North America Potato Chips and Crisps Market Size (2024-2030)

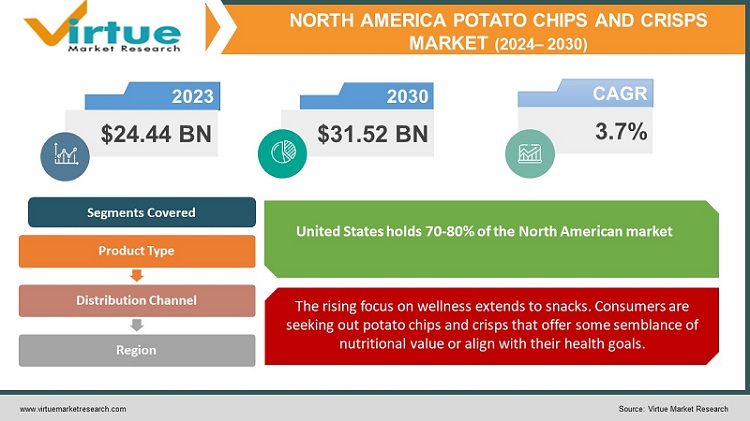

The North America Potato Chips and Crisps Market was valued at USD 24.44 Billion in 2023 and is projected to reach a market size of USD 31.52 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.7%.

Potato chips and crisps, those thinly sliced, salty, and satisfyingly crunchy snacks, hold an iconic place within the North American snacking landscape. From classic flavors to bold innovations, the market caters to diverse tastes and preferences. The potato chips and crisps market holds a significant share of the overall North American snack industry, generating billions in revenue annually. Potato chips and crisps are deeply ingrained in snacking culture, found in lunchboxes, at parties, and as a staple for movie nights and casual munching. While 'classic', 'salted', and 'sour cream and onion' flavors remain popular, the market is driven by constant flavor innovation. A growing demand for intense flavor profiles, heat, and spiciness is reflected in a wide range of hot and spicy chip options. Consumers seek cleaner ingredient lists, reduced sodium, trans-fat-free options, and the incorporation of whole grains, vegetables, or other 'healthy' additions. Positioning potato chips and crisps within a balanced diet is key. Smaller portion sizes and highlighting 'natural' aspects cater to mindful snackers.

Key Market Insights:

Potato chips and crisps hold a special place in the North American snacking landscape. They're a staple at parties, packed in lunches, and perfect for casual munching. The familiar crunch and salty goodness of potato chips evoke a sense of comfort and often carry nostalgic value for many consumers. The widespread popularity of classic potato chip flavors provides a platform for brands to introduce bolder and more unusual flavor combinations. The traditional ridged or thinly sliced potato chip with its satisfying crunch remains a favorite for many consumers. Kettle-cooked chips, with their thicker texture and bolder crunch, offer a distinct snacking experience and are often associated with premium positioning. The market spans the spectrum from classic salted chips to gourmet variations with truffle oil, exotic spice blends, or even dessert-inspired flavors. North American consumers are increasingly open to spicier chips, with flavors incorporating peppers from around the globe. While some flavors have mass appeal, distinct regional preferences can influence popular chip varieties across North America. The health and wellness trend drives demand for potato chips and crisps perceived as healthier than the standard option. Clean label initiatives and emphasizing natural ingredients are becoming crucial to building trust with health-conscious consumers. A large millennial demographic is receptive to globally inspired flavors, unique chip formats, and brands with a social impact mission. The growing Hispanic and Asian populations in North America influence the demand for flavors and snacking traditions from their respective cultures.

North America Potato Chips and Crisps Market Drivers:

While classic flavors like salted or sour cream and onion remain popular, consumers increasingly crave bolder, globally inspired, and unusual taste experiences.

The world of potato chips and crisps is undergoing a flavor renaissance. Consumers are moving away from a 'salt and vinegar' mindset, craving experiences that tantalize their taste buds and satisfy their thirst for the novel and unexpected. Chips now transport consumers to different regions of the world, showcasing iconic flavors like Indian Tikka Masala, Thai Green Curry, or Mexican street corn. Gone are the days of superficial flavor references. Consumers expect well-researched and authentic interpretations of global cuisines. North Americans are embracing heat in more complex ways, seeking out layered spice blends with nuanced flavor profiles rather than just a one-dimensional burn. Limited-edition chip flavors partnering with iconic restaurants or chefs bring the excitement of the culinary world to the snack aisle. Inspiration for new chip flavors comes from popular desserts, breakfast dishes, or even cocktails, blurring the lines between sweet and savory. Unique or highly anticipated flavors can create a 'gotta catch 'em all' mentality, particularly among younger consumers and snack enthusiasts. Online platforms and some retailers allow consumers to build custom flavor blends, choosing their base chip, spices and even finishes. The process of customizing chips online boosts brand engagement and collects valuable data on consumer flavor preferences. Brands are constantly pushed to develop new, attention-grabbing flavors to stand out in a crowded chip aisle. Gourmet flavors or those with rare ingredients can command higher prices, catering to those willing to pay more for a special snacking experience. Adventurous flavors attract younger consumers and open-minded snackers who might not have considered potato chips as their go-to snack previously.

The rising focus on wellness extends to snacks. Consumers are seeking out potato chips and crisps that offer some semblance of nutritional value or align with their health goals.

Early 'better-for-you' chips focused on reductions: lower sodium, baked instead of fried, and smaller portion sizes. The definition is expanding to include positive additions – whole grains, fiber, protein, or inclusions of 'superfood' ingredients. Consumers scrutinize ingredient lists. Shorter lists with pronounceable, natural ingredients are strongly favored. Chips made from sweet potatoes, beets, taro, parsnips, etc., gain traction with their natural colors, flavors, and potential health halo. Increasingly, plant-based chips incorporate sources like lentils, chickpeas, or beans to boost protein content and appeal to those seeking meat alternatives. Innovative startups are exploring unique vegetables and processing techniques to expand plant-based chip offerings. Plant-based chips allow for different textural experiences compared to the classic potato chip, appealing to consumers seeking novelty. Consumers are looking for chips aligned with specific health goals: reduced sodium for blood pressure, added fiber for digestion, or lower fat content for weight management. The growth of gluten-free, vegan, and paleo-friendly chips caters to those with dietary restrictions, allowing them to participate in snacking moments. Consumers are savvy to vague health claims. Clear communication about the specific benefits and reasoning behind ingredient choices is needed. The internet and social media empower consumers with easy access to nutrition information and ingredient comparisons. This allows them to make more informed decisions about what they put in their bodies.

North America Potato Chips and Crisps Market Restraints and Challenges:

The single biggest problem facing the traditional potato chip and crisps industry is rising consumer health consciousness. Customers are coming to identify these goods more and more with high fat, high salt content, and low nutritional value—hardly a recipe that fits with today's wellness objectives.

Growing consumer health awareness is the single biggest challenge for the traditional potato chips and crisps industry. Consumers increasingly associate these products with high salt, fat content, and low nutritional value – not a recipe for aligning with modern wellness goals. Health-conscious consumers gravitate towards snacks with cleaner ingredient lists, less processing, and the inclusion of positive elements like whole grains, fiber, and protein. This puts pressure on traditional brands to innovate or risk losing market share. New plant-based snacks, ethnic-inspired flavors, and unique textures excite consumers who may see traditional potato chips as less desirable in comparison. Potato prices can be unpredictable due to weather events, crop yields, and input costs (fertilizer, fuel). This volatility introduces significant uncertainty impacting manufacturers' profit margins. Recent global events have caused supply chain disruptions affecting the availability of potatoes, as well as packaging materials and transportation. This leads to higher costs and potential delays in bringing products to market. Acrylamide, a chemical formed during high-temperature cooking of starchy foods, is a potential health concern. Regulatory bodies monitor acrylamide levels, forcing manufacturers to adapt processes or reformulate to reduce its formation. Public health campaigns may advocate for 'sin taxes' on unhealthy snacks or restrictions on advertising to children, putting further pressure on the industry.

North America Potato Chips and Crisps Market Opportunities:

The potato chip and crisps market in North America is a dynamic and fiercely competitive arena. It has a broad range of snack options to satisfy customers' varied tastes. The desire for easy-to-eat snacks like chips and crisps is being driven by lifestyles characterized by eating on the go and frequently substituting smaller meals with snacks. Innovation in the market is being driven by consumer curiosity and their willingness to try new, strong flavors that are inspired by other countries. Major market share is held by brands including Utz, Pringles (Kellogg's), Kettle Brand, Frito-Lay (PepsiCo), and Cape Cod. They use broad distribution networks, well-known brands, and innovative skills to keep getting more and more dominant. Consumers who are concerned about their health respond very well to clear ingredient lists, minimal additions, and clean label formulations. Along with improved nutritional value, lower levels of sugar, salt, and bad fats are desired. There's always a thirst for flavors that are strong and distinct. This contains gourmet combos and inspiration from around the world (think fiery Asian or Indian flavors). Superior, handcrafted potato chips and crisps appeal to customers who are prepared to spend extra on fine dining experiences, premium ingredients, and distinctive taste profiles. Customers may see alternatives that are tailored to their dietary requirements or preferred flavors. In response to environmental concerns and mobile lives, portion-controlled packets, resealable choices, and sustainable materials will all see an increase.

NORTH AMERICA POTATO CHIPS AND CRISPS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.7% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA. Canada, mexico |

|

Key Companies Profiled |

Frito-Lay, Utz Quality Foods, Kellogg Company, Kettle Brand , Cape Cod Potato Chips, Great Lakes Potato Chip Co, Wise Foods |

North America Potato Chips and Crisps Market Segmentation:

North America Potato Chips and Crisps Market Segmentation: By Product Type

- Sliced

- Compound

- Baked

- Dehydrated

Sliced: These are traditional potato chips made from thinly sliced potatoes, either fried or baked. They hold the largest market share. Compound: These chips are manufactured using potato dough or dehydrated potatoes, offering more shape conformity and a unique texture compared to sliced chips. Baked: Baked chips, as opposed to fried, are generally perceived as a healthier alternative due to their lower fat content. Dehydrated: These chips are created from dried or dehydrated slices of potato, resulting in a distinctive, extra-crispy texture. Sliced potato chips undoubtedly reign supreme in the North American market. Sliced chips represent the quintessential potato chip experience – familiar, nostalgic, and deeply ingrained in snacking culture. The simple format of sliced chips allows for endless flavor innovation, catering to a broad range of consumer preferences. Sliced potato chips are universally available across various distribution channels, ensuring accessibility for all consumers. The baked potato chips segment is experiencing the most significant growth within the market. Baked chips align perfectly with the rising demand for 'better-for-you' snacks. They offer reduced calories, fat, and often lower sodium compared to their fried counterparts. Advances in technology have made baked chips more palatable, overcoming the initial drawbacks of less flavorful or less crispy textures. Baked chips are heavily marketed towards health-conscious consumers seeking indulgent snacking experiences with a reduced 'guilt factor'.

North America Potato Chips and Crisps Market Segmentation: By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Independent Retailers

The majority of the potato chip and crisps market is dominated by supermarkets and hypermarkets. In the chip and crisp market, these expansive retail formats provide a wide range of brands, flavours, sizes, and product varieties. Sales are further boosted by frequent promotions, bulk purchase discounts, and competitive price methods. Getting all the groceries a customer needs in one place makes it easy for them to select their preferred snack brands. Convenience stores are essential for attracting impulsive buyers and meeting needs for on-the-go snacks. They are conveniently accessible due to their many locations, long hours, and quick in-and-out transactions. Convenience stores, with their emphasis on single-serve packs, are ideally situated for instant consumption. It's common to combine chips and crisps with other convenience store products like drinks and prepared meals. The market for potato chips and crisps is seeing a significant increase in the online retail segment. Customers can order their preferred snacks whenever they want, from the convenience of their own homes. In comparison to individual brick-and-mortar businesses, online retailers frequently provide a greater selection of brands and flavours, particularly for niche and specialty brands. Competitive offers are encouraged by the ease with which pricing may be compared online. Numerous services guarantee simplicity and consistent sales by providing subscriptions or snack auto-replenishment. The distribution network includes independent businesses such as bodegas, corner stores, and smaller grocery stores. They are ideally situated in particular neighbourhoods or communities. Occasionally, they stock regional or local brands that are unavailable in bigger chain stores.

North America Potato Chips and Crisps Market Segmentation: Regional Analysis:

- US

- Canada

- Mexico

The United States holds 70-80% of the North American market. This is fueled by a strong snacking culture, a diverse population with varied tastes, and the dominance of major potato chip and crisp manufacturers. Canada holds 15-25% of the North American market. While smaller than the US market, Canada exhibits a similar love for potato chips and crisps and hosts some homegrown brands alongside big US players. Mexico boasts a thriving market for potato chips and crisps, often showcasing unique flavors catering to local preferences. While smaller in comparison to the US and Canada, it has the potential for significant future growth. Mexico holds 5-10% of the North American market.

The larger population of the United States naturally drives a greater volume of snack consumption. Powerful US-based brands with vast distribution networks contribute to a well-established market. Disposable income levels in developed markets like the US and Canada influence the ability to spend on snacks. Busy lifestyles in Mexico and other parts of North America fuel on-the-go snacking and convenience food purchases. Local taste preferences can influence how fast the market grows in specific regions. The growing popularity of spicy and globally inspired flavors is a contributing factor in parts of North America.

COVID-19 Impact Analysis on the North America Potato Chips and Crisps Market:

There was a spike in demand for shelf-stable snacks like potato chips and crisps during the early stages of the pandemic. Fearing a possible food scarcity, consumers stocked up on known, convenient options. Supply chains were momentarily affected by lockdowns and border restrictions, which raised the possibility of shortages of specific ingredients or packaging materials. For a little while, this might have affected the brands or flavors that were available. Consumer snacking patterns have evolved towards in-home consumption as a result of restaurant closures and restrictions on dining out. This helped the market for crisps and potato chips as a handy snack choice. Grocery sales online have increased significantly due to restrictions on transportation and consumers' rising preference for contactless buying. Online vendors now had a chance to increase the variety of potato chips and crisps they offered. With the epidemic raising people's awareness of health issues, many tended to choose products they thought were healthier. These could be baked versions, chips with less fat or sodium, or even veggie-based chips that satisfy dietary requirements. There has been an increase in demand for single-serve or lower pack sizes due to concerns about hygiene and portion management. This reduces sharing within homes and accommodates individual consumption.

Latest Trends/ Developments:

Consumers demand more than just simple ingredient lists. They seek clarity about sourcing, minimal processing, and positive nutritional additions. Potato chips and crisps now go beyond basic sustenance. Expect ingredients that support gut health, offer stress-reducing properties, deliver on immunity promises, or provide sustained energy. Bases like chickpeas, sweet potatoes, lentils, beans, and even seaweed are emerging as alternatives to traditional potato-centric options. Flavors inspired by Indian curries, East Asian spices, Mexican street food, and Mediterranean cuisines are on the rise. Flavor innovation is fast-paced, with limited-time releases to create excitement and a sense of scarcity for adventurous consumers. Brands are expected to demonstrate ethical sourcing, use sustainable packaging, and reduce their environmental footprint. Practices that promote soil health and biodiversity are gaining awareness, with some brands championing this effort. These offer convenience, resealable options, and greater shelf visibility for unique brands and flavors. Data analytics and consumer insights can inform new flavor combinations that align with emerging preferences. Smaller brands are leveraging online platforms and social media to connect directly with consumers, often providing niche and innovative flavors.

Key Players:

- Frito-Lay

- Utz Quality Foods

- Kellogg Company

- Kettle Brand

- Cape Cod Potato Chips

- Great Lakes Potato Chip Co

- Wise Foods

Chapter 1. North America Potato Chips and Crisps Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Potato Chips and Crisps Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Potato Chips and Crisps Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Potato Chips and Crisps Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Potato Chips and Crisps Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Potato Chips and Crisps Market– By Product Type

6.1. Introduction/Key Findings

6.2. Sliced

6.3. Compound

6.4. Baked

6.5. Dehydrated

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Potato Chips and Crisps Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets/Hypermarkets

7.3. Convenience Stores

7.4. Online Retail

7.5. Independent Retailers

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. North America Potato Chips and Crisps Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Potato Chips and Crisps Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Frito-Lay

9.2. Utz Quality Foods

9.3. Kellogg Company

9.4. Kettle Brand

9.5. Cape Cod Potato Chips

9.6. Great Lakes Potato Chip Co

9.7. Wise Foods

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Hectic schedules and on-the-go eating habits make potato chips and crisps an easy, portable snack choice. The trend of replacing traditional meals with frequent snacks benefits the industry.

Many traditional potato chips and crisps are high in calories, sodium, unhealthy fats (like trans fats), and refined carbohydrates

Frito-Lay, Utz Quality Foods, Kellogg Company, Kettle Brand

Cape Cod Potato Chips, Great Lakes Potato Chip Co, Wise Foods.

The US currently holds the largest market share, estimated around 70%.

Mexico exhibits the fastest growth, driven by its increasing population, expanding economy