold the crown.

Potato Chips and Crisps Market Segmentation - By Flavor

-

Plain/Salted

-

Flavored

Flavored varieties are the undisputed champion of the potato chip and crisp market. While classic, plain, or salted chips still hold a strong and loyal fanbase, the flavored segment explodes with innovation and caters to a wider range of taste preferences. From familiar favorites like cheese and sour cream to the adventurous world of fiery sriracha or globally inspired flavors, there's a flavored chip for every mood and craving. This vast array of options has secured flavored varieties as the dominant segment within the potato chip and crisp market.

Potato Chips and Crisps Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America, the established king, boasts mature markets dominated by classic flavors and well-known brands. Europe, in contrast, reveals a patchwork of regional specialties, reflecting a nuanced taste palette. However, even here, health-conscious snacking is gaining ground. The crown jewel for growth lies in the Asia Pacific region. This dynamic market, fueled by rising disposable income, is a breeding ground for innovation. Consumers here crave exciting new flavor profiles and textures, propelling it to the status of the fastest-growing region for potato chips and crisps. Meanwhile, Latin America and the Middle East & Africa represent exciting emerging markets. Both regions share a love for bold flavors, with Latin America leaning towards the spicy, while the Middle East & Africa experience a surge in demand for convenient packaged snacks as disposable income rises.

COVID-19 Impact Analysis on the Global Potato Chips and Crisps Market

COVID-19's impact on the potato chip and crisp market was a tale of two halves. Initial lockdowns triggered panic buying, leading to a surge in demand as people stocked up on convenient snacks. This benefited major players who experienced a temporary sales boom in 2020. However, supply chain disruptions caused by lockdowns and travel restrictions hampered production and distribution in some regions. Additionally, with restaurants and entertainment venues closed, out-of-home consumption, a significant sales channel, dwindled. As restrictions eased and consumers ventured out again, the market witnessed a shift towards healthier snacking options. This trend, coupled with a return to pre-pandemic routines, moderated chip consumption at home. Overall, COVID-19's long-term effect on the market is still unfolding. While the initial surge subsided, the market is expected to experience steady growth as our love for this salty comfort food endures.

Latest trends/Developments

The potato chip and crisp market is constantly evolving to cater to the dynamic preferences of today's consumers. Health is a major focus, with manufacturers offering baked versions alongside innovative options like veggie chips made from exotic vegetables like kale or beets. Whole grain flours are being incorporated for added fiber, while reduced-sodium varieties cater to health-conscious snackers. Flavor innovation is another hot trend, with global spices and ethnic inspirations taking center stage. We're seeing a rise in chip flavors inspired by cuisines from around the world, offering consumers a taste of adventure in every bite. Sustainability is also gaining traction, with manufacturers exploring eco-friendly packaging and using upcycled ingredients like "ugly" vegetables to create delicious and guilt-free snacking experiences. Additionally, portion control is becoming a priority, with resealable bags and single-serve packs allowing for mindful snacking. The rise of e-commerce platforms presents new opportunities for direct-to-consumer sales and subscription boxes with unique flavor combinations, while partnerships with delivery services ensure these crispy treats reach consumers exactly when they crave them.

Key Players:

-

PepsiCo

-

Calbee Inc.

-

The Hershey Company

-

Mondelez International

-

Utz Brands, Inc.

-

Intersnack Group GmbH & Co. KG

-

Lorenz Bahlsen Snack-World Group

-

Synder's-Lance

-

Diamond Foods

-

Kettle Foods

Chapter 1. Potato Chips and Crisps Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Potato Chips and Crisps Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Potato Chips and Crisps Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Potato Chips and Crisps Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Potato Chips and Crisps Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Potato Chips and Crisps Market – By Product Type

6.1 Introduction/Key Findings

6.2 Fried

6.3 Baked

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Potato Chips and Crisps Market – By Flavor

7.1 Introduction/Key Findings

7.2 Plain/Salted

7.3 Flavored

7.4 Y-O-Y Growth trend Analysis By Flavor

7.5 Absolute $ Opportunity Analysis By Flavor, 2024-2030

Chapter 8. Potato Chips and Crisps Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Flavor

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Flavor

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Flavor

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Flavor

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Flavor

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Potato Chips and Crisps Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PepsiCo

9.2 Calbee Inc.

9.3 The Hershey Company

9.4 Mondelez International

9.5 Utz Brands, Inc.

9.6 Intersnack Group GmbH & Co. KG

9.7 Lorenz Bahlsen Snack-World Group

9.8 Synder's-Lance

9.9 Diamond Foods

9.10 Kettle Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Potato Chips and Crisps Market was valued at USD 29.35 billion in 2023 and will grow at a CAGR of 4% from 2024 to 2030. The market is expected to reach USD 38.62 billion by 2030.

Changing lifestyles and eating habits, Increasing urbanization, and Growing demand for convenience food are the reasons that are driving the market.

Based on Product Type it is divided into two segments – fried and baked.

North America is the most dominant region for the Potato Chips and Crisps Market.

PepsiCo, Calbee Inc., The Hershey Company, Mondelez International