Plant-based Protein Market Size (2024 – 2030)

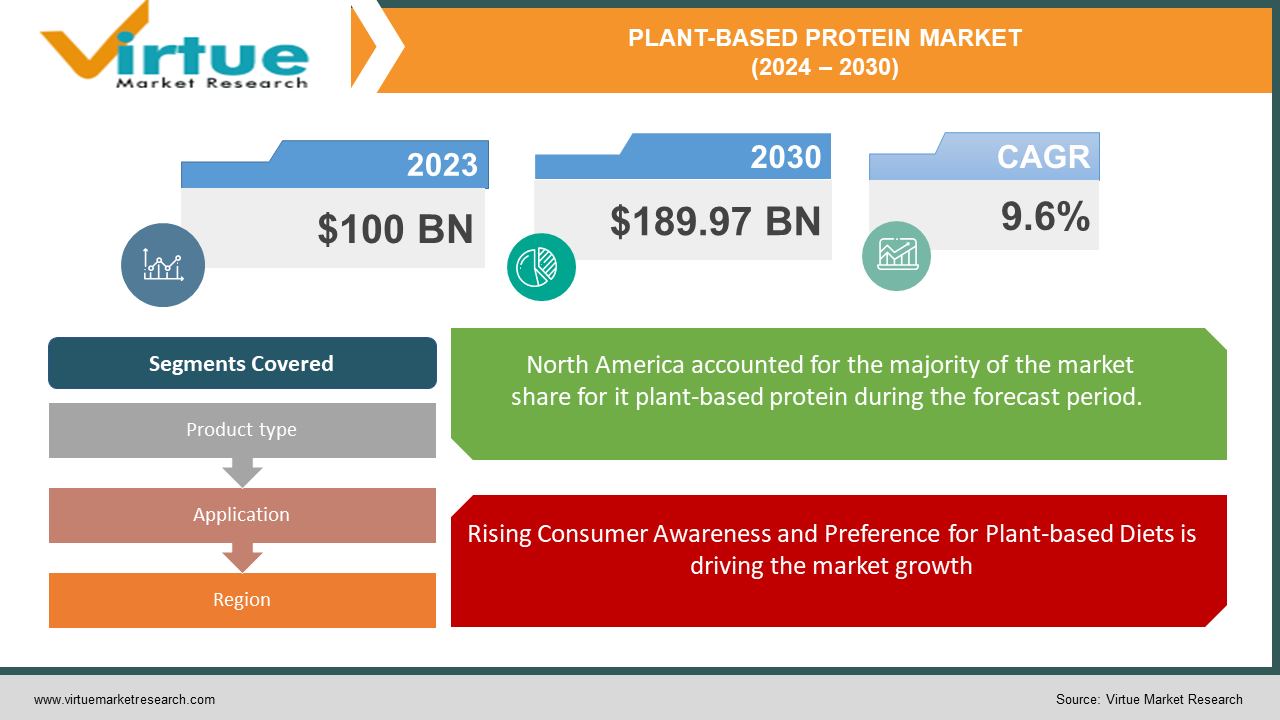

The Global Plant-based Protein Market was valued at USD 100 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030. The market is expected to reach USD 189.97 billion by 2030.

The plant-based protein market includes a variety of protein sources such as soy, pea, and wheat, which are increasingly being used in food and beverage products as well as dietary supplements. The shift towards healthier lifestyles, increasing awareness of the benefits of plant-based diets, and the rising demand for sustainable and ethical food options are some of the key factors driving market growth. Plant-based proteins are known for their nutritional benefits, including being rich in essential amino acids, vitamins, and minerals. The rising consumer preference for plant-based diets and the growing awareness of the health benefits associated with plant-based proteins are significantly driving market growth.

Key Market Insights:

The increasing prevalence of lactose intolerance and dairy allergies is boosting the demand for plant-based protein alternatives. Many consumers are seeking non-dairy protein sources to avoid digestive issues and allergic reactions, which is contributing to the market expansion.

North America with a market share of 28.7% is the most dominant region in the plant-based protein market.

Technological advancements in food processing and ingredient development are enabling the creation of high-quality plant-based protein products that mimic the taste and texture of animal-based proteins.

The growing environmental and ethical concerns regarding animal farming and meat production are driving the demand for plant-based proteins.

The increasing investments by key market players in research and development activities to improve the functionality and sensory attributes of plant-based proteins.

Global Plant-based Protein Market Drivers:

Rising Consumer Awareness and Preference for Plant-based Diets is driving the market growth

The growing awareness of the health benefits associated with plant-based diets is a major driver of the plant-based protein market. Consumers are increasingly adopting plant-based diets due to their potential to reduce the risk of chronic diseases such as obesity, diabetes, and cardiovascular diseases. Plant-based proteins are considered a healthier alternative to animal proteins as they are low in saturated fats and cholesterol, and rich in essential nutrients such as fiber, vitamins, and minerals. According to a survey conducted by the International Food Information Council, 43% of consumers believe that plant-based diets are healthier than traditional animal-based diets. This shift in consumer preference towards healthier food options is driving the demand for plant-based protein products. Additionally, the increasing prevalence of lactose intolerance and dairy allergies is contributing to the market growth. Many consumers are seeking non-dairy protein sources to avoid digestive issues and allergic reactions. The rising awareness of the environmental and ethical implications of animal farming and meat production is also encouraging consumers to choose plant-based proteins. As a result, the demand for plant-based protein products is expected to continue to rise in the coming years.

Technological Advancements in Food Processing and Ingredient Development are driving the market growth

Technological advancements in food processing and ingredient development are playing a significant role in driving the growth of the plant-based protein market. Innovations in protein extraction, formulation, and texturization are enabling the creation of high-quality plant-based protein products that closely mimic the taste, texture, and nutritional profile of animal-based proteins. For instance, advanced extrusion technology is being used to produce plant-based protein products with meat-like textures, making them more appealing to consumers. The development of novel plant protein sources, such as algae, hemp, and mung beans, is also expanding the range of available plant-based protein products. Additionally, improvements in flavor masking and enhancement technologies are helping to overcome the taste challenges associated with plant-based proteins. These technological advancements are attracting investments from key market players, who are focusing on research and development activities to improve the functionality and sensory attributes of plant-based proteins. The continuous innovation in food processing and ingredient development is expected to drive the growth of the plant-based protein market by offering consumers a wider variety of high-quality, appealing, and nutritious plant-based protein products.

Growing Environmental and Ethical Concerns are driving the market growth

The growing environmental and ethical concerns regarding animal farming and meat production are driving the demand for plant-based proteins. Animal agriculture is a major contributor to greenhouse gas emissions, deforestation, and water pollution. According to the Food and Agriculture Organization (FAO) of the United Nations, livestock production is responsible for approximately 14.5% of global greenhouse gas emissions. The increasing awareness of the environmental impact of animal farming is encouraging consumers to reduce their meat consumption and adopt more sustainable dietary practices. Plant-based proteins have a lower environmental footprint compared to animal proteins, as they require fewer natural resources and produce lower greenhouse gas emissions. Additionally, the ethical concerns related to animal welfare and the treatment of livestock are driving the demand for cruelty-free protein sources. Many consumers are choosing plant-based proteins as a way to support more humane and ethical food production practices. The rising popularity of plant-based diets and the growing demand for sustainable and ethical food options are expected to continue to drive the growth of the plant-based protein market in the coming years.

Global Plant-based Protein Market Challenges and Restraints:

Taste and Texture Challenges are restricting the market growth

One of the significant challenges faced by the plant-based protein market is the taste and texture of plant-based protein products. Many consumers are accustomed to the taste and texture of animal-based proteins, and replicating these attributes in plant-based products can be challenging. Some plant-based proteins have a distinct aftertaste or gritty texture that can be off-putting to consumers. For instance, soy and pea proteins, two of the most commonly used plant-based proteins, can have a beany or earthy flavor that some consumers find unappealing. Additionally, achieving the desired texture and mouthfeel in plant-based meat and dairy alternatives can be difficult. The lack of juiciness, chewiness, and tenderness in plant-based meat products can deter consumers from switching to plant-based options. To address these challenges, companies are investing in research and development to improve the taste, texture, and overall sensory experience of plant-based protein products. The use of advanced processing technologies, flavor masking agents, and texturizing ingredients is helping to enhance the appeal of plant-based proteins. Overcoming the taste and texture challenges is crucial for the widespread acceptance and adoption of plant-based protein products.

High Production Costs and Prices Premium is restricting the market growth

The high production costs and price premiums associated with plant-based protein products are another challenge for the market. Producing high-quality plant-based proteins often involves complex processing methods and the use of specialized ingredients, which can drive up production costs. For example, the extraction and purification of plant proteins, such as soy, pea, and rice proteins, require sophisticated equipment and processes that can be expensive. Additionally, the cost of sourcing raw materials, such as organic and non-GMO crops, can contribute to higher production costs. As a result, plant-based protein products are often priced at a premium compared to their animal-based counterparts. This price premium can be a barrier for price-sensitive consumers, particularly in developing regions where affordability is a key consideration. To make plant-based proteins more accessible and affordable, companies are focusing on optimizing their production processes, improving supply chain efficiencies, and exploring alternative protein sources that are cost-effective. Scaling up production and achieving economies of scale are also essential to reducing the cost of plant-based protein products. Addressing the cost and price challenges is crucial for expanding the market reach and driving the growth of the plant-based protein market.

Market Opportunities:

The Plant-based Protein Market presents several significant opportunities for growth and innovation. One of the key opportunities lies in the expanding consumer base for plant-based diets. As more people become aware of the health, environmental, and ethical benefits of plant-based eating, the demand for plant-based protein products is expected to increase. Companies can capitalize on this opportunity by developing a wide range of plant-based protein products that cater to different dietary preferences and lifestyles. For instance, there is a growing demand for plant-based protein products that are free from common allergens such as soy, gluten, and nuts. By offering allergen-free and hypoallergenic options, companies can attract a broader consumer base and address the needs of individuals with dietary restrictions. Another significant opportunity lies in the development of new plant protein sources. While soy, pea, and wheat proteins dominate the market, there is increasing interest in alternative protein sources such as algae, hemp, and chickpeas. These new protein sources offer unique nutritional profiles and functional properties that can be leveraged to create innovative and appealing plant-based protein products. Additionally, the foodservice sector presents a lucrative opportunity for the plant-based protein market. The growing popularity of plant-based foods in restaurants, cafes, and fast-food chains is driving the demand for plant-based protein ingredients. Collaborating with foodservice providers and offering plant-based protein solutions tailored to their needs can help companies tap into this expanding market. Furthermore, the increasing adoption of plant-based proteins in sports nutrition and functional foods offers another avenue for growth. Plant-based proteins are gaining popularity among athletes and fitness enthusiasts due to their health benefits and sustainability credentials. By developing plant-based protein products that cater to the specific needs of the sports nutrition market, companies can unlock new growth opportunities. Overall, the plant-based protein market is poised for significant growth, driven by the expanding consumer base, the development of new protein sources, and the increasing adoption of plant-based proteins in various sectors.

PLANT-BASED PROTEIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.6% |

|

Segments Covered |

By Product type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Cargill, Incorporated, DuPont de Nemours, Inc., Kerry Group plc, Ingredion Incorporated, Roquette Frères, Burcon NutraScience Corporation, Axiom Foods, Inc., BENEO GmbH, Glanbia plc |

Plant-based Protein Market Segmentation: by Product Type

-

Soy Protein

-

Pea Protein

-

Wheat Protein

-

Others

Soy protein is the most dominant segment in the plant-based protein market, accounting for the largest share of the market. Soy protein is widely used in various food and beverage applications due to its high protein content, versatility, and functional properties. It is commonly used in meat alternatives, dairy alternatives, and protein supplements. The high demand for soy protein is driven by its well-established reputation as a high-quality plant-based protein source, as well as its affordability and availability. Additionally, soy protein is considered a complete protein, providing all essential amino acids required by the human body, making it a preferred choice for consumers seeking plant-based protein options.

Plant-based Protein Market Segmentation: by Application

-

Food and Beverage

-

Dietary Supplements

-

Animal Feed

-

Others

The food and beverage segment is the most dominant segment in the plant-based protein market, accounting for the largest share of the market. Plant-based proteins are increasingly being used in a wide range of food and beverage products, including meat alternatives, dairy alternatives, bakery products, and snacks. The growing consumer demand for plant-based food options, coupled with the increasing awareness of the health and environmental benefits of plant-based proteins, is driving the growth of this segment. The food and beverage industry is witnessing a surge in innovative plant-based protein products that cater to the evolving tastes and preferences of consumers, further fueling the market growth.

Plant-based Protein Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the plant-based protein market, accounting for the largest share of the market. The high demand for plant-based protein products in North America is driven by the growing consumer awareness of the health benefits of plant-based diets, the increasing prevalence of lactose intolerance and dairy allergies, and the rising environmental and ethical concerns regarding animal farming. The presence of key market players and the availability of a wide range of plant-based protein products also contribute to the dominance of this region. The United States and Canada are the major contributors to the growth of the plant-based protein market in North America.

COVID-19 Impact Analysis on the Plant-based Protein Market:

The COVID-19 pandemic had a mixed impact on the Plant-based Protein Market. On one hand, the pandemic led to disruptions in the supply chain, affecting the production and distribution of plant-based protein products. The closure of manufacturing facilities, restrictions on transportation, and labor shortages caused delays and shortages in the supply of raw materials and finished products. On the other hand, the pandemic also accelerated the shift towards healthier and more sustainable food choices. The increased awareness of the link between diet and health, coupled with the growing concerns about food security and sustainability, led to a surge in demand for plant-based protein products. Consumers became more conscious of their food choices and sought out plant-based proteins as a healthier and more sustainable alternative to animal proteins. The pandemic also highlighted the vulnerability of the meat supply chain, further driving the demand for plant-based protein products. As the world recovers from the pandemic, the Plant-based Protein Market is expected to continue its growth trajectory, driven by the sustained consumer demand for healthy, sustainable, and ethical food options.

Latest Trends/Developments:

The Plant-based Protein Market is witnessing several notable trends and developments that are shaping its growth and evolution. One significant trend is the increasing innovation and diversification of plant-based protein products. Companies are expanding their product portfolios to include a wide range of plant-based protein products, from meat and dairy alternatives to snacks, bakery products, and beverages. The focus is on developing products that closely mimic the taste, texture, and nutritional profile of animal-based proteins, making them more appealing to consumers. Another key trend is the growing interest in alternative protein sources. While soy, pea, and wheat proteins dominate the market, there is increasing interest in novel protein sources such as algae, hemp, and chickpeas. These new protein sources offer unique nutritional profiles and functional properties, providing opportunities for innovation and differentiation. Additionally, the increasing adoption of plant-based proteins in sports nutrition and functional foods is a notable trend. Plant-based proteins are gaining popularity among athletes and fitness enthusiasts due to their health benefits and sustainability credentials. Companies are developing specialized plant-based protein products that cater to the specific needs of the sports nutrition market. Furthermore, the growing focus on sustainability and environmental responsibility is driving the development of eco-friendly plant-based protein products. Companies are adopting sustainable sourcing practices, reducing their carbon footprint, and investing in environmentally friendly packaging solutions. These trends and developments are driving innovation and growth in the Plant-based Protein Market, providing new opportunities for businesses and enhancing the overall appeal of plant-based protein products.

Key Players:

-

Archer Daniels Midland Company

-

Cargill, Incorporated

-

DuPont de Nemours, Inc.

-

Kerry Group plc

-

Ingredion Incorporated

-

Roquette Frères

-

Burcon NutraScience Corporation

-

Axiom Foods, Inc.

-

BENEO GmbH

-

Glanbia plc

Chapter 1. Plant-based Protein Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Plant-based Protein Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Plant-based Protein Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Plant-based Protein Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Plant-based Protein Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Plant-based Protein Market – By Product Type

6.1 Introduction/Key Findings

6.2 Soy Protein

6.3 Pea Protein

6.4 Wheat Protein

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Plant-based Protein Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverage

7.3 Dietary Supplements

7.4 Animal Feed

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Plant-based Protein Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Plant-based Protein Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Cargill, Incorporated

9.3 DuPont de Nemours, Inc.

9.4 Kerry Group plc

9.5 Ingredion Incorporated

9.6 Roquette Frères

9.7 Burcon NutraScience Corporation

9.8 Axiom Foods, Inc.

9.9 BENEO GmbH

9.10 Glanbia plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Plant-based Protein Market was valued at USD 100 billion in 2023 and is projected to grow at a CAGR of 9.6% from 2024 to 2030. The market is expected to reach USD 189.97 billion by 2030.

Key drivers include rising consumer awareness and preference for plant-based diets, technological advancements in food processing and ingredient development, and growing environmental and ethical concerns.

The market is segmented by product type (soy protein, pea protein, wheat protein, others) and application (food and beverage, dietary supplements, animal feed, others).

North America is the most dominant region due to high consumer awareness, the prevalence of lactose intolerance and dairy allergies, and the presence of key market players.

The leading players include Archer Daniels Midland Company, Cargill, Incorporated, DuPont de Nemours, Inc., Kerry Group plc, Ingredion Incorporated, Roquette Frères, Burcon NutraScience Corporation, Axiom Foods, Inc., BENEO GmbH, and Glanbia plc.